Reason to trust

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Made by experts from the industry and carefully assessed

The highest standards in reporting and publishing

Strictly editorial policy that focuses on accuracy, relevance and impartiality

Morbi Pretium Leo et Nisl Aliquam Mollis. Quisque Arcu Lorem, Ultricies Quis Pellentesque NEC, Ullamcorper Eu Odio.

Este Artículo También Está Disponible and Español.

On Wednesday, the American Federal Reserve decided to leave its benchmark interest unchanged in the reach of 4.25% –4.5% – and Bitcoin responded immediately. The break, although generally expected, came up with somewhat revised prospects with a slower timeline for future rate reductions and a remarkable adjustment to the balance reduction of the central bank.

According to the statement of the Federal Open Market Committee (FOMC), the “Dotplot” of the FED now indicates only two 25 basic rate reductions for this year-the’s things than many market participants who were expected in December. Policy makers emphasized that although the interest rates remain in restrictive areas, the timing of actual cuts depends on the path on economic indicators, in particular inflation and employment.

However, the last statement no longer claims that inflation and employment are ‘in balance’, as a result of the growing concern of the committee on economic uncertainty. But perhaps the most important pivot was the announcement of the Fed that it will slow down the reduction in its bond companies, better known as “quantitative tightening” (QT).

Related lecture

From April, the monthly drainage for government bonds will fall from $ 25 billion to $ 5 billion – a substantial retirement that many analysts consider a prelude to a more accommodating attitude such as economic or market conditions.

What this means for Bitcoin

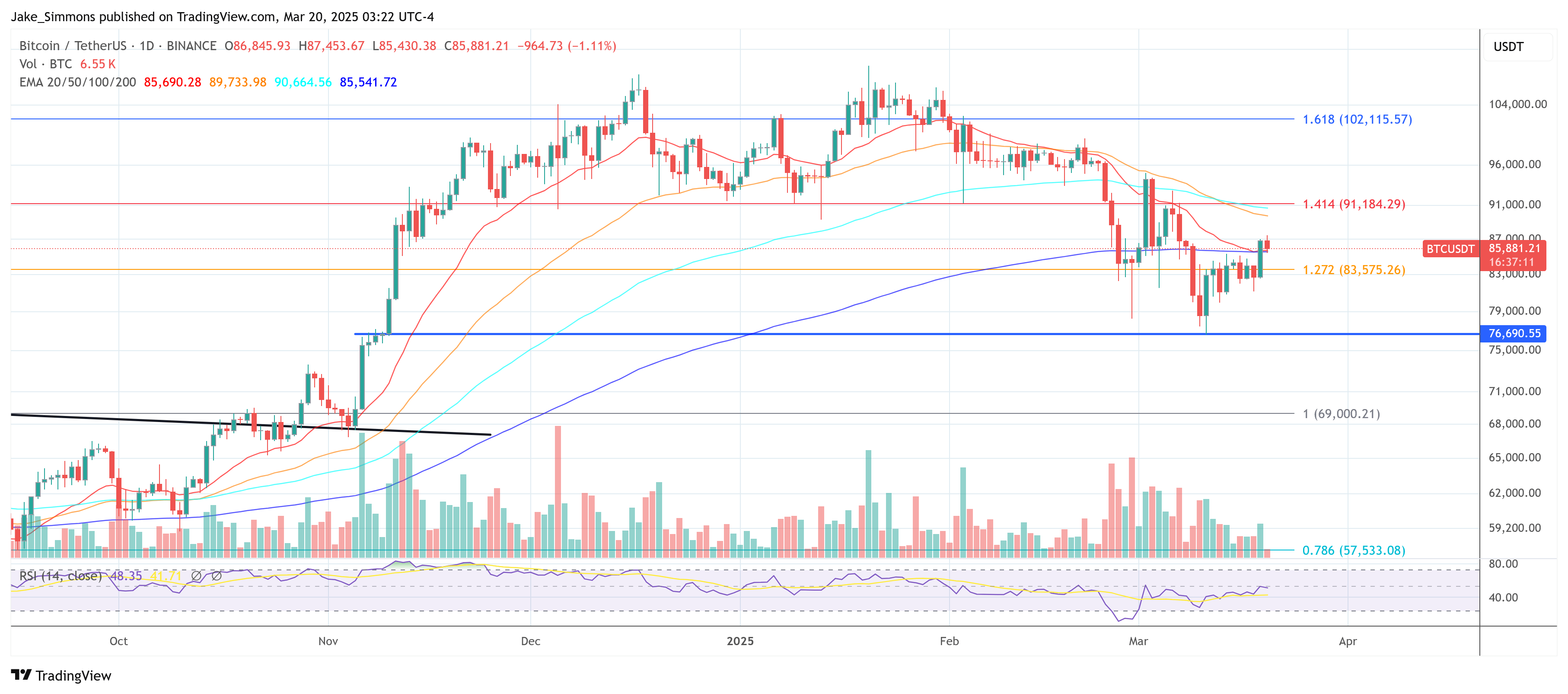

Shortly after the announcement of the FED, Bitcoin set up about 4-5%, which briefly surpassed the USD 86,000 level. Nik Bhatia – founder of the Bitcoin layer and author of Bitcoin Age – has to his latest VIDEO -UPDATE To dissect the implications of the decision. “Bitcoin an increase of 4% on the news that the FED QT slows down and is still dedicated to reducing interest rates,” Bhatia said at the start of his analysis and noted that the market was aimed at whether the central bank would change its quantitative tightening approach.

Bhatia explained how the reduction of the monthly drainage cap from $ 25 billion to $ 5 billion can yield the liquidity restrictions in the total system: “Now demolition the Fed is also still its balance, but now this will only do five billion a month in contrast to 25 billion a month, and that is a material change,” he said.

Related lecture

“This is not some:” Hey, we are now about QE now just because we have gone from 25 to five “, but the first step is to get the balance to stop shrinking … so that if the Fed has to run, it can quickly go from 5 billion in QT per month to a modest expansion.”

Bhatia underlined that such a movement can feed the appetite of the market: “The market sees the FED for what it is: it supports credit creation that expands balances around the world, and that ends electricity in asset prices … Some of those assets can be shares, Bitcoin -[and] Other financial assets. “

Other experts are even more drastic in their assessment. BitMex co-founder Arthur Hayes stated Via X: “Jaypow has supplied, QT in principle for April 1.

Jamie Coutts, head of Crypto analyst at RealVision, virtually agreed: “After last night, QT is effective (for quite some time). Treasury Volatility has immediately withdrawn and now reflects the decline of DXY compared to earlier this month. This is all extremely liquidity positive.”

At the time of the press, Bitcoin traded at $ 85,881.

Featured image made with dall.e, graph of tradingview.com