Constantly shifting in its dynamics, the non-fungible token domain has witnessed swings in valuation and demand over the past 30 days, according to research by Nansen on Twitter.

The past 30 days have not been kind to NFTs…

Many of the “Blue-Chip” NFTs have seen rock bottom prices drop by more than 25%, while Azuki’s has continued to drop since the launch of the Elementals.

But it’s not all bad as some NFTs have broken the trend of just down… pic.twitter.com/2xeVu84uJs

— Nansen 🧭 (@nansen_ai) August 22, 2023

Azuki, a formerly steadfast name in the NFT arena, has taken a dip, especially after the launch of their Elementals. Collections like Milady Maker, on the other hand, have bounced back from this general downturn, recording a remarkable 66% rock-bottom price increase.

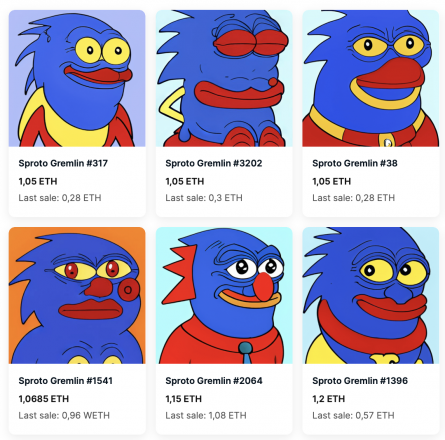

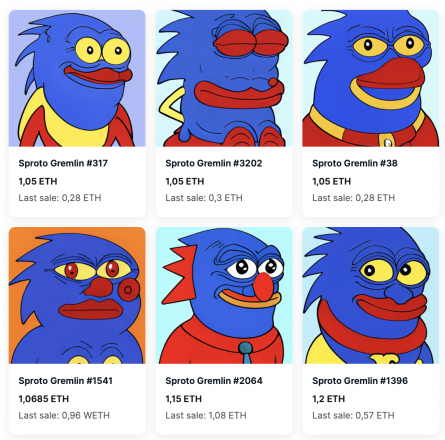

This wave positions them on the heels of seasoned tokens, including Mutant Ape Yacht Club. But apart from the crowd stands Sproto Gremlins. This token was designed especially for Bitcoin enthusiasts and has reported an astronomical growth of 262% within a month.

Some variants of Sproto Gremlin: Open Sea

Nansen points out that among the top 20 holders are no smart money addresses — which Edward Wilson, Nansen’s social media manager, describes to Crypto Briefing as “those who bought a certain no. of NFTs from a collection in one day, when spending a minimum threshold [from] at least 3 different NFT collections” — this time proudly at the top of the list is a “legendary NFT collector”.

The lack of “smart money addresses” in this list could mark a turnaround in the NFT market. Wilson further told Crypto Briefing that “in the NFT market, we have seen a steady decline in NFT volume and prices from their peak. Many NFTs have seen floor prices drop by more than 90%, causing holders to lose significant money.”

A former smart money address has diversified its NFT holdings – the NFT’s highest ranked smart money holder [and] are outside the top 20 holders” because their portfolio is not diversified – with 21 Sprotos now in its possession. Their buying strategy included a large acquisition 81 days ago at an average of 0.03 ETH and subsequent acquisitions the next day at 0.32 ETH each.

They sold a few 11 days ago for a small profit, sent a few to @NFTX_, and a few more to another address 5 days ago (unsold)

With the current floor price of 1.6 ETH, this looks like another highly profitable trade to add to this savvy money trader’s collection… pic.twitter.com/6jMQUMgT5P

— Nansen 🧭 (@nansen_ai) August 22, 2023

Wilson further noted that “combined with fewer new entrants entering the market, and repeat buyers are where they were in December 2021, this downward trend for NFTs more broadly is only likely to continue as investors trying to pay money.”