- The 47,516 BTC outflows of Bitcoin Being on institutional accumulation in the midst of Retail sentiment.

- Large recordings suggested a potential shortage of supply, which fueled speculation about the future momentum of Bitcoin.

Bitcoin [BTC] I just saw the biggest net flow of stock exchanges since the beginning of 2022, so that speculation about institutional accumulation was fueled.

About 3% of BTC exchange supply disappeared in just a few days, with a similar pattern seen after the FTX in -order.

Historically, such flow indicates that large players position themselves for a potential market shift. Yet this comes in the midst of a careful sentiment, where investors still process recent volatility.

The question remains: is institutional confidence that this drives, or is there another force in the game?

While the retail trade hesitates, big money may already be on the move.

Bitcoin: the scale of outskirts

Bitcoin witnessed a huge 47,516 BTC Net -outflow, which marked the greatest outflow since 2022 and reflects a 3% decrease in BTC offering on trade fairs.

Data is displayed That this outflow reflects the aftermath of the FTX -in -the -door deposit, with Panic Selling BTC drove to only $ 16k.

Source: Cryptuquant

The only comparable event took place in July 2023, when another important outflow of BTC took place. Detailing retail traders BTC usually deposit, but these large -scale admission hints on institutional accumulation.

Despite the market hesitation, players with deep bags seem to stack quietly BTC, making it possible to be a long -term movement.

Buyer behavior: Is buying institutional in the game?

Large investors often accumulate bitcoin during market dips, benefit from lower prices, while the retail sentiment remains careful.

The recent net outflow of 47,516 BTC suggests that this could be the case, because such large-scale recordings are unusual for retail traders.

Institutional buyers, including funds and investors with a high NetNet, usually work in Stealth and collect assets when Market sentiment is bearish.

The latter outflow coincides with broader market uncertainty and strengthens the theory that institutions buy, while others hesitate.

Read Bitcoin’s [BTC] Price forecast 2025–2026

What does this mean for the future of Bitcoin?

The recent net outflow of exchanges suggests institutional accumulation, which could have bullish implications in the long term.

Historically, large moves preceded the shortages of the offer, stimulate prices higher.

