- Trading volume of BTC ETFs reaches $5.7 billion.

- BTC and ETH are recovering from a market downturn.

Over the past 30 days, the cryptocurrency markets have experienced extreme volatility. The past two days have seen the crypto markets crash and recover, with BTC falling below $49,000, while altcoins also fell at the same time.

As the crypto markets crashed, BTC spot ETF trading volume doubled.

BTC ETF trading volume reaches $5.7 billion

Source: Coinglass

Amid the market crash, trading volume for Bitcoin ETFs has soared to more than $5.7 billion. According to the report, the recent surge came after 48 hours of increased volatility in the crypto market.

Coinglass data shows that ETF outflows have slowed and remained stable over the past 48 hours, reaching a moderate level of $84.1 million.

Likewise, Coinglass showed that net assets remain at $48 billion. The data shows a positive market reaction to ETFs as crypto tokens continue to exhibit uncertainty.

BTC and ETH ETFs are rebounding after high outflows

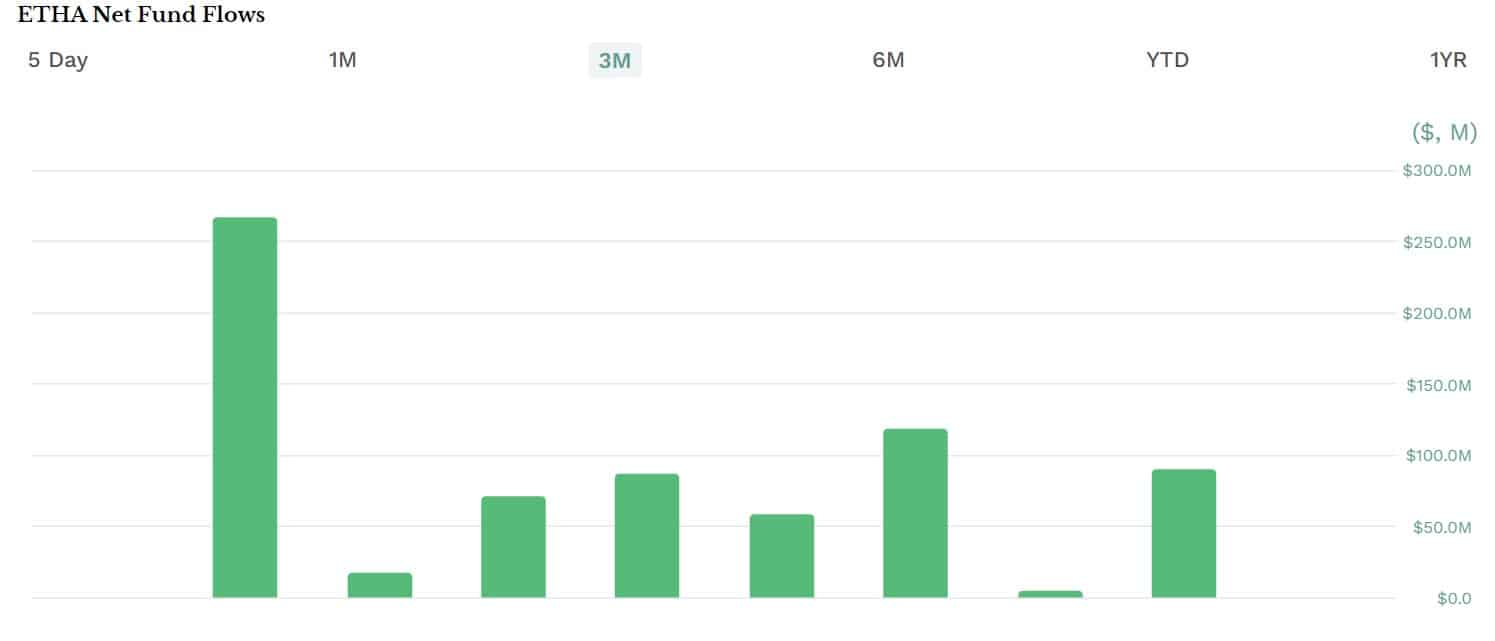

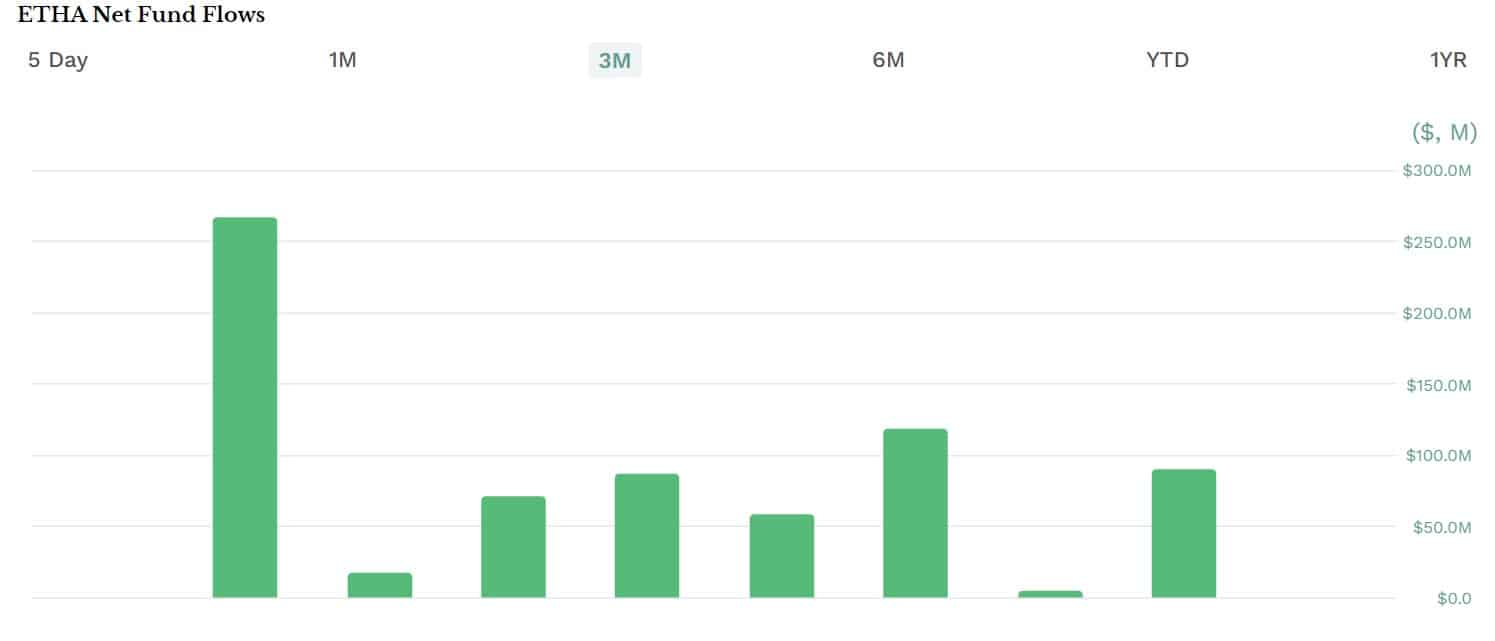

Since the launch of Ethereum ETFs last month, they have reported high outflows, which have affected ETH prices.

ETH ETFs have recorded high outflows in recent weeks, exceeding $2 billion in value. ETHE reached outflows of $2.1 billion, raising concerns about the ETH ETF’s ability to compete with Bitcoin ETFs.

Source: ETHA

