- Sui surpasses Ton in Stablecoin transfers and daily active address use on his platform.

- Sui approaches an important level of support, because traders buy orders on the market.

Sky [SUI] has lagged behind in the past month and dropped 35% with their price. However, the sales pressure in the past week has disappeared, because it actively lost a meager 3.42% of the market.

In the last 24 hours, the momentum has been deeply delayed, which indicates that Sui could go to a recovery, because the statistics start to show active participation of market traders. Here is how:

Sui surpasses Ton, a sign of growth

According to recent market data, Sui Ton has surpassed important market statistics, which demonstrates the involvement of market participants in the first and the likely preferred chain.

Currently, the Stablecoin transmission volume has surpassed SUI Ton and reached up to around $ 73 billion, while Ton remains $ 49 billion.

Such a significant difference means that users prefer sui and probably continue to use the chain, which can influence a rally.

Source: Artemis

To confirm active participation, Ambcrypto compared the daily active addresses on Sui and Ton.

At that time there was a considerable difference in active addresses, in which SUI reached 1.8 million, while Ton remained lower at 600,000 – almost a triple gap.

Historically, active participation, in particular with such high -quality transfers, confirms that bulls are on the market and that sui could benefit from the use of his network.

Support level to offer a rally katalyst

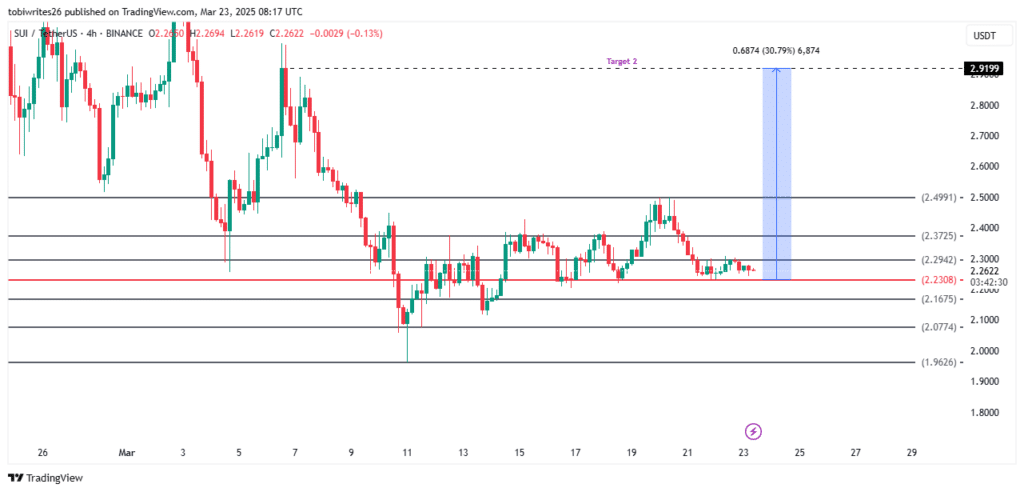

On the 4-hour graph, Sui shows potentially for a large rebound because it is approaching an important level of support at $ 2.23, characterized by the Fibonacci retraction line.

This level has been an interest in traders; The first two times that it was actively traded in this level, it saw a big prize.

Source: TradingView

With the current market momentum, if Sui acts again in this support zone, it could see a big rally, with the first goal at $ 2.50 and a continuous step up if the momentum persists.

