- Bitcoin lost more than 6.88% of his in the last 24 hours

- Holders in the short term leave the market aggressively as the losses set up

Short -term holders under pressure

While the market crashed over the past 48 hours, Bitcoin [BTC] Saw a sharp decline on the charts and reached a low 5 -month low. Since breaking the most important psychological level of $ 80k, holders have been left in extreme panic in the short term.

In moments of increased volatility, short -term holders (STH) are often the first to respond. And usually they leave the market to minimize losses.

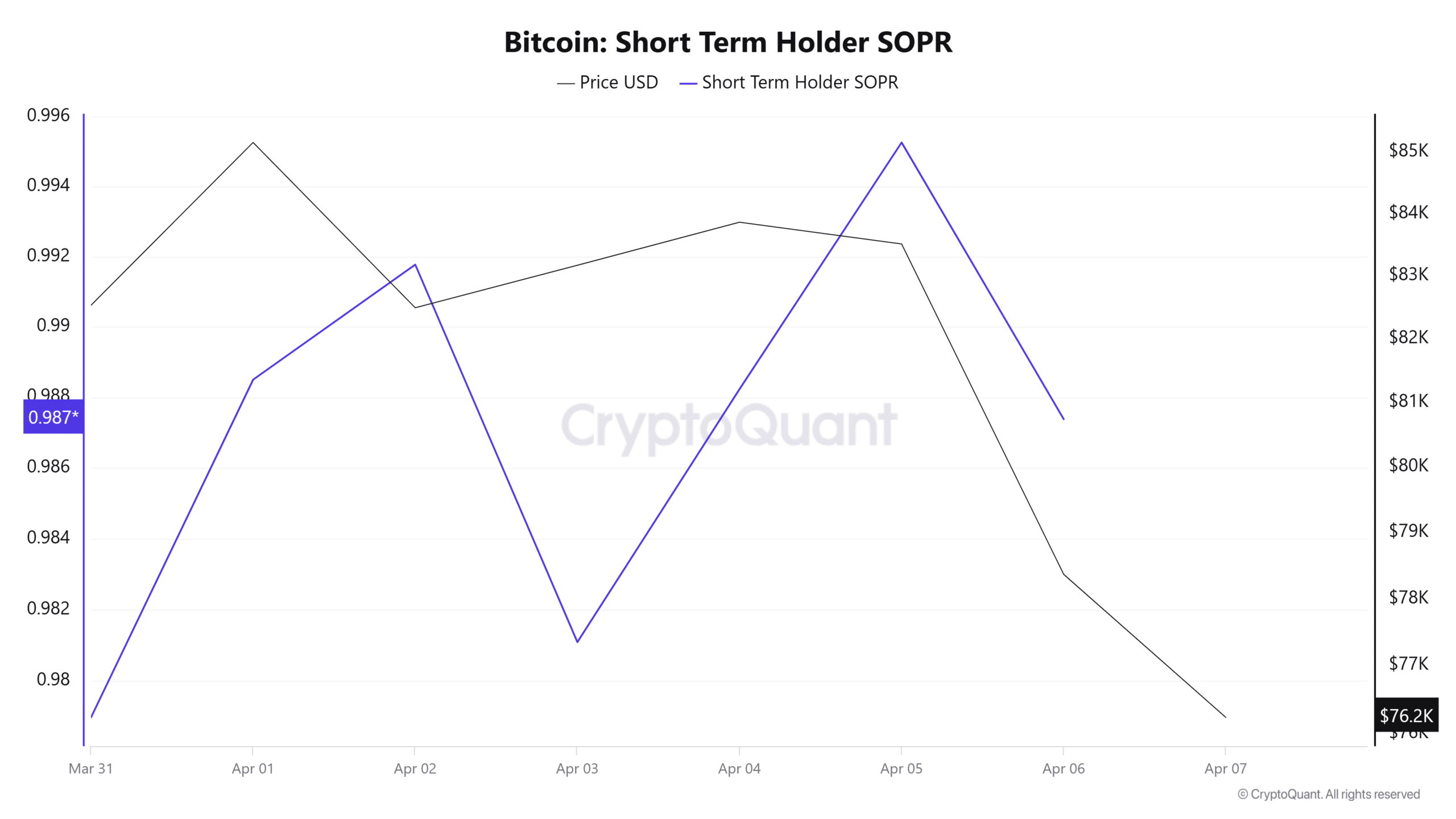

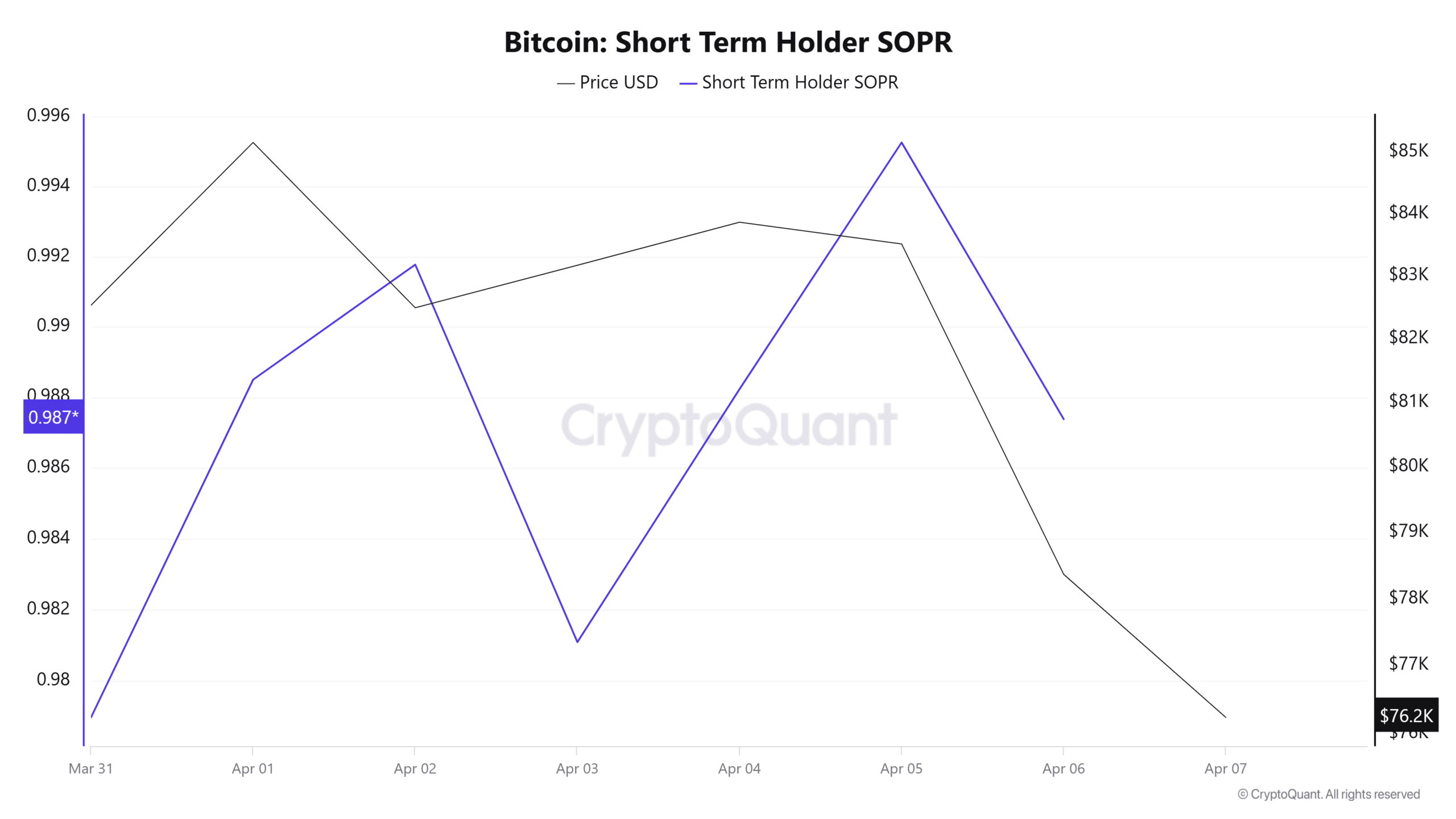

Such behavior is often effectively recorded by the STH-Sopr. When the STH-Sopr drops under 1.0, this means that investors realize losses in the short term-a classic signal of capitulation.

Historically, an important price correction has accompanied a sharp fall in the STH-SOP. In 2024, for example, the STH -SOPR fell under the -2 standard abnormality tire that was followed by panic sales under STHS.

Source: Cryptuquant

At the time of writing, the STH-Sopr fell under 1 to hit 0.98, according to Cryptoquant. This suggested that the price fall, short -term holders have discussed the full capitulation mode.

It seems that STHs are currently leaving the market aggressively. This also means that recent buyers have entered the loss area and they close their positions to reduce losses. Such a Bitcoin set -up positions for a potential disadvantage of the charts.

Is the worst still coming?

According to the analysis of Ambcrypto, Bitcoin has noticed considerable bearish sentiments between market participants.

