While many crypto enthusiasts are hoping that digital assets will enter the proverbial spring, there is one segment of the market that is clearly still deep in winter: non-fungible tokens.

As part of the zeitgeist of the 2022 crypto market mania, NFTs have fallen in value and have not seen much relief in the past year. The Bitwise Blue-Chip NFT Index fund — which offers institutional investors exposure to the largest NFT collections — is down 28.8% since the start of the year, while bitcoin is up 70% over the same period.

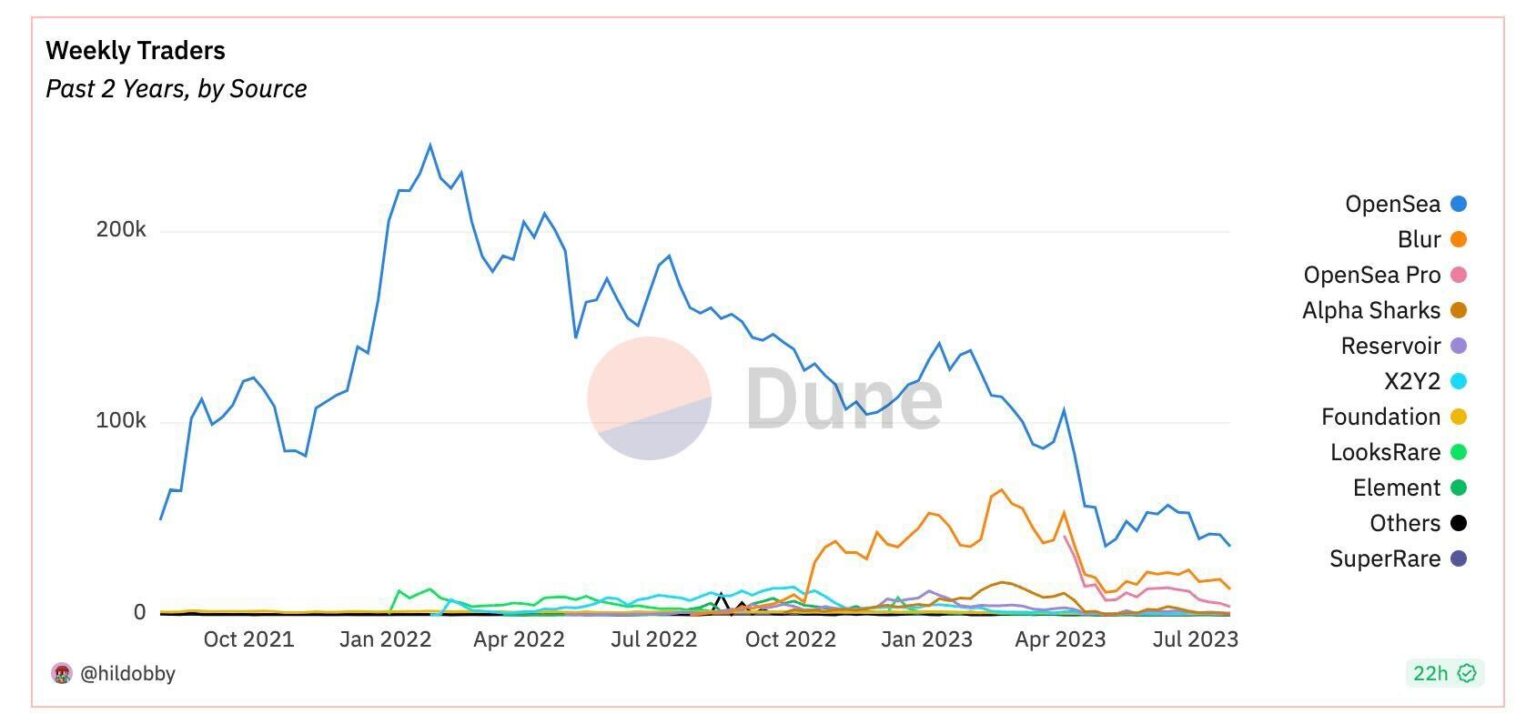

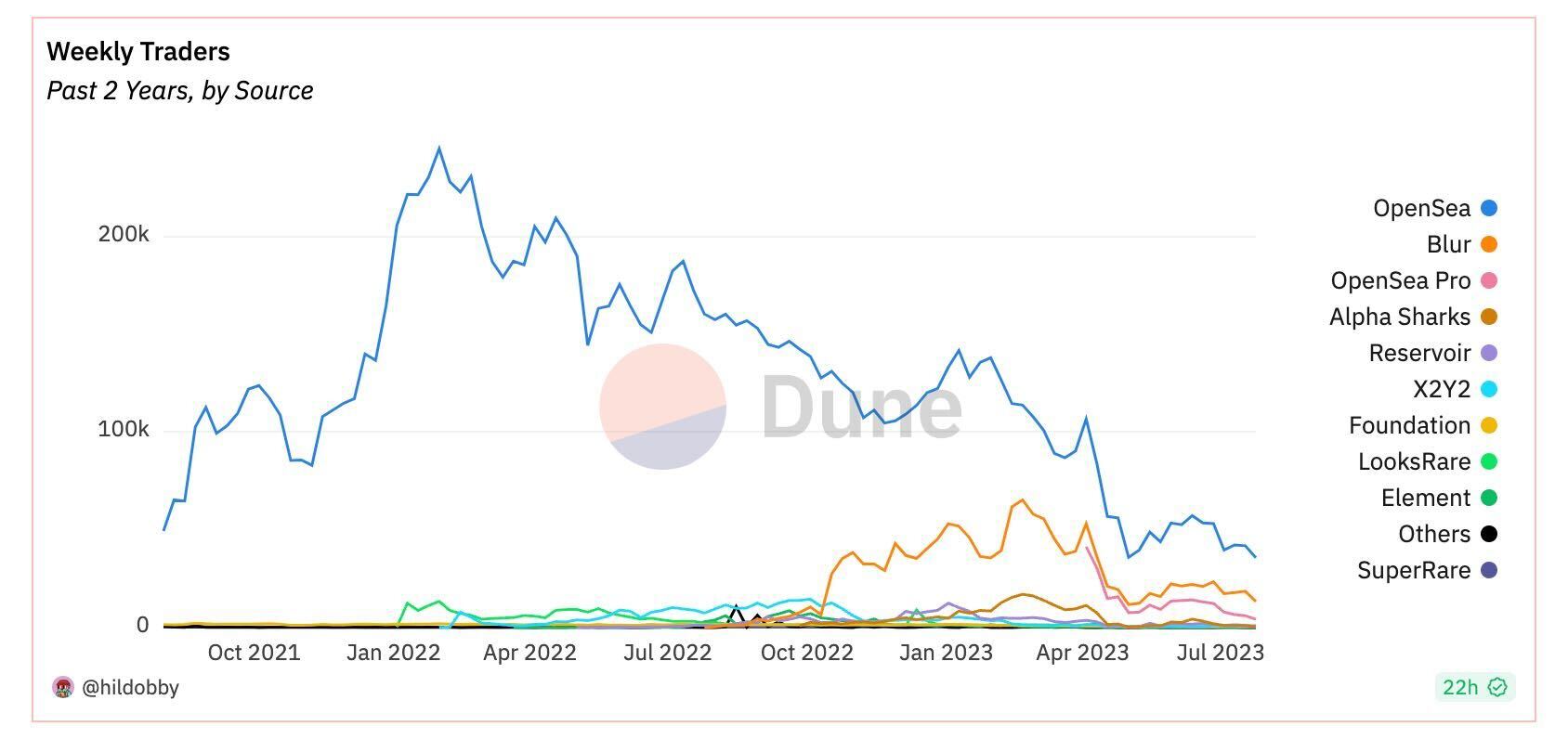

Unsurprisingly, it’s been a brutal period for marketplaces, which have seen active weekly user counts and volume plummet since January 2022.

Only down

OpenSea – which was once the darling of the NFT market with a valuation of over $10 billion – has seen active traders on its platform drop from nearly 250,000 a week to around 40,000.

Source: Dune analysis

Monthly volumes for Ethereum-based NFTs on marketplaces fell from a peak of $1.72 billion in February 2023 to $455 million in July 2023, according to The Block’s data dashboard.

NFTs run at their own pace

In a sense, the gap between NFTs and cryptocurrencies should come as no surprise to close observers of the market, as they often do not trade in lockstep. As the most recent bull run fizzled out, NFTs were still trading higher in trend than experts at the time thought exemplified their resilience.

“They’re going to lag fungibles for some time because they’re more of a luxury product,” noted Mike Dudas of 6th Man Ventures.

In a sense, that slowdown is tied to the fact that most investors in NFTs are the crypto rich, so would-be active NFT collectors sit on the sidelines until broader crypto prices are robust enough for investors to monkey into, a prominent commenter noted. NFT enthusiast op. collector and commentator called “DCInvestor.”

“I don’t expect volume to increase significantly until we enter a sustained uptrend in ETH and crypto more broadly,” he told The Block. “When crypto participants feel rich, they buy NFTs.”

