- SUI rose +150% from the early August low.

- Network growth has slowed slightly in recent days.

Sui [SUI] has continued its recovery, up more than 150% since its early August low of $0.5. So far in September, the L1 Network is up 60% and reclaimed $1.2, a previous resistance in the second/third quarter, and this could signal another bullish next move.

According to crypto analyst Raoul Pal of Real Vision, that was even the case prepared for a huge rise on the price charts. The analyst cited SUI’s recent break above long-term trendline resistance and the SUI/SOL ratio.

In short, he suggested that SUI could print an explosive run higher than SOL.

SUI Price Forecast: Are More Recovery Gains Likely?

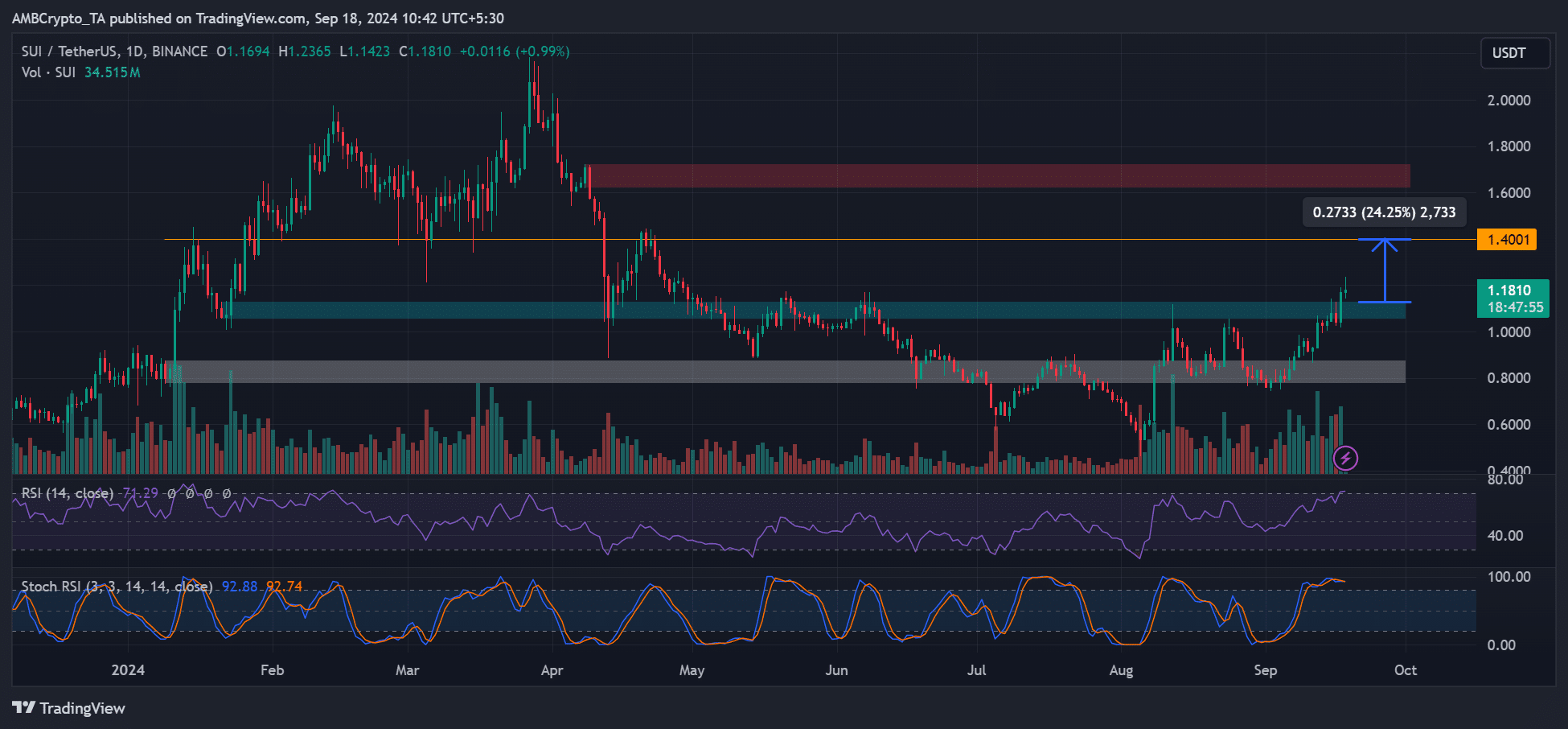

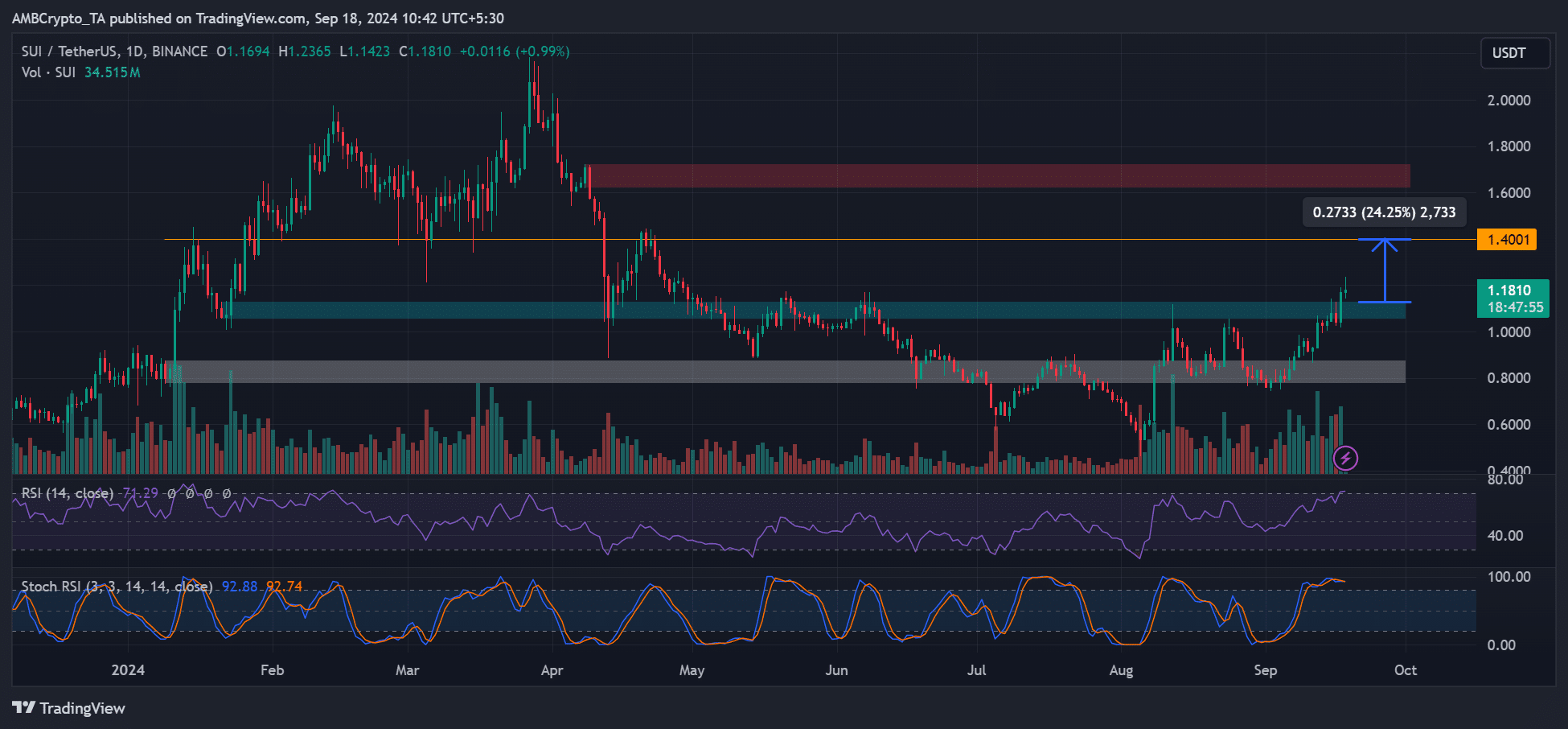

Source: SUI/USDT, TradingView

SUI struggled to stay above $1 during the market downturns in the second and third quarters. However, at the time of writing, it broke above $1 and was about to turn the $1.05 – $1.13 resistance zone (marked in cyan) into a support zone.

If so, the near-term bullish target of $1.4 could offer a potential upside of 24%. In addition to the bullish market structure, the technical chart indicators displayed bullish values.

However, the RSI and the stochastic RSI also pointed to an overbought situation in the run-up to the Fed’s interest rate decision. Thus, a price drop below $1 would negate the above short-term bullish outlook.

In such a case, the demand zone above $0.8 (highlighted in white) could be crucial to keep an eye on.

Sui’s network growth increased, but…

Source: Artemis

Despite the above bullish outlook, some on-chain metrics disagreed. For example, the recovery coincided with increased network growth, as evidenced by an increase in the number of daily active users (yellow).

