- Liquidity growth on the BNB chain has been considerable, with a rally up to $ 730 that looks feasible in the graph

- Sentiment on the market indicated that there is a bearish force, but buying volume can destroy it

For the first time in more than a month BNB Bullish wins on the charts, with the crypto by almost 2% in 24 hours. This, after an earlier downward trend, had the losses of almost 17% with investors.

This rally can mark the start of a large movement, especially if BNB exceeds a critical resistance line and cools the sales pressure in the derivatives market. That is why it is worth exploring the potential movement of BNB in a deeply.

Liquidity inflow reinforces the price movement of BNB

According to Ambcrypto’s analysis, there has been a remarkable inflow into the BNB chain, with the same intensification of recent times. These inflow not only contributed to the price rally, but have also insisted an increase in the total value (TVL).

TVL measures the amount of BNB deposited and locked over different protocols on the BNB chain. A walk suggests that more investors lock their assets, indicating trust in a potential price rally.

Source: Defillama

Between 12-15 March, the TVL from BNB Chain rose by $ 496 million, which represents the amount of BNB in the protocols. Also the scale of this Liquidity inflow can be associated with a walk in active addresses during this period.

At the time of writing, active addresses peaked at 1.1 million after a monthly low of 959,200 on 8 March, with the transaction count hit 4.5 million. The growth in these statistics, together with the price and TVL, hinted to the dominance of buyers on the market.

BNB is confronted with key resistance

BNB has pushed the aforementioned price stick to a resistance line that has been in forming since mid -February. In the last two occasions when the price contact with this resistance, this led to a fall across the board.

If it sees an infringement above this level, there is a high chance that the active profit of 23.48%will achieve and climb up to $ 732.

