- Ethereum’s DeFi sector maintained its strength amid price stagnation and market volatility.

- New developments on the network increased as general retail interest grew.

Despite a month of Ethereum [ETH] price remained relatively stable, the DeFi space on its network showed remarkable vitality and stood strong against the backdrop of broader market uncertainties.

Is your wallet green? Check out the Ethereum Profit Calculator

Defy the odds

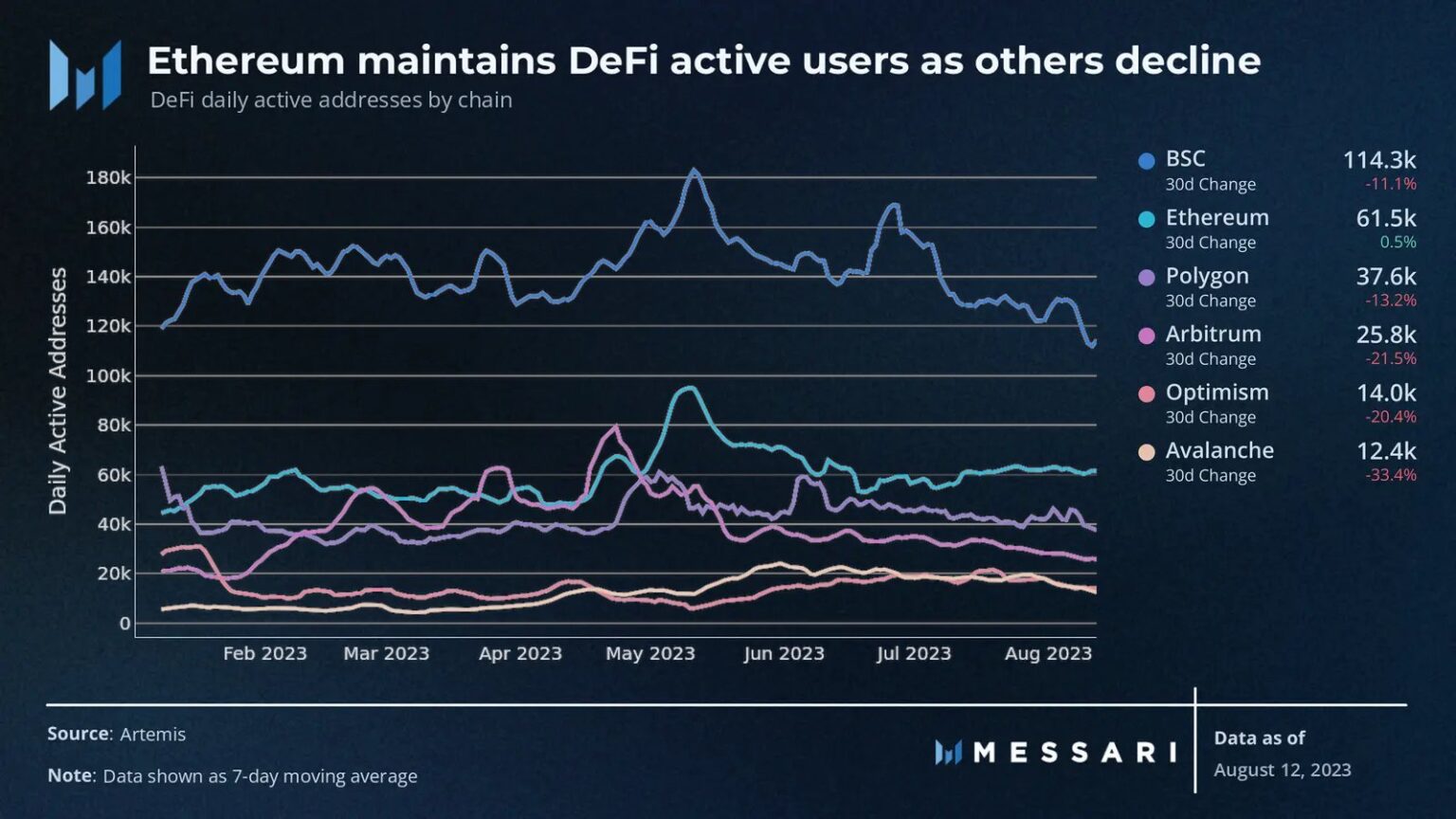

Messari’s data revealed a remarkable contrast as Ethereum defied the norm and maintained an active and engaged user base, while many other major blockchain platforms experienced declines in user activity.

This departure from the prevailing trend highlighted Ethereum’s enduring appeal and its ability to weather market turbulence.

Amid the ebb and flow of the market, Ethereum’s resilient DeFi ecosystem is showing its capacity to serve as a consistent hub for decentralized finance activities.

This reliability may further establish Ethereum as a base platform for a variety of applications, fostering investor confidence and generating continued interest from DeFi innovators.

Source: Messari

Developments continue

Aside from Ethereum’s growth in the DeFi sector, developments on the Ethereum network could also positively impact it.

On August 10, Ethereum’s core developers gathered virtually for the 115th All Core Developers Consensus (ACDC) call. This meeting was an important step towards the impending upgrade of Deneb/Cancun (Dencun).

The upcoming launch of Devnet 8, a critical milestone in the test network, focuses on refining customer configurations based on insights from Devnet 7. The upcoming launch offers a comprehensive proof of completed Ethereum Improvement Proposals (EIPs) for Dencun, enabling seamless integration between customer teams is promoted.

EIP 4788, which enables improved data accessibility, transitions from a stateful precompile to a regular smart contract after an agreement during the All Core Developers Execution (ACDE) call #167. Discussions include optimizing fork selection processes through a pre-Dencun soft fork, reinforcing a robust confirmation rule.

Progress extends to standardizing customer behavior on validator attestations and improving proposal boost functionality to discourage early submission of hold.

In addition, anticipation is building around the launch of the Holesky testnet poised to replace Goerli. Careful experimentation refines the size of the validator set to ensure optimal performance. This progress reflects Ethereum’s relentless commitment to refining its infrastructure and strengthening network efficiency.

Shopping interest rises, prices remain the same

As developments took place to improve the state of Ethereum, retail interest in ETH increased dramatically. Glassnode’s data set an all-time high (ATH) of 24,719,582 addresses with over 0.01 coins.

Realistic or not, here is the market cap of ETH in terms of BTC

This surge in interest underlined ETH’s increasing appeal among individual investors and suggests a growing belief in its long-term viability.

Source: glasnode

At the time of writing, ETH was trading at $1840 after seeing a drop in volume over the past few days.

Source: Sentiment