A crypto strategist who accurately called Bitcoin’s correction from before this year’s halving believes that BTC is undergoing a technically sound breakout process.

Pseudonymous analyst Rekt Capital tells his 507,000 followers on the social media platform

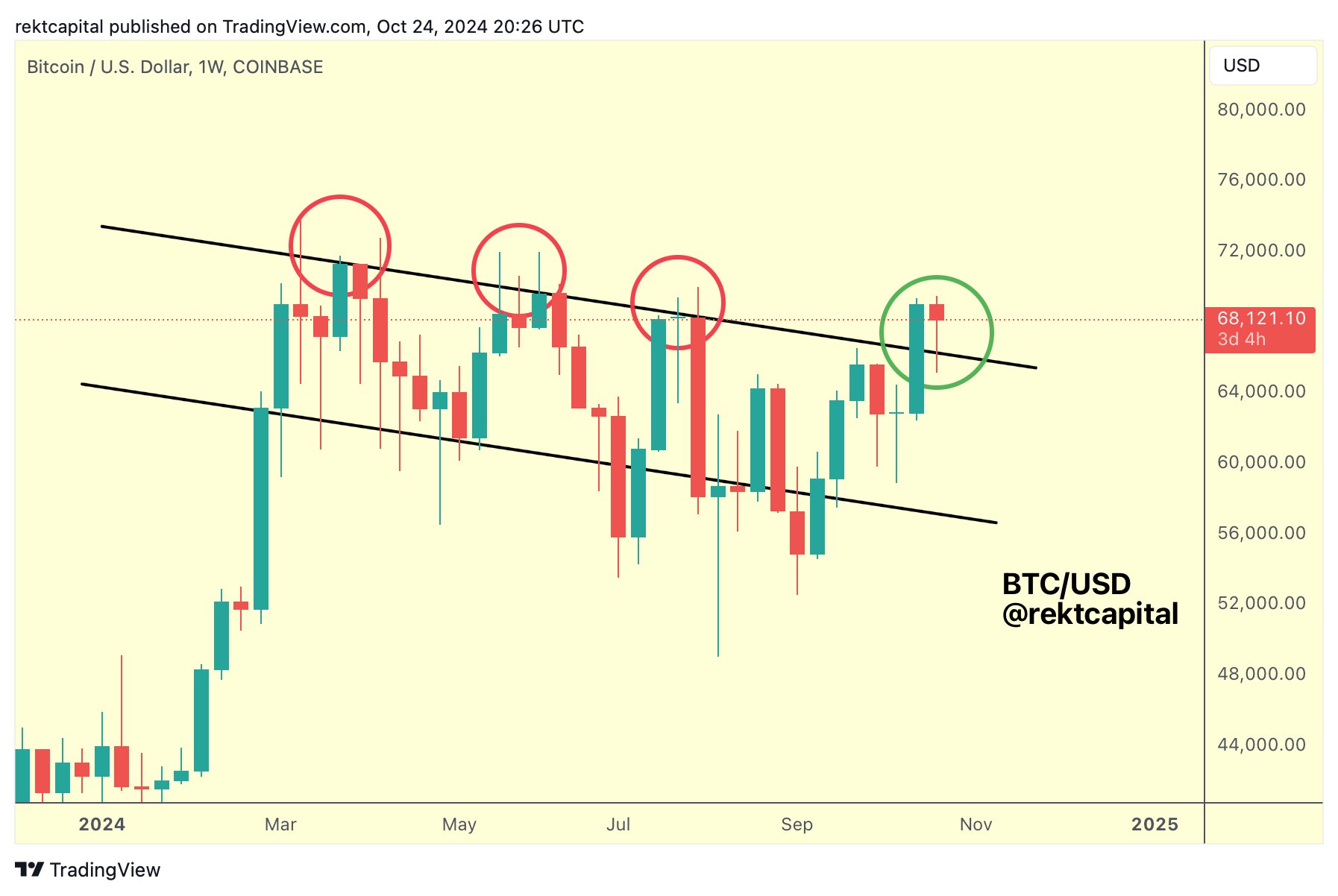

“The old downtrend is now acting as support.

It seems like a textbook confirmation after the outbreak.”

