- Terra Luna Classic posted strong gains on Saturday and managed to turn the structure bullish.

- A price drop seemed imminent due to rising bearish sentiment and the build-up of long-term liquidations.

Terra Luna Classic [LUNC] prices rose 23.3% from the start of the day to the end of the day on Saturday, August 10. This move occurred amid a spike in trading volume, and the range highs seemed to be the next target.

Still, Bitcoin’s short-term trend [BTC] in addition to the build-up of long liquidation levels suggested that LUNC could see some losses and volatility soon.

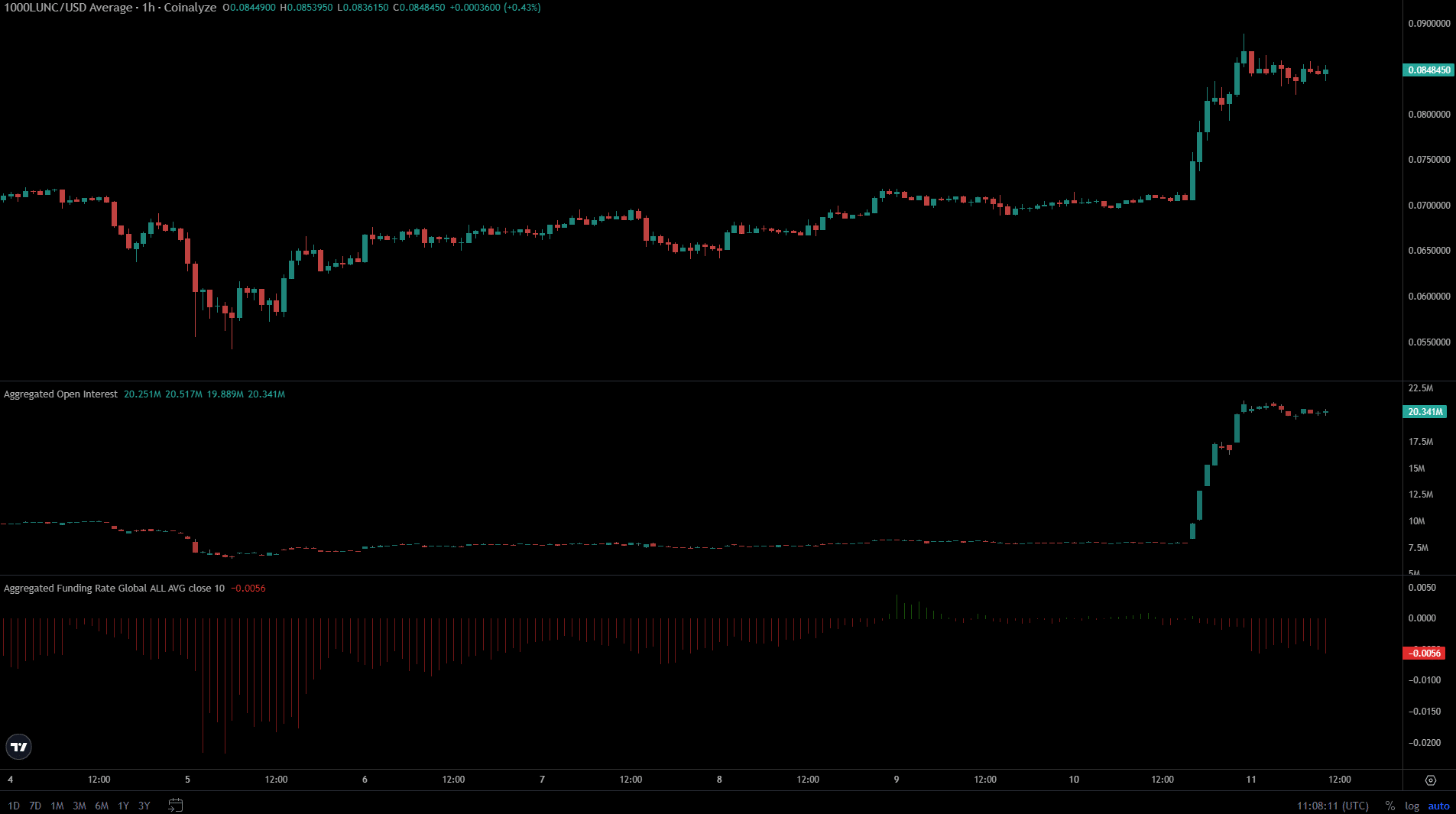

Open Interest increases as prices cross the mid-range