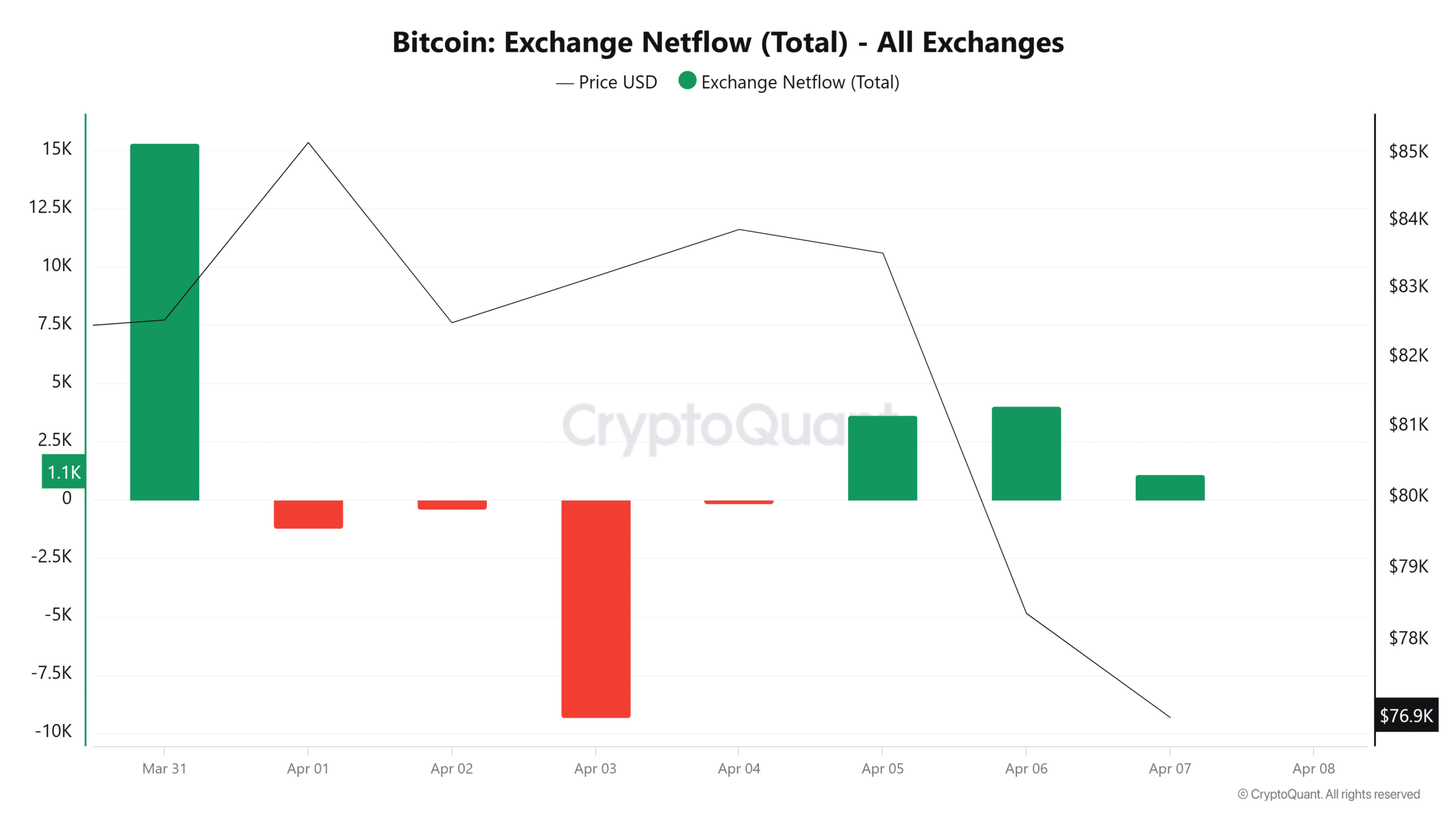

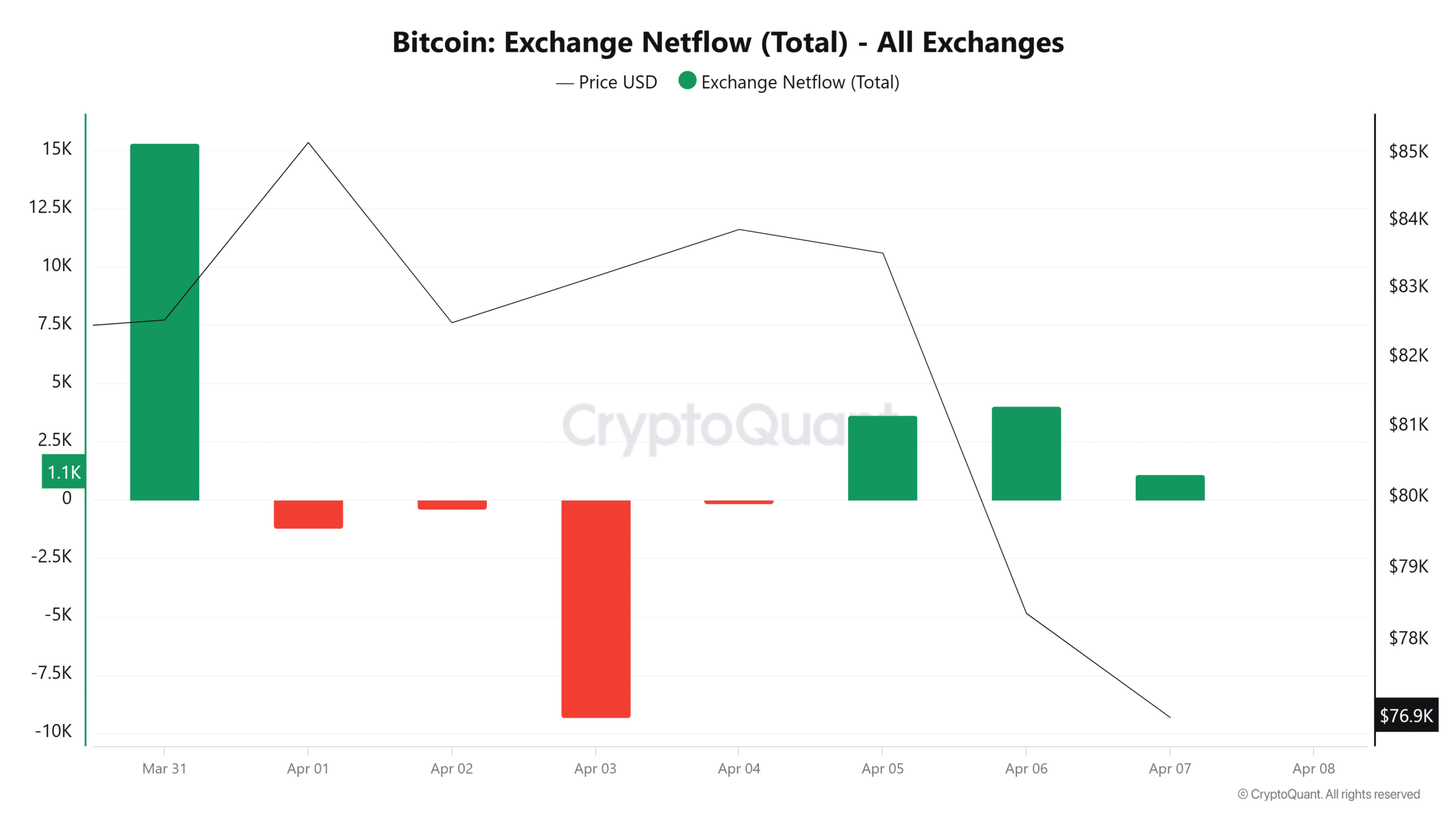

Source: Cryptuquant

In fact, there has been a significant sales activity of holders of short term, both retailers and whales.

To begin with, Bitcoin has seen three consecutive days of positive exchange network flows. When Netflows retain for a certain period within positive territory, this means that markets are filled with more sellers. Accordingly, there have been more inflow into stock markets than outsourcing, which sells more than accumulation implies.

