- BTC is down 1.67% over the past week.

- Bitcoin’s number of individual investors must remain above 54 million for it to rise.

Bitcoin last week [BTC] has undergone a significant market correction. The correction was accompanied by a sharp decline in trading activity. In particular, trading volume has decreased by 62%, leading to less demand and fewer participants.

This decline in participants has analysts talking about the importance of individual investors in a BTC rally. One of them is the CryptoQuant analyst Burak Kesmeci, which has suggested that BTC must exceed 54 million individual investors to gather.

Why 54 million individual investors are critical

In his analysis, Kesmeci stated that the indispensable condition for Bitcoin’s bull rally is an increase in the number of individual investors.

Source:

According to him, BTC needs to surpass 54 million individual investors before the crypto sees a price increase. The number of individual investors has risen for 12 months after falling to 43 million in January 2023.

During this period the number increased to 52.4 million, which amounts to 22%. After the adoption of ETFs, this number dropped to 51.6 million in February 2024.

However, this number saw a sustained increase during the March 2024 rally and peaked at 54.14 million in June. Since then, the number of individual investors has decreased.

Historically, an increase in the number of individual investors has been closely correlated with BTC prices. For example, BTC rose 300% as the number of individual investors increased in January 2023.

As a result, Bitcoin’s price fell after the number of individual investors peaked in June 2024.

The number of Bitcoin participants continues to decline

Kesmeci’s analysis suggests that increasing the number of investors is essential for a BTC rally. This implies that newcomers to the BTC blockchain are essential for the price increase. The question is: will new investors enter the market?

According to AMBCrypto’s analysis, Bitcoin is experiencing a decline in the number of participants.

