- PEPE pulled back to retest a significant support level before a possible price reversal

- Key figures highlighted PEPE’s resilience and possible bullish trends going forward

PEPE has been attracting investor attention in recent days, especially as it has been trading close to a strong support level for a likely price reversal if emerging bullish momentum drives a price increase. Such a move could even trigger a major rally in the charts.

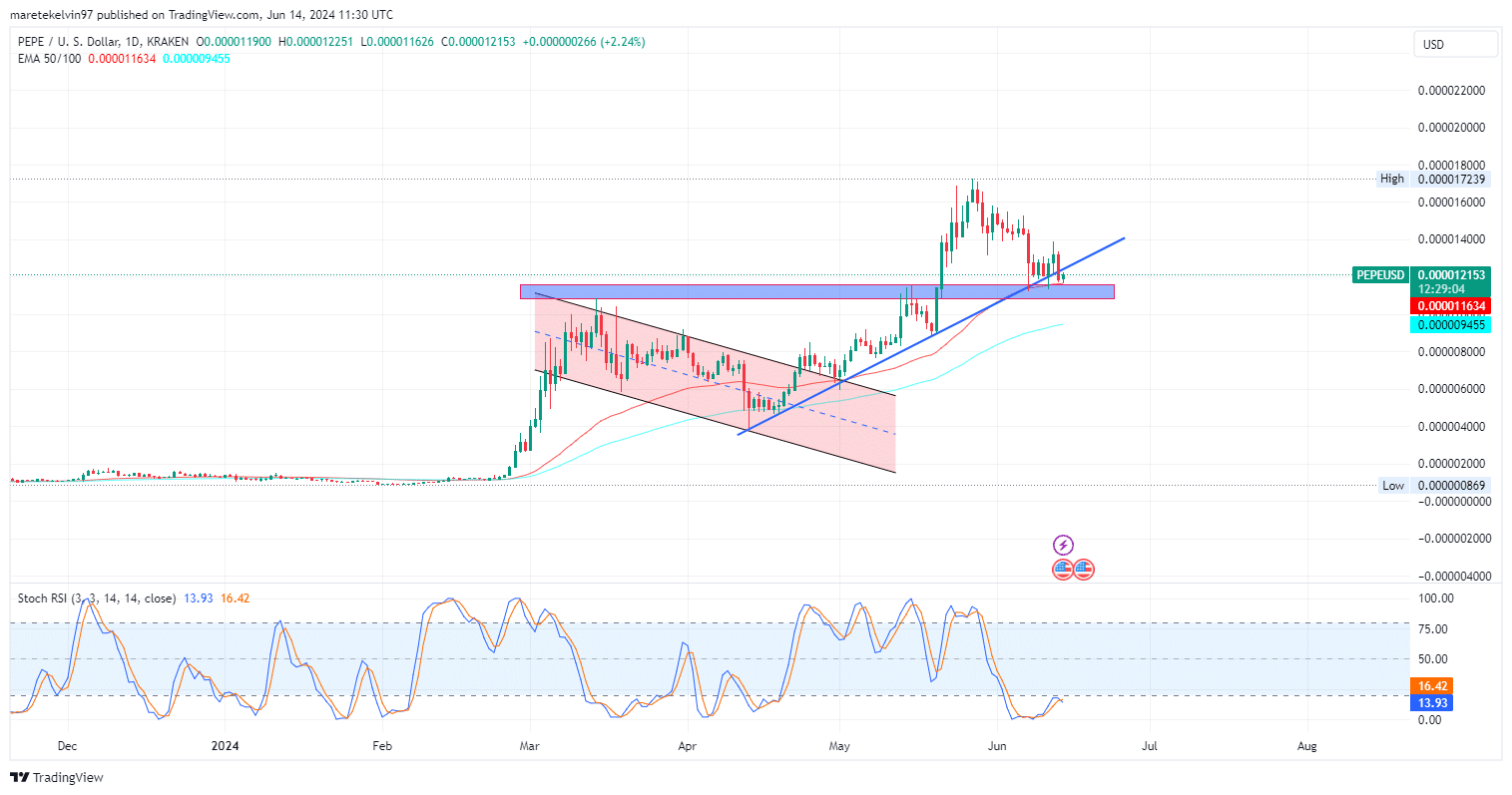

PEPE prices have registered a decline of 33.53% since May 28, retesting the support level at $0.000015. PEPE has since consolidated around the support level over the past six days, with bullish momentum gradually increasing. The price action has also respected an upward trendline.

