- BTC is struggling because its price last week continues to fall by 1.4% by 1.4%.

- The short -term investors of Bitcoin have entered a period of extreme panic and fear.

The last day, Bitcoin [BTC] has refused to reach a low of $ 81k. The King Coin remained in the red zone, with a fall of 1.40% on the weekly charts and 0.51% decrease in daily cards.

These price fluctuations and rising volatility have left investors in a panic in the short term.

Extreme panic and fear

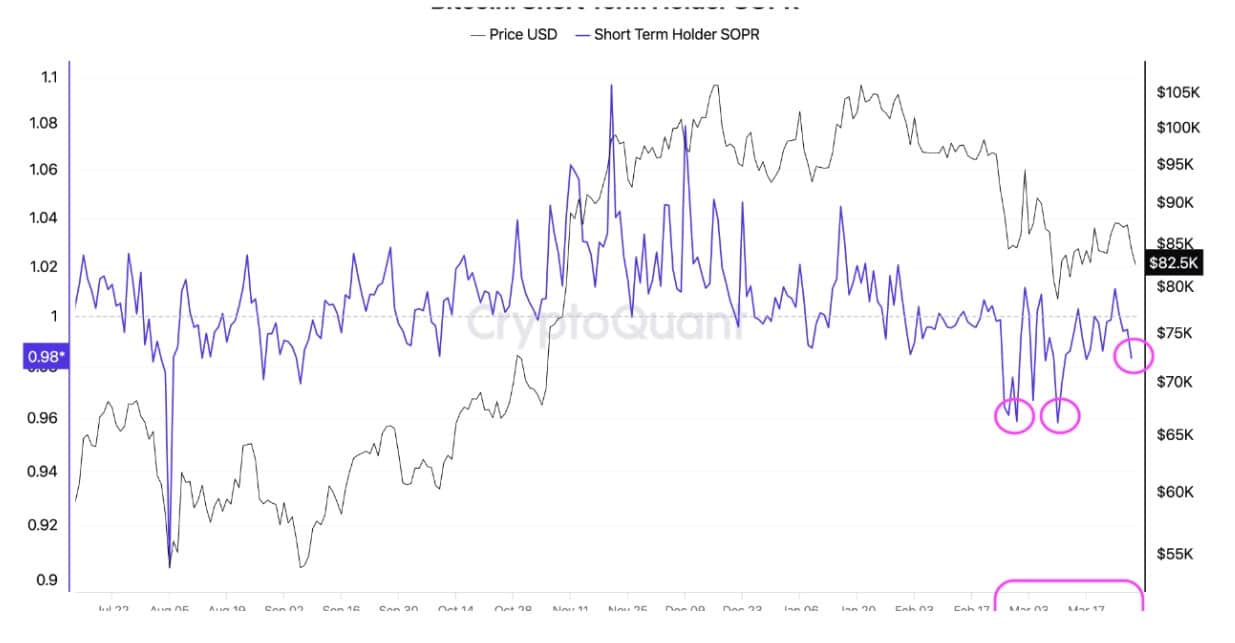

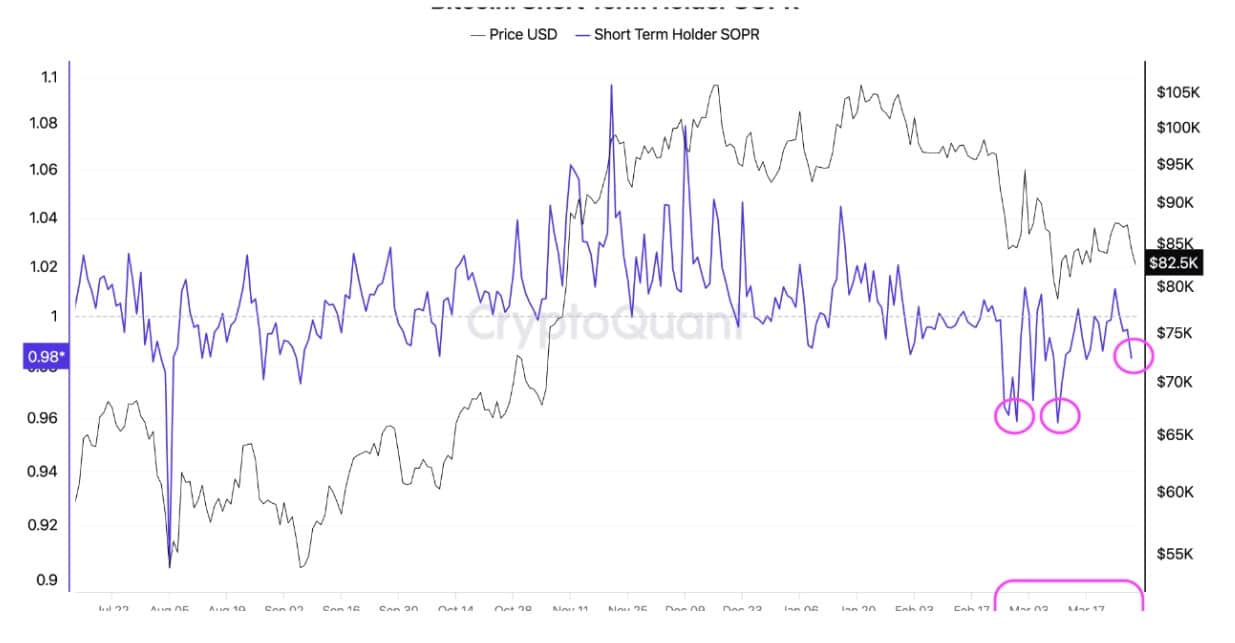

According to CryptoquantThe short -term investors of Bitcoin are in a state of extreme panic and fear. According to the analysis, short -term holders have consistently sold their coins with losses since the beginning of February.

Source: Cryptuquant

With investors who decide to sell with loss, this means their lack of market confidence. As such, this cohort seems to be missing a clear direction.

Insofar as they sell to prevent further losses, which reflect extreme fear of the uncertainty of the market.

Looking at StH Sopr, it was under 1 at the moment of the press, which suggests that most movements in the chain are no longer.

During the decreases in March, short -term investors sold more with losses, which indicates that panic and fear from their part ruled.

