BTCUSD, BTCGBP and BTCEUR are the most traded Bitcoin pairs, each reflecting the interaction between Bitcoin and the specific economic environment of their underlying currency. By analyzing their respective performance, we can gain insight into the global Bitcoin market and how local economic conditions influence price action. While this data is limited to a single exchange, in this case Bitstamp, it provides a representative view of broader trends and allows for meaningful conclusions.

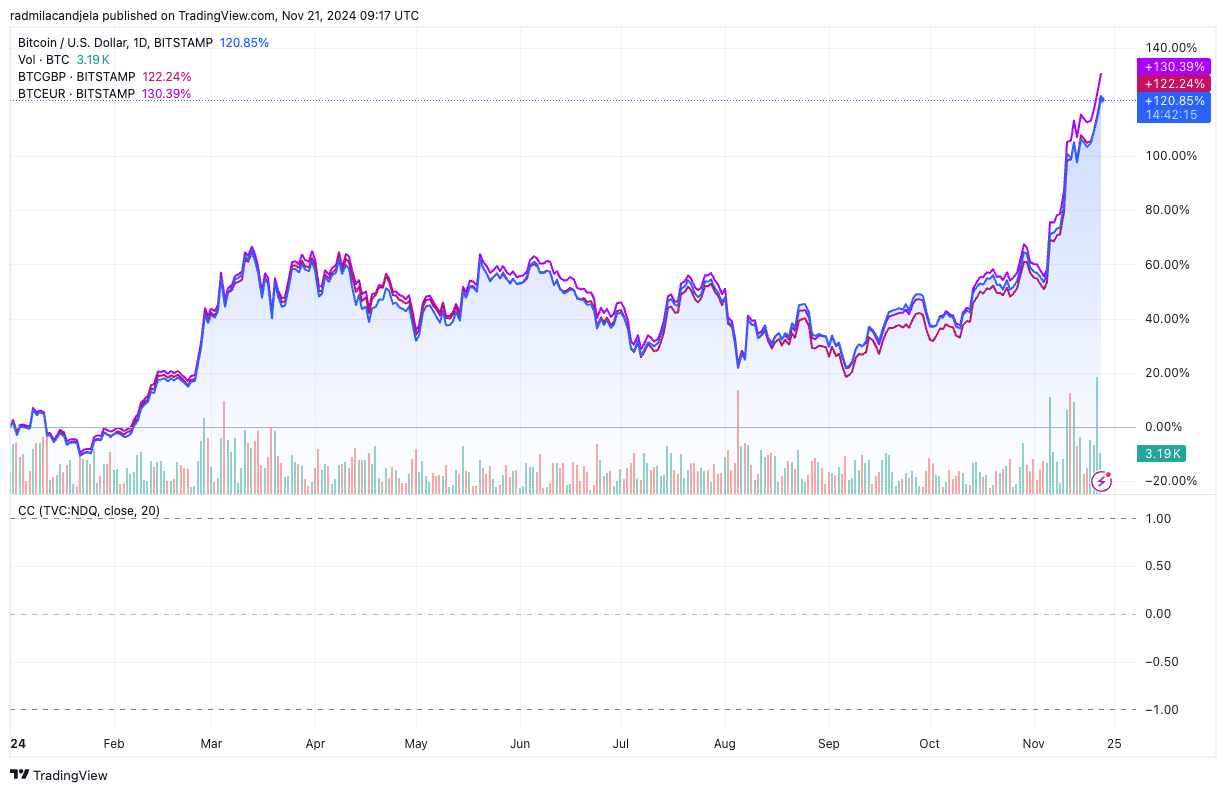

So far, BTCEUR has achieved the highest returns, with a gain of 130.39%, compared to 122.24% for BTCGBP and 120.85% for BTCUSD. This outperformance can largely be attributed to the weakness of the euro against the dollar and the pound. With the eurozone struggling with low growth and limited monetary policy flexibility, the currency has suffered against the backdrop of a strong dollar.

