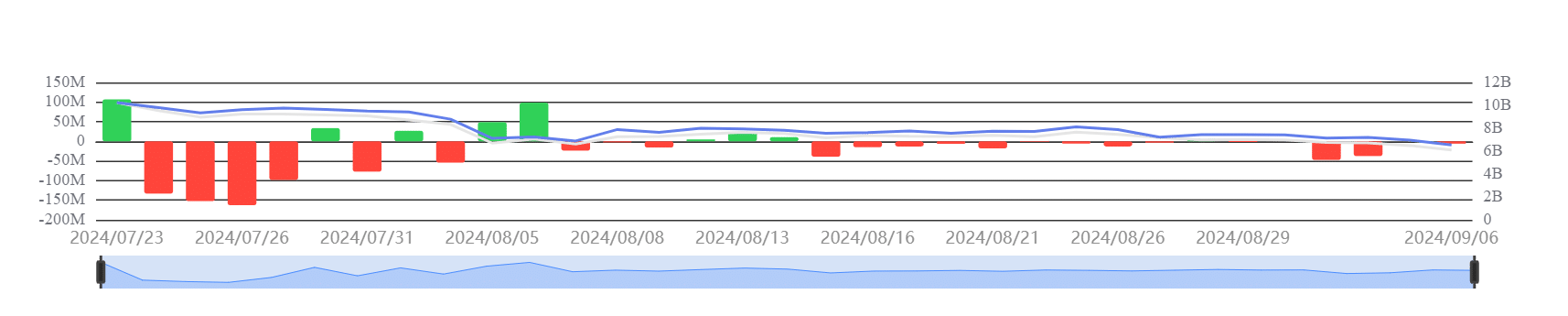

- Spot ETH ETFs had net flows of -$91 million this week.

- The ETH ETF volume has not increased compared to the BTC ETF

Ethereum has seen notable events surrounding its ETFs this week. A major asset manager announced it was shutting down one of its Ethereum-based features. At the same time, another company filed for a new spot Ethereum ETF.

These developments occurred during a week where Spot ETH ETFs saw virtually no inflows, further contributing to the mixed sentiment surrounding ETH.

New Ethereum ETF feature in Australia

Earlier this week, the Australian asset manager said Monochrome Asset Management announced that it has applied to list the Monochrome Ethereum ETF (Ticker: IETH) on Cboe Australia. The announcement highlighted that the asset manager plans to hold ETH passively, making it the first ETF in Australia to do so. This move marks Monochrome’s continued expansion into the cryptocurrency ETF space, following the launch of its BTC ETF in June 2024.

While Monochrome is making progress with its Ethereum ETF, VanEck, another major asset manager, has announced it is discontinuing one of its ETH ETF features.

VanEck will close Ethereum Futures ETF

In a September 6 announcement VanEck revealed that the board has approved the liquidation of its VanEck Ethereum Strategy ETF (EFUT) – a futures-based Ethereum ETF.

The decision to liquidate the fund was attributed to insufficient demand. It said traders showed a preference for spot ETFs over futures offerings. According to the statement, EFUT shares will cease trading on September 16. Also, the fund’s assets will be liquidated and returned to investors on or around September 23.

The contrasting moves of Monochrome and VanEck highlight the growing popularity of spot ETFs in the cryptocurrency market. The spot launch of Monochrome Ethereum ETF (IETH) is in line with this trend. At the same time, VanEck’s decision to phase out its Futures ETF reflects the declining appeal of Futures products in favor of direct exposure through spot ETFs.

However, despite the apparent preference for spot ETFs, the overall trend for these products over the past week has been characterized by outflows.

Spot ETH ETF records consecutive outflows

Spot Ethereum ETFs recorded consecutive outflows across most exchanges over the past week, according to analysis of data from SoSoValue. At the close of trading on September 6, outflows were approximately $6 million, bringing total net outflows for the week to $-91 million.

Source: SoSoValue

– Read Ethereum (ETH) price forecast 2024-25

Additionally, total net flows for spot ETH ETFs now stand at approximately $-568.30 million, indicating a continued trend of investor withdrawals.

What this means is that market conditions have prompted investors to withdraw their ETH positions in recent weeks.