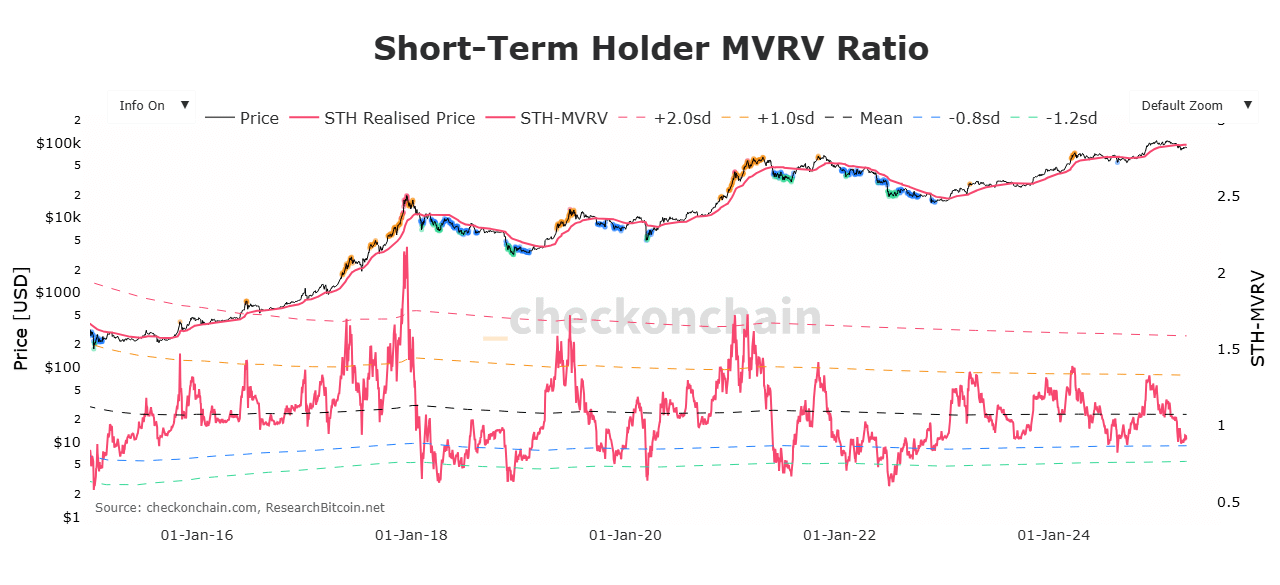

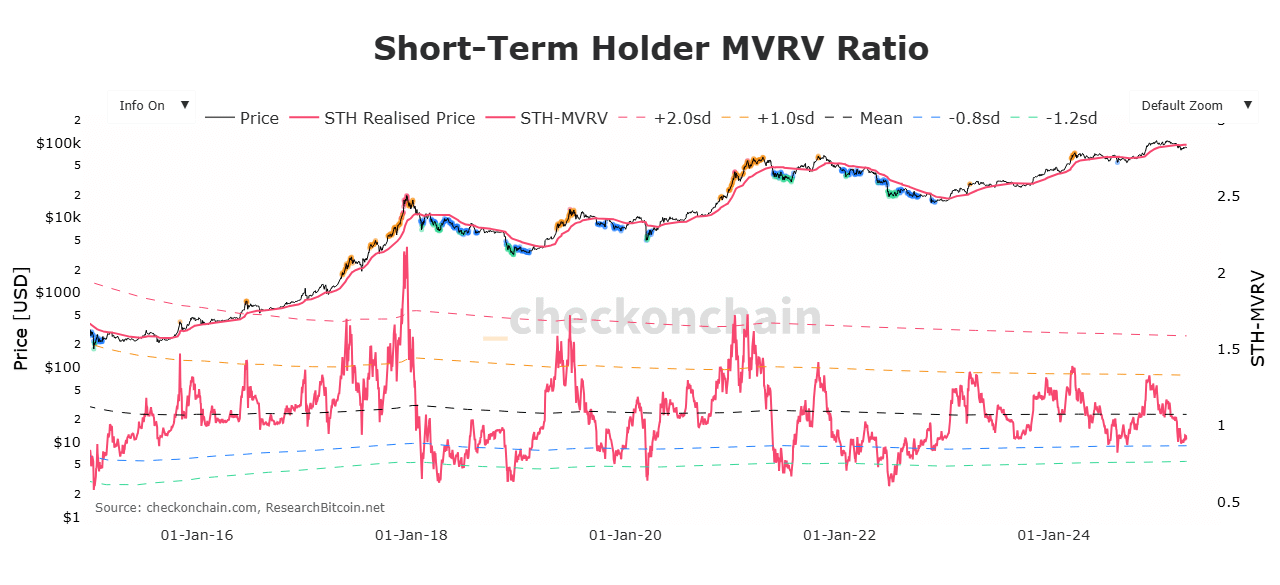

Source: Checkonchain

This lack of market confidence in short-term investors is further validated by a falling MVRV ratio of the short-term holders.

According to Checkonchain data, STH MVRV has fallen to 0.86, which implies that STH holders hold with a loss.

Historically, when STH MVRV drops under 1 for a long period, this is followed by further price drops, because Bitcoin sees a weak question. With a higher sales speed of STH than buying, prices will fall further.