Similarly, Bitcoin ETF outflows had reached an all-time high over the past six months. On the 5th, as the market collapsed, BTC ETF outflows reached $168.4 million, with Grayscale BTC Trust ETFs and ARK 2iShares BTC ETFs leading the outflows.

However, in the past 24 hours, BTC ETFs have reached an all-time high, with trading volume exceeding $1.3 billion in the first minutes of trading on July 6.

With the increase, iShares Bitcoin Trust achieved the highest trading activity, with a value of over $1.27 billion.

Source: Blokwerken

Impact on BTC and ETH?

The market prices of ETH and BTC have recovered significantly after low months. Bitcoin hit a two-month low after falling below $50,000, while Ethereum recorded a low of $2116.

The decline was due to increased turnover of $1.2 billion in crypto liquidations following a ripple effect from the global stock crash.

Source: Tradingview

Despite the decline, BTC prices have rallied and data shows that ETF holders have maintained their positions during the market decline. BTC is trading at $56888 after rising 1.97% in 24 hours and making a significant recovery from a low of $49577.

Therefore, as ETF holders held positions, the trading volume of BTC ETF increased to $5.2 billion, which was even greater than the trading volume in January after its launch.

Similarly, Ethereum ETFs that have recorded massive outflows in the past have recorded inflows of over $49 million.

Thus, increased ETF trading volume and inflows have played a crucial role in pushing BTC and ETH prices up from two-month lows.