This depreciation amplifies Bitcoin’s gains in EUR terms, as it takes more Euros to buy the same amount of BTC. In contrast, the strength of the dollar – buoyed by strong US economic data, robust Treasury yields and expectations of longer and longer Federal Reserve policy – has tempered BTCUSD’s apparent gains, as a stronger dollar continues to put upward pressure on the price of Bitcoin compensates.

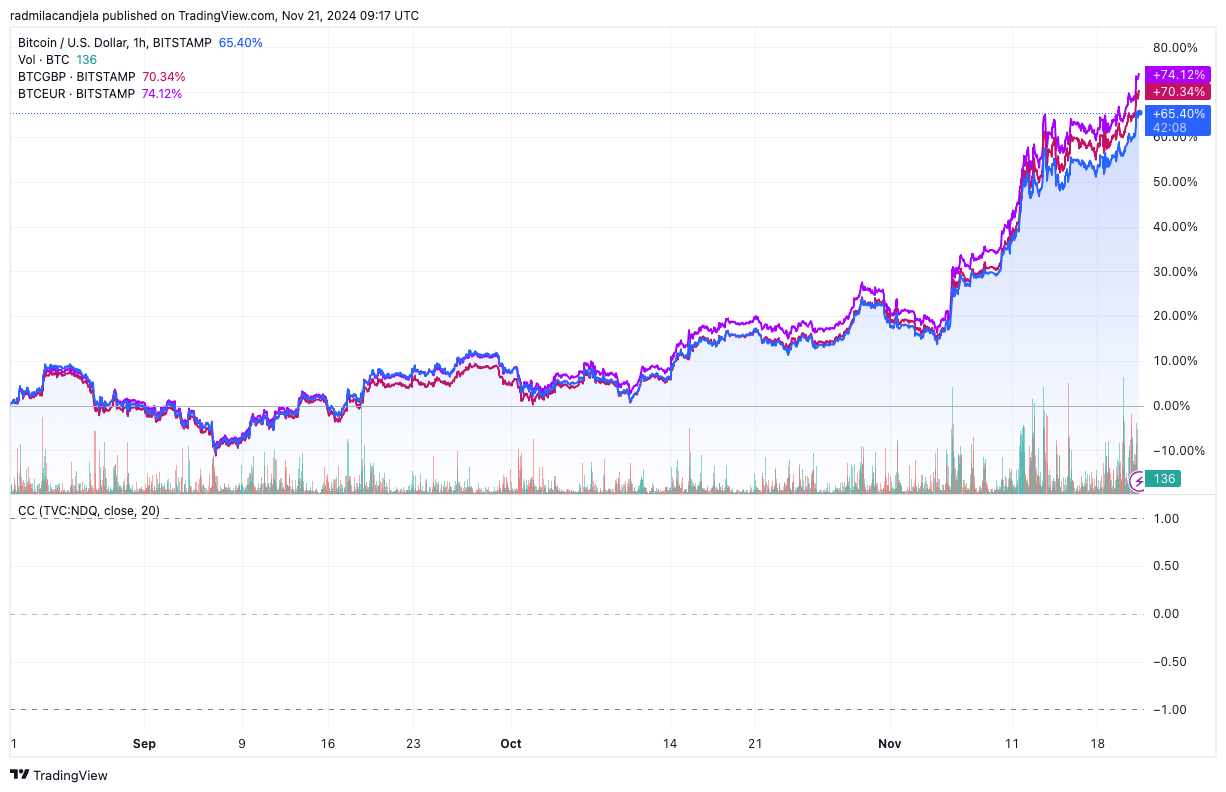

Over the three-month period, the trends remain consistent, with BTCEUR continuing to outperform BTCGBP and BTCUSD. During this period, the euro’s weakness became even more apparent, falling to a one-year low against the dollar. This decline reflects a combination of disappointing growth figures in the eurozone, mild signals from the European Central Bank and geopolitical uncertainties.

Meanwhile, BTCGBP has performed slightly more robustly than BTCUSD, underscoring the pound’s relative weakness. Continued economic stagnation in Britain and the Bank of England’s less aggressive stance have put pressure on the GBP, even as the country remains slightly more resilient than the euro.