Source: TradingView

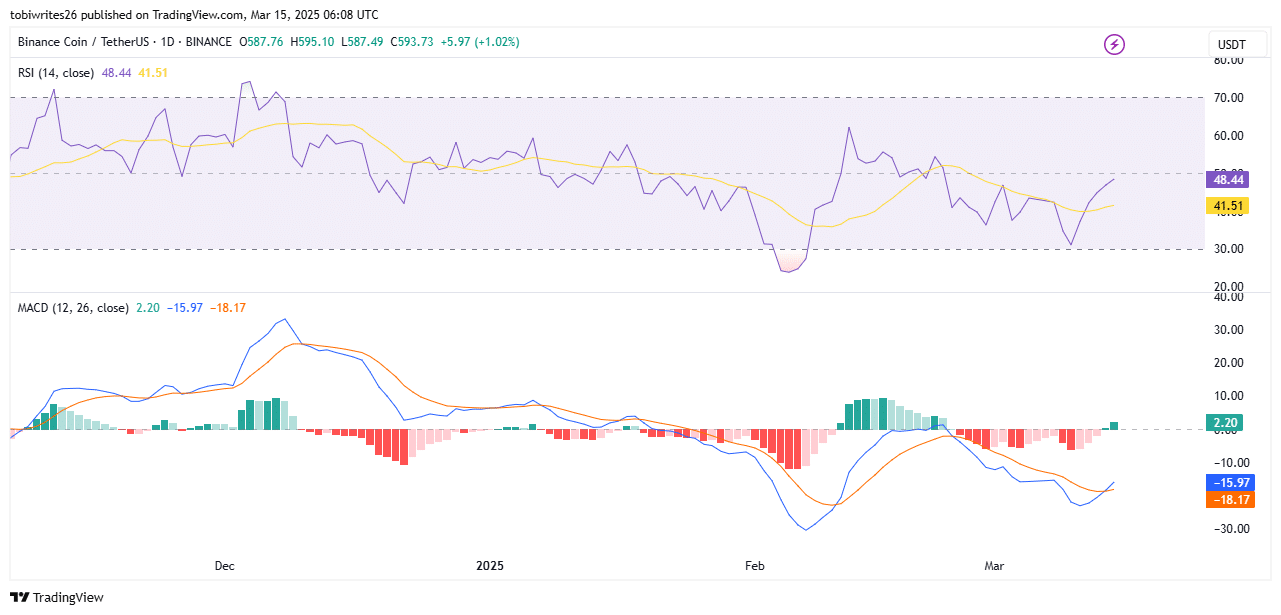

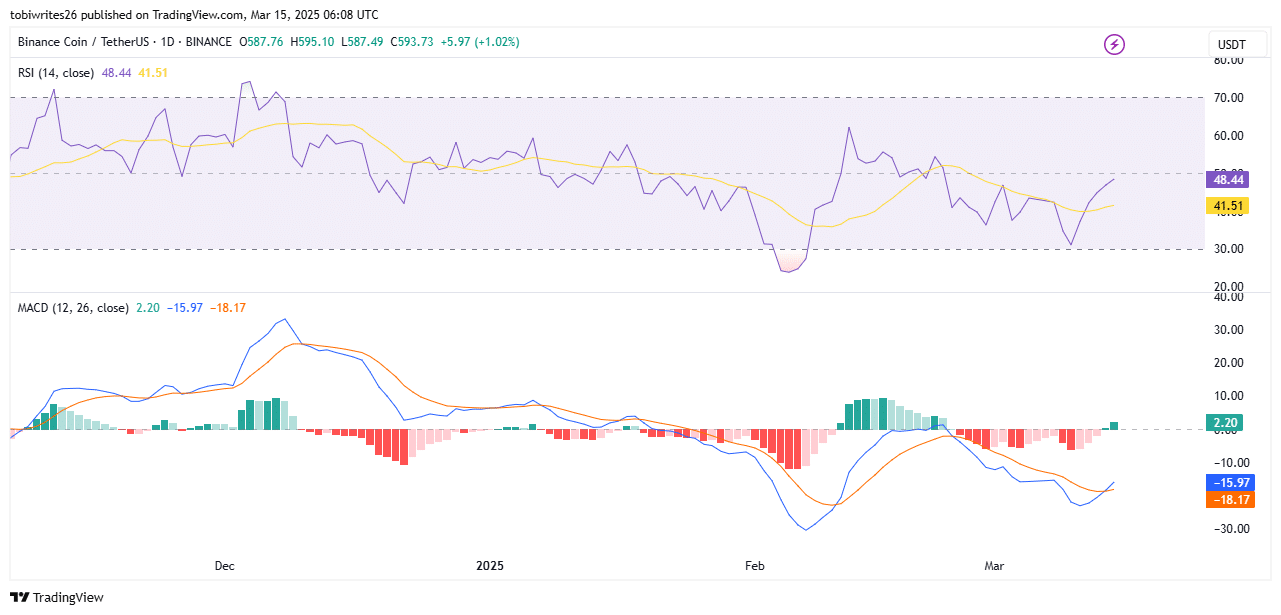

Technical indicators on the graph hinted to the potential for a market trally. At the time of the press, the relative strength index (RSI) and the moving average convergence -divigence (MACD) referred to a bullish scenario for the altcoin.

The daily RSI movement also revealed that it could be actively higher trends. Especially since the RSI seemed to close to the purchase zone – above 50.

Source: TradingView

The MACD also formed a classic golden intersection pattern that occurs when the blue MacD line crosses the orange signal line.

Such a pattern usually precedes a bullish in the market. If this happens, a BNB outbreak could occur in the short term.

Dischairage data Show mixed sentiment at traders

Despite a high bullish sentiment on the market, some traders have sold. At the time of writing, the open interest in both the Futures and the option markets had fallen by 2.30% and 1.56% respectively.

A falling open interest means that restless contracts on the derivatives market can be possible to be filled by short traders who anticipate a price decrease. This usually stops upward price movement or influences an attack of depreciation in the charts.

Source: Coinglass

However, derivatives traders on Binance and OKX have continued to buy, with the long-to-korter ratio flashing measurements of 1.43 and 2.18 respectively. When this ratio is above 1, this means buying more than selling. And, the further above 1 it is, the stronger the purchase volume is over the market.

If derivaten traders continue to buy in these fairs, the sales pressure of other cohorts in the derivatives market would remain minimal. Only then can the BNB price break out in the charts.