Bitcoin spot trading volumes over the past week have shown varying levels of market activity and sentiment. Bitcoin’s price has seen some volatility over the past week, peaking at $69,270 on May 25, followed by a slight decline and stabilization around $68,000 to $69,000.

This spike corresponds to the lowest spot market trading volume in the past week of $2.121 billion. This shows that the price spike may have reduced trading activity as the market waited out further price movements or reached a point of hesitation.

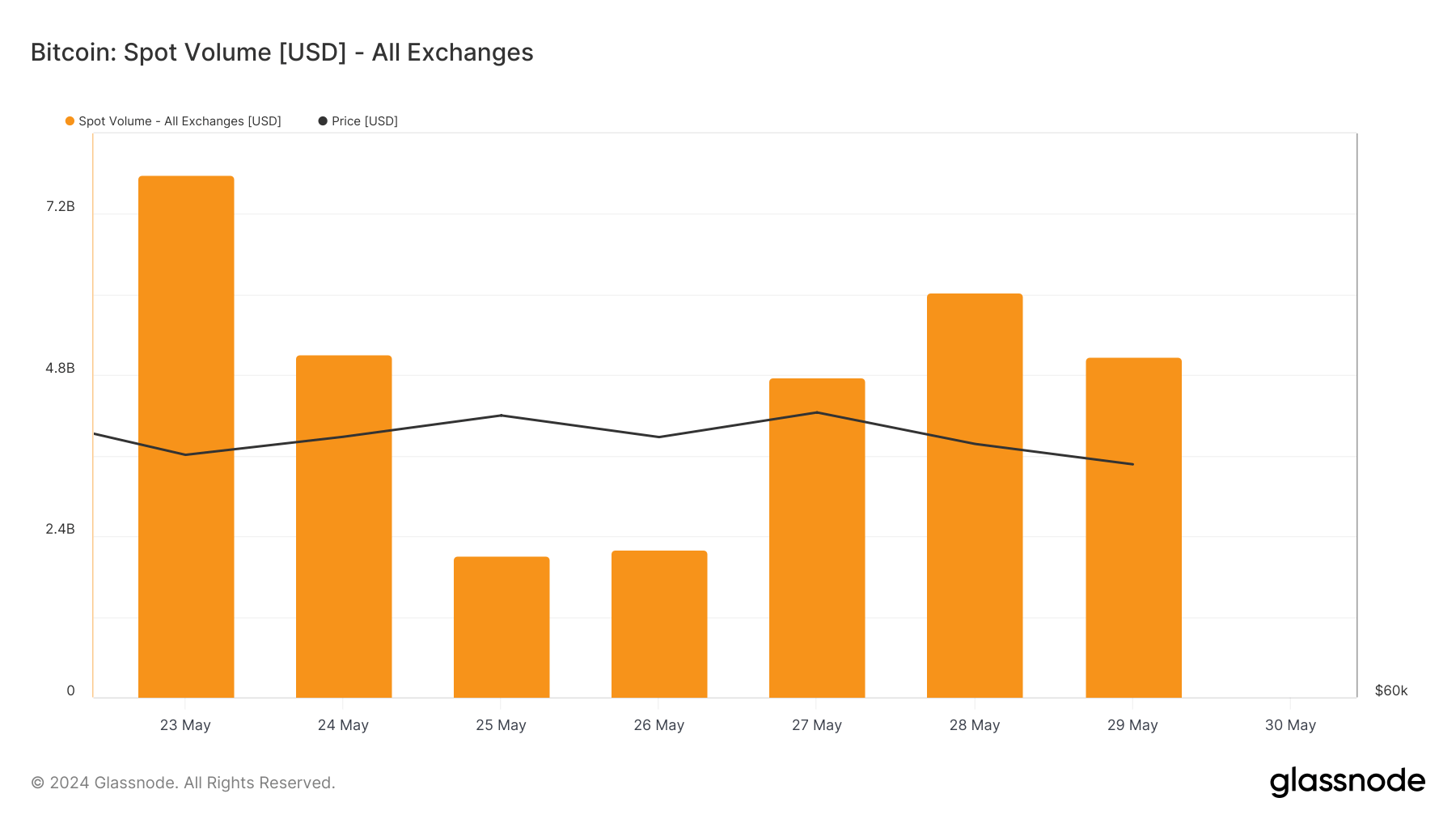

Glassnode’s intraday spot volume data shows a sharp decline from May 23, at $7.780 billion, to May 25, at $2.121 billion. This significant drop in volume signals a period of low volatility and a lack of strong market catalysts, leading to a substantial reduction in trading activity.

The following days show a recovery in trading volumes. On May 27, spot market trading volume rose to $4.761 billion, while Bitcoin gained another $69,385. On May 28, spot trading volume exceeded $6 billion, despite a slight price decline to $68,280.

This pattern suggests that price spikes are not always followed by an immediate increase in trading activity, as traders tend to wait for the consolidation that inevitably occurs after a price increase.

