- Bitcoin’s price volatility is leading to miner capitulation, signaling potential market shifts.

- CryptoQuant’s CEO suggests that the current capitulation phase of miners could continue, and advises caution in market participation.

Bitcoin [BTC] price swings continue to dominate the crypto markets, with the leading cryptocurrency experiencing both highs and lows over the past week.

Recently, Bitcoin showed signs of recovery, rising 3.1% to push its trading price to $58,941. This increase comes after a dramatic drop below $54,000 last week, a price point not seen since February.

Despite this brief revival, Bitcoin is still down 7.1% over the past week and is down 21.9% from its March high of over $73,000.

Miners’ Capitulation: A Persistent Concern

Ki Young Ju, CEO of CryptoQuant, a renowned cryptocurrency analysis company, marked that Bitcoin miners continue to face challenges, a condition known as “miner capitulation.”

This term refers to a period when mining profits are under pressure due to falling Bitcoin prices, causing miners to sell their assets to cover operating costs, potentially driving prices down further.

Ki Young Ju notes that miners’ capitulation typically ends when the daily average mined value falls to 40% of the annual average; currently it stands at 72%.

This extended capitulation phase suggests that the market may experience a lack of exciting moves in the coming months, emphasizing a strategy of optimism in the long term but cautious trading in the short term.

In the words of Ju:

“The capitulation of Bitcoin miners is still ongoing. Historically, it ends when the daily average mined value is 40% of the annual average; it now stands at 72%. Expect the crypto markets to be boring over the next 2-3 months. Stay optimistic in the long term, but avoid excessive risk.”

