- A PEPE whale took a +$3 million hit after a sell-off of 330 billion tokens

- PEPE remained below the neutral line of its RSI at the time of writing

The big move by a PEPE whale has sparked curiosity and prompted a closer look at the memecoin’s on-chain data. An analysis of these on-chain metrics can give us insight into the true trend of the market and the prevailing sentiment among holders and traders. Including the whale in question.

What did the whale do?

Recent data from Look at chain revealed that a PEPE whale made a major move less than 24 hours ago. The whale deposited 330 billion tokens, worth approximately $2.53 million, into Kraken. This deposit usually suggests an intention to sell. In most cases, such a large transaction is likely to be profitable. In this case, however, the data suggested the whale might be sold at a loss: more than $3 million.

The whale’s recent trading activity provides context for this decision. Earlier this month, the whale had taken advantage of market swings by selling high and buying low. However, despite these past gains, the current holdings have not been profitable, leading to the decision to sell some of the tokens. Possibly to prevent further losses.

Interestingly, even after this major sale, the whale still owns approximately 1 trillion PEPE tokens, worth over $7 million. This means that even though the whale is offsetting losses on a number of companies, it still has a significant position in PEPE. This may be because the whale is anticipating a future recovery or price increase.

Data on the chain points to huge sales

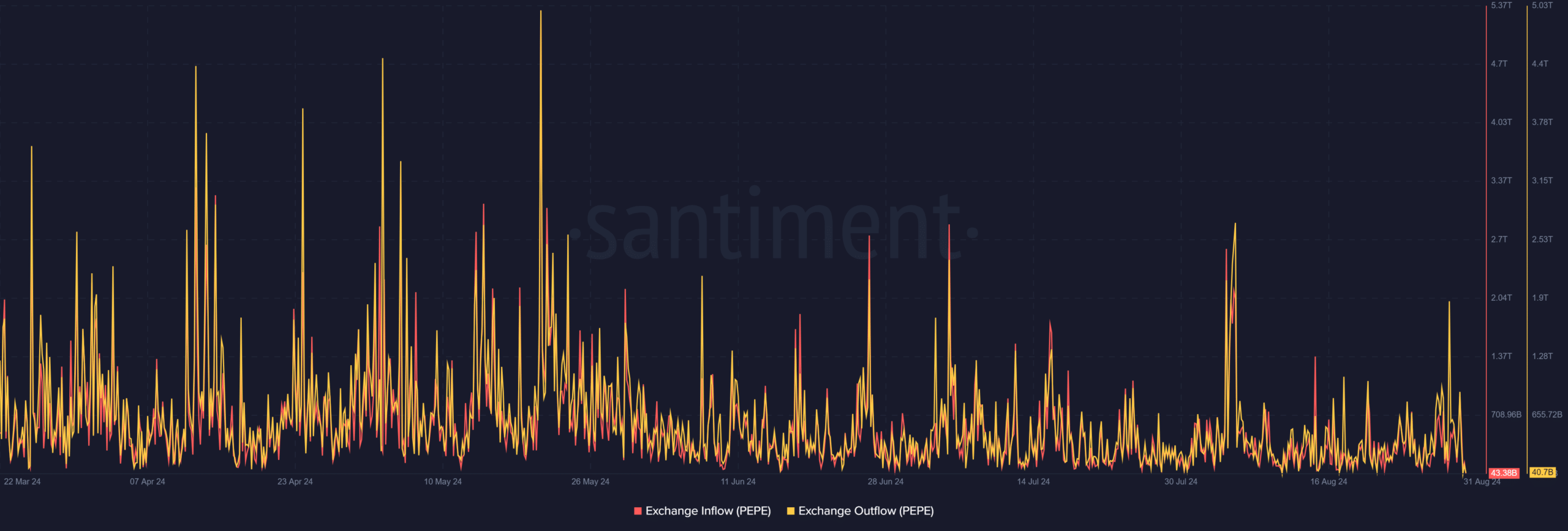

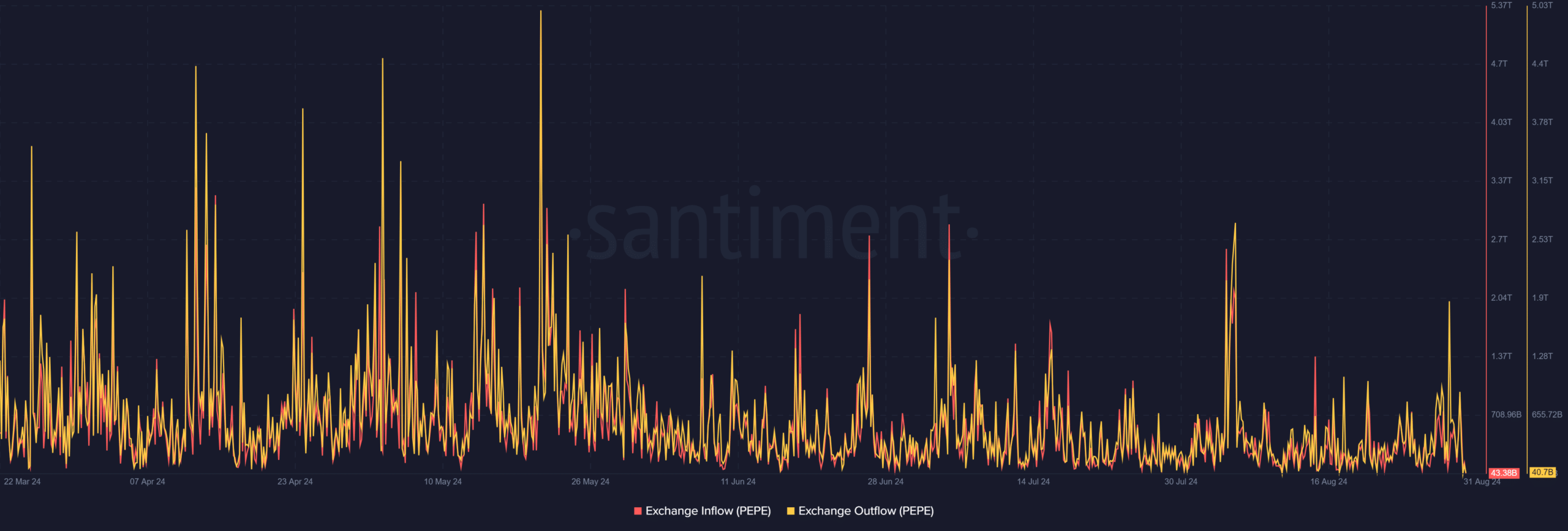

An analysis of PEPE’s data on currency inflows and outflows on Santiment revealed a significant difference between the two metrics.

Inflows refer to the deposits of PEPE tokens on exchanges, which is usually a signal of a potential intention to sell. At the same time, outflows represent tokens being withdrawn from exchanges, typically indicating accumulation or ownership.

Source: TradingView

At the end of trading on August 30, data showed inflows exceeding 76 billion PEPE tokens. On the contrary, the outflow amounted to approximately 23 billion tokens.

This disparity suggested that significantly more tokens were deposited on exchanges than withdrawn, implying increased selling pressure during that trading session.

The large influx figure is consistent with the previous report of a significant whale deposition, indicating that the movement of this whale was not an isolated incident. Instead, multiple holders have attempted to sell their tokens, which has contributed to the overall increase in inflows.