By analyzing intraday spot buying and selling volumes, we can determine overall market sentiment. If most of the trading volume comes from selling, this indicates a bearish market that is rushing to profit from sharp price movements and wants to get out of the market or cut its losses.

Conversely, if the majority of trading volume comes from buying, the overwhelming sentiment is bullish as the market rushes to enter at current price levels in anticipation of further gains.

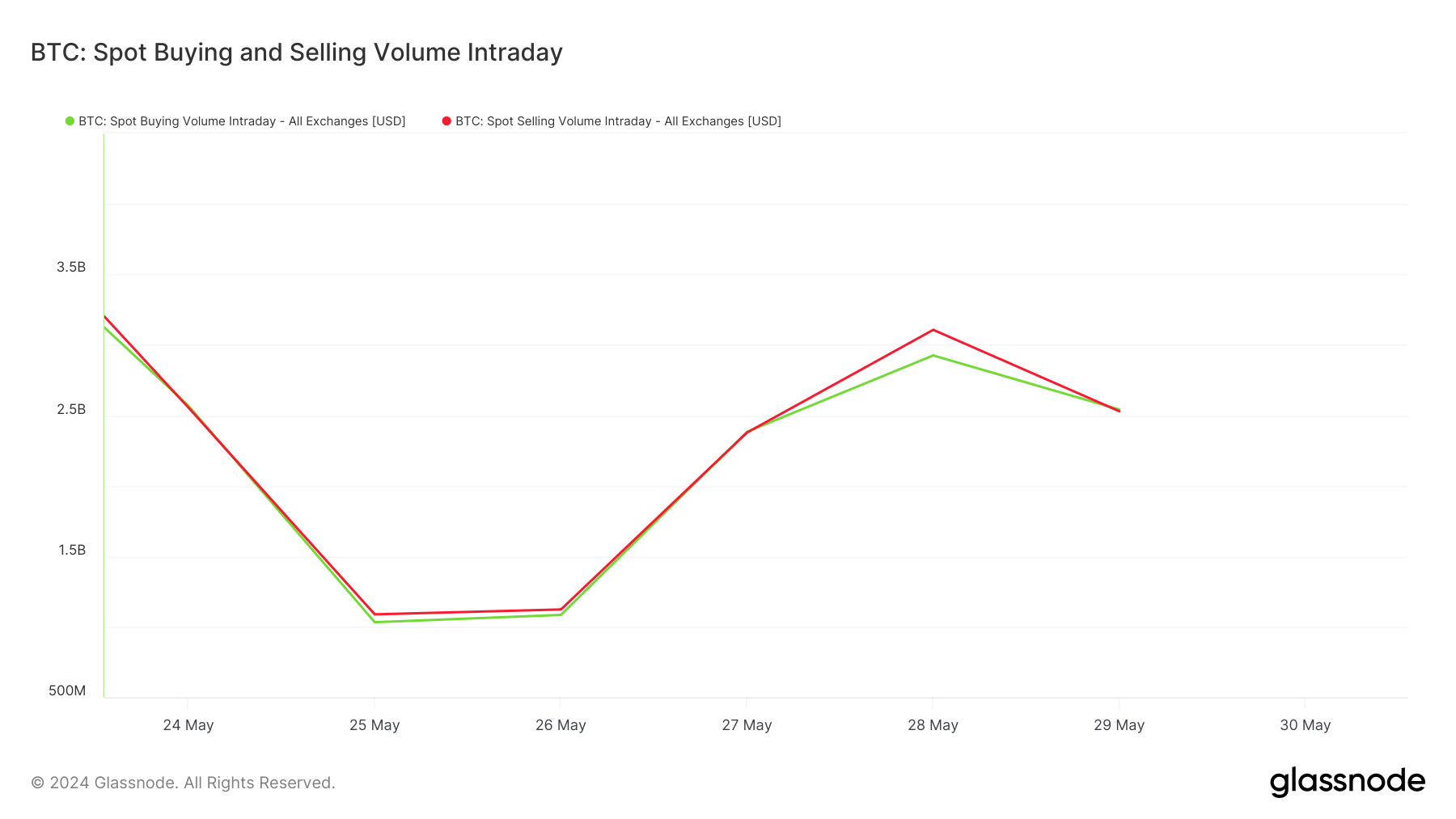

Glassnode’s data from the past week shows the market is close to equilibrium. On May 23, buying volume was $3.796 billion, compared to selling volume of $3.984 billion. While this would generally indicate bearish sentiment, the fact that these volumes are so close together indicates a divided market with no clear directionality.

This trend continued last week. On May 24, there were almost equal buying and selling volumes of approximately $2.566 billion and $2.553 billion respectively, while the lowest volumes in May saw buying of $1.032 billion and selling of $1.088 billion.

As trading volume began to pick up on May 27, buying and selling volumes remained level at approximately $2.383 billion and $2.378 billion, indicating a very active trading environment with participants equally involved in buying and selling.