Bitcoin fundamentals indicate market stress

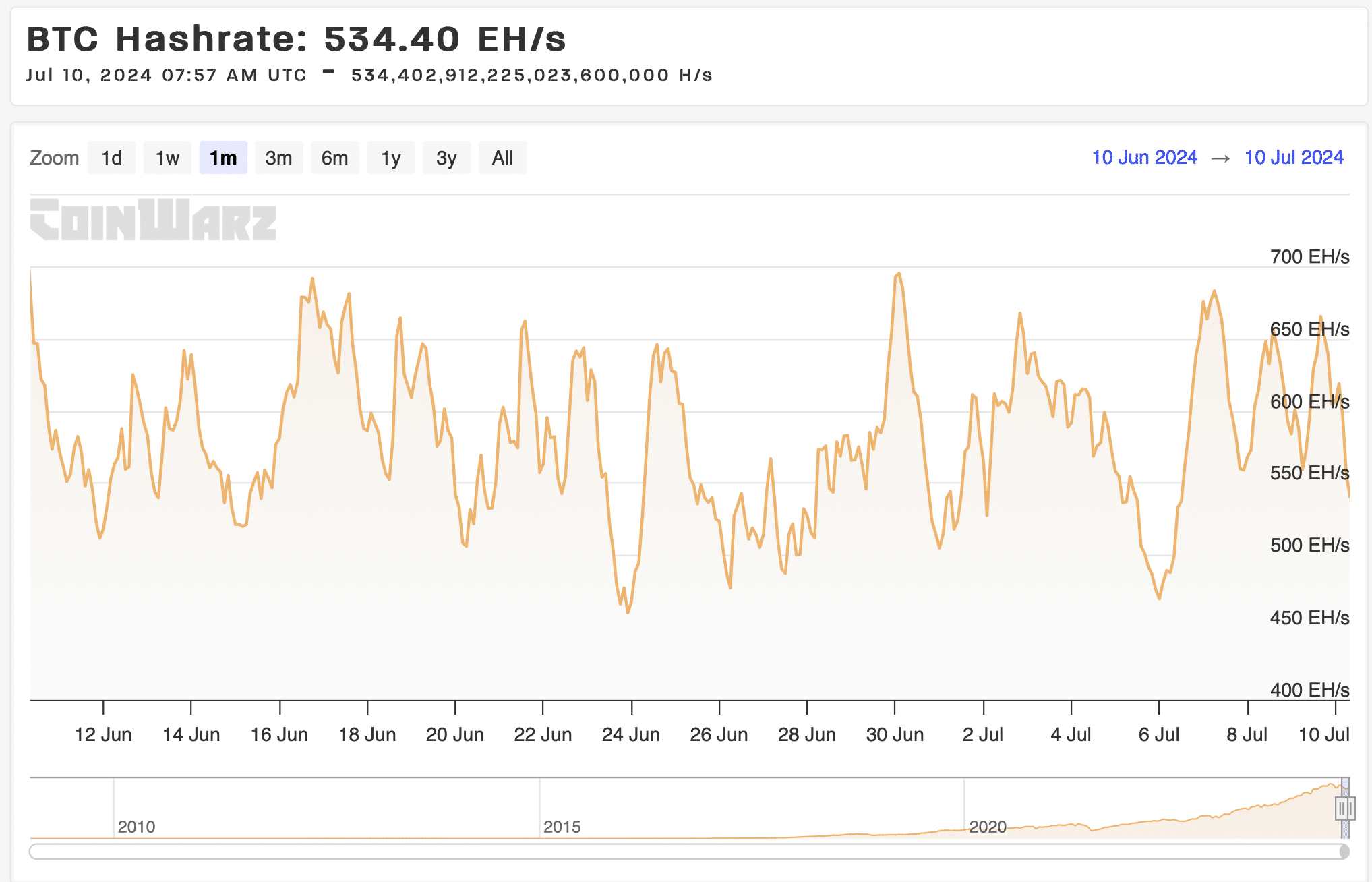

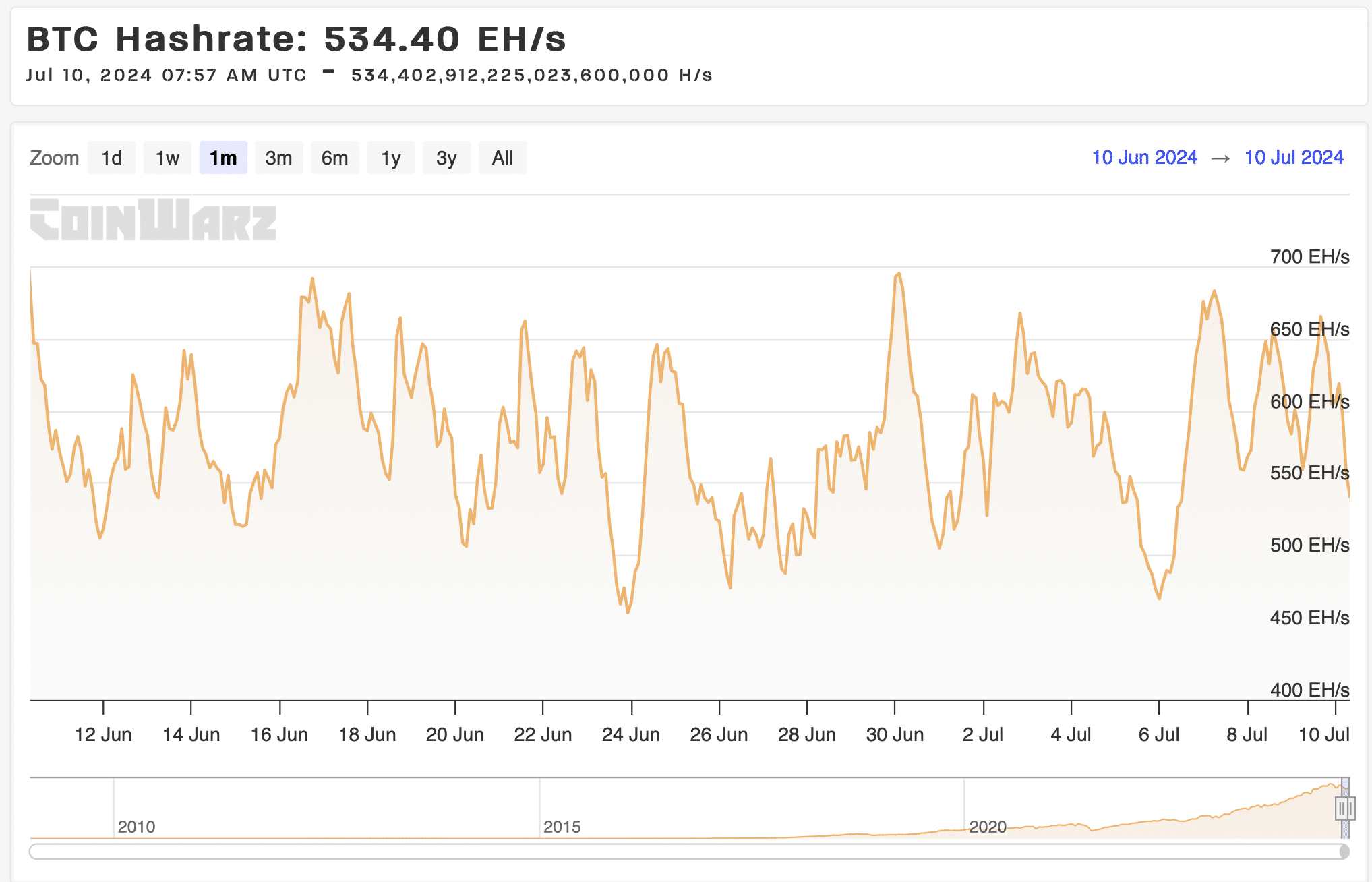

Amid the continued capitulation of miners, the Bitcoin network’s total computing power, or hashrate, recently fell to 540 exahashes per second (EH/s) from a peak of 751 EH/s in April, according to CoinWarz. facts.

Source: CoinWarz

This decline indicates that several miners are turning off their equipment, likely due to profitability challenges.