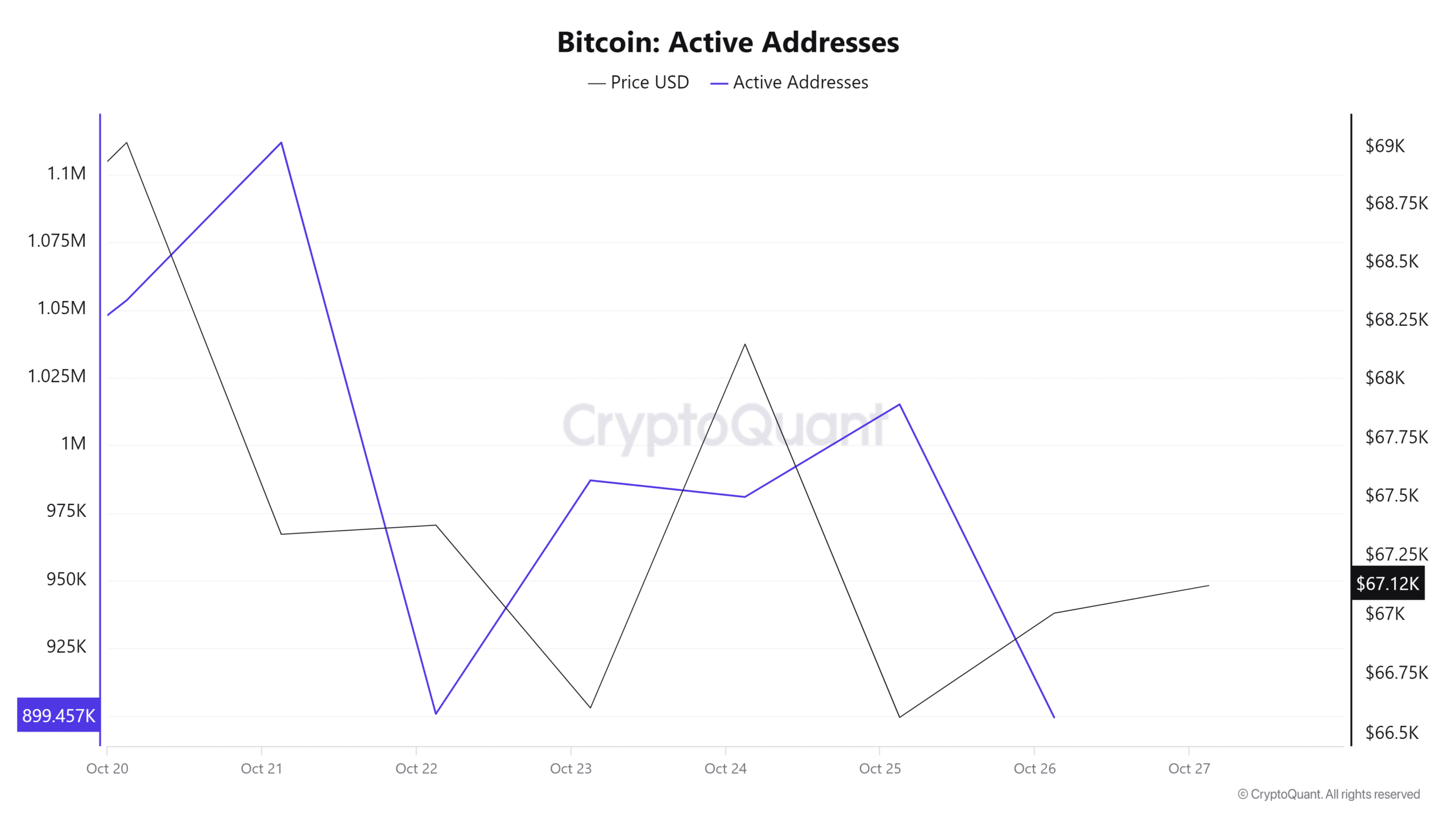

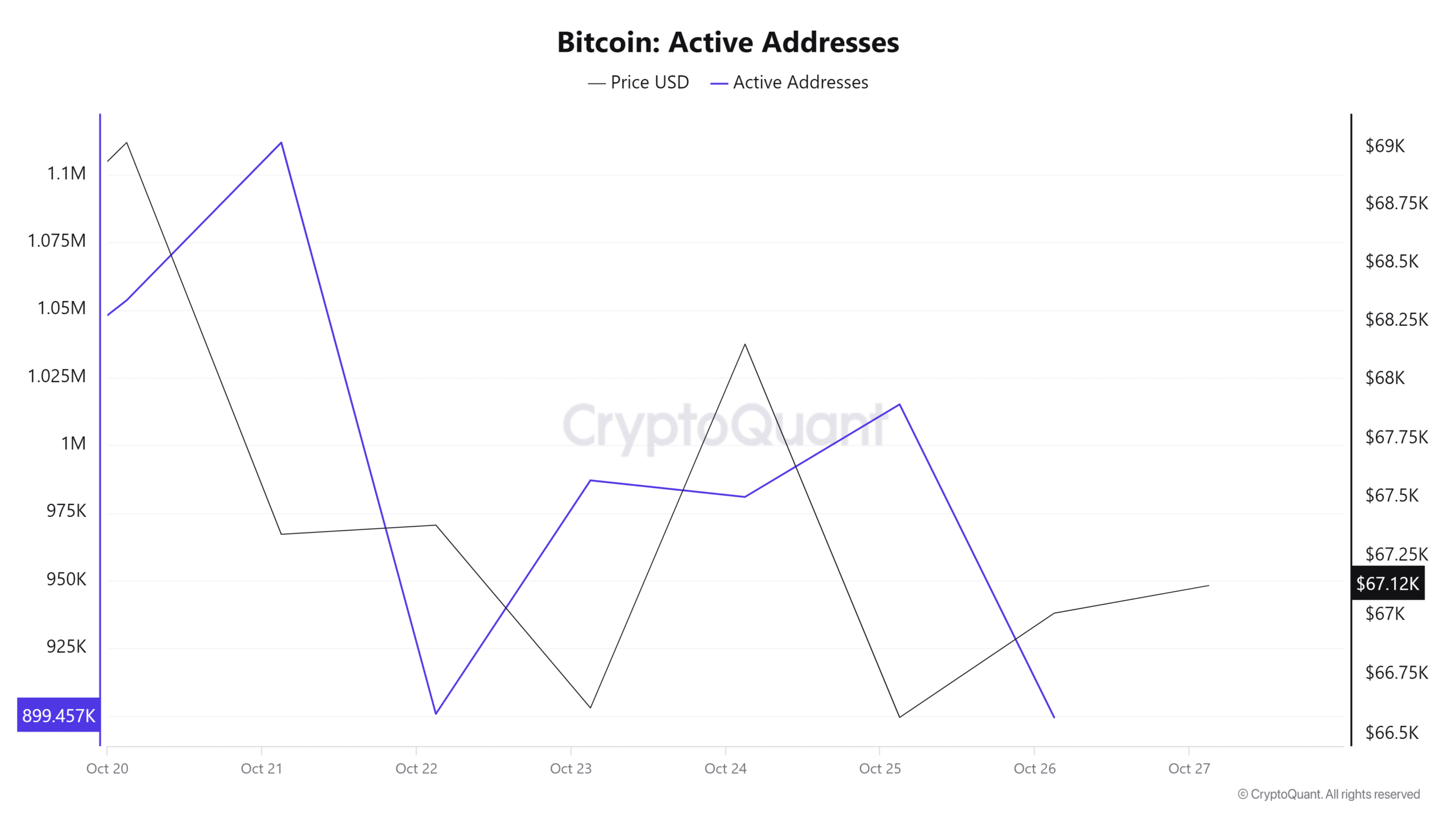

Source: Cryptoquant

For example, Bitcoin’s daily active addresses continue to decline. Over the past week, the number of active addresses fell from 1.1 million to 899,000. This indicates that fewer investors are entering the market, indicating a decrease in the number of individual investors.