The spike in spot selling volume on May 28 of $3.106 billion, compared to buying volume of $2.924 billion, indicates slightly bearish sentiment, possibly influenced by the price drop to $68,280, as traders took advantage of the price movements to sell their positions.

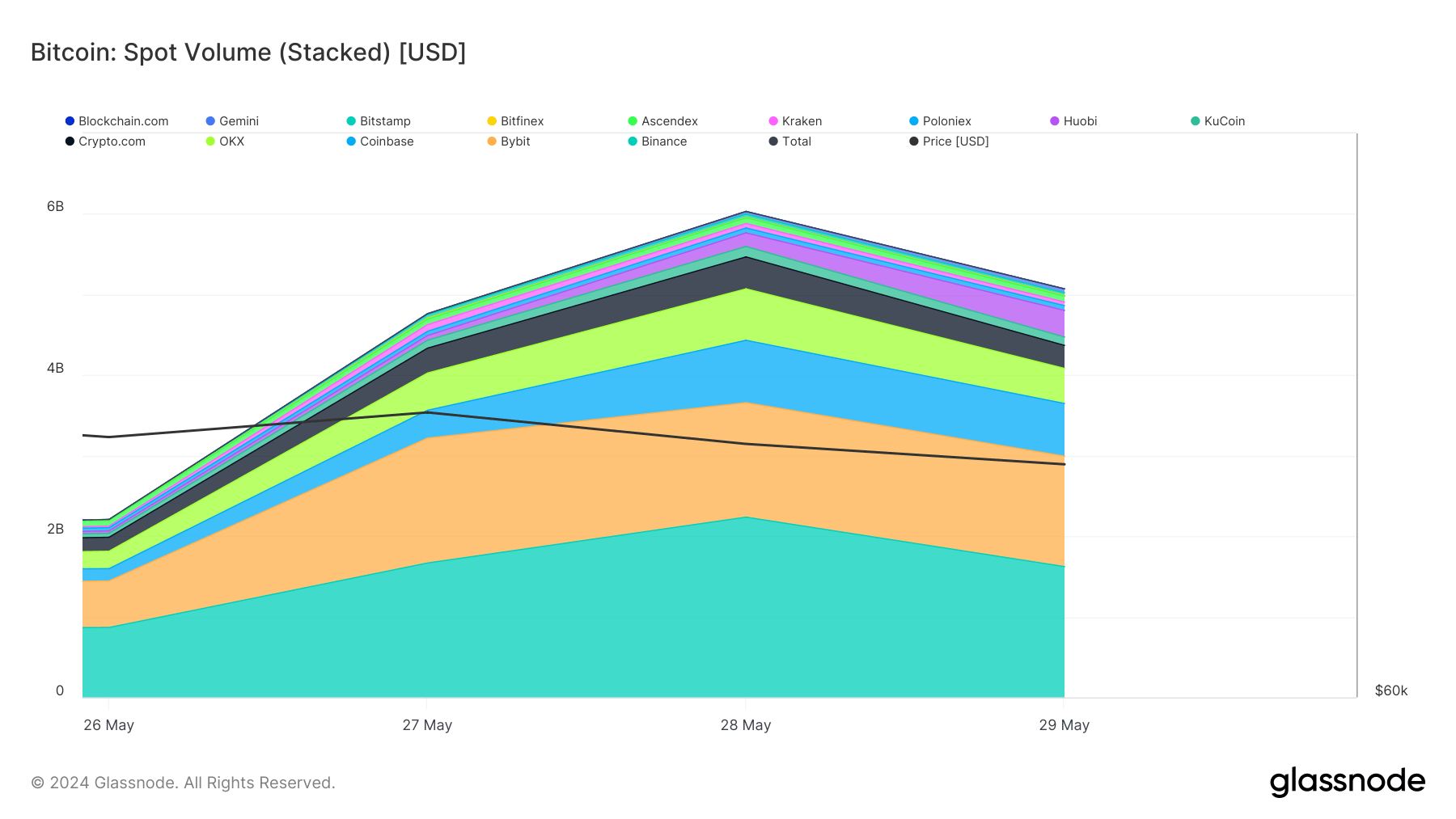

Looking at the spot volumes on the exchanges, Binance consistently leads the way, followed by Bybit and Coinbase. On May 26, Binance had a volume of $866.776 million, which increased significantly to $2.236 billion on May 28. Bybit and Coinbase also showed volume increases, with Bybit peaking at $1.550 billion on May 27 and Coinbase at $774.203 million on May 28.

The significantly higher volumes on Binance, which often exceeded the combined volume of Bybit and Coinbase, can be attributed to its large user base and low trading fees, making it the exchange of choice for high-volume traders.

The balance between buying and selling volumes over the past week indicates that the market is indecisive and volatile.

The post-Bitcoin market split as buying and selling volumes remain the same appeared first on CryptoSlate.