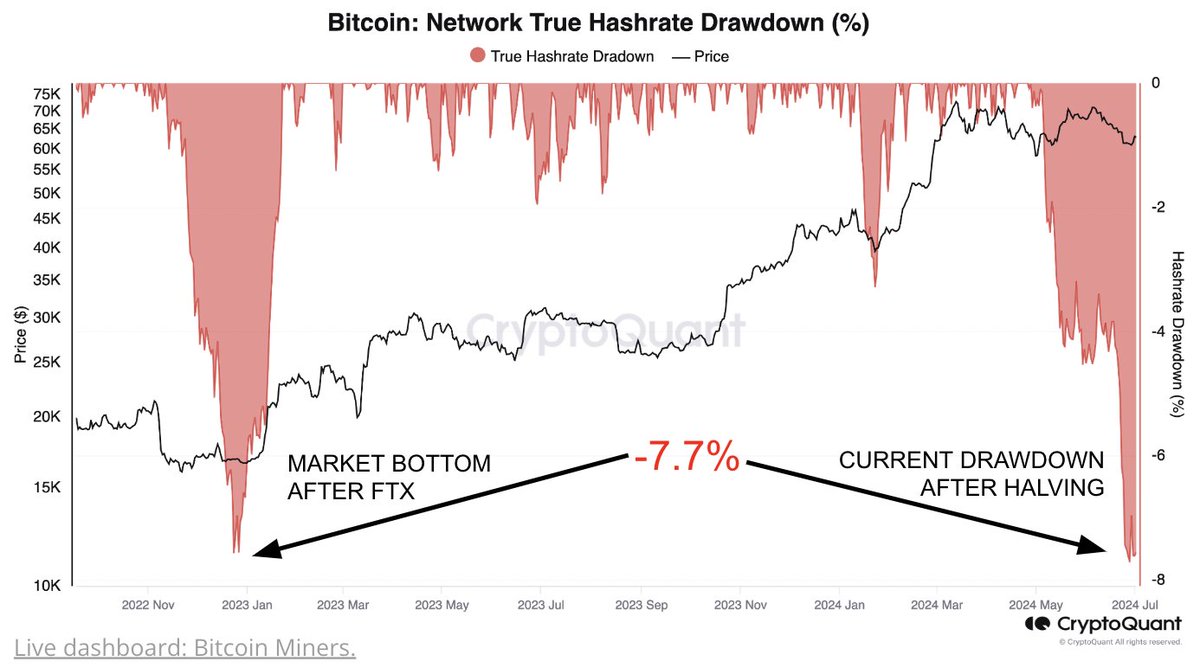

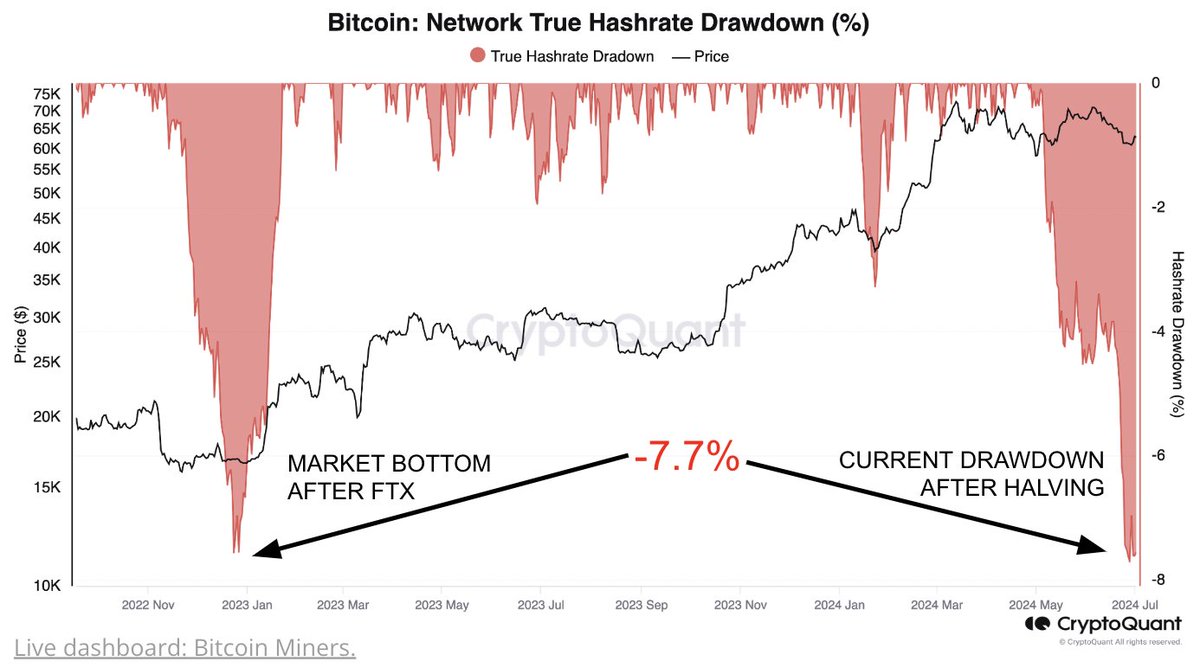

CryptoQuant has noticed that significant declines in hashrate have historically aligned with market bottoms, suggesting that they may be indicative of turning points in market dynamics.