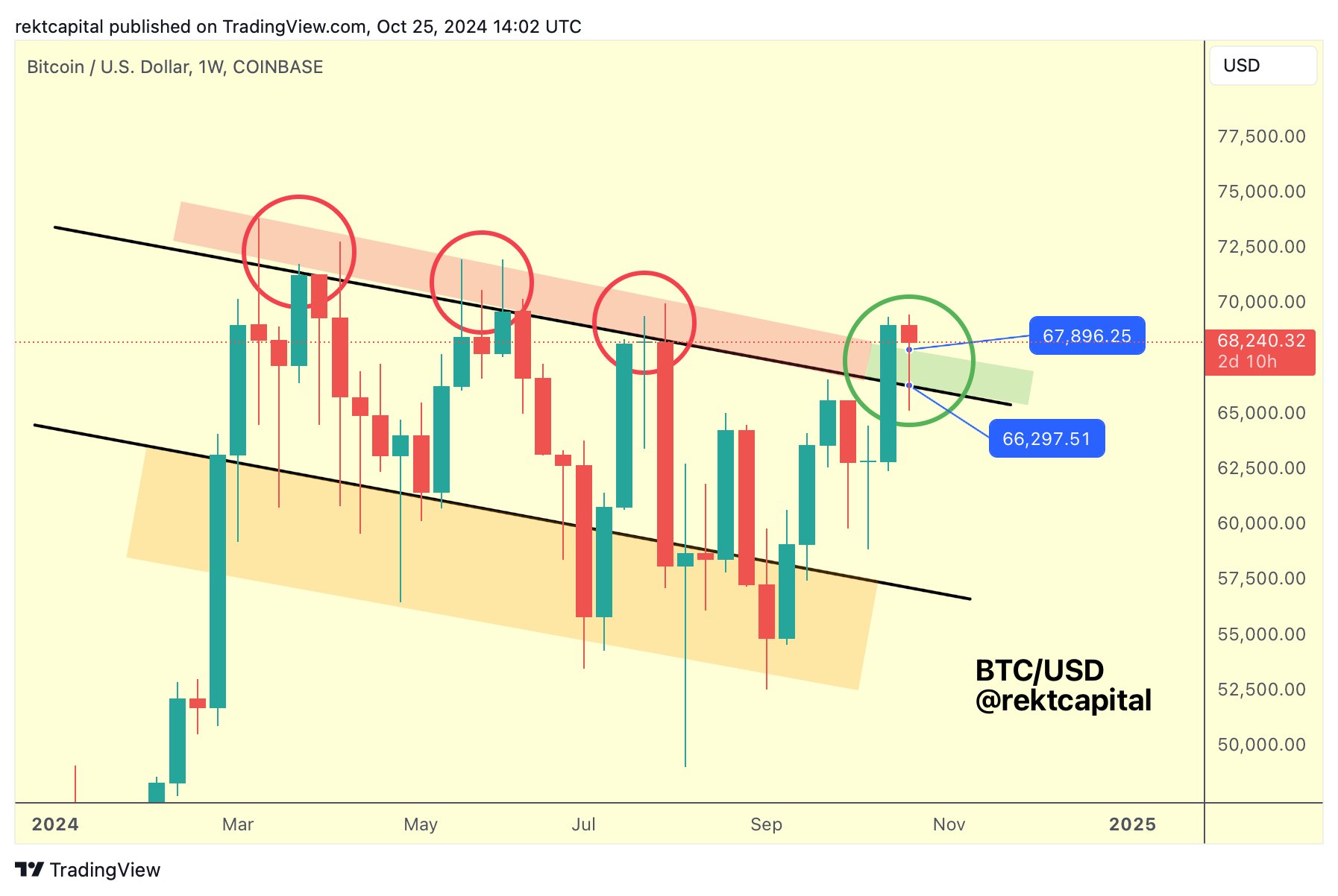

The analyst says Bitcoin needs to end the current week above two crucial levels to strengthen the breakout.

“A bullish weekly close would be above ~$66,300 (top of the black channel).

A very bullish weekly close would be above ~$67,900 (green box top).

At the time of writing, Bitcoin is trading at $66,989.

