- Analysts predict a price increase of 200% for Ethereum based on historical graph patterns and cycles.

- Liquidity flows back to Ethereum, reinforcement and positioning for a potential rally.

Despite Ethereum’s [ETH] Relatively muted performance Recently analysts point to signs that a big price increase could be imminent.

With technical indicators and market behavior that coordinate in a way that precedes significant rallies, some experts predict a potential increase in value of 200%.

If we start in February – often a strong month for ETH – many wonder if this marks the start of the next big rally for the coin.

Ethereum: Potential for 200% increase

The recent graph patterns of ETH have inflamed speculation among analysts about a potential rally. If the ETH/BTC pair observes, experts note parallels with the explosive run of 2021, which yielded a profit of 180% in just two months.

Source: X

The data suggests that Ethereum may be ready for another similar Golf, where the current cycle resembles historical accumulation zones followed by Breakout rallies.

A potential 200% rally Is not excluded, especially since ETH is approaching the four-year cycle pivot, which has highly marked the start of important upward trends.

The four -year cycle

Ethereum has shown remarkable cyclical patterns, especially in 2017 and 2021, where it has experienced considerable price increases.

In 2017, the ETH price rose by around 9,380%, which reached around $ 881.94 towards the end of the year.

Similarly, the market capitalization of ETH surpassed $ 250 billion for the first time in 2021, which indicates considerable growth.

These historical trends suggest a pattern of significant growth approximately every four years.

As we approach the next cycle, consider analysts or ETH is ready for another substantial rally, possibly validating predictions with an increase of 200%.