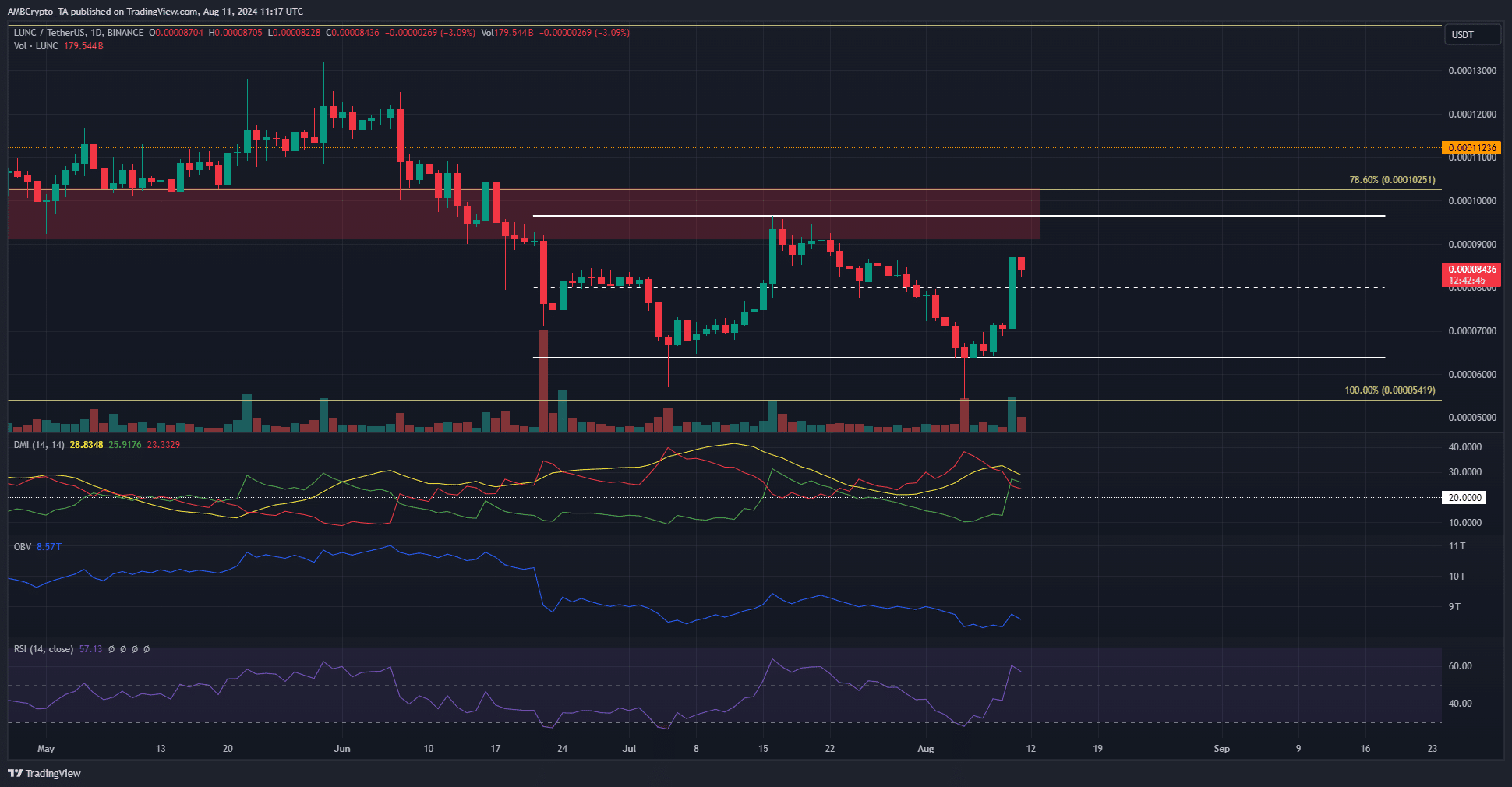

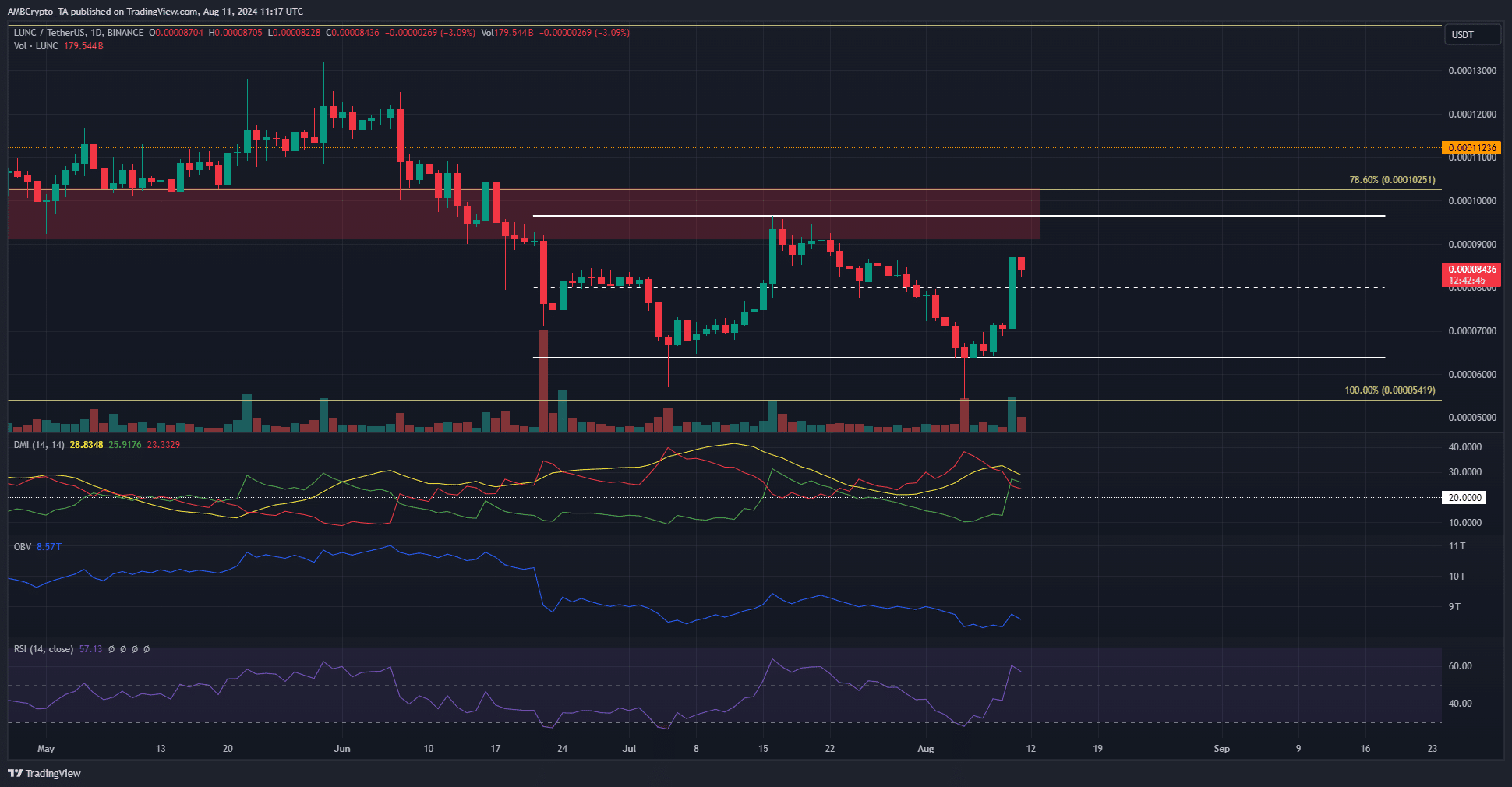

Source: LUNC/USDT on TradingView

In the one-day time frame, LUNC managed to reverse a bullish structure after moving past $0.000087 the previous day. The recovery from the lows also caused the RSI to jump above the neutral 50 level.