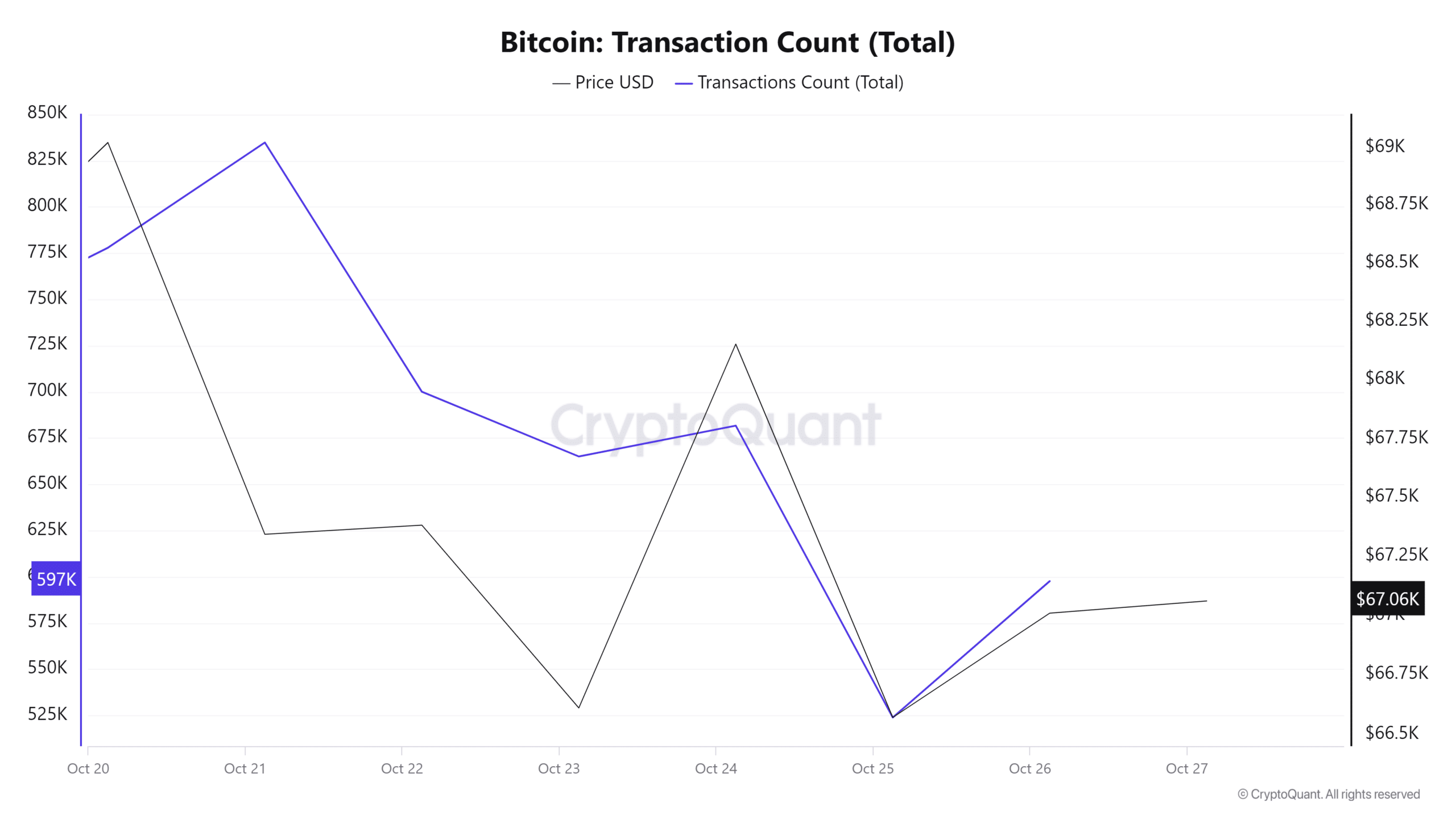

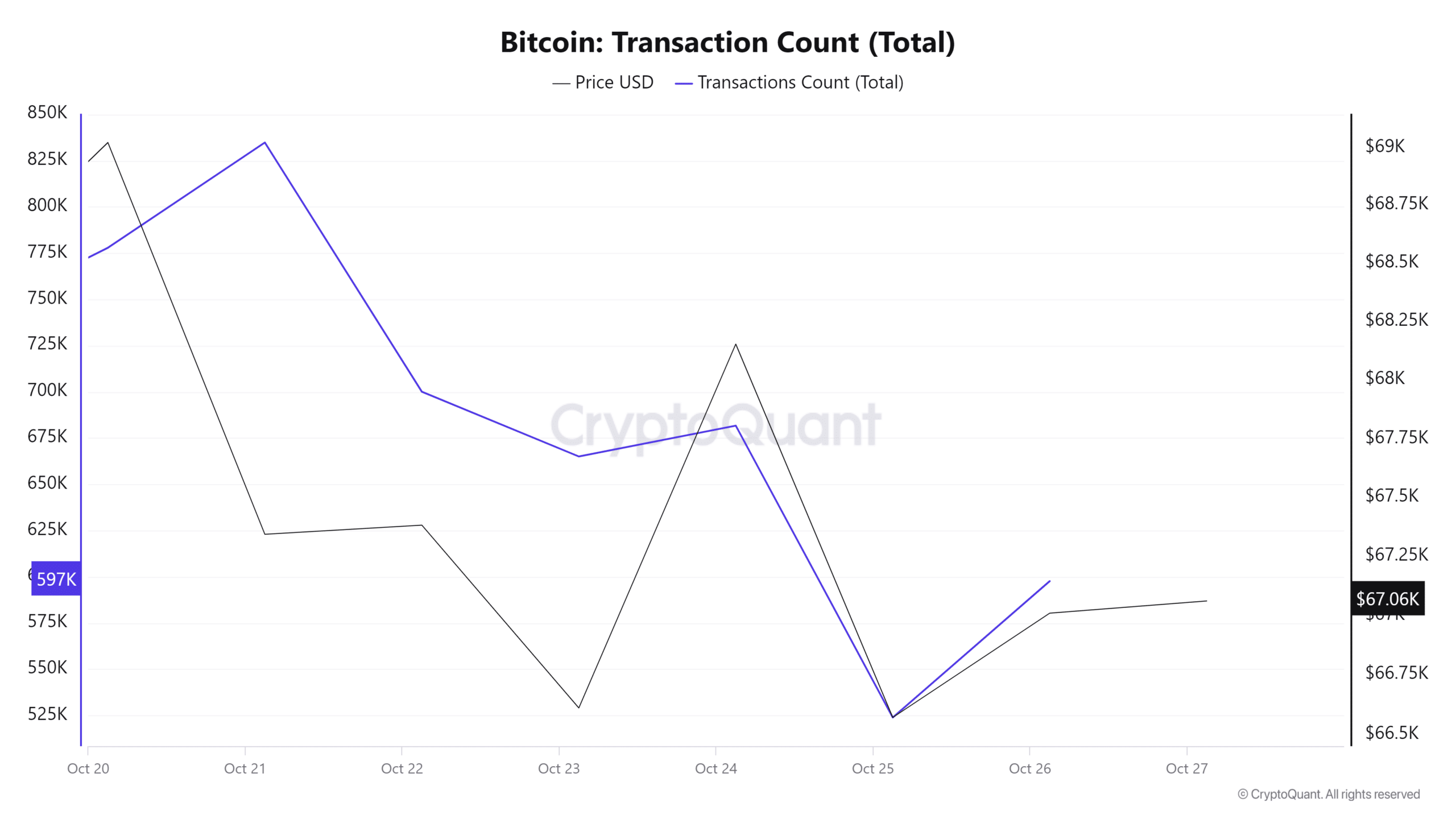

Source: Cryptoquant

Is your portfolio green? Check the Bitcoin Profit Calculator

Moreover, the number of Bitcoin transactions fell from 834,000 to 598,000 in the past week. This indicated lower demand for BTC as fewer investors use the blockchain.

As noted above, BTC is experiencing a decline in the number of participants. This usually results in a market correction, as seen this past week when Bitcoin was trading at $67,074 at the time of writing. So if the current trend continues, BTC could fall further to $65,757.