The bear trend continues…

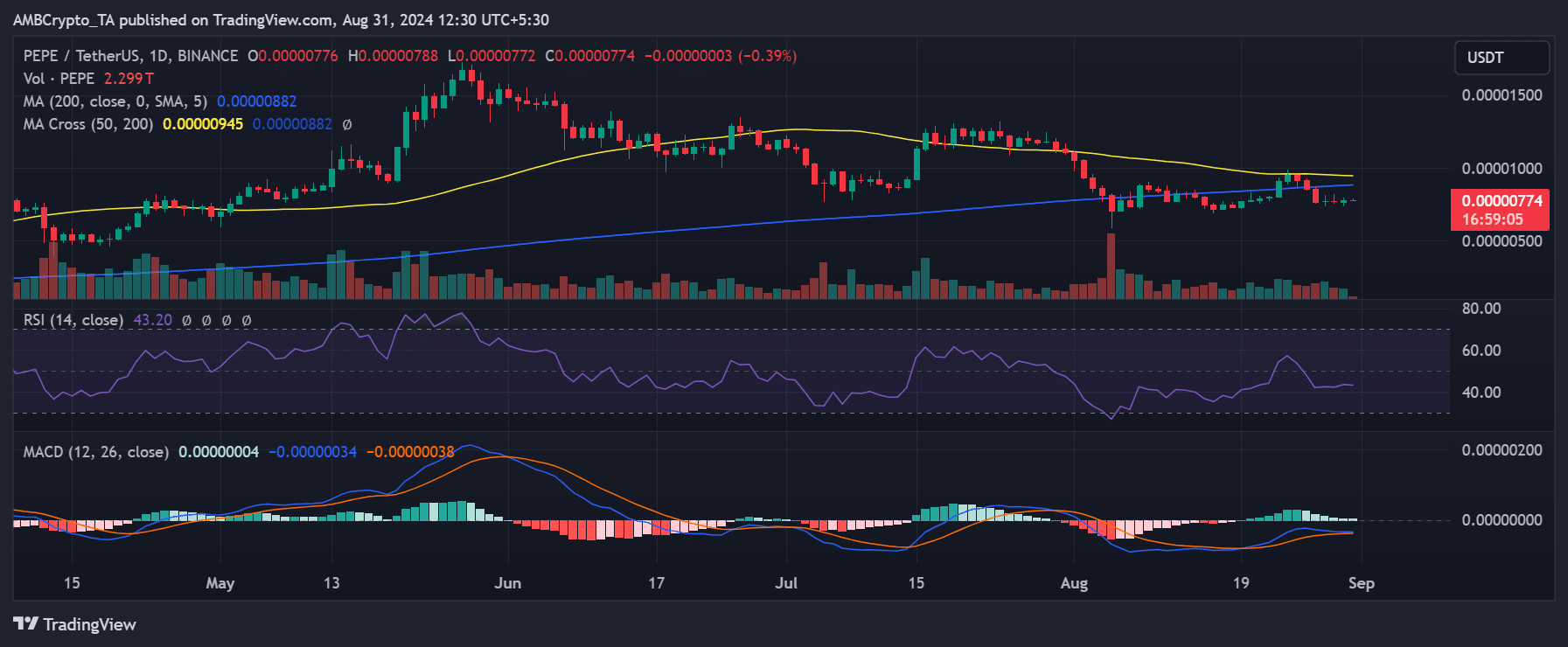

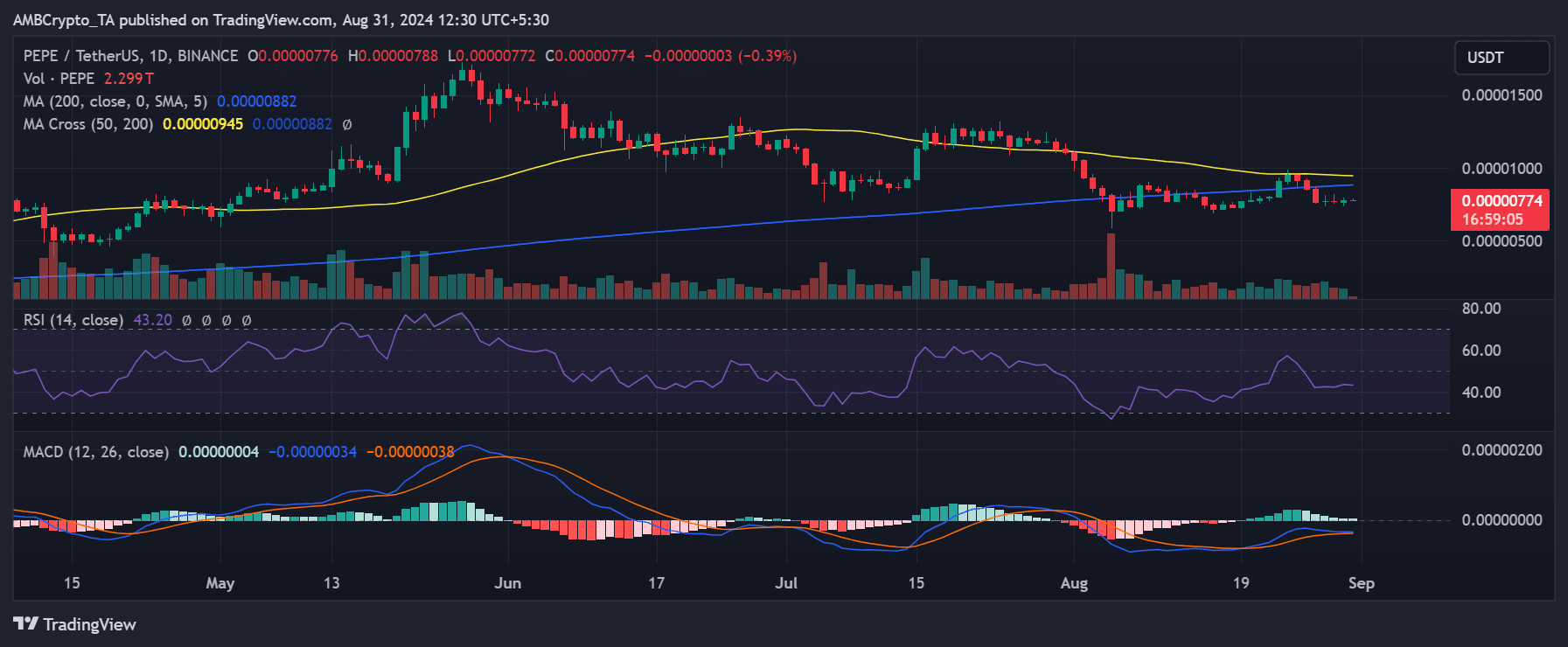

An analysis of PEPE on the daily time frame indicated that it ended the last trading session with a modest gain of 1.57%. However, larger profits would be needed to counter the selling pressure, especially from the whale addresses analyzed.

Source: TradingView

Further analysis revealed a largely bearish market. The memecoin recorded a short bull trend that lasted only three days during the month. This bearish momentum was reflected in the Relative Strength Index (RSI), which stood around 40 at the time of writing.

The position suggested that the token may be in weak or bearish territory, although it is not yet oversold.

– Is your portfolio green? View the PEPE profit calculator

At the time of writing, PEPE was trading at around $0.00000773, after a slight decline of 0.3%.