Still, he pointed to some signs that NFTs have become popular to some degree, including recent Sotheby’s auctions. In May, the auction house raised $2.4 million selling part of the NFT portfolio of bankrupt hedge fund Three Arrows Capital. The company also launched a secondary, peer-to-peer marketplace for NFTs that same month.

In any case, other market participants point to broader issues within the NFT space that go beyond market cyclicality and explain the current woes. Those collectors and investors told The Block that the industry must witness a fundamental turn before prices and activity return to levels of the previous cycle.

Gaming pivot

One segment that could breathe new life into NFTs is gaming, according to Loopify, a self-proclaimed jpeg enthusiast and anon behind metaverse and NFT studio Endless Clouds. In his view, the market needs to shift from being dominated by the menagerie of cartoon profile pictures to NFTs representing in-game items such as “skins.”

“NFTs are just the underlying technology for these digital assets, so you just wait for good games and users. The difference between what I think will be the future bull market versus the previous one is where the volume is coming from,” he told The Block. “Having a large number of users (hundreds of thousands to millions) transacting on-chain (or even custody solutions) with small amounts pays off big time.”

DCInvestor also sees gaming as a potential catalyst, but a return to the heady days of 2022 will depend on robust crypto prices across the board.

“It’s always possible that some new use cases will really pop up (like gaming) and bring in a lot of new users/buyers, but overall I would expect this to coincide with more bullish market conditions,” he said.

To adapt to that new world, companies like OpenSea — which made money facilitating the sale of Bored Apes and Pudgy Penguins — will have to cater to the demographics of game studios developing this content.

“You need really well curated marketplaces specific to the games, so I don’t think most of the volume will go through the current MPs if they don’t adapt or work with the studios,” he said.

Disclaimer: Mike Dudas is a co-founder of The Block.