- Global markets are facing turmoil, with cryptocurrencies and major stock indices experiencing severe declines.

- Arthur Hayes predicted that the Japanese yen’s swings could boost cryptocurrencies.

On August 5, a major upheaval rocked the global economy, with markets including Japan facing a severe downturn.

Cryptocurrencies were the hardest hit by this shift, as was Bitcoin [BTC] and other altcoins fell double digits due to widespread risk aversion.

This dramatic decline in the crypto sector reflected broader financial instability.

Japan’s Nikkei index suffered its biggest decline in decades and European shares fell sharply, marking the worst performance in two years.

Meanwhile, India’s Bombay Stock Exchange closed down more than 2,000 points.

The head of strategy at Astris Advisory in Tokyo expressed his concern about this Neil Newman to CNN noted:

“That was a crash. It smelled like 1987. Today was brutal. It was unusual because there was no recovery at the end of the day, which you would normally see with short covering.”

Adding to the controversy was Andrew Lokenauth, who said:

Source: Andrew Lokenauth/X

What’s Behind the Global Bear Market?

There is speculation that the turbulence in the US financial markets could affect economic conditions in Japan.

For those unaware, the Federal Reserve’s upcoming decision on possible rate cuts in September has amplified market volatility, contributing to a widespread sell-off.

Kazuo Ueda, Governor of the Bank of Japan, said:

“If the economy and prices move in line with our expectations, we will continue to raise rates.”

A falling yen could benefit Bitcoin

Needless to say, Arthur Hayes, co-founder of BitMEX, wanted to share a unique perspective when he said that the yen’s swings could impact tech stock prices and the dynamics of U.S. debt.

He also indicates that if US policymakers respond to Japanese interest rate changes as he expects, it could have a positive impact on the cryptocurrency markets.

Well, this isn’t the first time Hayes has linked Japanese economic movements to cryptocurrency price developments. Earlier in his blog titled ‘Easy button’, he noticed,

“I think a rise in the USDJPY towards 200 is enough to attract the Chemical Brothers and shout ‘Push the Button’.

‘Chemical Brothers’ refers to the US and Japan, while ‘Push the Button’ means printing money or ‘injecting liquidity’.

Here, Hayes predicted that a weakening yen could trigger currency conflicts between Japan and China, potentially leading to the US intervening by devaluing the dollar.

This could boost dollar-based assets and potentially trigger a crypto boom.

What does the current data tell us?