Yet the OBV has not experienced a significant increase. That requires consistent purchasing volume, and that wasn’t the case. The DMI reflected the confused trend of Terra Luna Classic, which is typical of a range formation.

Open Interest shot up from $8 million to $21.1 million, showing that speculators were eager to make some profits during LUNC’s rise. In recent hours, the OI has remained at a plateau and the funding rate has become more negative.

This indicated growing bearish sentiment.

Will Terra Luna Classic be able to test the range heights?

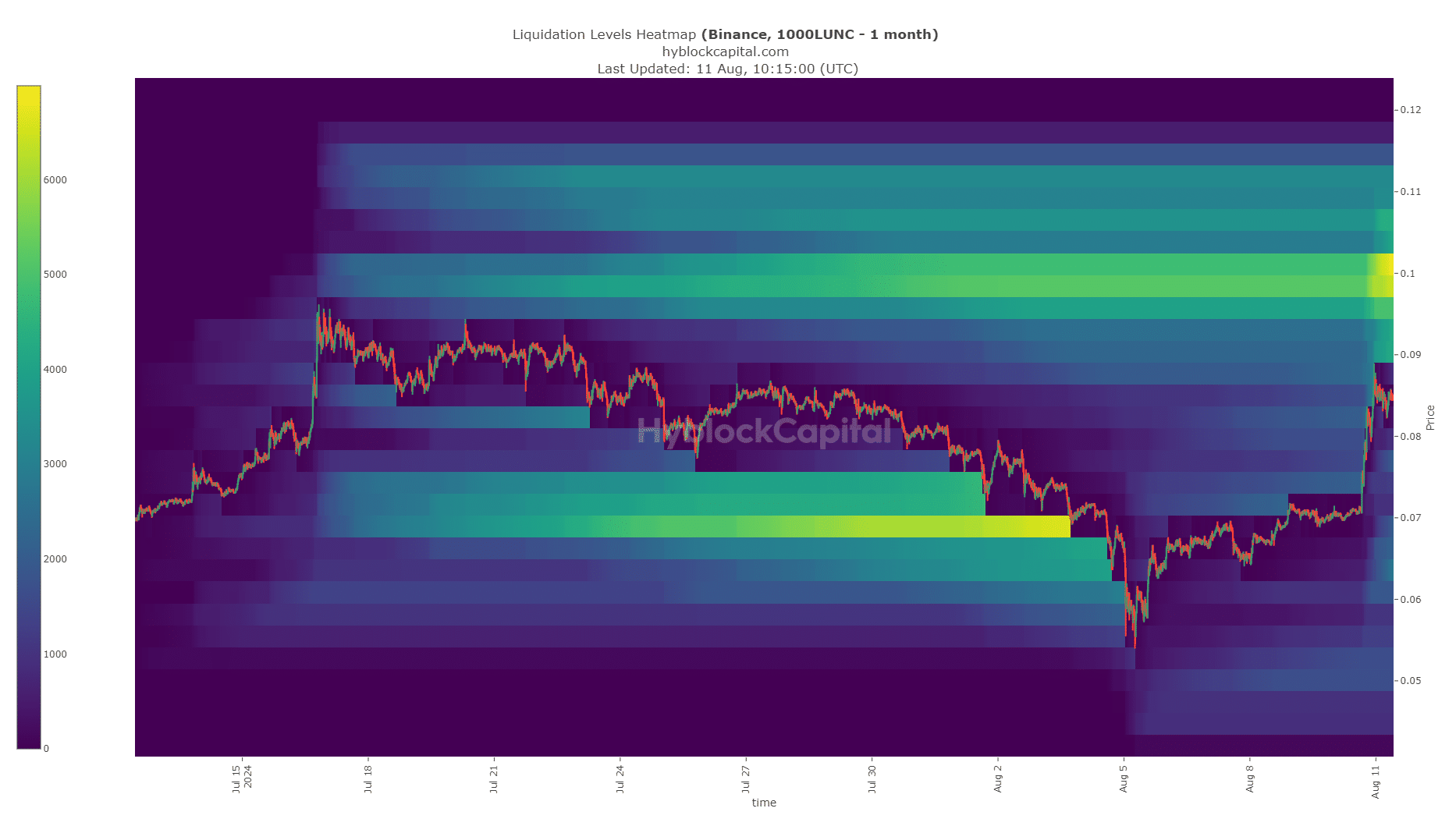

According to the liquidation heatmap, the answer is yes. There was a deep pocket of liquidity of $0.0001 that could be wiped out before a bearish reversal occurred. This matched the range highs in the technical chart.

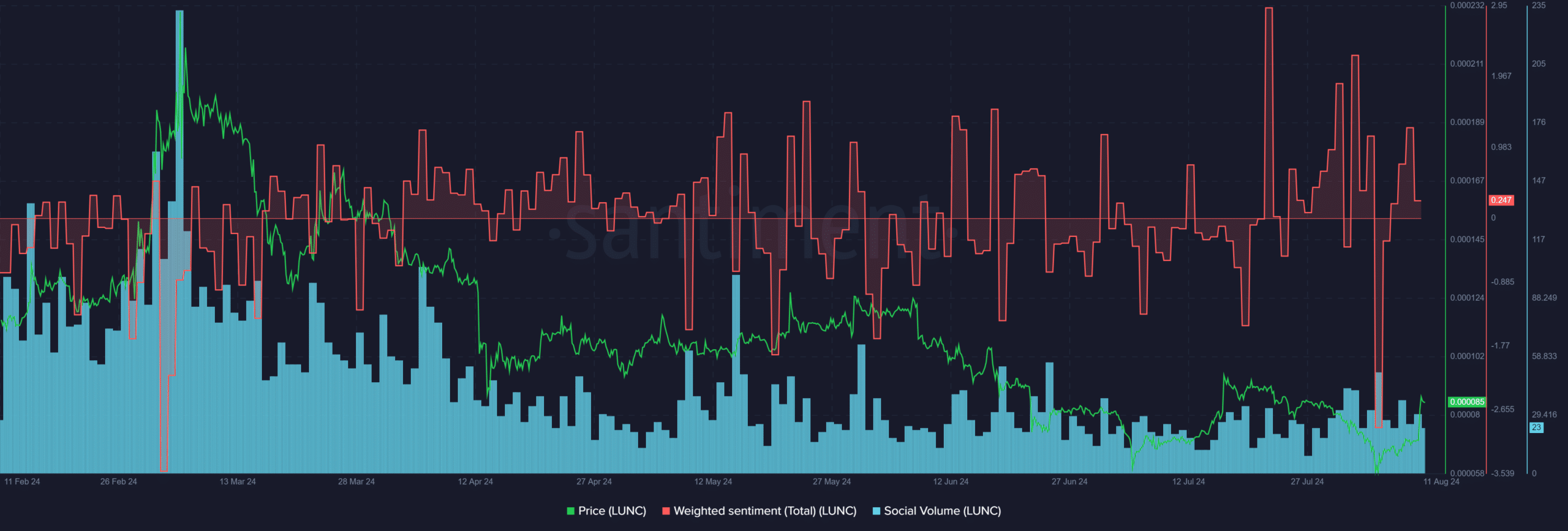

Weighted sentiment moved into positive territory again, showing that online engagement was bullish. Yet, despite the price increases, social volume did not grow noticeably.

This was an indication that LUNC lacked hype, which could hamper its bullish ambitions.