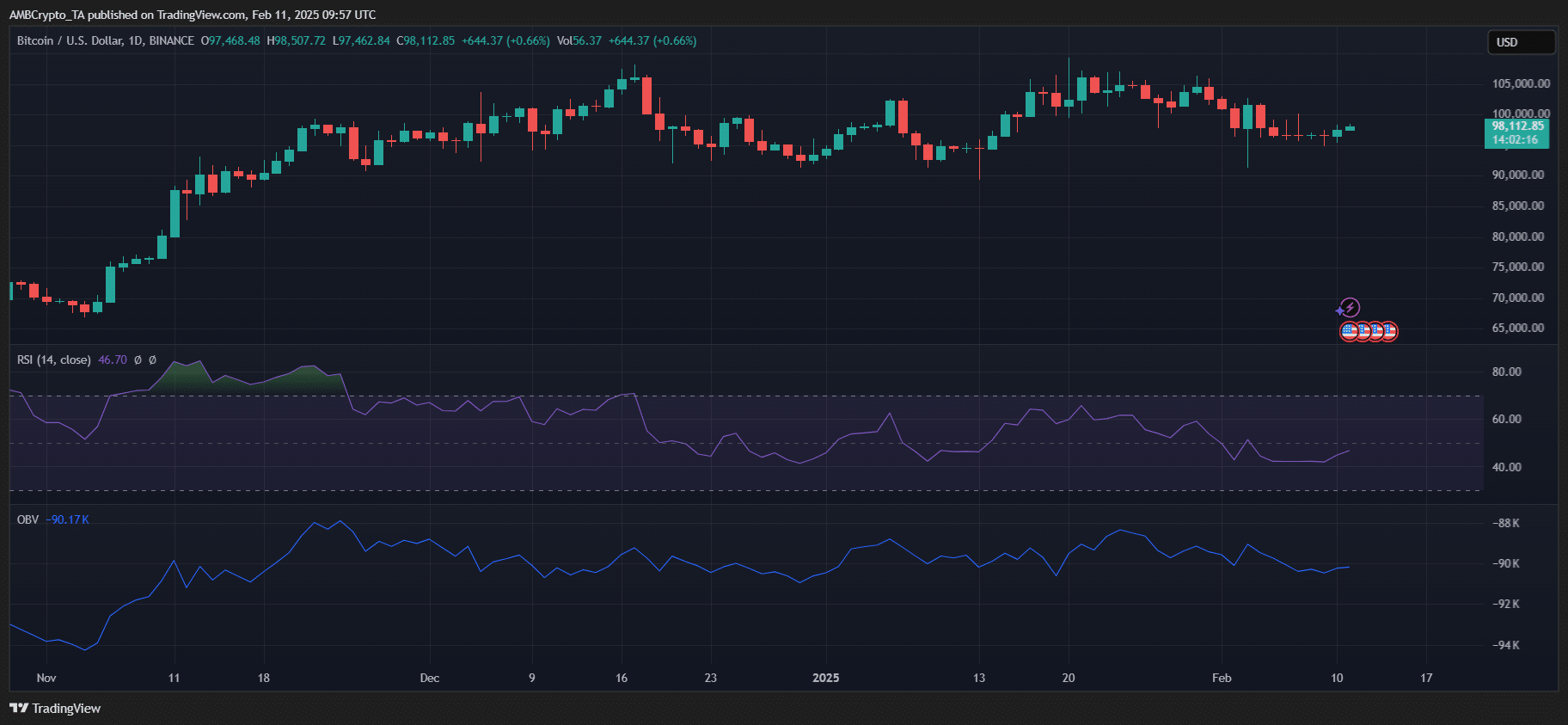

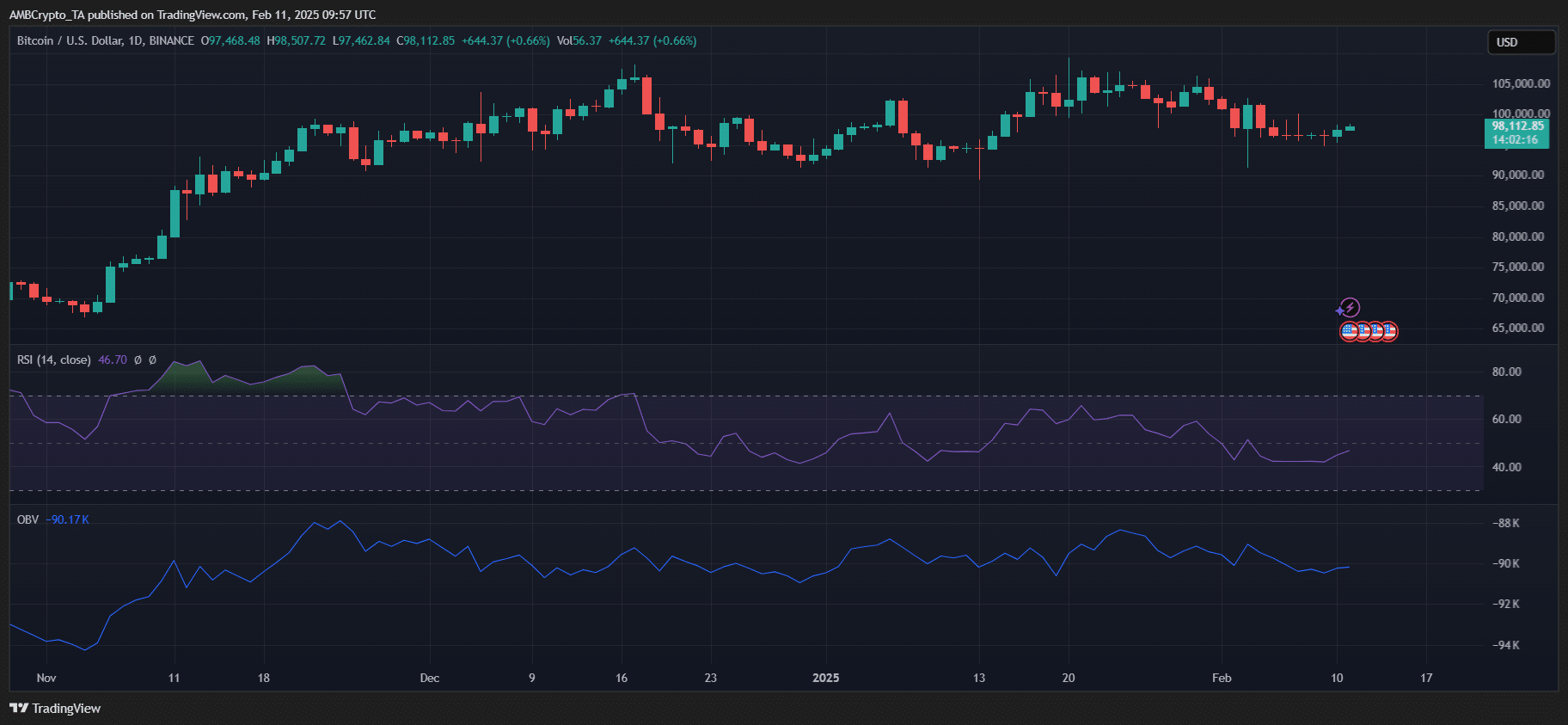

Source: TradingView

Despite the current market hesitation, Bitcoin acted at the time of around $ 98.112, with an RSI of 46.7, which indicates neutral momentum.

The OBV remained negative and suggested a weak overall buying momentum. Institutional accumulation can, however, shift this dynamic. If these large withdrawals continue, they can be a signal that strong hands accumulate pending a rally.

Retail sentiment remains mixed, but institutional accumulation during uncertainty has historically driven price rebounds.

If these trends persist, Bitcoin could see renewed momentum, especially if the outflows cause stock pressing in the coming weeks.