- The FET has fallen by more than 20% in the last 48 hours

- The statistics showed mixed signals on the charts

FET has seen a sharp drop of over 20% in less than 48 hours. This sudden price drop made investors curious about the implications and next possible steps of FET. Before this sudden drop, however, FET had enjoyed an impressive rally on the charts.

It was up about 73% since retesting its all-time low. However, the latest price action has wiped out a significant portion of these gains. Needless to say, this sudden turnaround raises questions about market sentiment and underlying fundamentals.

At the time of writing it is The FET was valued at $1.50, after falling 7.30% in the past 24 hours. The market capitalization also fell by 18.27% during the same period.

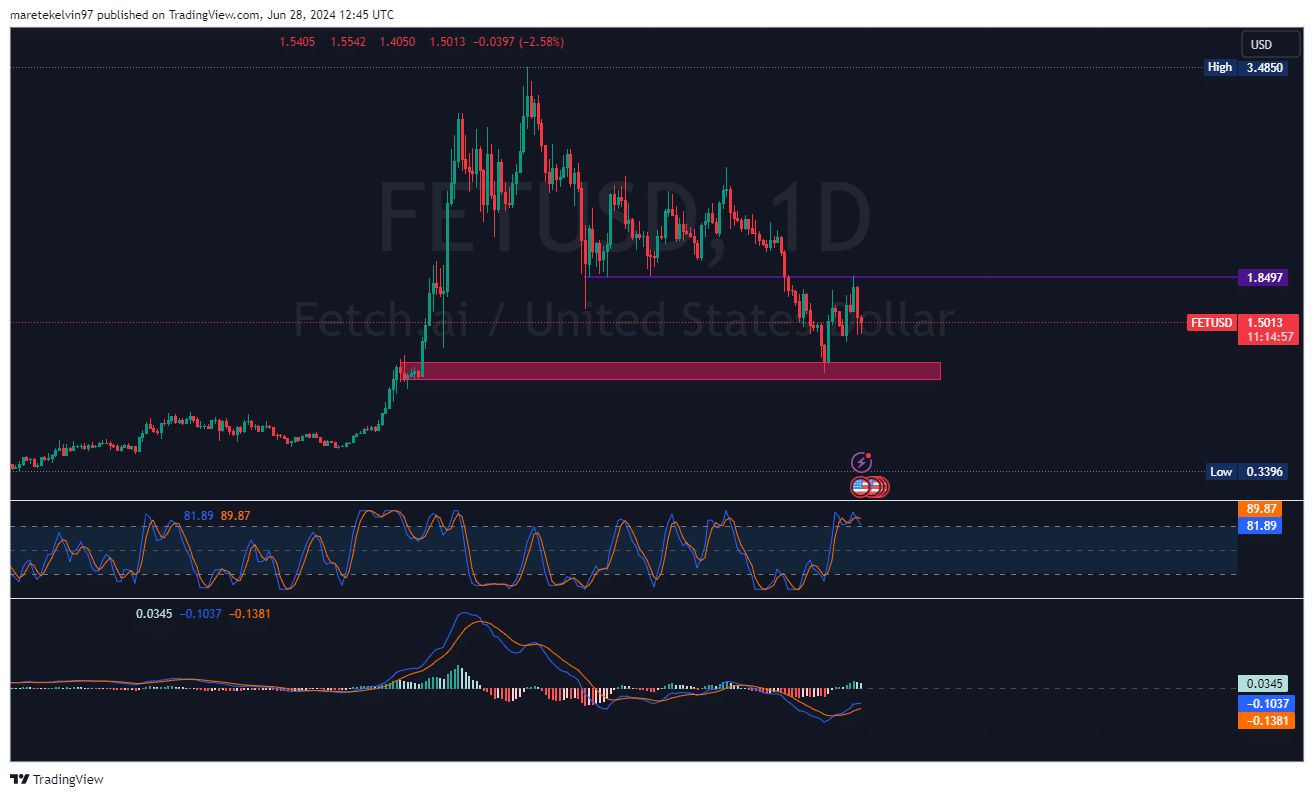

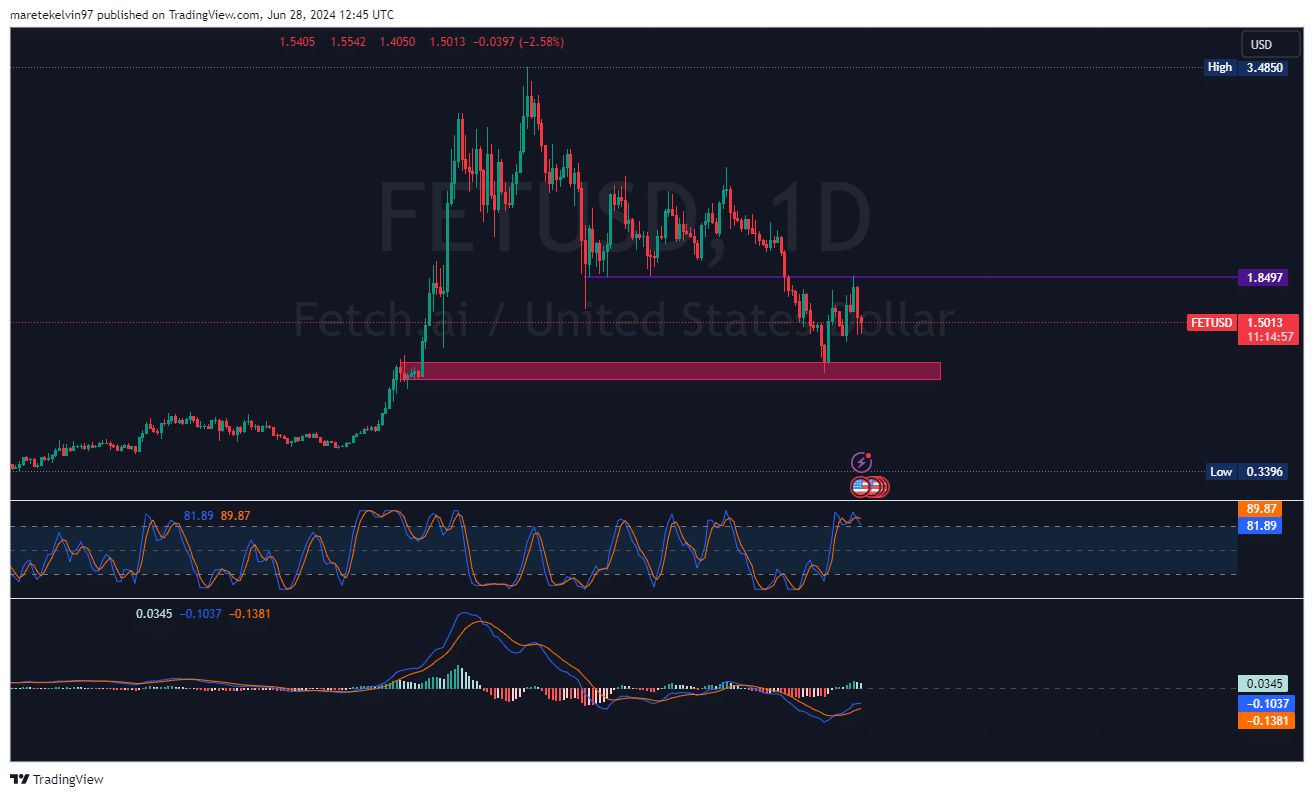

Source: FET/USD, TradingView

On the charts, both the Stochastic RSI (89.87) and the MACD indicated an overbought position, indicating that a price decline is likely.