Liquidity flows back to Ethereum

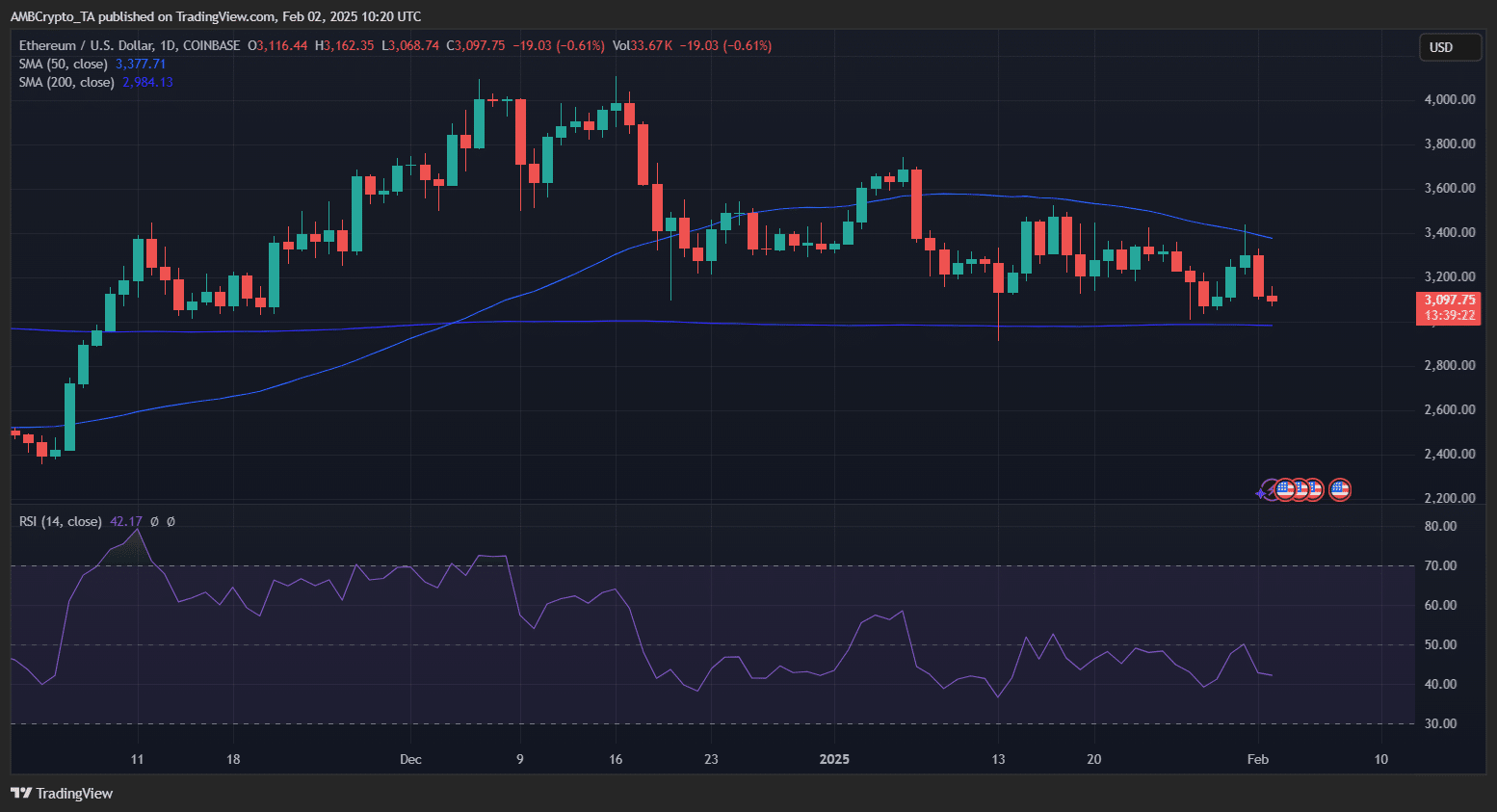

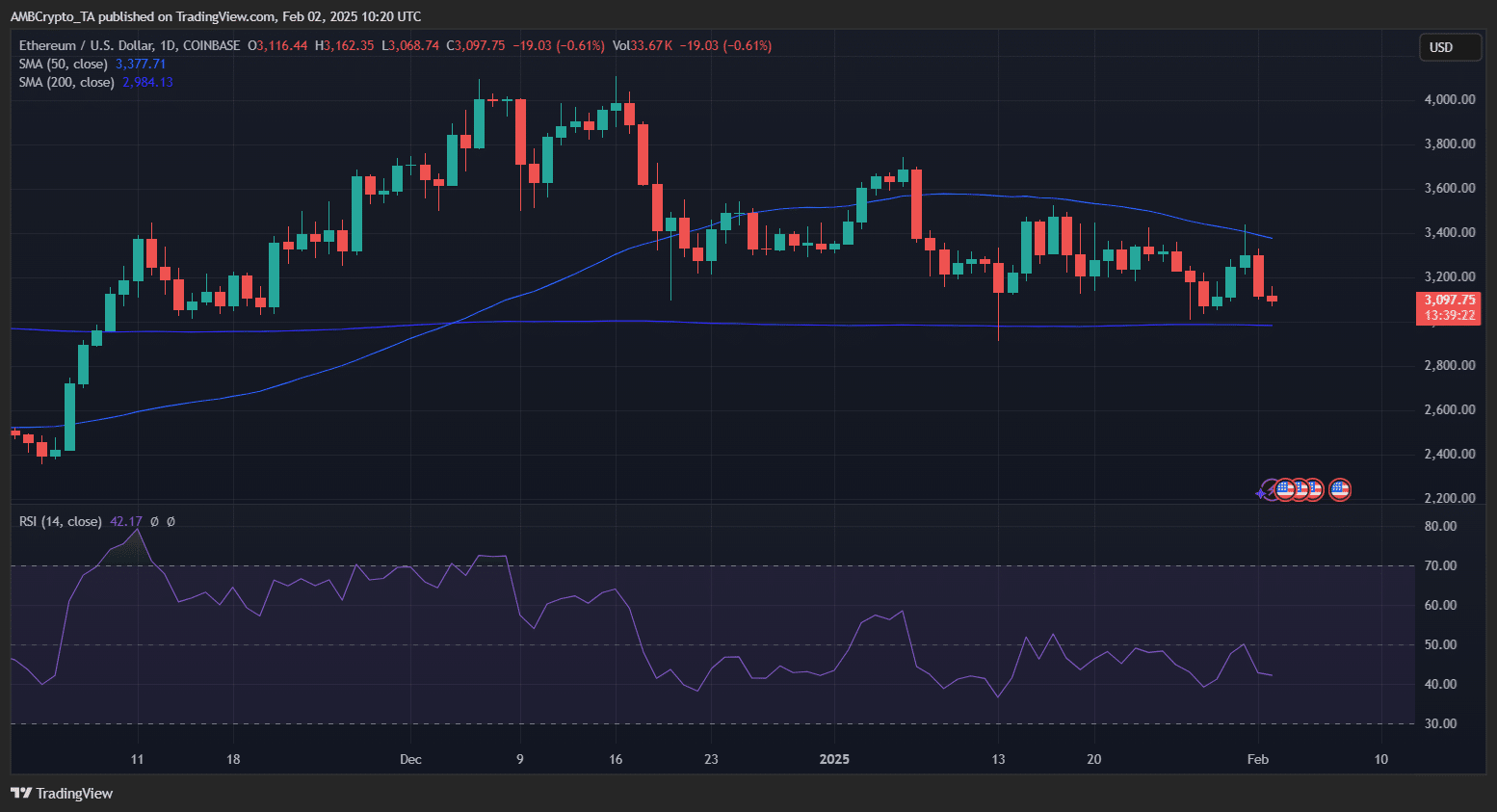

Source: TradingView

The short -term price promotion of Ethereum showed a struggle to maintain levels above $ 3,100, with RSI near the over -sold area on 42.17, which indicates potential accumulation.

The 50-day SMA remained above the 200-day SMA and signaled remaining bullish momentum but the gap is narrowing.

Ethereum held his critical support near $ 2,984, a decisive level that could dictate the next step.

Source: X

Read Ethereum’s [ETH] Price forecast 2025-26

In the meantime, liquidity trends prefer Ethereum if Capital flows back from Solana. In the last 24 hours, Solana has bridged 4x more capital for Ethereum than vice versa, which signals renewed investor confidence in ETH.

This inflow of liquidity could serve as a headwind, in support of the defense of Ethereum of the current levels, while it is placed for a potential rebound.