Source: Cryptuquant

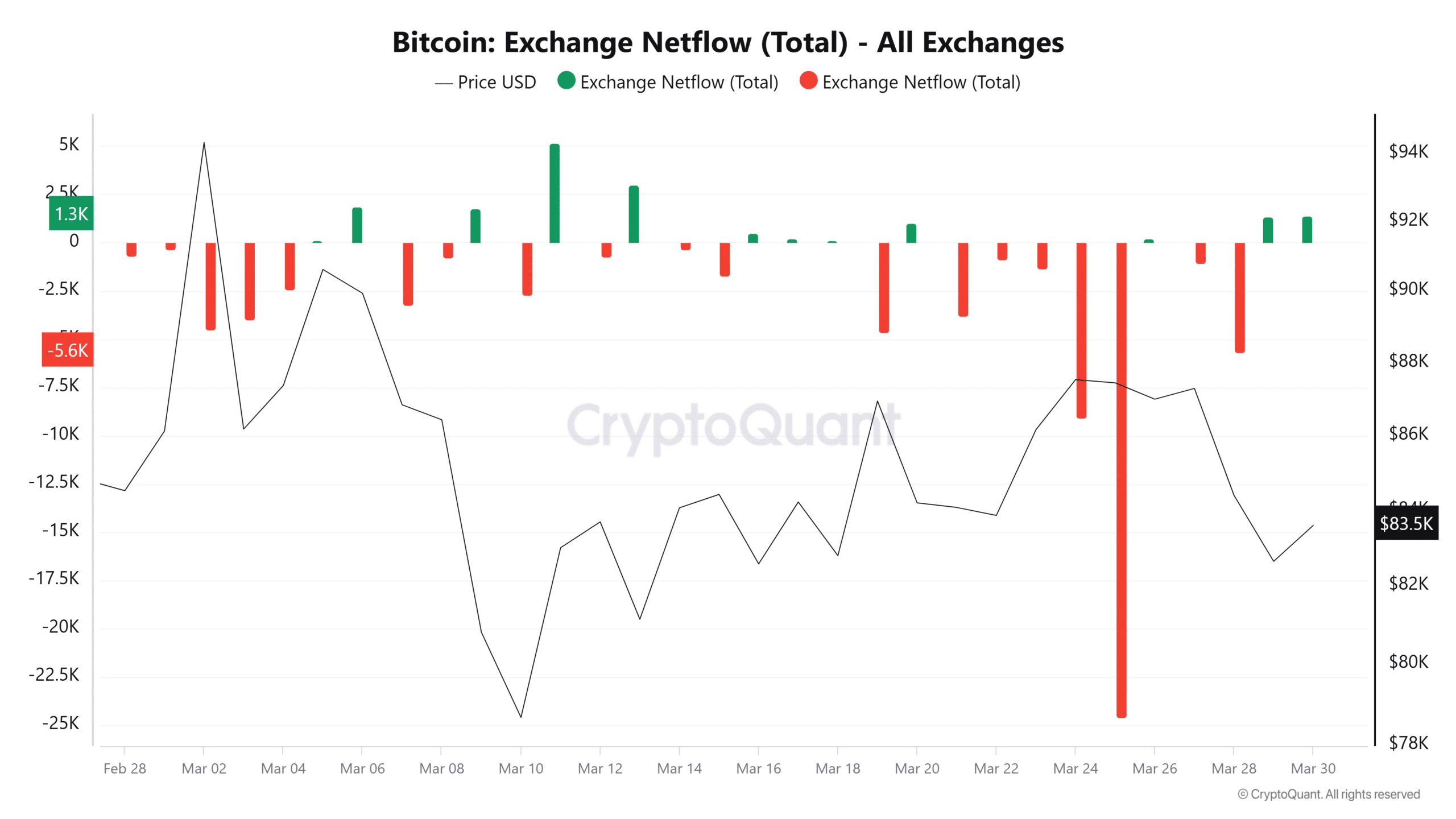

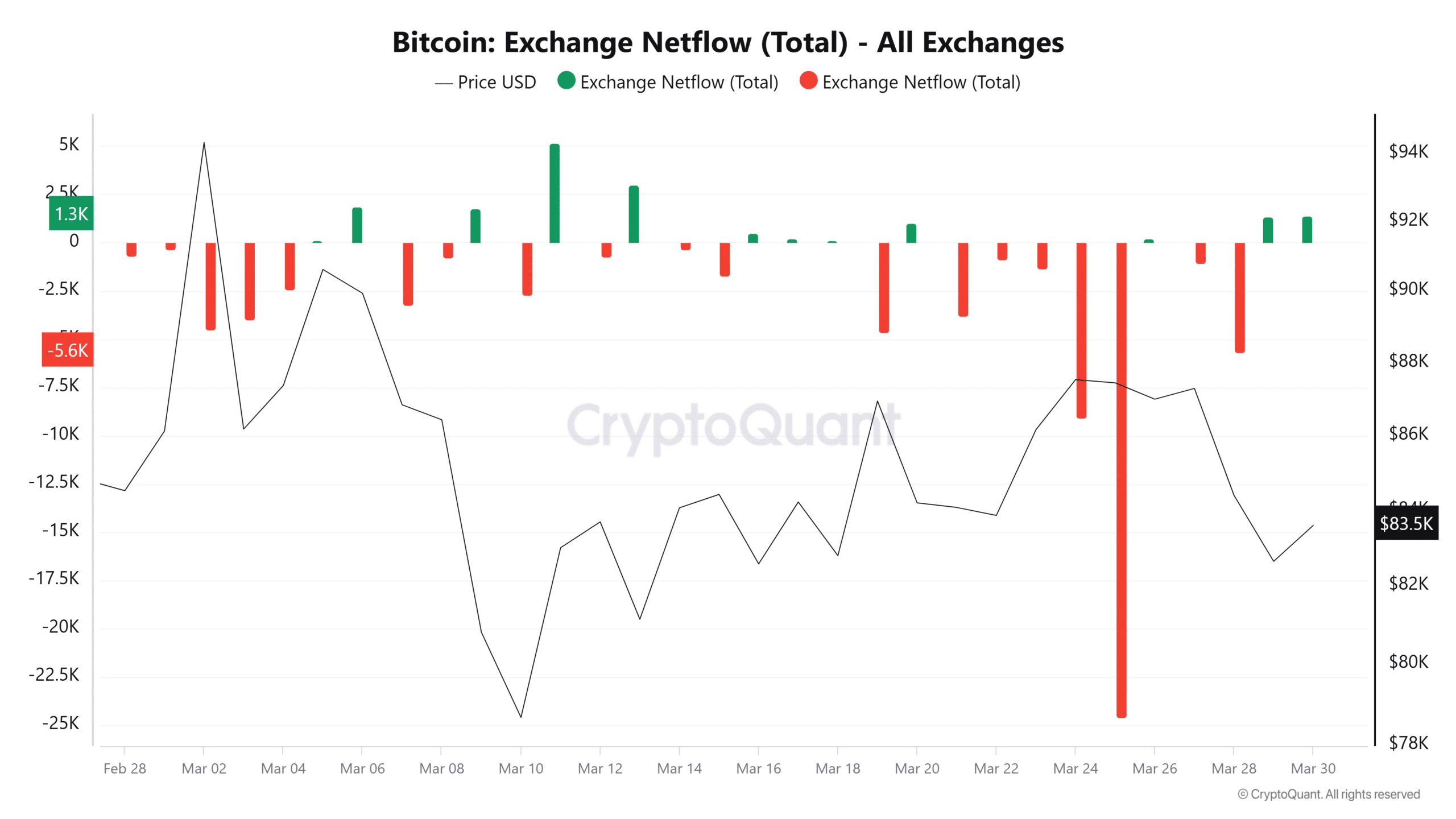

Looking at Bitcoin’s Exchange Netflow, we can see that investors have sold themselves aggressively. As such, BTC has registered two consecutive days of positive Netflow for the first time in 12 days.

This suggests that panic has resulted in a higher sales activity of the cohort for short -term investors, whereby the outflows of the exchange of exchange flood.