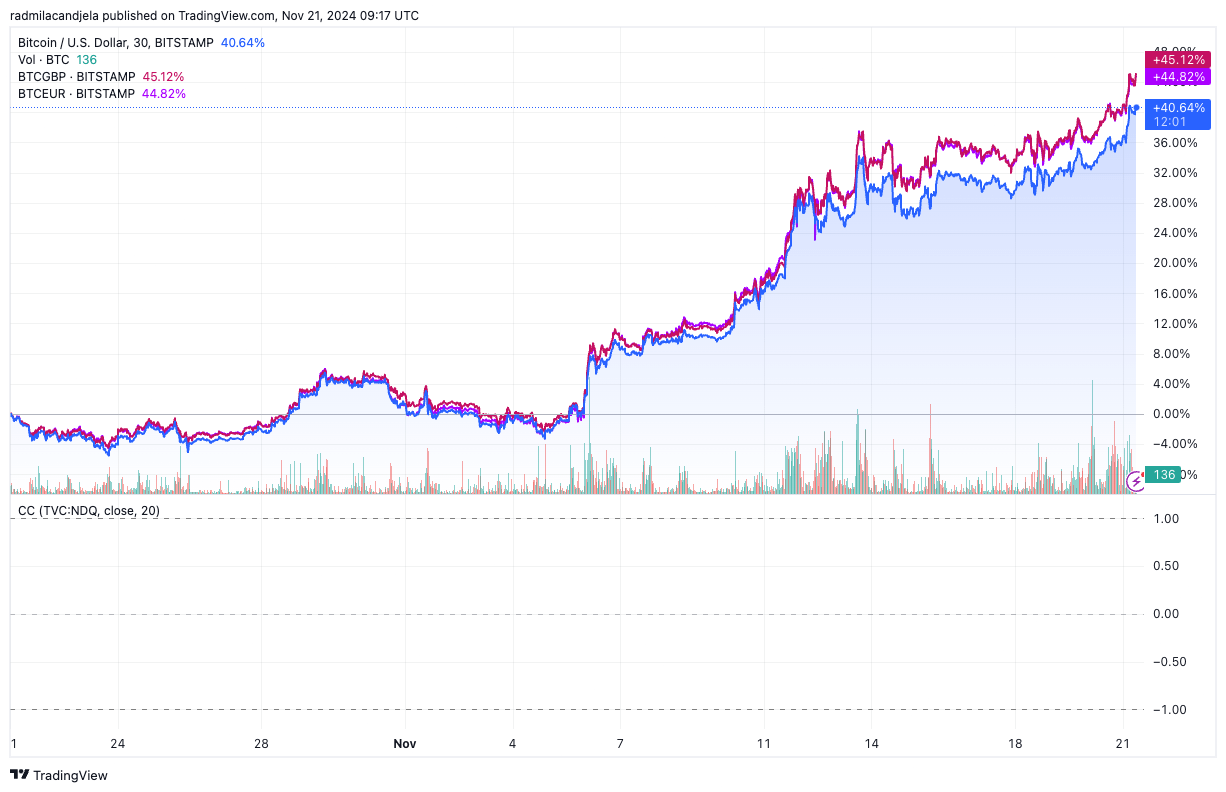

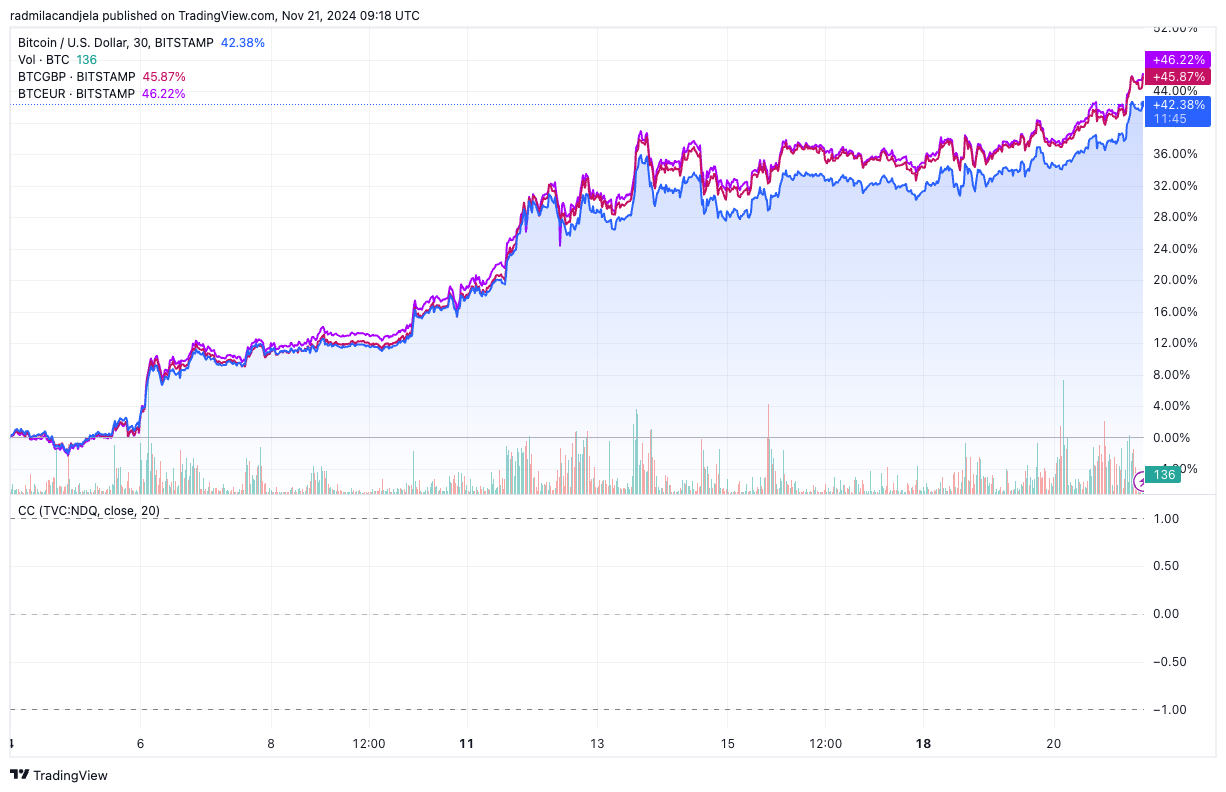

The price action since the US election shows that Bitcoin’s performance against these three currencies reflects the latest macroeconomic and geopolitical developments. BTCUSD rose 42.38%, behind BTCEUR and BTCGBP, which grew 46.22% and 45.87%, respectively. The continued strength of the dollar has been key in dampening BTCUSD’s gains. The market reaction to the US elections was aggressive.

As the policies of the incoming Trump administration are expected to boost US growth, the election strengthened the dollar and boosted demand for US assets, which weighed on BTCUSD. In contrast, BTCEUR and BTCGBP were relatively unaffected by this political event, and their performance remained largely a function of their respective fiat weaknesses.

The difference in Bitcoin’s performance between these pairs also shows how fiat volatility impacts perceived returns. The euro and the pound have been much more volatile than the dollar this year, especially given the contrasting monetary policies and economic prospects of each area.

This volatility exaggerates Bitcoin’s price movements in terms of EUR and GBP, creating the illusion of greater returns compared to BTCUSD. As the Eurozone continues to face structural growth challenges, Bitcoin’s outperformance against the Euro is likely to continue. While the pound has been under similar pressure, it has shown slightly more resilience due to less severe structural issues, consistent with BTCGBP’s mid-range performance against BTCUSD and BTCEUR.

The short-term trends observed since the November 5 US elections show a rather interesting market situation. Despite the strength of the USD, BTCUSD rose steadily during this period. This suggests that while the strength of the dollar dampened Bitcoin’s gains compared to BTCEUR and BTCGBP, it did not completely suppress price momentum.

For BTCEUR and BTCGBP, the continued weakness of the EUR and GBP after the elections allowed Bitcoin to maintain its relative outperformance. This is especially relevant given that Eurozone and UK markets are increasingly viewing Bitcoin as a hedge against depreciating fiat currencies.

The post Weak Euro Fuels Bitcoin’s Standout Performance in the Eurozone appeared first on CryptoSlate.