Source: CryptoQuant

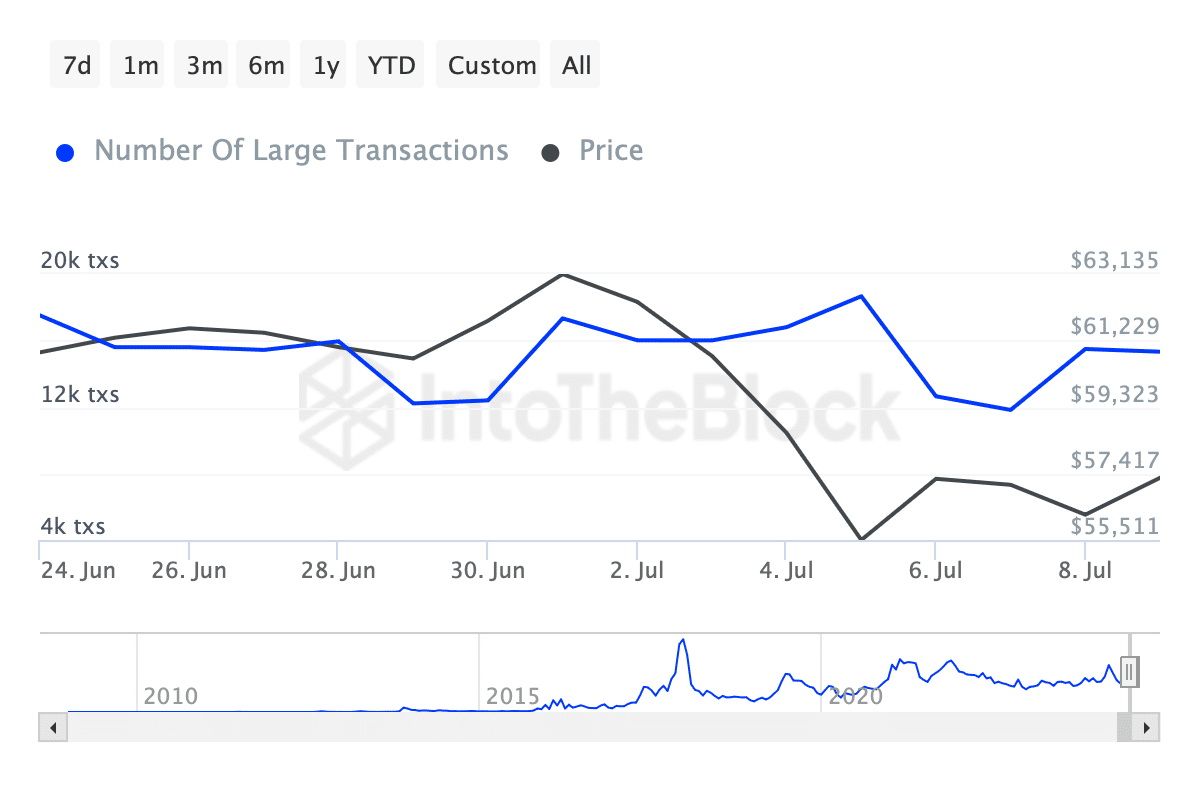

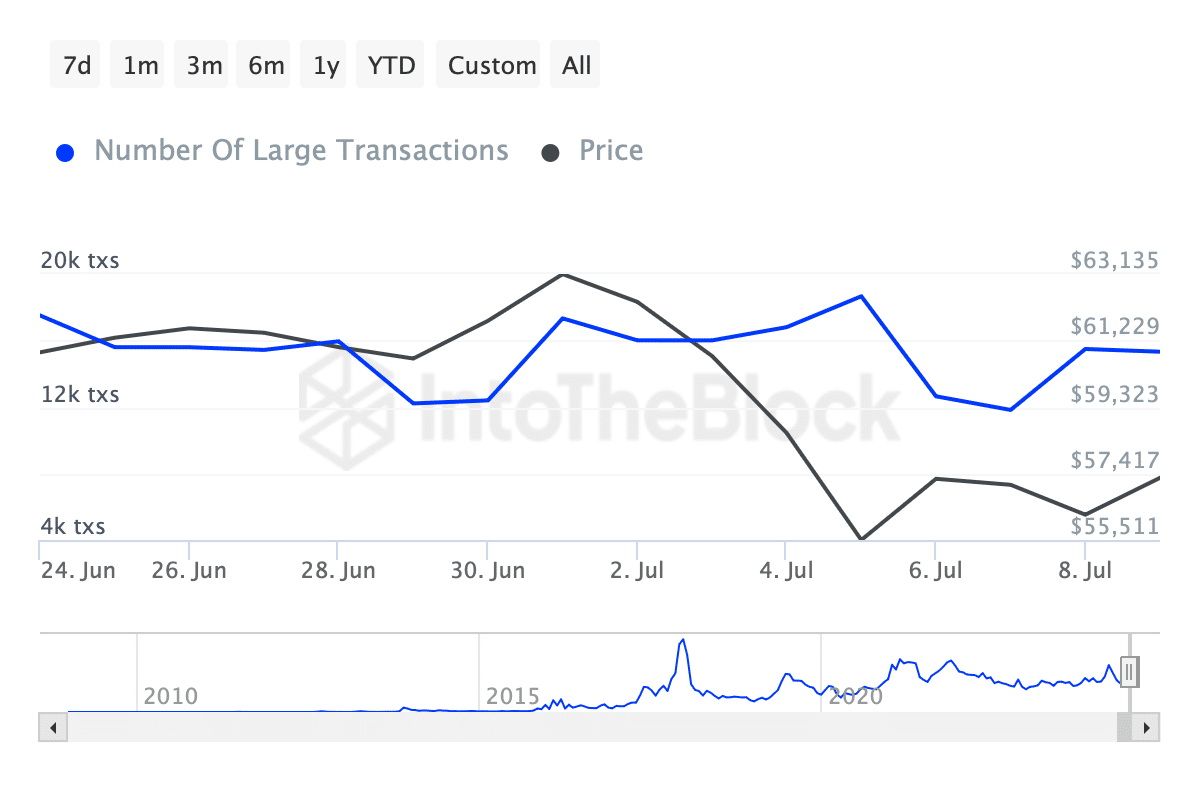

Continue transaction facts from IntoTheBlock shows a declining interest in whales. In particular, the number of Bitcoin transactions above $100,000 fluctuated alongside the price, reflecting market volatility.

Read Bitcoin’s [BTC] Price forecast 2024-2025

Currently, this value has fallen from over 17,000 at the end of June to 15,330 transactions, underscoring the cautious attitude of many large-scale traders and investors.

Source: IntoTheBlock

Despite all this, AMBCrypto recently reported that the Bitcoin probability is still 25% to beat a new all-time high (ATH) this year.