The exponential moving averages (EMA 50/100) seemed to provide additional support as the EMA 50-day trend was above the EMA 100-day, while PEPE was trading above it.

Furthermore, the stochastic RSI pointed to a slightly overbought zone, indicating a continued uptrend after a brief consolidation. This confluence of support levels and indicators makes PEPE a meme for investors to watch for long positions.

Source: PEPE/USD, TradingView

PEPE volume, open interest on USD exchanges flash bullish signals

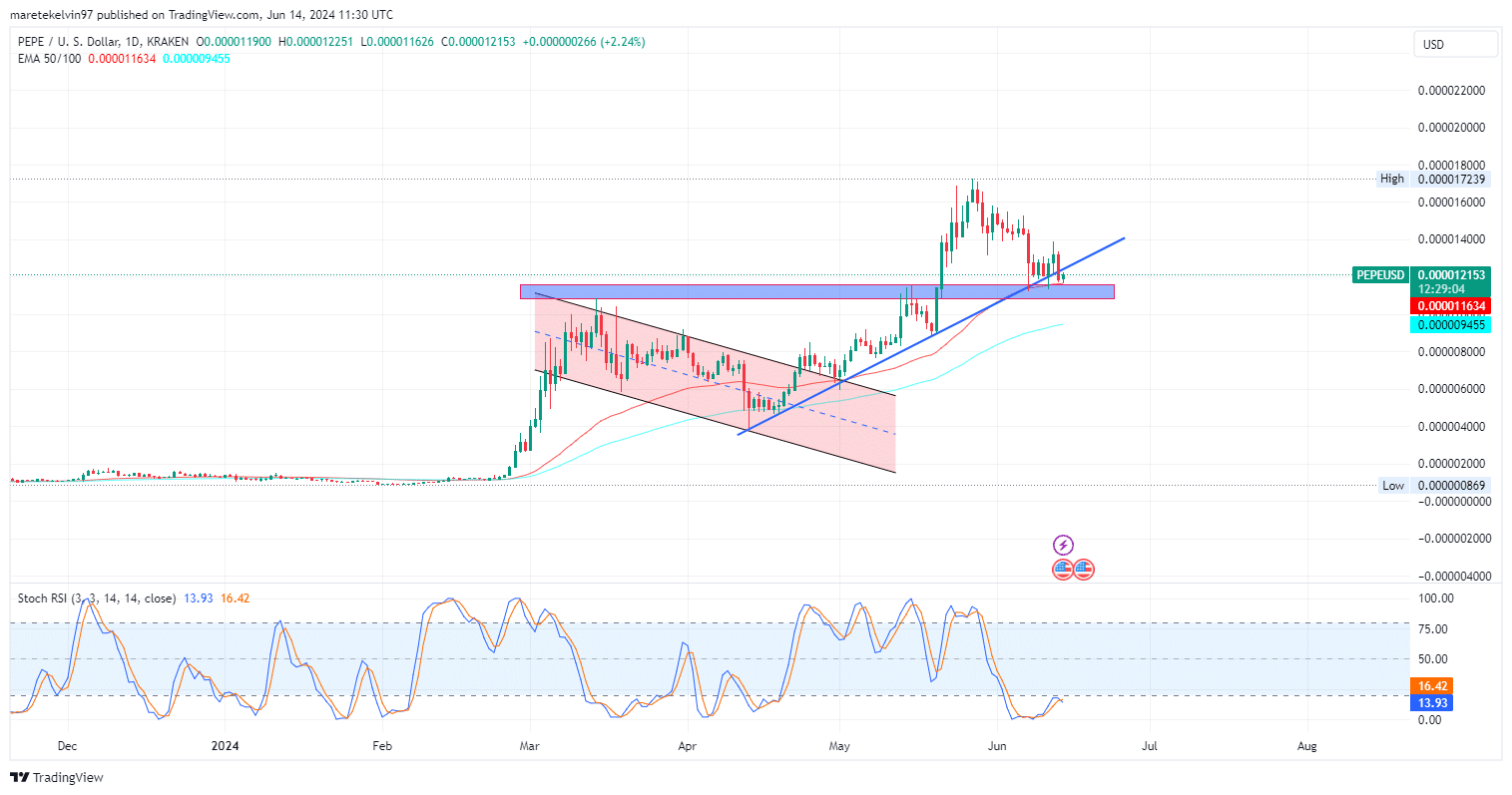

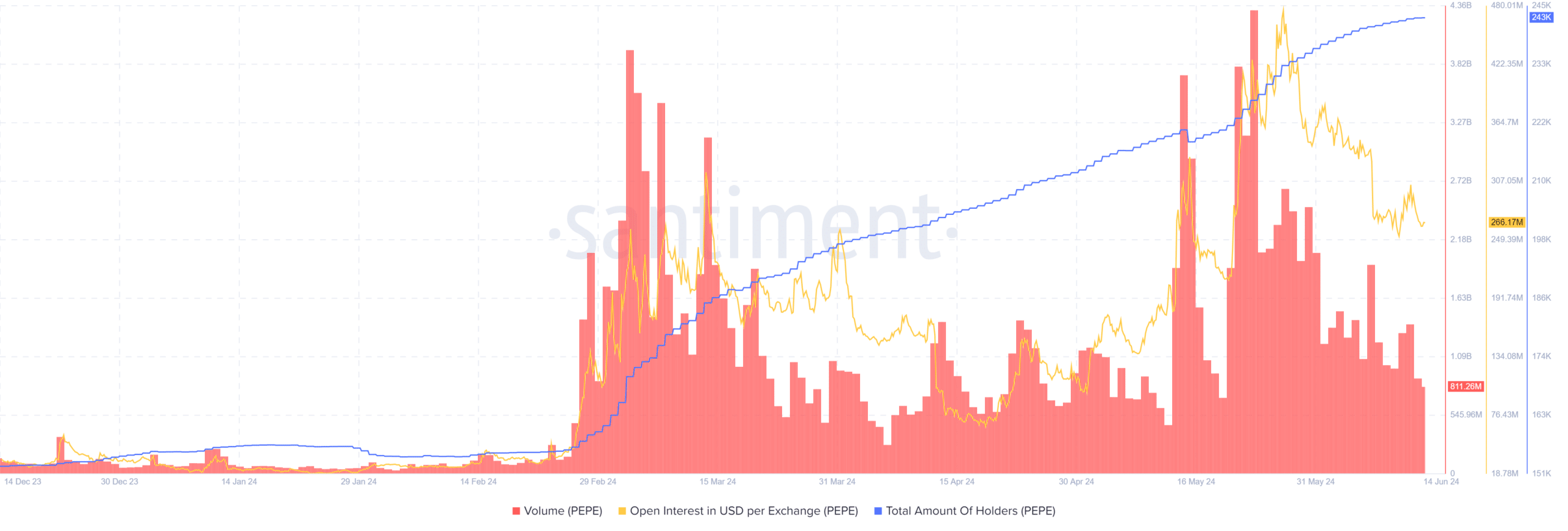

AMBCrypto further analyzed the volume, open interest on the USD exchange and the total number of holders on Santiment. PEPE volume indicated several peaks associated with increasing open interest. This correlation highlighted greater PEPE trading activity and interest at this significant support level.

The total number of holders also appeared to steadily increase, reflecting growing investor confidence and accumulation of PEPE tokens. With this market sentiment, the key support level may prove to be a support point for the market bulls.

Source: Santiment

What should liquidity dynamics add?

The aggregate liquidity delta in the order book indicated that buy orders are outweighing sell orders around the key support level – a sign that buying interest is surging. This liquidity imbalance also meant that buyers were arming themselves to defend the support level against further periods of depreciation. Hence the bullish bias.

Source: Coinglass

Is PEPE positioned for a turnaround?

Technical indicators, rising shareholder numbers and positive liquidity all seemed to give the market a bullish outlook. Investors should keep an eye on PEPE as it hovers around the support level with a potential price increase on the horizon.

However, if the price falls past the support level, a retest of $0.000009 will be imminent.