- PancakeSwap sees robust increase in Zksync Era in just 2 months

- To catch the falling knife or not? Our opinion on whether or not to buy CAKE.

It has been about two months since PancakeSwap V3 was rolled out on Zksync Era. Preliminary data already shows that the launch and subsequent operations have been quite successful so far.

Is your portfolio green? Check out the PancakeSwap profit calculator

PancakeSwap’s latest update reveals the extent of that success. According to the update, PancakeSwap V3 recently surpassed $850 million in trading volume. A sign of a healthy revival in the short period since its launch on Zksync Era. This indicates that the DEX has enjoyed a healthy rebound since then, despite less than favorable market conditions.

🥞 PancakeSwap v3 on @zksync Era has reached over 850 million in trading volume in the first two months since launch 🎉

Do not miss it:

🔁 Swap: 0.01% fee

🚰 Increased returns for LPs

🚜 Earn CAKE by staking LP tokens in farms

💳 Buy crypto directly with fiatThis is how it works👇 pic.twitter.com/2awW5wLoiE

— PancakeSwap🥞Everyone’s favorite DEX (@PancakeSwap) October 13, 2023

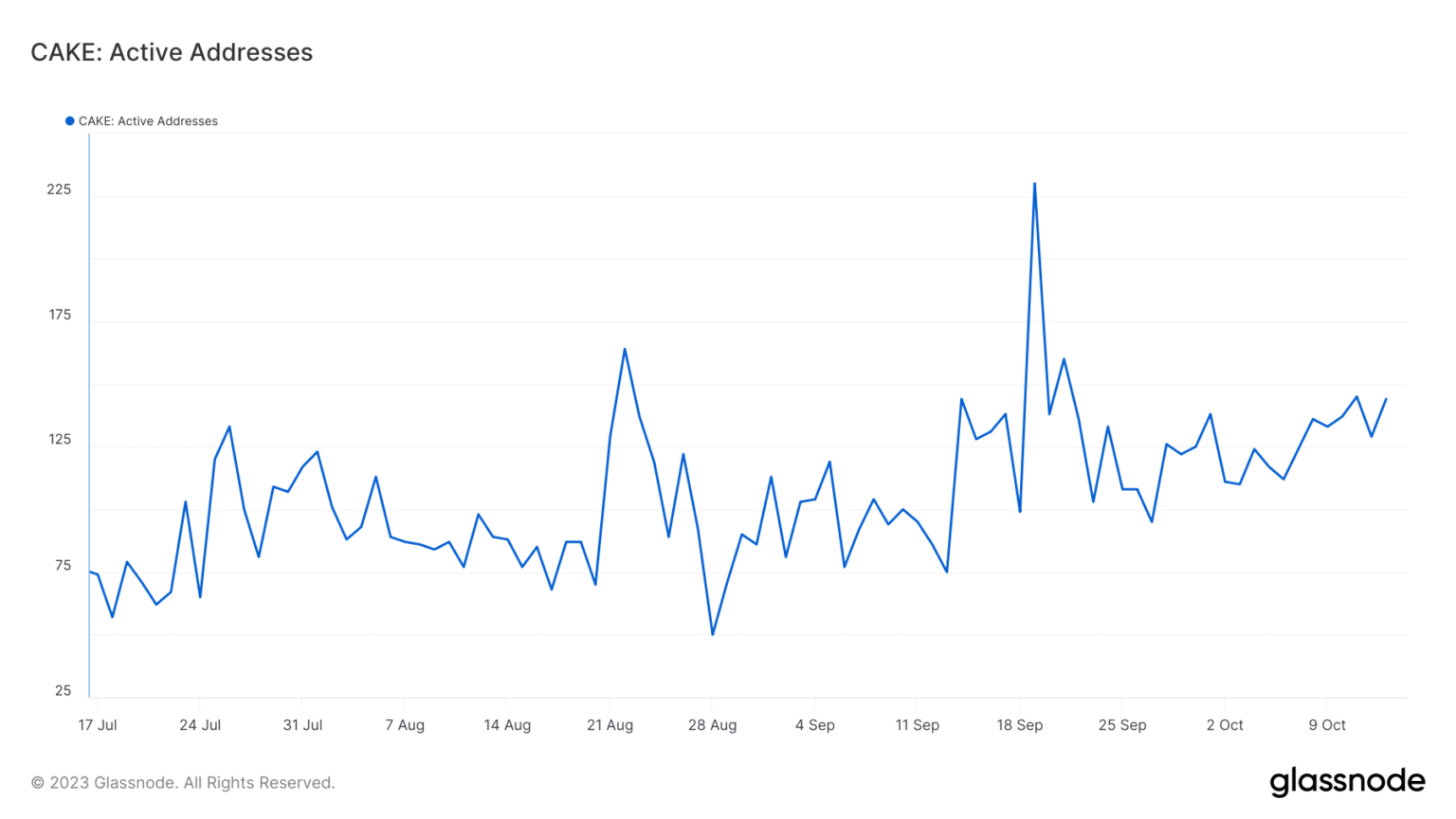

PancakeSwap’s rising volume is consistent with address activity. According to Glassnode, the number of active addresses on Uniswap V3 has increased over the past 3 months. This confirms that the DEX handled more activity during that period.

Source: Glassnode

What are the key drivers behind this impressive adoption? Well, Zksync Era has experienced a robust revival as one of the first Ethereum Layer 2 solutions to offer ZK technology. As a result, demand for this layer 2 has increased. The PancakeSwap DEX was one of the first decentralized exchanges to support Zksync Era and was therefore able to benefit from the growing utility.

In addition to the support, PancakeSwap offers incentives that have facilitated the recovery. Some of these incentives include low swap fees and healthy returns for liquidity providers to encourage participation.

Will the increase in trading volume affect CAKE’s demand?

Growing PancakeSwap volumes underscore the need for liquidity, meaning there is organic demand for cake from liquidity providers. However, this type of demand often pales in comparison to the trading/speculative demand in the spot and derivatives markets.

Speaking of demand, interest in CAKE continues to wane and is in danger of slipping into oversold territory again. It is also about to retest the same low range where the price returned earlier in September. At the time of writing, a piece of cake was exchanging hands for $1.08.

Source: TradingView

Read more about CAKE’s 2024 price forecast

CAKE’s long-term downtrend has resulted in a new low for 2023. This price action signals declining trader confidence, which may have perpetuated falling cake prices. The proverbial falling knife cuts through CAKE, but is it close to the bottom?

It is unclear whether CAKE is at the bottom of its long-term bearish trend. However, the RSI has made higher lows in recent months, which could indicate that relative strength is gradually returning.