- DeFi TVL marked a 70% drop from its December 2021 peak.

- The technology began to evolve in line with the realities of today’s market dynamics.

There is little doubt in admitting that decentralized finance (DeFi) has proved to be at the forefront of the financial revolution in the new decade. The rise of blockchain technologies, the disruptive narrative surrounding decentralization, and the historic crypto bull market of 2020-2021 played a huge role in boosting the DeFi economy.

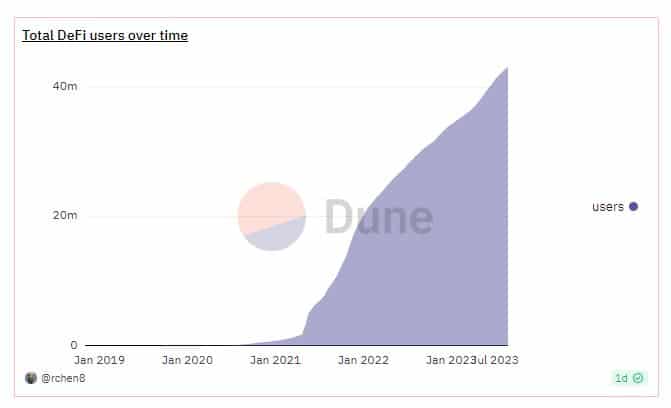

From just over 80,000 total users in 2020, the ecosystem has exploded to over 43 million at the time of publication, according to data from Dune.

Source: Dune

In the past year, however, this breakneck growth hit a speed bump. The onset of the crypto bear market in 2022 has left scars on this burgeoning sector, from which it had not recovered at the time of writing.

DeFi winter freezes TVL growth

According to an analysis company in the chain InTheBlock, the total value locked (TVL) in DeFi protocols hit a 2.5-year low. New data from DeFiLlama confirmed this claim. The TVL was $62.75 billion at time of publication, last seen in the first quarter of 2021.

Additionally, the TVL marked a 70% drop from its December 2021 peak. Needless to say, the 2022-2023 bear market played a huge part in making DeFi investors unnerved, resulting in an outflow of approximately $170 billion from the ecosystem.

Source: DeFiLlama

TVL, or the total value of all crypto assets deposited on smart contracts, remains the most popular indicator among investors. The blocked capital is used for operations such as staking, borrowing and liquidity provisions on a DEX.

A higher TVL means more liquidity and thus greater chances of project adoption, and vice versa.

While the broader crypto market experienced a strong recovery in 2023, the value captured in DeFi experienced a slow recovery. On a year-to-date (YTD) basis, the TVL grew 19% compared to the global crypto market cap growth of 32%.

A story of implosions and hacks

The sensational collapse of stablecoin Terra USD [UST] and its support coin Terra [LUNA] has accelerated the crisis, leading to a sharp drop in token prices. This cascading effect led to significantly lower returns on deposits, in stark contrast to the situation in 2021.

As depositors waved away, the influx of tokens dwindled, leading to less perceived value for the protocol

In addition, security vulnerabilities undermined investor confidence. According to DeFiLlama, 2022 was the most notorious year for DeFi exploits. In the past year, nearly $3.27 billion worth of crypto assets were stolen from the DeFi protocols.

Source: DeFiLlama

DeFi 2.0

DeFi may be going through a rough patch, but it began to evolve in line with the realities of today’s market dynamics.

When yields on risk-free government bonds were low, DeFi attracted hordes of savers because of the higher rewards. However, with yields that touch each other record highs recently DeFi has begun to orient its game from savers to borrowers.

According to IntoTheBlock, the lending protocol borrows Aave [AAVE] offered attractive interest rates of 1-1.5% on its stablecoin GHO. As a result, the decentralized stablecoin surpassed $20 million in market cap and $60 million in collateral within a month of its launch.

Source: IntoTheBlock

Furthermore, the popular stablecoin lending protocol MakerDAO [MKR], began using part of its revenue from US Treasury bonds to provide stablecoin DAI users with high returns. This resulted in sharp demand for DAI in the following weeks, as evidenced by the growth in circulating supply, according to data from Glassnode.

Source: Glassnode

Maker’s decision also signaled its strategy to include more real-world assets (RWAs) in its DeFi business. Several proposals have been made among the MakerDao community to increase holdings of US Treasuries aimed at diversifying DAI’s collateral reserves.

Recall that DAI is conceived as a cryptocurrency-backed stablecoin. However, the recent moves were designed to avoid the dangers associated with crypto reserves that surfaced during the USD Coin [USDC] March crisis.

In short: the DeFi protocols embarked on a new wave of experimentation to attract investors. The bear market can be a tough time for investment and value, but the reduced noise can cause developers to build products and plans that align with long-term growth plans.