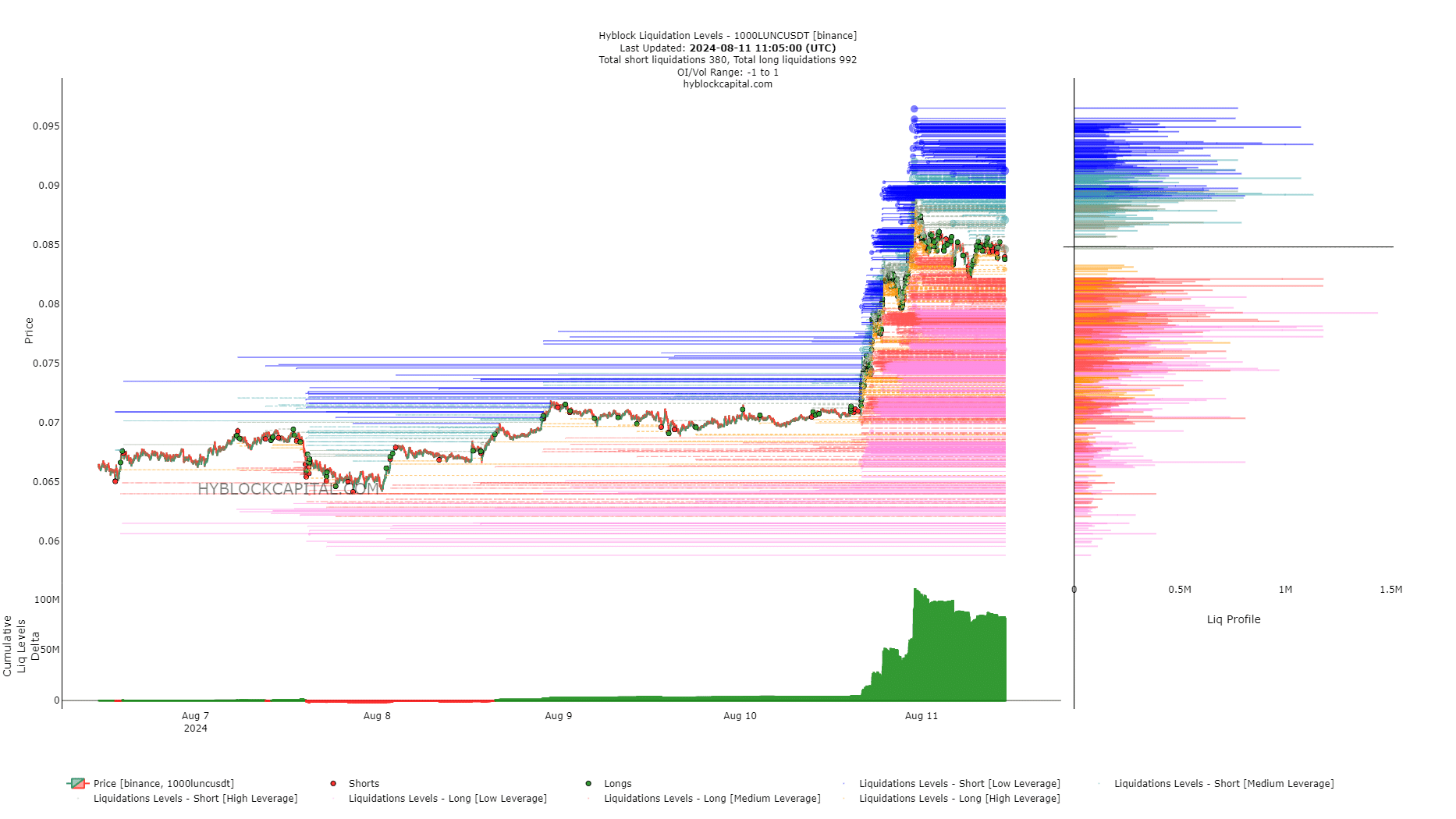

Another short-term hurdle was noted in the heatmap of liquidation levels. As a result of the price increase, the delta of liq levels was extremely positive.

Realistic or not, here is the market cap of LUNC in terms of BTC

This could, in turn, put pressure on long positions, forcing liquidations.

The $0.0008 level is a short-term target and is in line with the mid-range support level. Whether or not the bulls can sustain the rally after this support retest will depend on whether BTC can stay above the $60,000 mark.