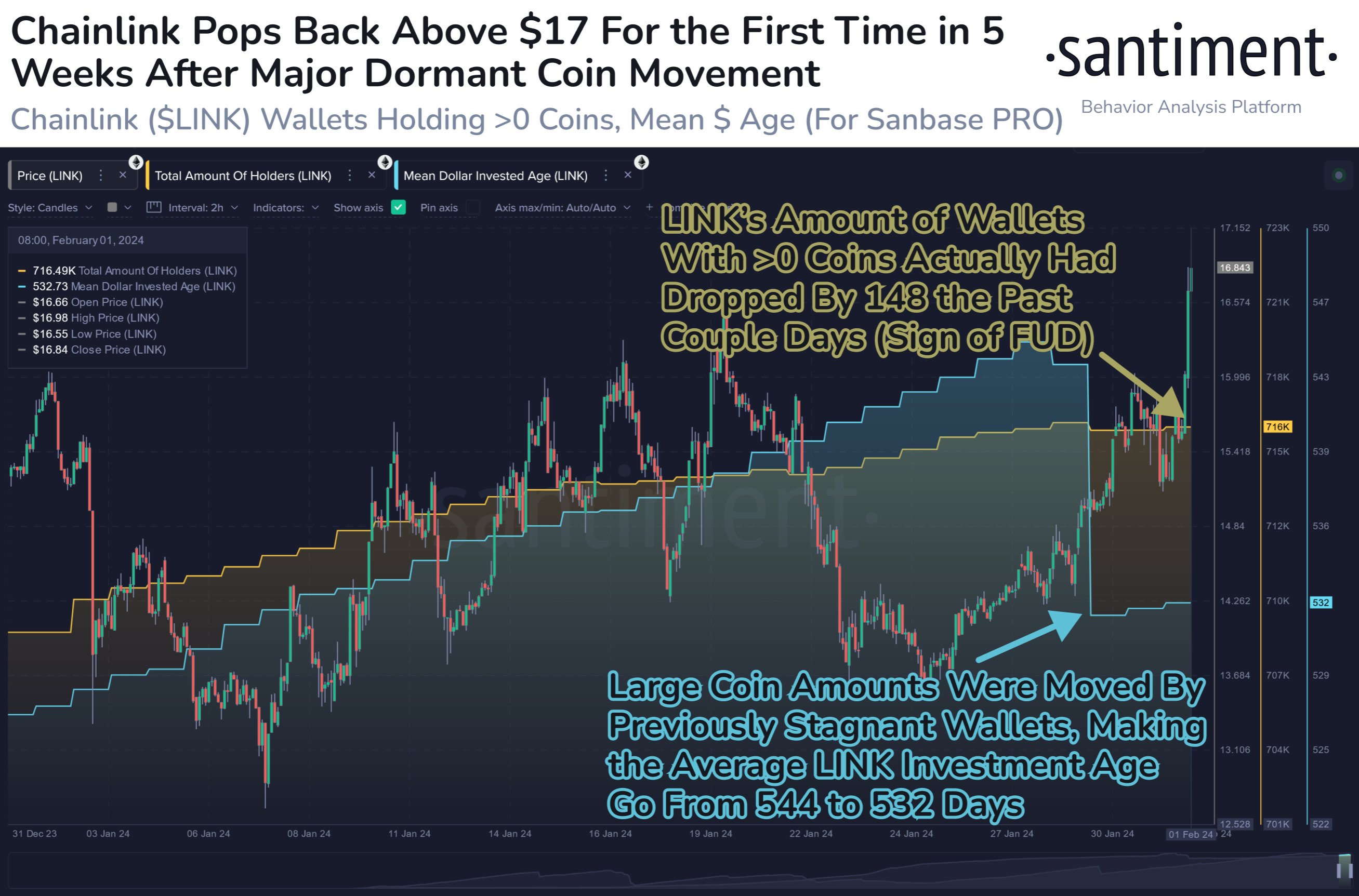

Crypto analytics firm Santiment says one metric suggests decentralized oracle network Chainlink (LINK) could have more upside potential.

In a new thread on the social media platform X, the market information platform say that Chainlink’s rally could continue even if LINK portfolios see a sudden drop.

According to Santiment, an abrupt decline in the portfolio is generally a sign of market capitulation due to fear, uncertainty and doubt (FUD), which could indicate a price increase may soon follow.

“Chainlink has jumped ahead of the altcoin pack after a number of previously dormant wallets created the highest age spike (5.38 billion, calculated by multiplying the coins moved by the number of days these coins were inactive). This influx of LINK back into the network’s circulation likely contributed to the price increase.

Additionally, the network had seen small portfolio liquidations, which is often a sign of FUD that can contribute to further price increases.”

LINK is trading at $18.76 at the time of writing, up almost 12% in the last 24 hours.