Source: Intotheblock

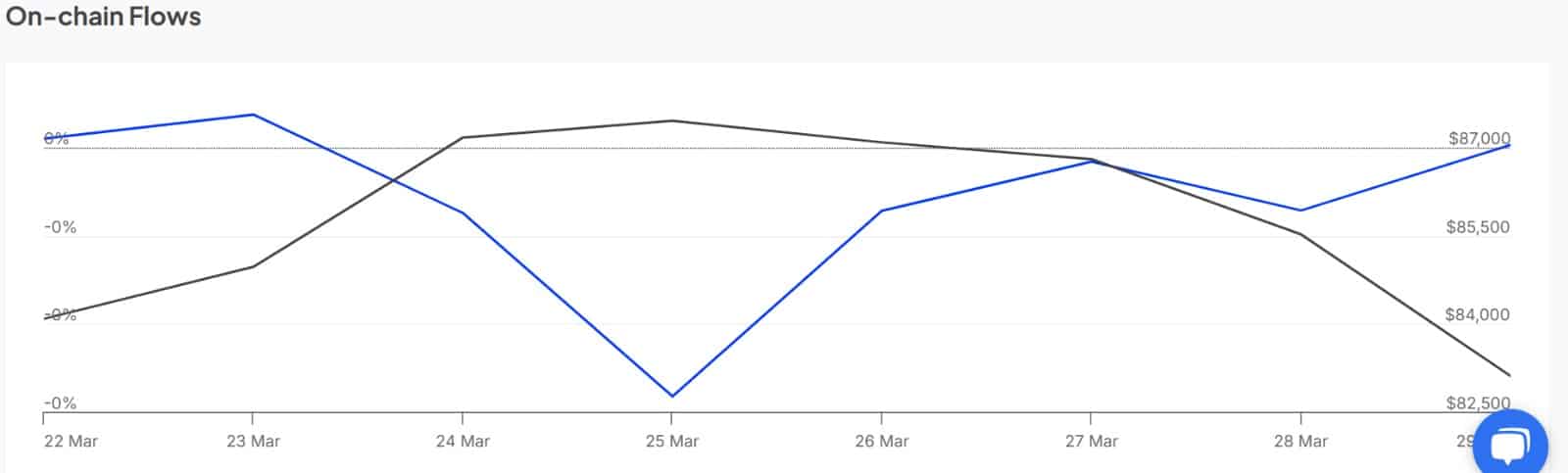

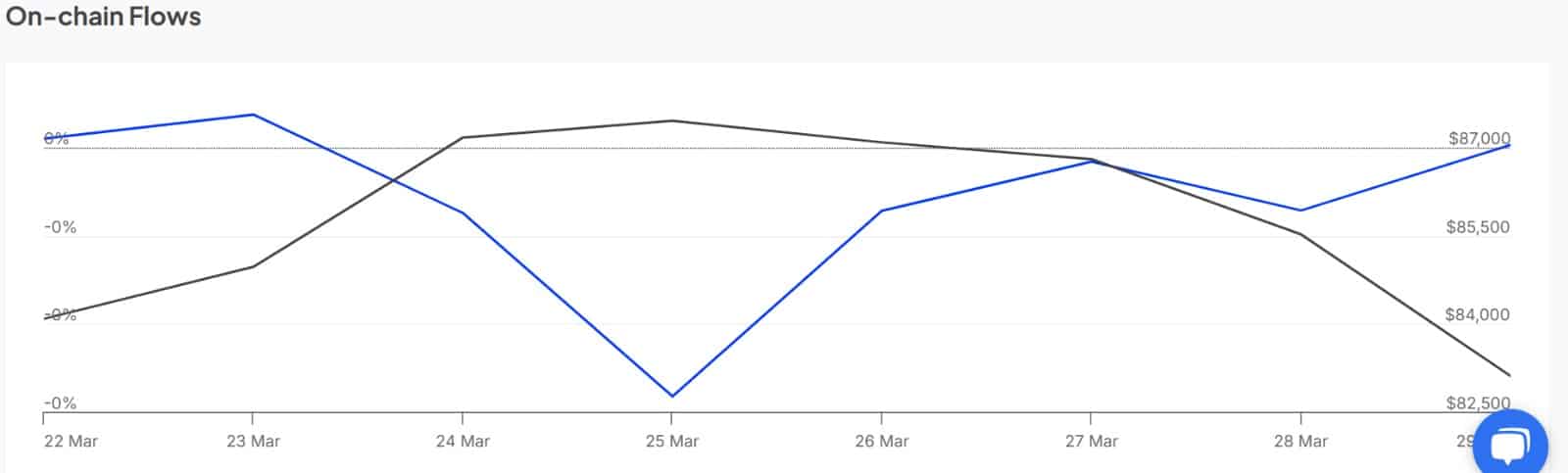

This market behavior is not isolated for traders in the retail trade, but also whales. According to Intotheblock data, the Netflow of the Great Holder is to make the Netflow ratio positive in the past day, walking from -0.09.

A shift to the positive side here implies that whales send more BTC to fairs, which also causes pressure on its price charts.

What it means for BTC

According to the analysis of Ambcrypto, as investors in the short term, a period of extreme fear and panic, Bitcoin experiences considerable bearish sentiments.

This ariting is seen with whales and retailers in equal measures. This usually reflects when whales and retailers increase their exchange rate inflow, a strong lack of trust in the market.

Historically, a combination of both small investors and whales on the sales side has resulted in a higher sales pressure.

Therefore, if the prevailing fear in the market applies, we could see BTC more losses on its price charts. A decline here could see BTC fall to $ 81617.

However, if buyers take the decrease in STH MVRV as a buying, Bitcoin will regain $ 84900 and try a switch to $ 87k.