- The purchase sparked renewed interest in Bitcoin, with clear support around $57,493

- BTC could struggle to reach $60,000 due to reduced network activity

After Bitcoin [BTC] The price fell to $54,000 on July 9 and a market participant bought 10,000 coins worth $540 million. Ali Martinez, an analyst from X, revealed this.

Shortly afterwards, Bitcoin’s price rose to $58,000. The action mentioned above is a typical ‘buy the dip’ behavior. This underlines the belief that a price drop is a sign to buy at low prices before another jump occurs.

However, the buyer was not the only one involved in the purchase of Bitcoin. Around the same period, Bitcoin ETF inflows, which were experiencing a dry spell, recorded an increase of 3,760 BTC, accumulated in three days.

This according to data from Farside Investors. Buying BTC directly and greater exposure on the ETF front together imply increasing confidence in the cryptocurrency.

Big purchases, huge support

At the time of writing, Bitcoin was valued at $57,384, marking a slight decline of 0.60% in the past 24 hours. However, despite the decline, AMBCrypto’s analysis showed that the coin’s price could be close to $60,000.

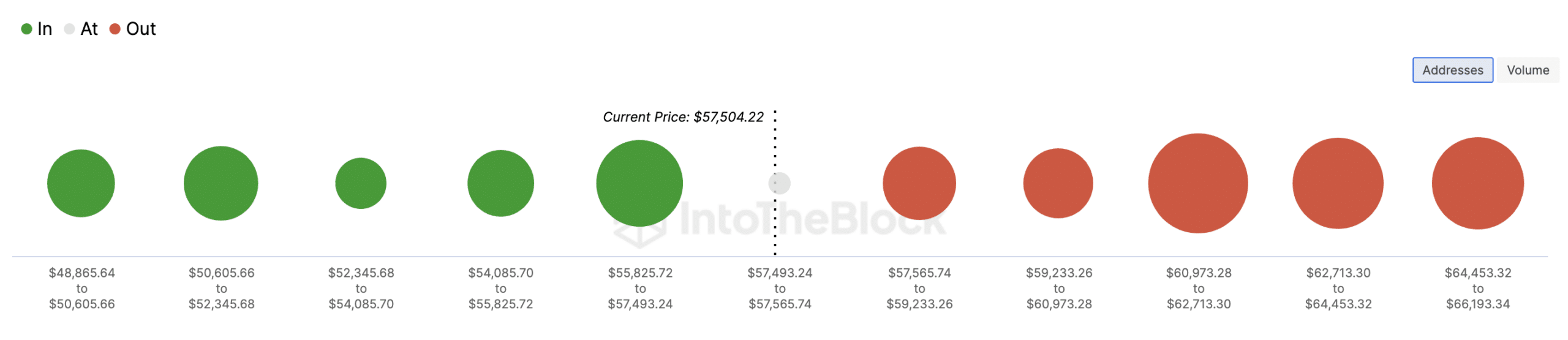

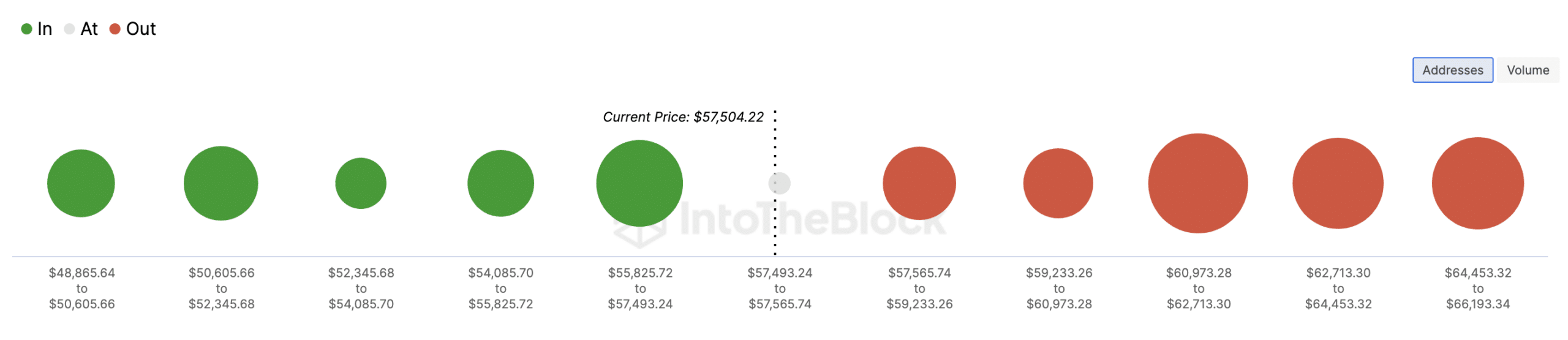

This was the conclusion after we examined the In/Out of Money Around Price (IOMAP) indicator. Here the IOMAP classifies addresses based on those that make money and those that don’t.

This statistic can be used to see if a coin has done that strong support or resistance to a certain price. Normally, the larger the cluster of addresses in a price range, the stronger the support or resistance.

According to IntoTheBlock, 1.11 million addresses purchased a total of 623,720 BTC between $55,825 and 57,493. These addresses are profitable.

On the other hand, 701,630 addresses bought 279,210 BTC between $57,565 and $59,233. Since there was a larger number of addresses at the lower levels, they can provide support for Bitcoin.

Source: IntoTheBlock

Will buying now yield returns?

If this is the case, Bitcoin price could potentially break the USD 59,233 resistance. If this is the case, the value of the coin could rise above $60,000 in the short term.