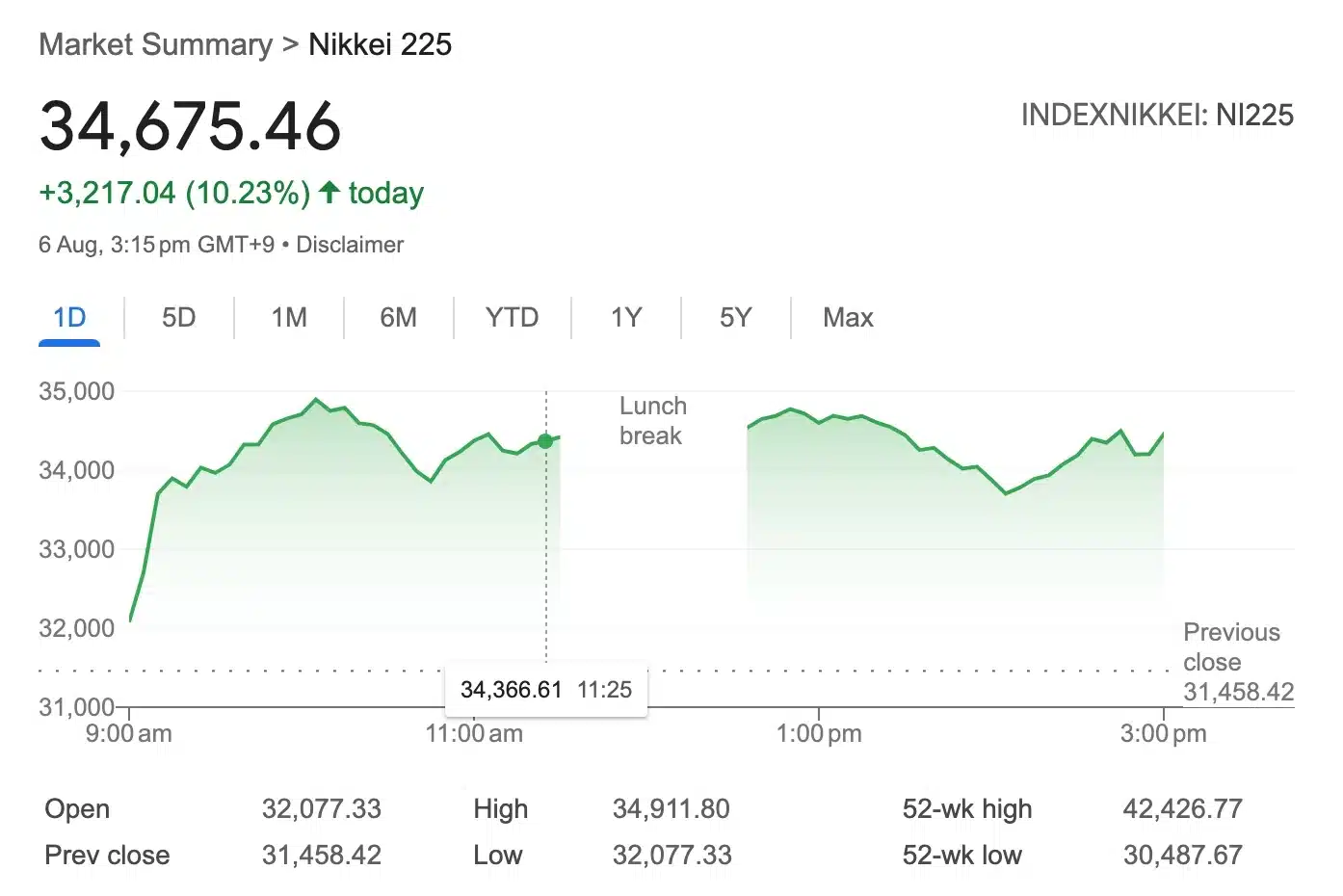

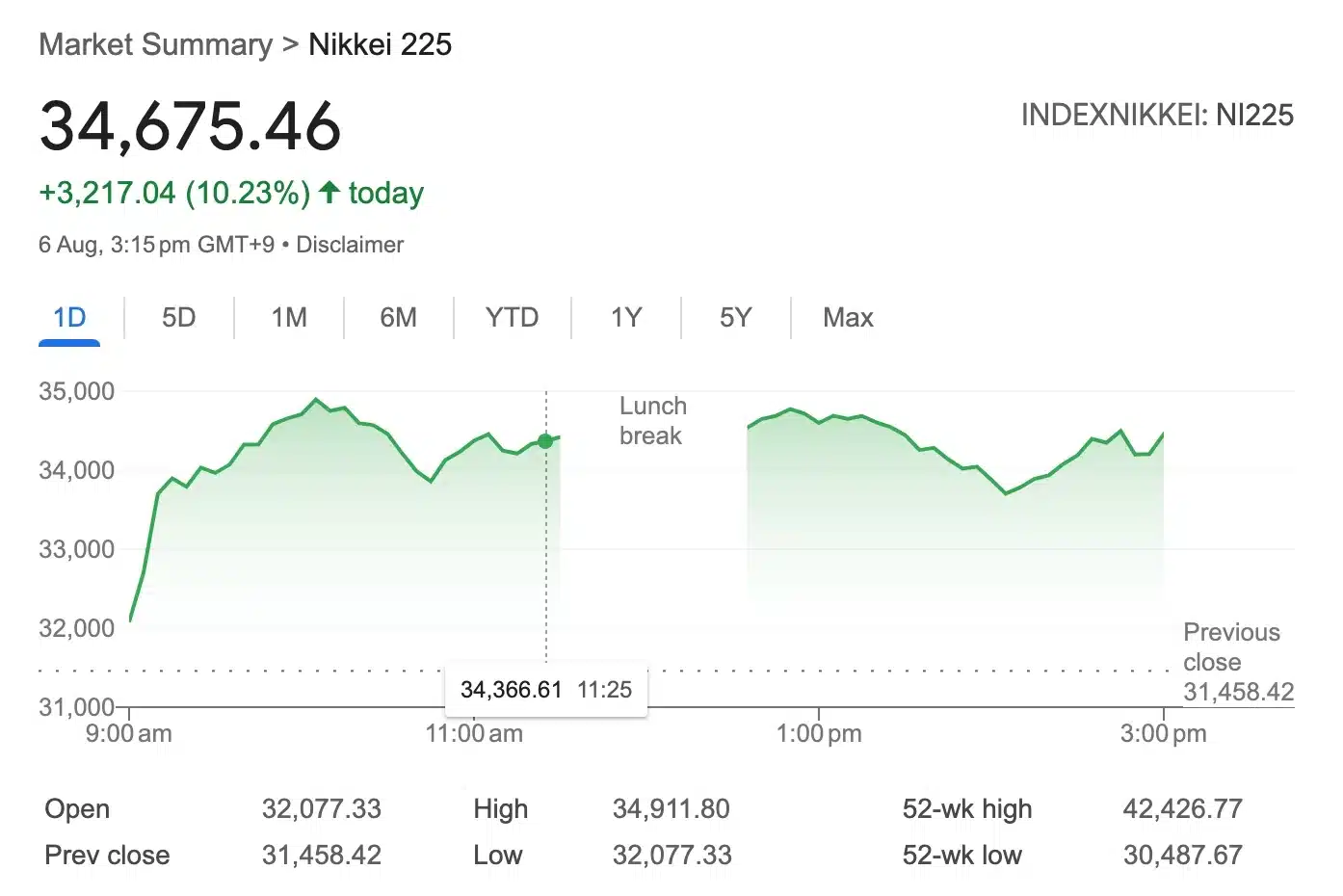

As of now, the Nikkei 225 has that came back in impressive fashionup more than 10% just a day after its biggest ever two-day drop.

Source: Google Finance

In contrast, the global cryptocurrency market has also seen a notable increase, with the market capitalization rising to $1.95 trillion – an increase of 4.86% in just 24 hours. CoinMarketCap.

These sharp swings underscore the current volatility in the economic landscape as markets react to upcoming Federal Reserve decisions on interest rates.