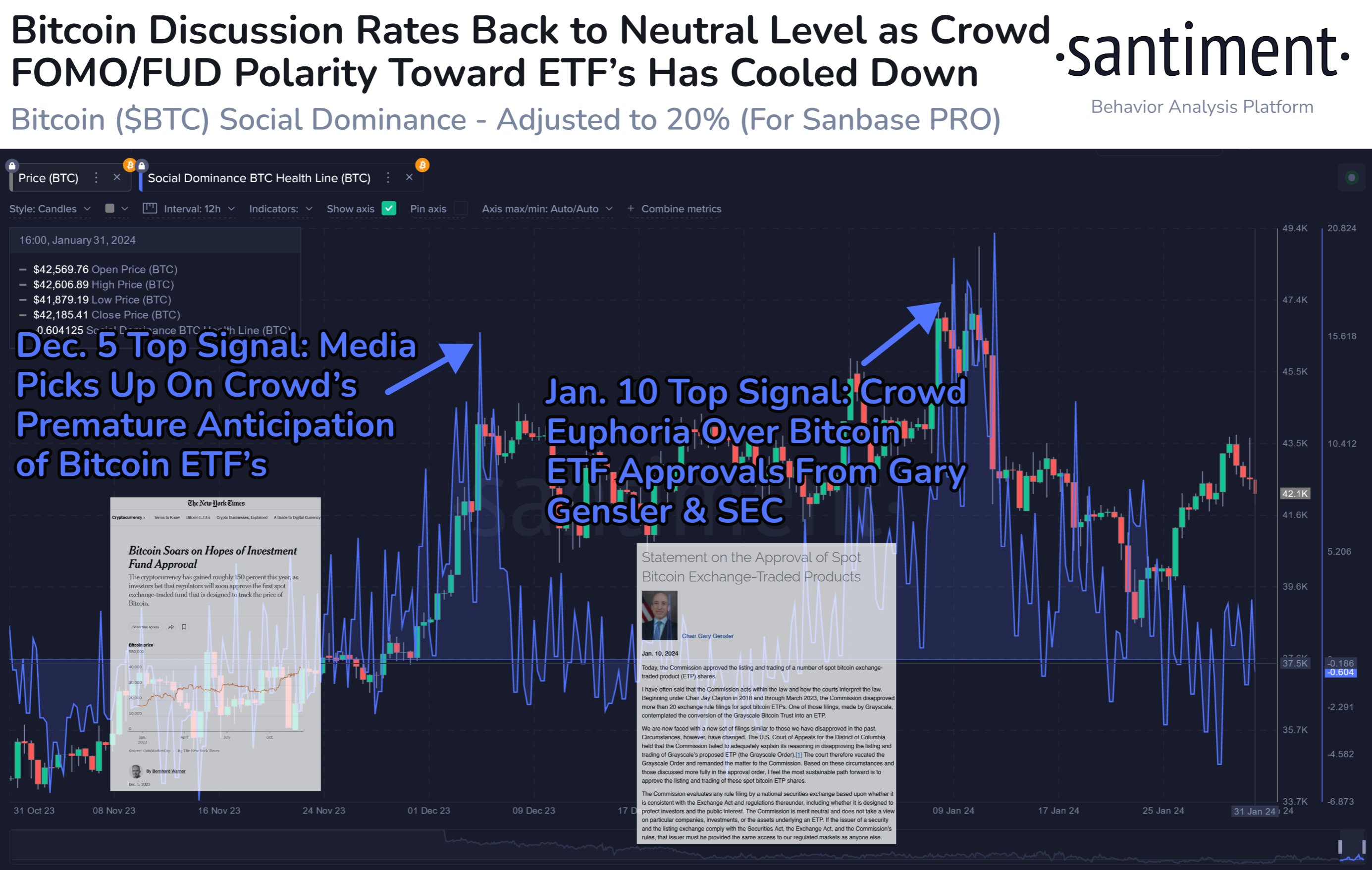

Next up is Santiment say that the Social Dominance Indicator, which tracks crypto discussions on social media platforms, could turn bearish for Bitcoin (BTC) and bullish for altcoins this week.

“Historically, a high percentage of public discussions about Bitcoin is a sign of fear. However, since mid-2023, the euphoria and optimism surrounding ETFs (exchange traded funds) have turned high BTC discussions into a greed indicator due to (arguably) unrealistic expectations for the markets.

Three weeks after the SEC (US Securities and Exchange Commission) approved the Bitcoin ETFs, it seems that this indicator has finally normalized.

High altcoin discussions could push the ratio of BTC discussions into bearish ‘unhealthy’ territory if they outperform the #1 market cap during this first week of February. Unlike the last two spikes in Bitcoin’s social dominance that foreshadowed predictable spikes, a negative spike means the asset is once again ignored in favor of the crowd once again eagerly exaggerating portfolios toward alts.”

Bitcoin is trading at $43,140 at the time of writing.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Tithi Luadthong