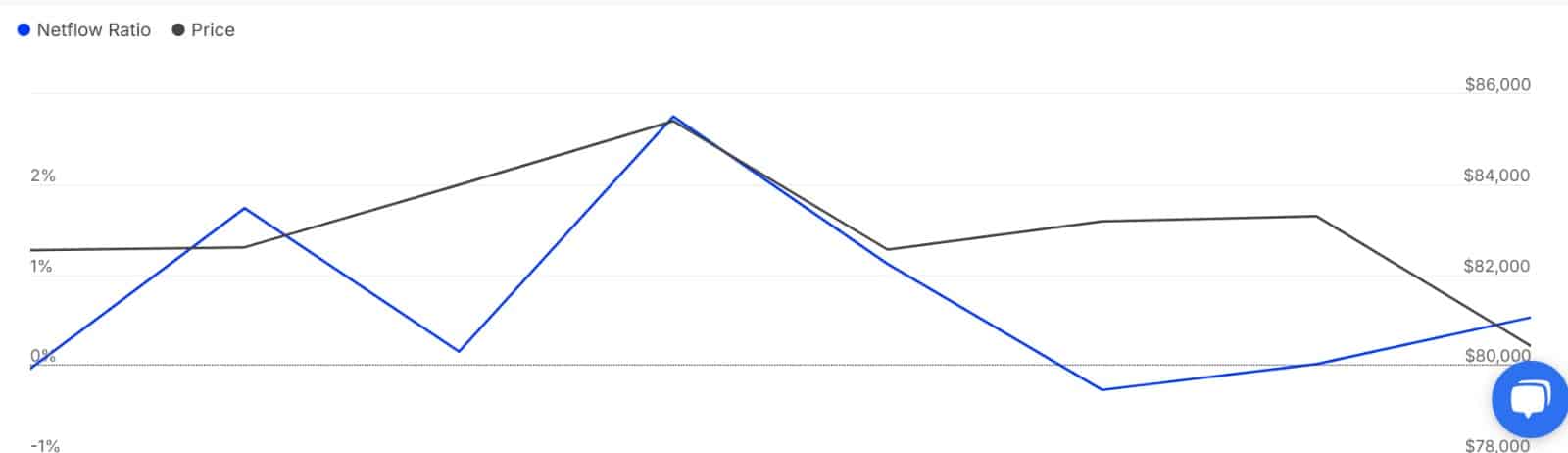

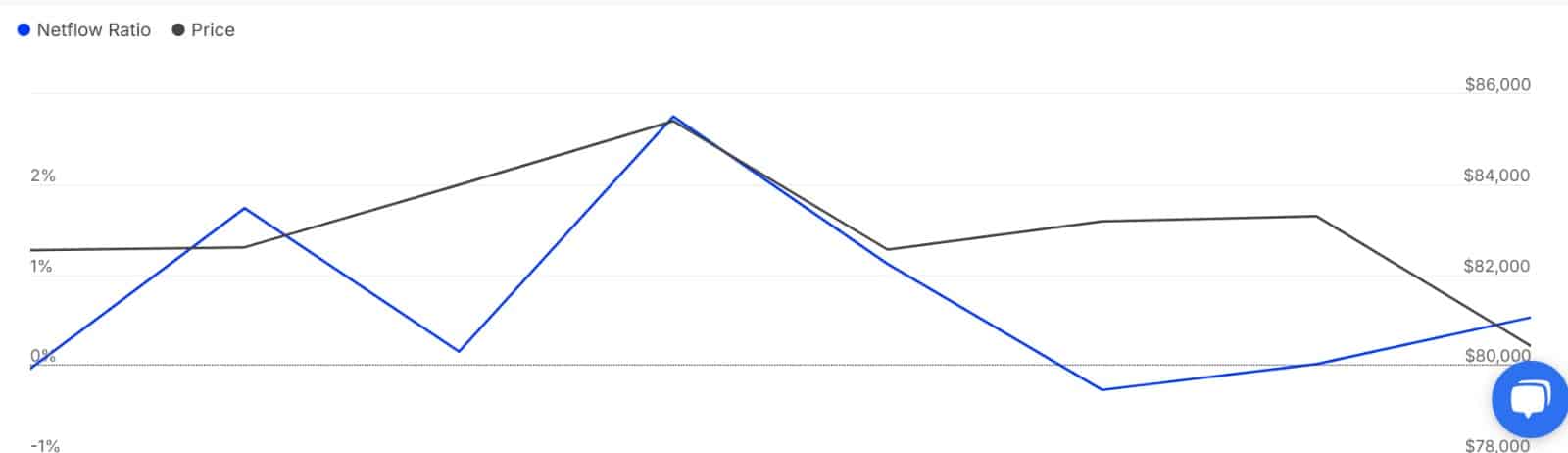

Source: Intotheblock

With aggressive sales on the market, even whales were killed to sell.

In fact, the Netflow of large holders is to change the Netflow ratio to 0.53% in the last 24 hours. This peak seemed to suggest that whales send more bitcoin to fairs. What this means is that whales are currently selling. When whales turn to sell, this causes a lack of market confidence at large entities.