Addresses spiked above 1.25 million when SUI rose above $1. This was also followed by a rise in DEX volume, indicating an increase in DeFi activity on the network. However, the number of active addresses has decreased over the past three days, which could slow the recovery.

Read Sui [SUI] Price prediction 2024-2025

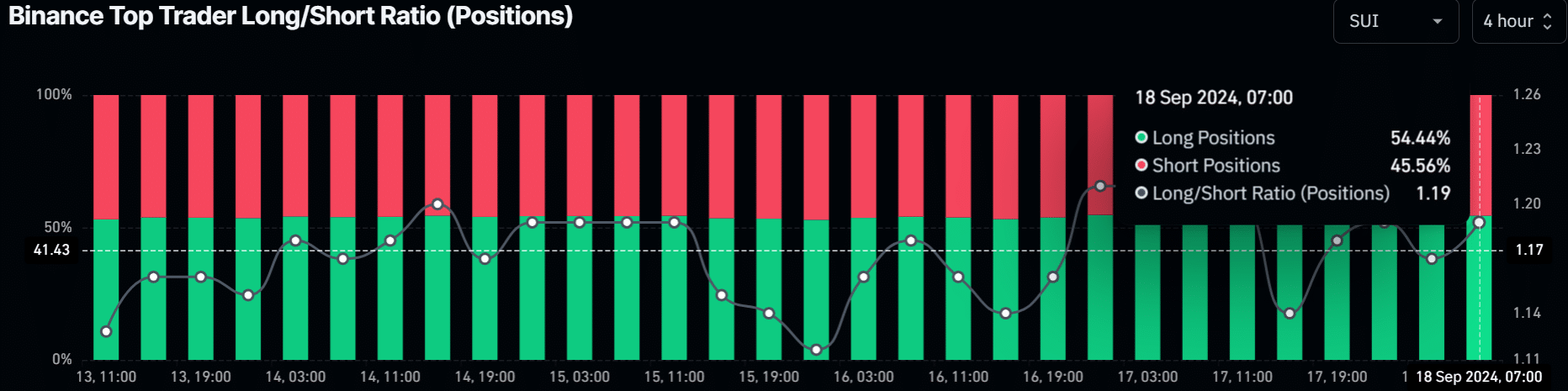

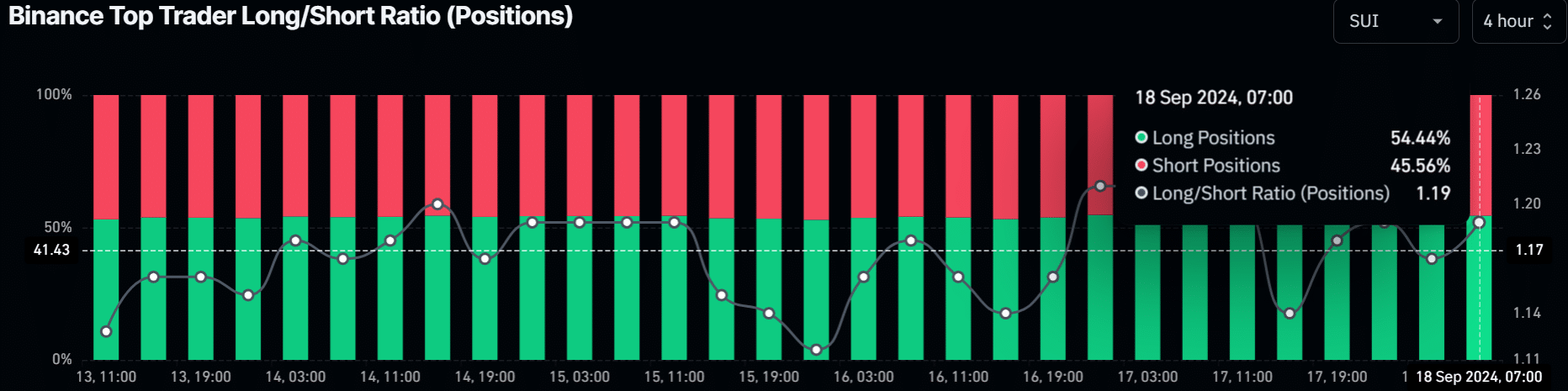

That said, some of the top smart traders on Binance were betting on further price increases for SUI. About 54% of this smart money category was in long positions. This meant upside potential for SUI.

Source: Coinglass

However, it is worth keeping an eye on macro updates and geopolitical factors that could impact SUI and the overall risk markets.