- The exchange communicates details about new TUSD pairs.

- The exchange supply of the stablecoin leveled off despite the increasing volume.

Binance made this known in an official statement on May 30 TrueUSD [TUSD] would get three new trading pairs on the exchange. According to the announcement, Litecoin [LTC] would participate Cardano [ADA] and BinanceUSD [BUSD] linked to the stablecoin as pairs.

Of the lot, the addition of BUSD is the only one that can be called surprising. This was because it was going through a winding down season. For ADA and LTC, the exchange’s decision to add it as a TUSD pair could be connected to recent events.

Determined not to take the fall

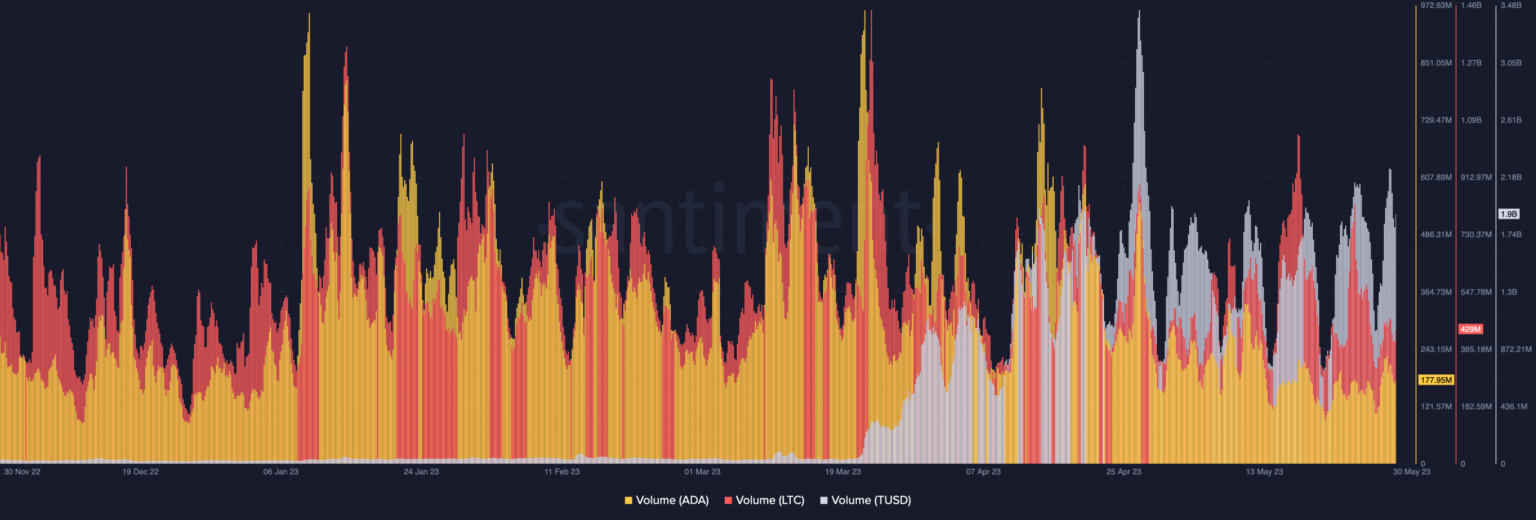

Recently the volume of ADA and LTC has increased as interest in the cryptocurrencies spiked. At the time of writing, ADA’s volume was 177.9 million. In the case of Litecoin, the volume increased to 429 million.

Source: Sentiment

Based on on-chain data, TUSD’s volume also rose to $1.9 billion – one of the highest since it acquired the crypto community attention earlier this year. For context, volume represents public sentiment and can be used to determine bullish or bearish outcomes.

Aside from TUSD, the surge in ADA and LTC volume suggests that quite a few market participants could be bullish on the asset. In turn, it could contribute to the adoption of TUSD, provided they maintain the status quo.

While Binance prides itself on being the world’s largest exchange, the new peg is no guarantee that TUSD’s market cap will change significantly. Perhaps there are tendencies to rise, the stablecoin still has such Tether [USDT] And Circle [USDC] fight.

The hype is back

At the time of writing, TUSD is ranked #31 in market cap. With a market cap of over $2 billion, the stablecoin continues to attract the crypto community looking for alternatives to the rest.

In the context of social dominance, Santiment showed that TUSD accounted for 0.042%. Social dominance is measured by looking at the percentage of discussions about assets compared to others in the top 100.

Source: Sentiment

So TUSD’s inability to reach the point the metric was at when May started implies that the hype surrounding the stablecoin had subsided.

Realistic or not, here is the market cap of TUSD in USDT terms

also the offer at fairs of TUSD has been greatly affected with a decline since May 2. At the time of writing, the statistic was 448.58 million.

Meanwhile, the metric measures the asset supply currently stored in the portfolios of centralized exchanges. When the supply decreases, it means that some coins are taken off these platforms, but when the metric is high, it suggests a potential increase in trading activity with the coin.

Source: Sentiment