Source: Cryptuquant

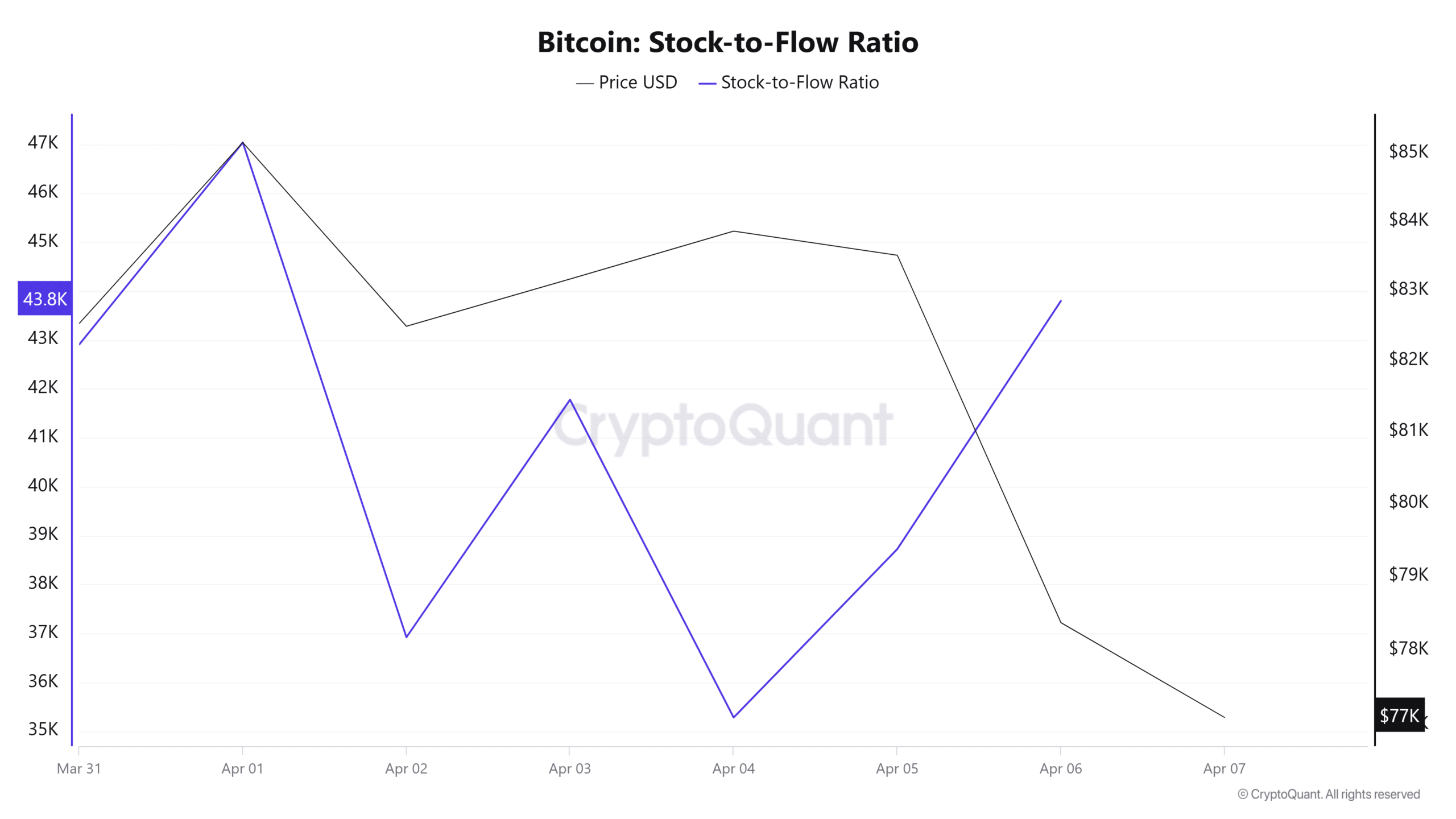

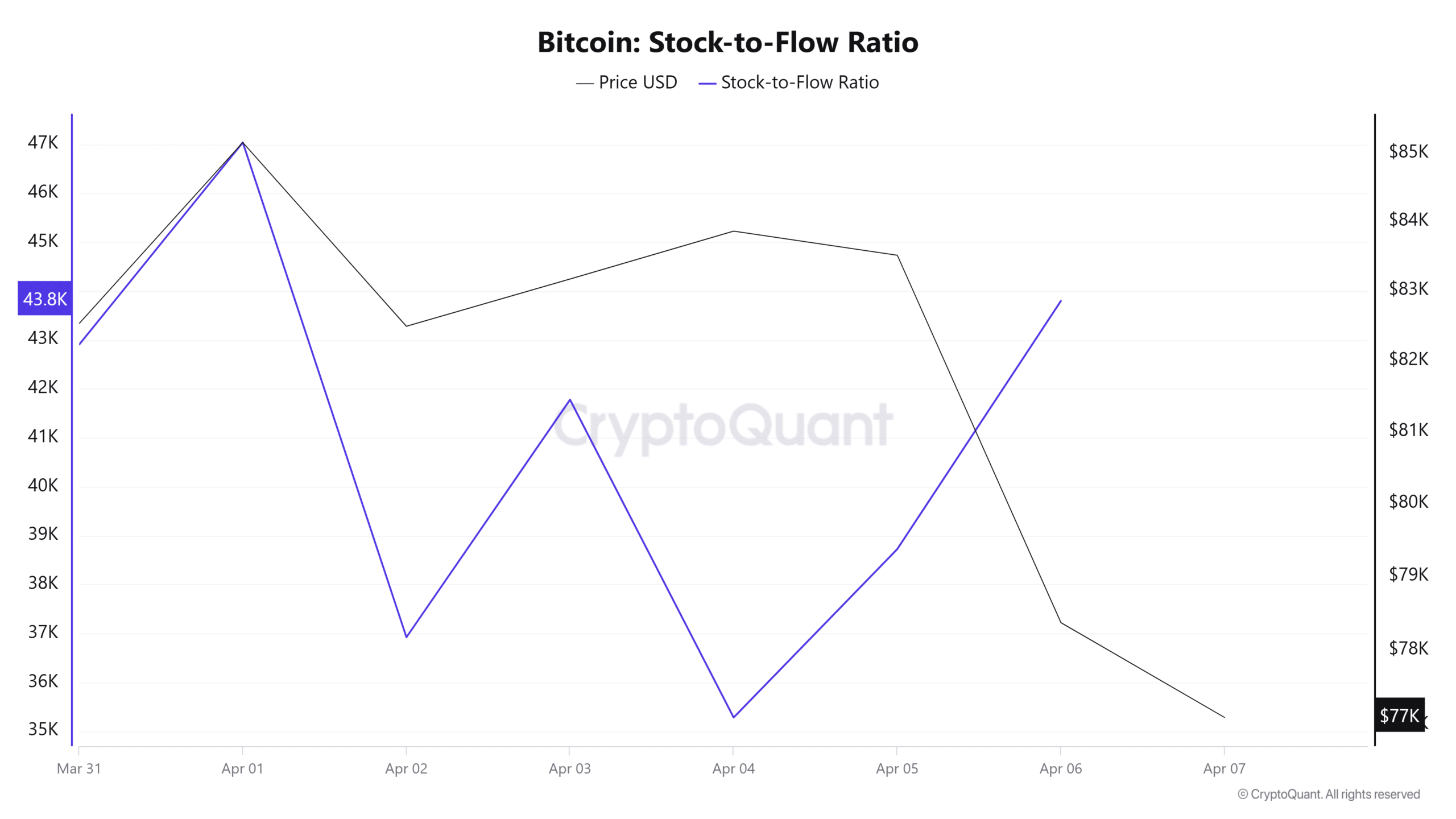

Persistent sales activities for all market participants has resulted in a higher Bitcoin supply. We can see the rising power supply as the sharing-flow ratio that has been enriched in the past day from 35.2k to 43.8k BTC. When the supply rises while demand remains low, the price drops.

With the sales printing while the supply is also increasing, Bitcoin risks further downwards. That is why we could see BTC falling a bit more if the current market conditions persist. A continuation of the Bearish trend will see BTC Dip Dip up to $ 71,858.

For a bullish reversal, Bitcoin has to reclaim the psychological level around $ 80k.