- PancakeSwap users now have access to additional rewards when using the BNB Chain.

- The development could change the situation of the project’s TVL, which has declined in the last 24 hours.

Decentralized crypto exchange PancakeSwap [CAKE] has announced a new partnership that would enable its users to access single-asset deposit vaults and optimize their assets for high-yield, risk-adjusted returns.

Realistic or not, here it is CAKE’s market capitalization in BNB terms

By the CAKE team, for users

According to the revelation provided by the project, the updates would only be available to the users who are on the BNB chain. BNB Chain is fully known as the “Build N Build” Chain. As the second largest Layer-1 ecosystem, the chain facilitates cross-chain transactions and interaction.

However, the development would have been impossible without the input of Bril Finance. PancakeSwap describes Bril Finance, a decentralized finance (DeFi) platform that turns highly advanced portfolio management strategies into easy-to-use services.

Furthermore, the disclosure mentioned how users can benefit from activities using the various liquidity pools on PancakeSwap. A liquidity pool acts as a reserve. Here, users can pool their assets into DEX smart contracts to provide liquidity to traders involved in token exchanges.

In an exclusive press release sent to AMBCrypto, PancakeSwap noted that the update will allow users to earn additional rewards. The project noted that,

“Users can earn additional rewards in CAKE tokens for up to four weeks after launch. Namely, liquidity pools such as USDT/CAKE, USDT/BNB and BTCB/USDT will receive 1,000 CAKE per week, and BNB/CAKE, BTCB/CAKE and ETH/CAKE pairs will receive 500 CAKE per week.”

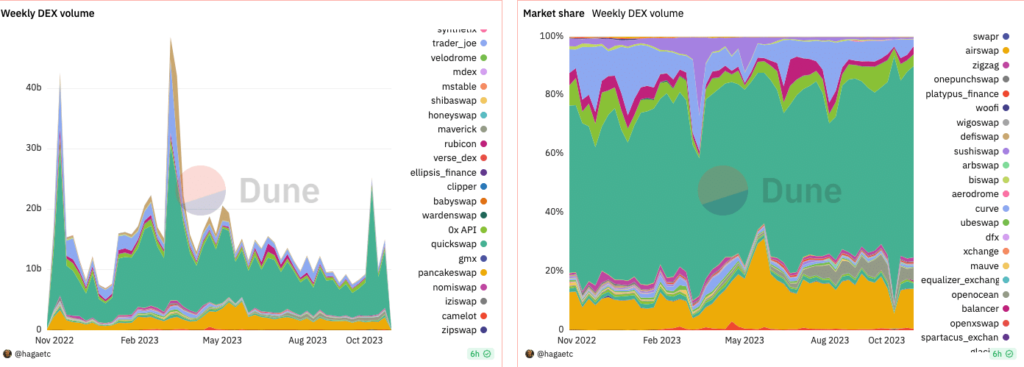

When activity in these liquidity pools increases, DEX volume on the BNB Chain could reach high levels as it did in May. Also PancakeSwap which surpassed BNB Chain’s past earnings could replicate this one more time.

To help the declining TVL?

While revenue may increase for PancakeSwap, it may be difficult to top the DEX volume charts. It is like that because Uniswap [UNI] has a strong hold on the metric. It can also be largely difficult to top, as evidenced by the Dune Analytics graphic below.

Source: Dune Analytics

However, there is one area where development can help PancakeSwap recover. That is in terms of the Total Value Locked (TVL). The TVL is a DeFi metric used to measure the total value of assets locked or staked in a protocol.

The chef of PancakSwap, popularly known as Chef Mochi, shared the same opinion. According to Mochi, the integration could bring more opportunities to the DeFi sector. He told AMBCrypto that:

“By partnering with Bril Finance, we are excited to offer our users additional DeFi capabilities. We aim to become a hub for all DeFi and such integrations, allowing us to become a one-stop shop for portfolio management.”

At the moment of writing, TVL from PancakeSwap amounted to 1.39 billion dollars, equivalent to 61 million BNB. This value had dropped by 23% in the last 24 hours, meaning that confidence in the protocol has decreased.

Source: DeFiLlama

Is your portfolio green? Check the PancakeSwap profit calculator

With the new liquidity pool and returns strategy, PancakeSwap could be well on its way to attracting more users. But this would also depend on the sentiment that the market has towards the development.