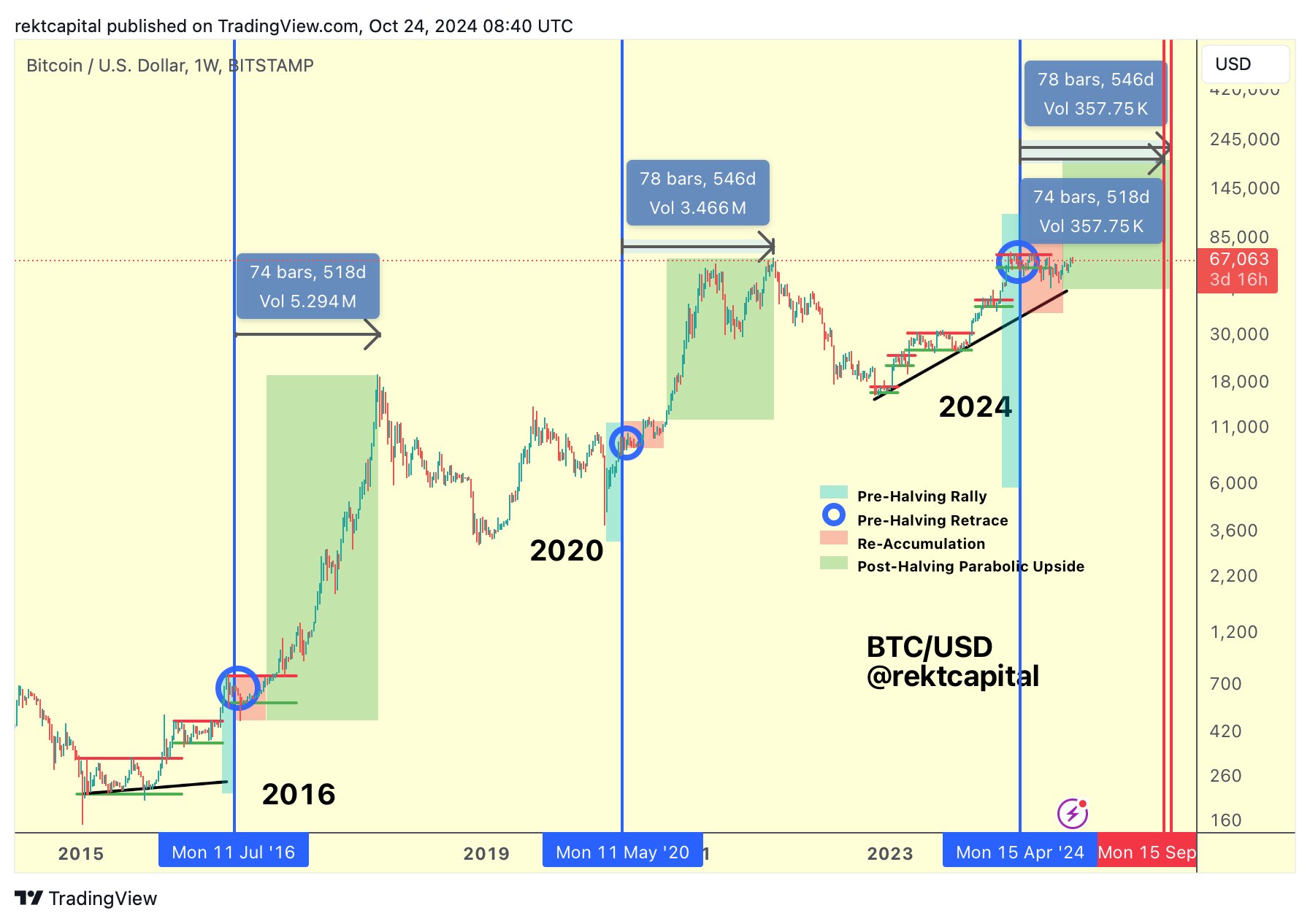

Zooming out, Rekt Capital highlights that Bitcoin’s halving cycle is still on schedule, despite BTC’s long consolidation period.

He looks based on historical data and notes that BTC is currently well over a month ahead of other halving cycles.

“In the 2015-2017 cycle, Bitcoin peaked 518 days after the halving.

In the 2019-2021 cycle, Bitcoin peaked 546 days after the halving.

If history repeats itself and the next bull market peak occurs 518-546 days after the halving, that would mean that Bitcoin could peak in this cycle in mid-September or mid-October 2025.

Currently, Bitcoin is still accelerating in this cycle by about 35 days.

So the longer Bitcoin consolidates after the halving, the better it will be to re-sync this current cycle with the traditional halving cycle.”

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

Follow us further X, Facebook And Telegram

Surf to the Daily Hodl mix

Generated image: Midjourney