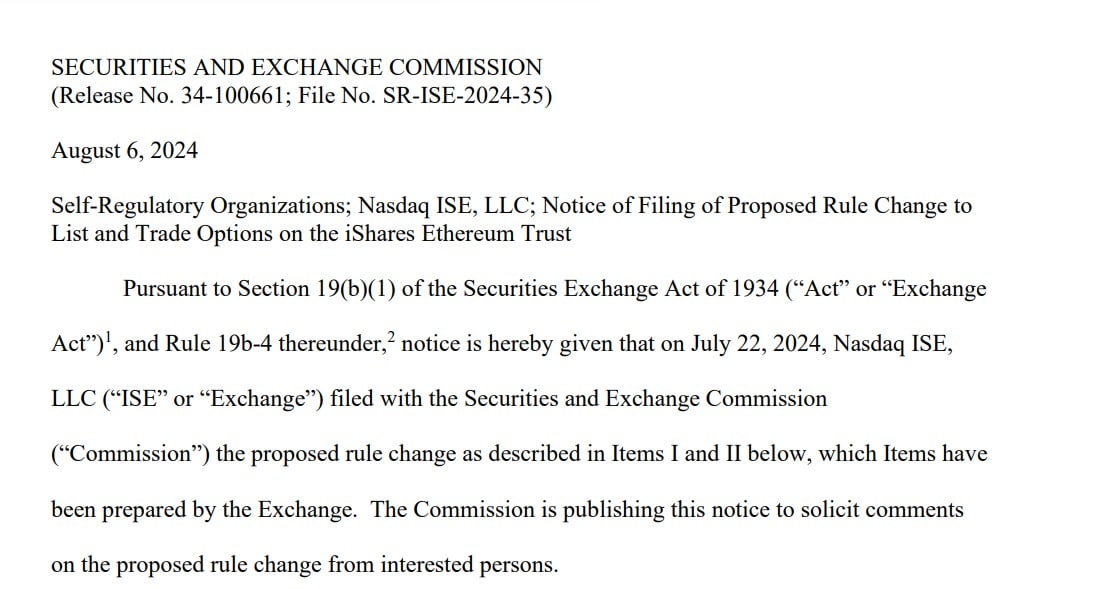

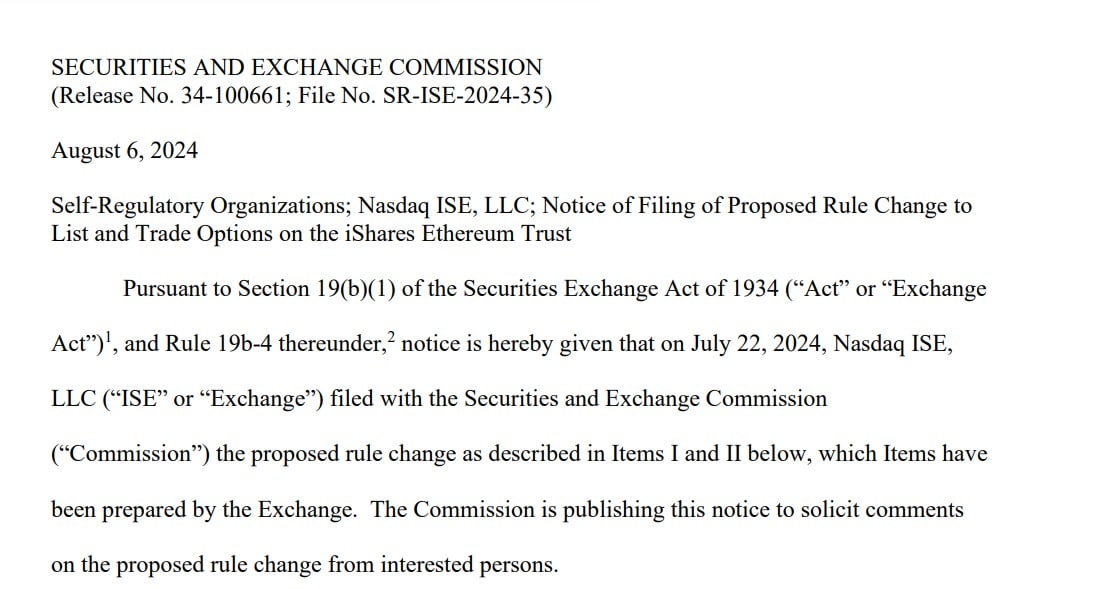

BlackRock, Nasdaq File for spot Ethereum ETF

Another boost for Ethereum ETFs amid increased market uncertainty is the recent move by Blackrock and Nasdaq.

According to reports, the two companies have decided to add options to Ethereum ETFs to ETHA (iShares Ethereum Trust). The SEC filing by Nasdaq and Blackrock proposed a rule change to allow options trading of the iShares Ethereum Trust (ETHA).

The submit stated that,

“The Exchange believes that offering options on the Trust will benefit investors by providing them with an additional, relatively lower cost investment vehicle to gain exposure to spot ether, as well as a hedging vehicle to meet their investment needs related to ether products and positions. .”

Source: SEC

The filling comes almost three weeks after the launch of Ethereum ETFs. Although Ethereum ETFs have faced great uncertainty, the markets see it as a success and need additions for trading options.