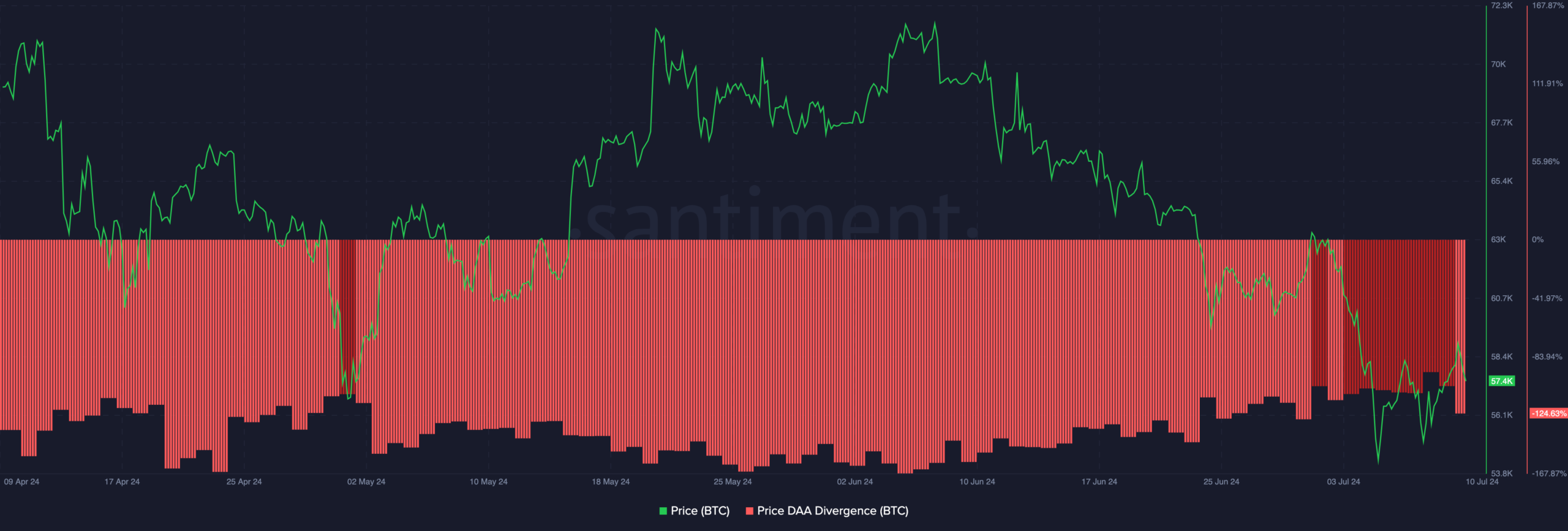

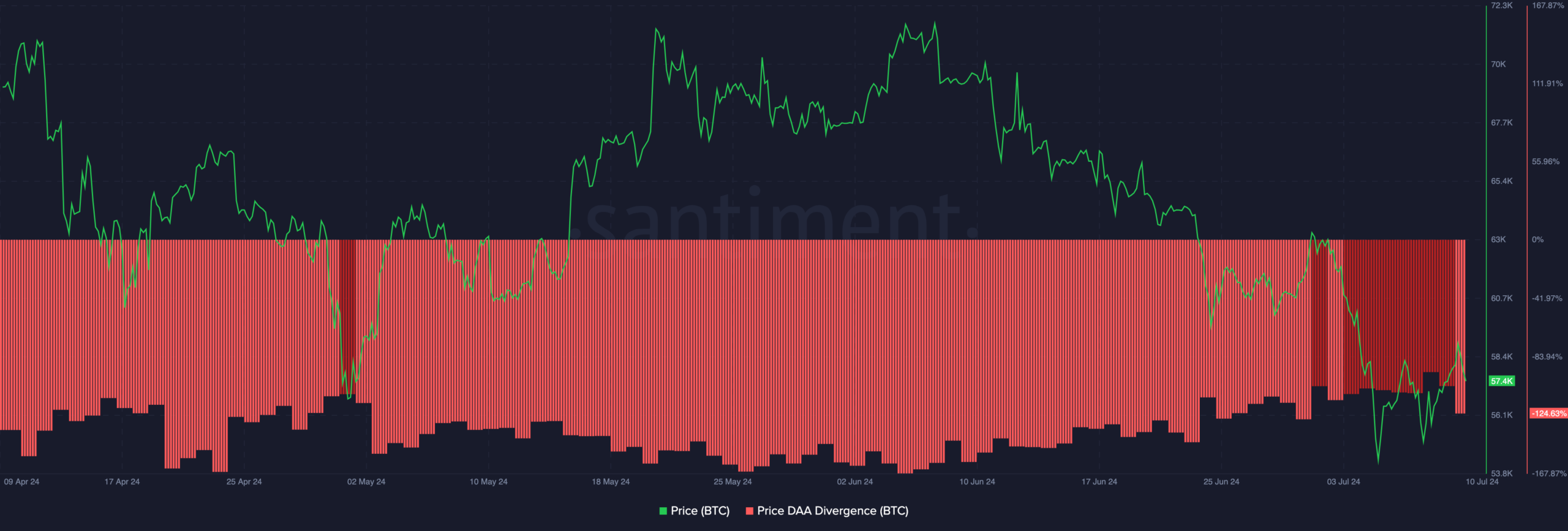

AMBCrypto also analyzed the price-DAA divergence. DAA is an acronym for Daily Active Addresses. Therefore, the indicator measures price changes and participation rates to generate buy and sell signals.

If the price rises as much as the DAA, it means that the value of Bitcoin has risen and may continue to rise. At the time of writing, the difference was negative, indicating a price drop accompanied due to a decrease in network activity.

Source: Santiment

If this remains the same, it could be challenging for BTC to sustain a price increase. However, if activity on the network starts to increase, BTC could register a slow rise on the charts, crossing $60,000 in the process.

Read Bitcoin’s [BTC] Price forecast 2024-2025

On the contrary, this prediction could be debunked if selling pressure continues. For example, Germany, which has been at the forefront of Bitcoin distribution lately, still holds about $1 billion. If it decides to distribute these coins, the crypto could fall back below $58,000.