Volume spikes during sales

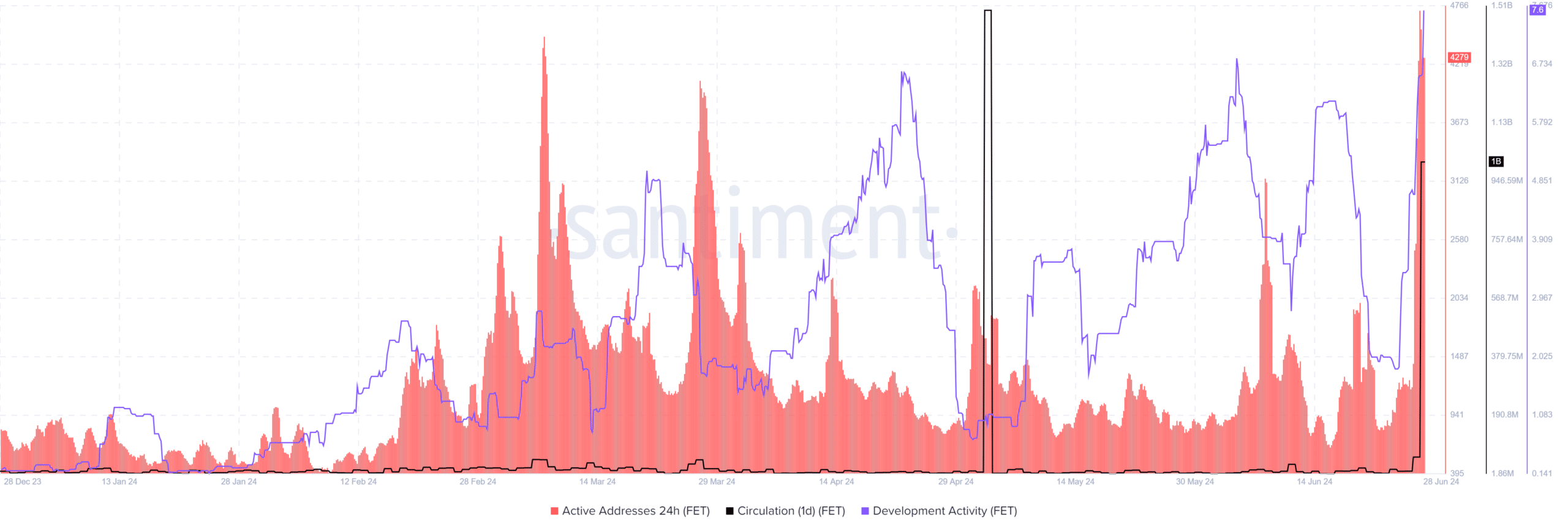

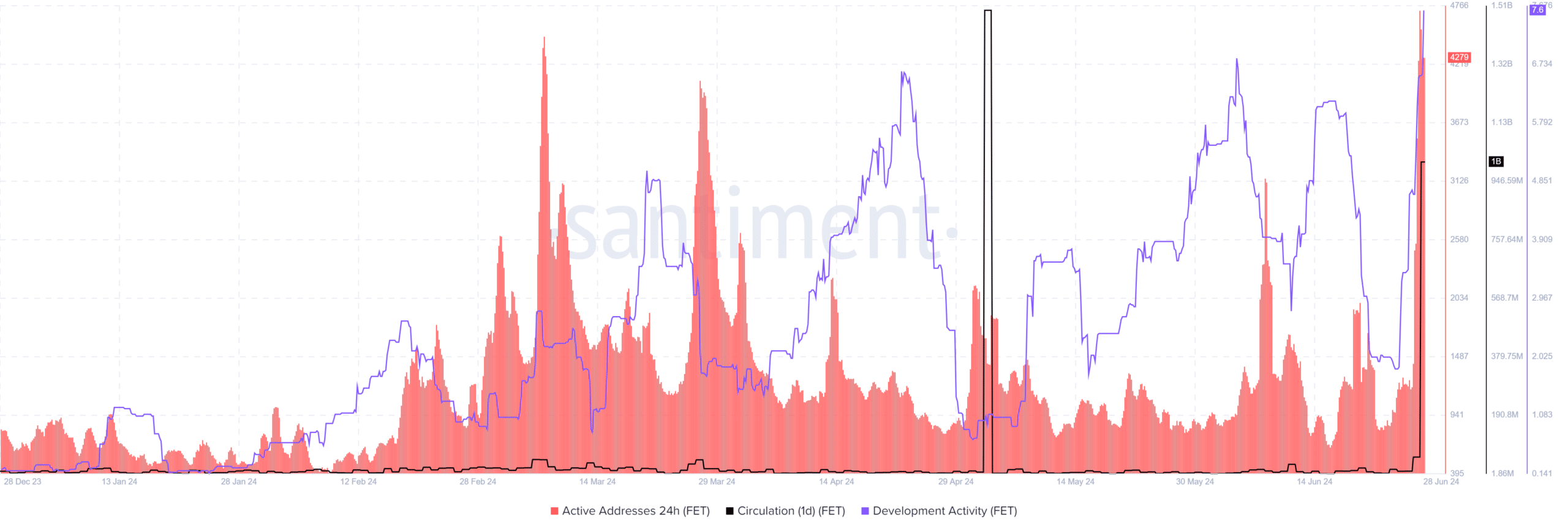

AMBCrypto analyzed data from Santiment for further insights. The data showed that there was a notable spike in trading activity during the recession. The number of 24-hour active addresses for FET increased dramatically, indicating increased network participation as prices plummeted.

