The current state of Bitcoin options and futures markets is witnessing a remarkable shift, reflecting a broader transformation in the crypto trading landscape.

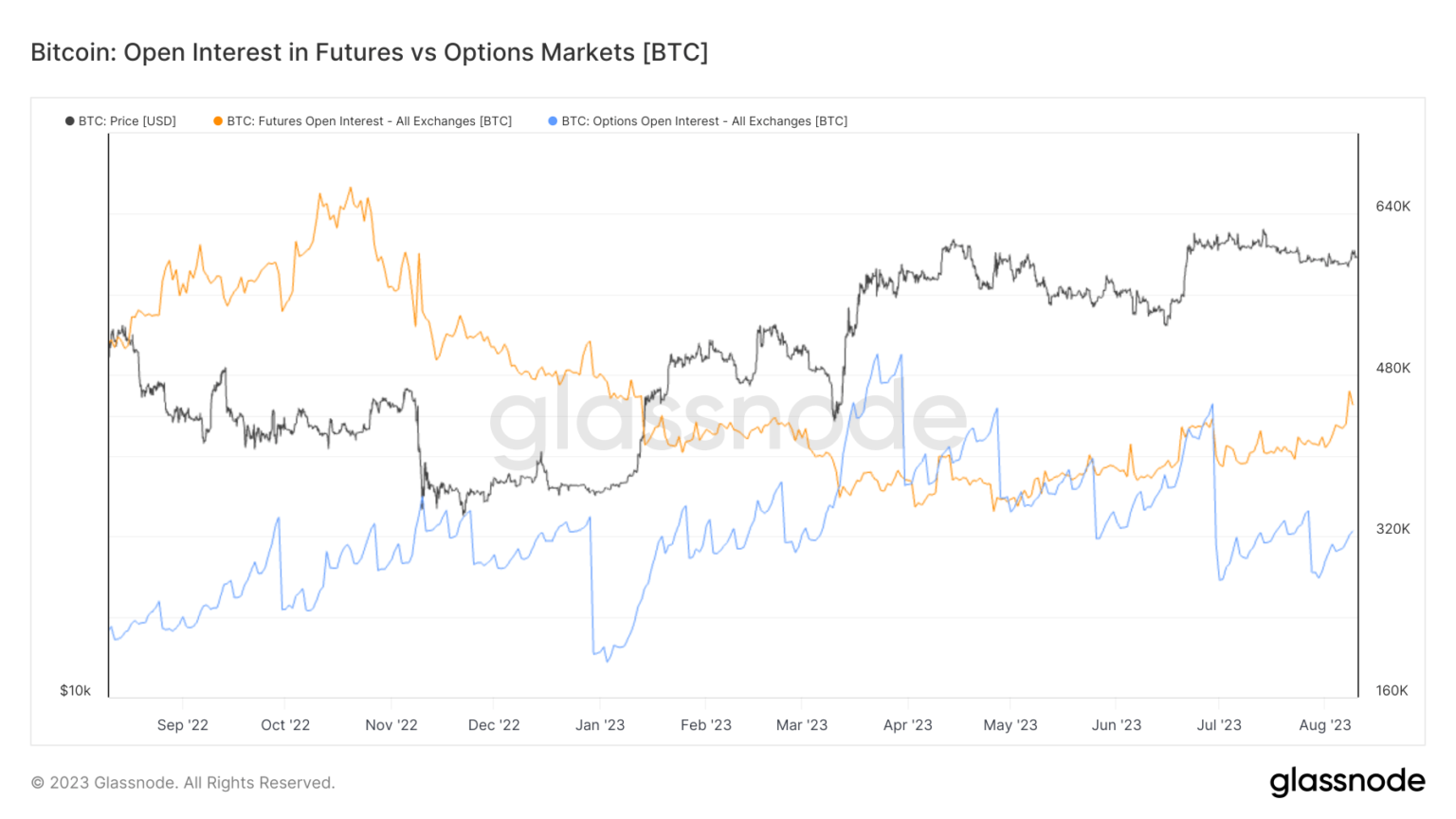

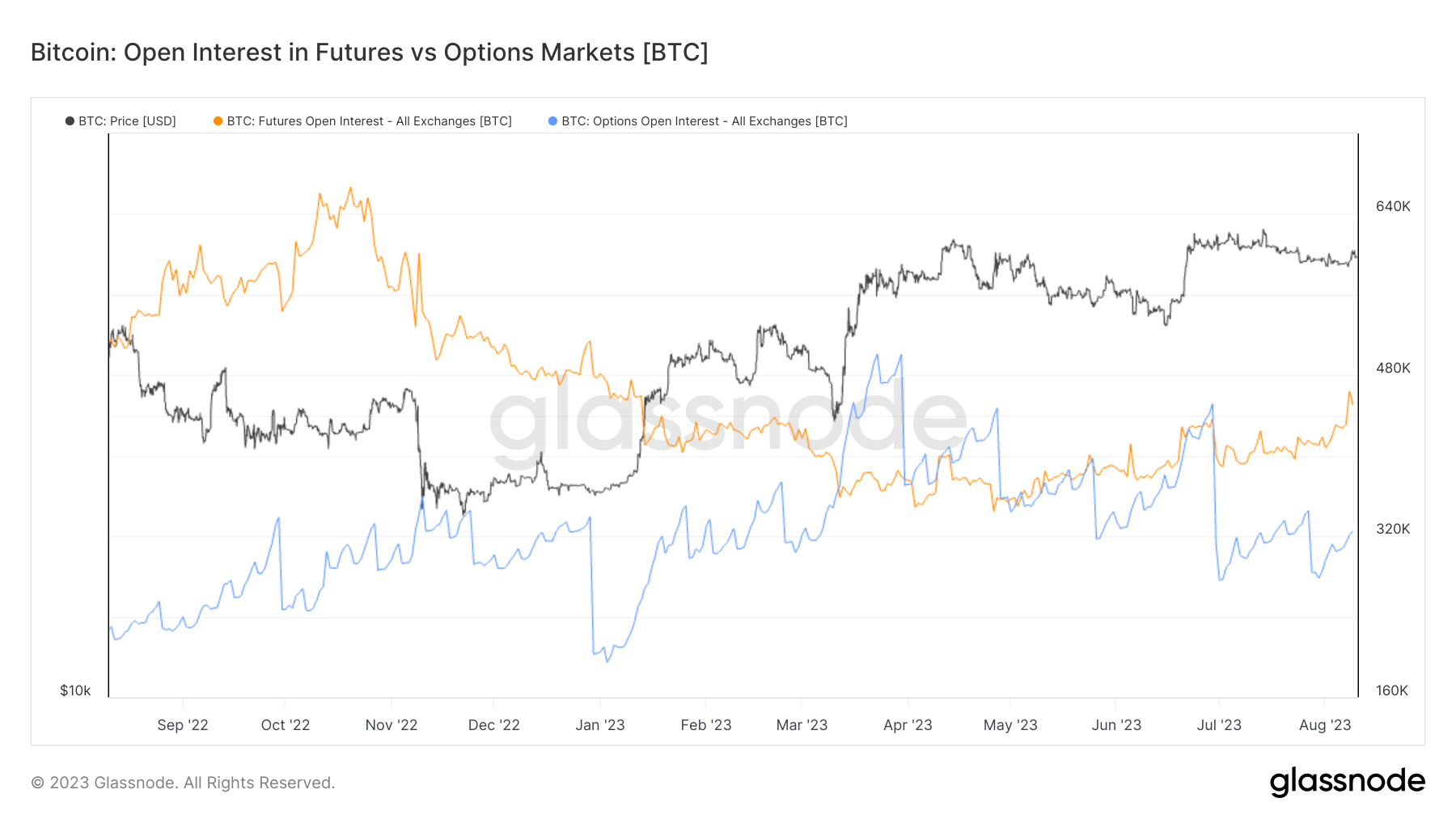

Over the past 12 months, Bitcoin options markets have experienced significant growth, with outstanding interest more than doubling. This growth in options trading indicates an increased interest in strategic financial products that offer flexibility and risk management capabilities.

Options now rival futures markets in terms of open interest, signaling a shift in trading strategies and possibly a sign of market maturity.

On the other hand, open interest on futures has steadily declined since the collapse of FTX in November 2022.

This decline can be interpreted as a loss of confidence in the futures market, raising concerns about stability and risk management practices. However, in 2023 there was a slight increase in open interest on futures, indicating a tentative return from traders, but the overall trend remains negative compared to the options market.

The open interest on Bitcoin futures is currently 420,000 BTC, while the open interest on Bitcoin options is 312,000 BTC.

The growth in Bitcoin options trading reflects a more strategic and risk-averse approach to Bitcoin trading. Options, which provide the right but not the obligation to buy or sell an asset at a specified price, are preferred over futures, which obligate the buyer to buy the asset or sell the seller at a predetermined future date and price.

This shift has far-reaching consequences for market structure, regulation and general market behavior. The rise in options trading may lead to different price dynamics, affecting the overall volatility of Bitcoin’s price.

Options provide leverage, which can amplify both gains and losses, attracting more speculative trading. While this can increase liquidity, it can also increase short-term volatility as traders move in and out of positions quickly.

However, it is important to note that options can also act as a stabilizing force for the broader crypto market. Since options are often used as a hedging instrument to protect against adverse price movements, they can effectively provide a floor for potential losses, potentially mitigating sharp declines during market downturns.

The shift between futures and options may also change the competitive landscape of exchanges that offer these products. Those focused on options may see growth, while future-oriented platforms may face challenges.

The data may also reflect changes in investor behavior, with potentially more institutional participation in options as a risk management tool and possibly a decline in speculative futures trading.

The post The Changing Landscape of Bitcoin Futures and Options Markets appeared first on CryptoSlate.