Interestingly, development activity rates for FET have remained relatively stable during these price swings. This suggests that there is ongoing work on the project’s core technology, which could potentially provide a silver lining for long-term owners.

Source: Santiment

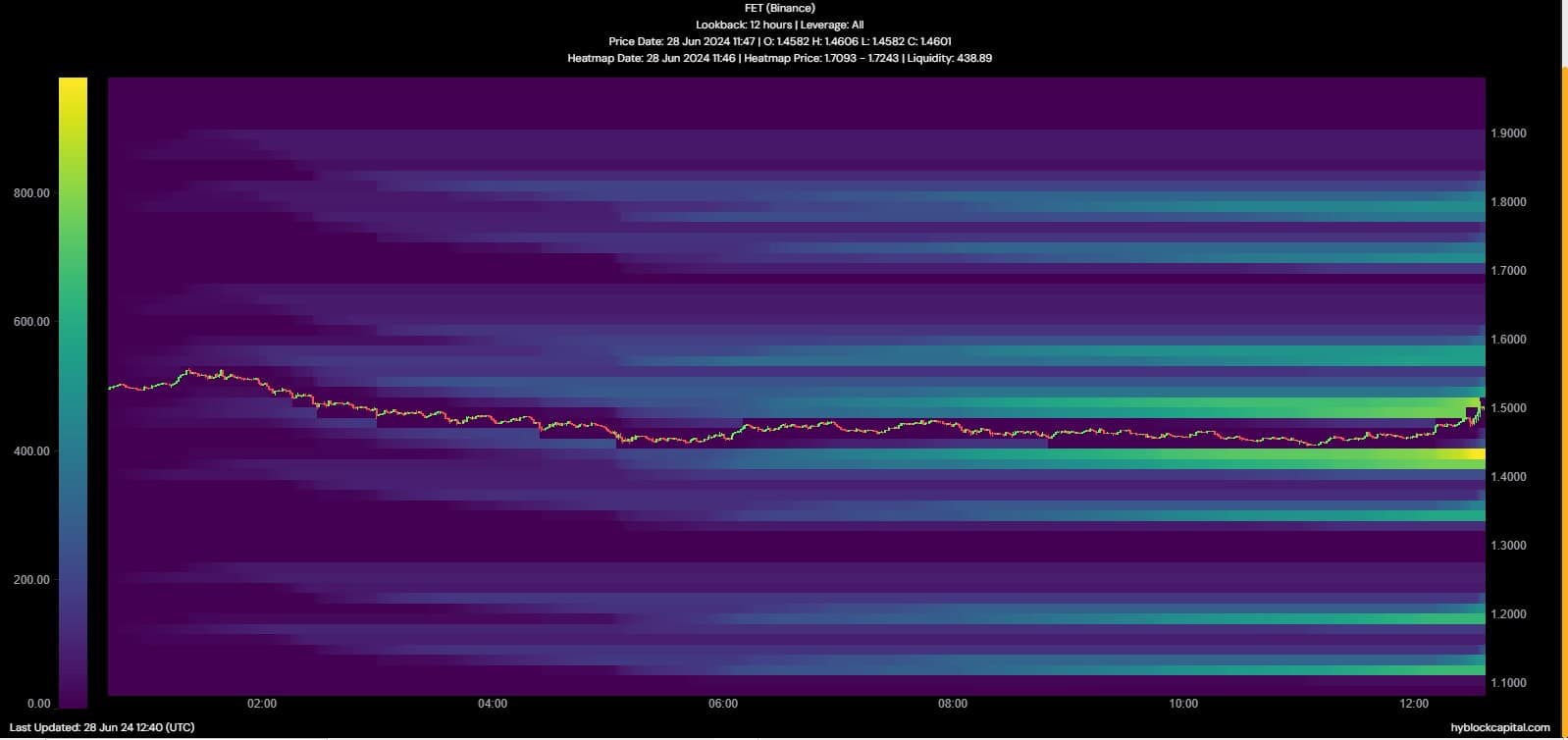

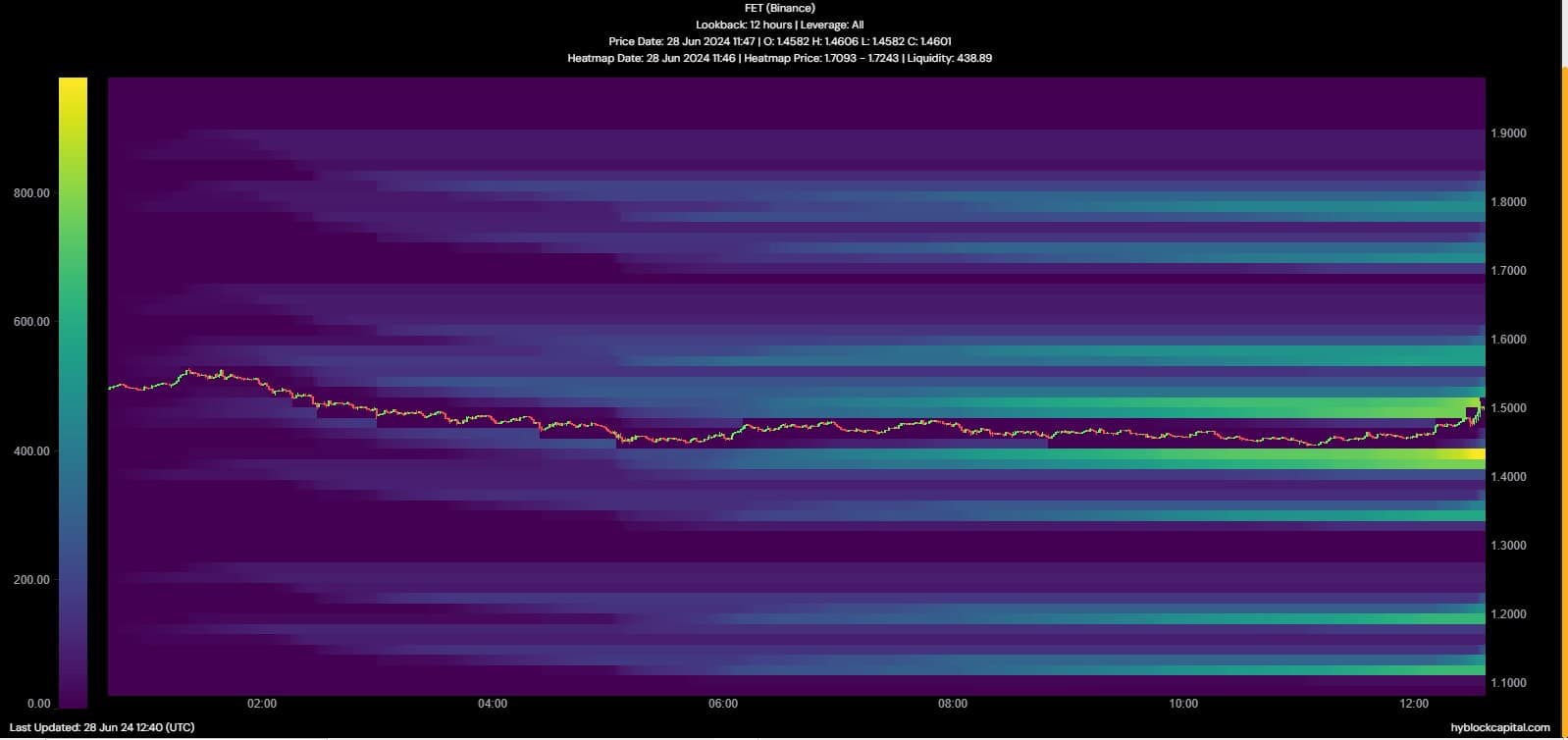

Furthermore, Hyblock’s Liquidation Heatmap data indicated a bearish bias over the past 12 hours. It also suggested that the short-term bias is not over and that FET’s price could fall in the short term before staging another long-term rally.

Source: Hyblock Capital

We further analyzed the long/shot ratio data to evaluate the direction of the market. The data indicated fluctuations in the long and short positions. This is a crucial finding, especially as short positions have taken control of the market lately.

Source: Coinglass

Uncertainty surrounding token migration

The broader crypto market has seen increased volatility recently. FET’s price charts also seemed to reflect this volatility. However, it is worth pointing out that the recent announcement regarding Coinbase’s position on the ASI token migration may have scared some investors.

What awaits FET?

FET holders should watch for key support and resistance levels in the coming days. The $1.40–$1.50 range appears to be a critical zone. If selling pressure continues, FET could retest a potential recent low around $1.20.

Otherwise, regaining the $1.80 level could signal a potential trend reversal and fuel bullish momentum.