Market participants place bets

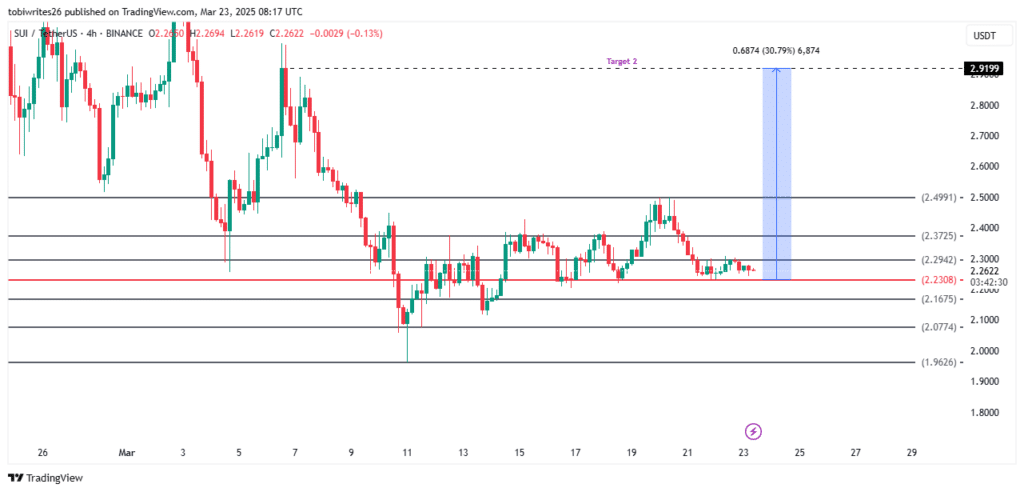

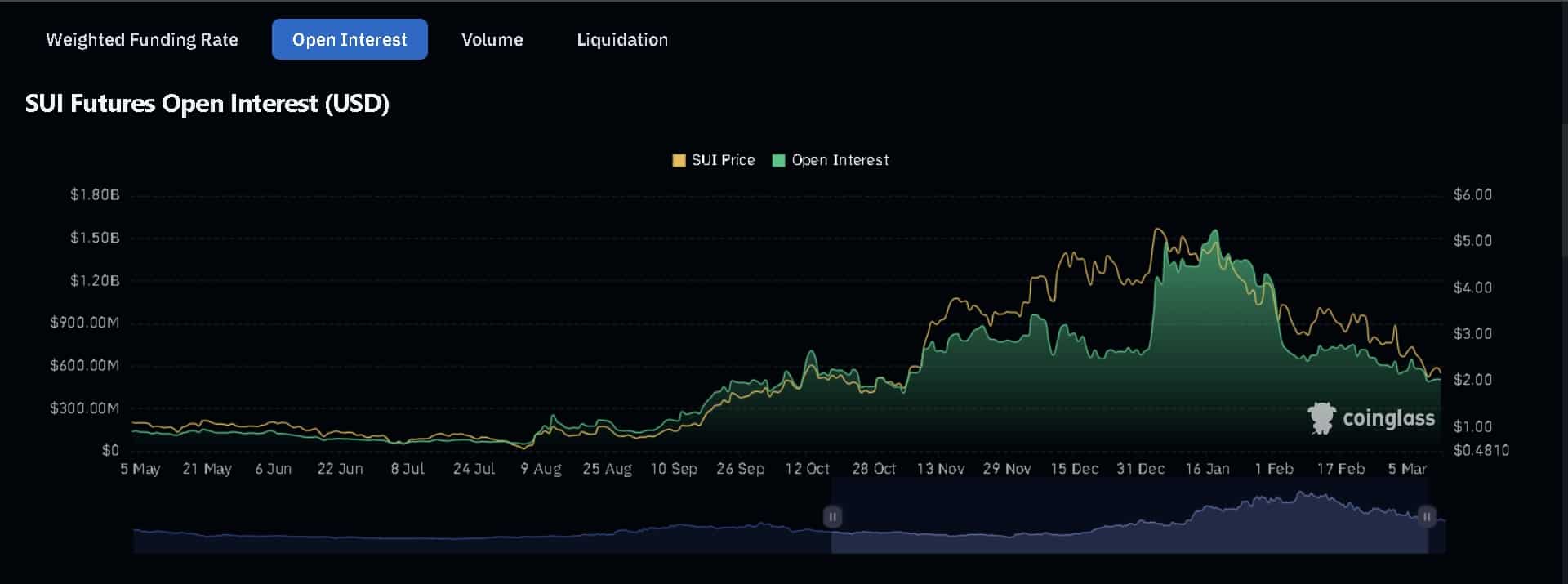

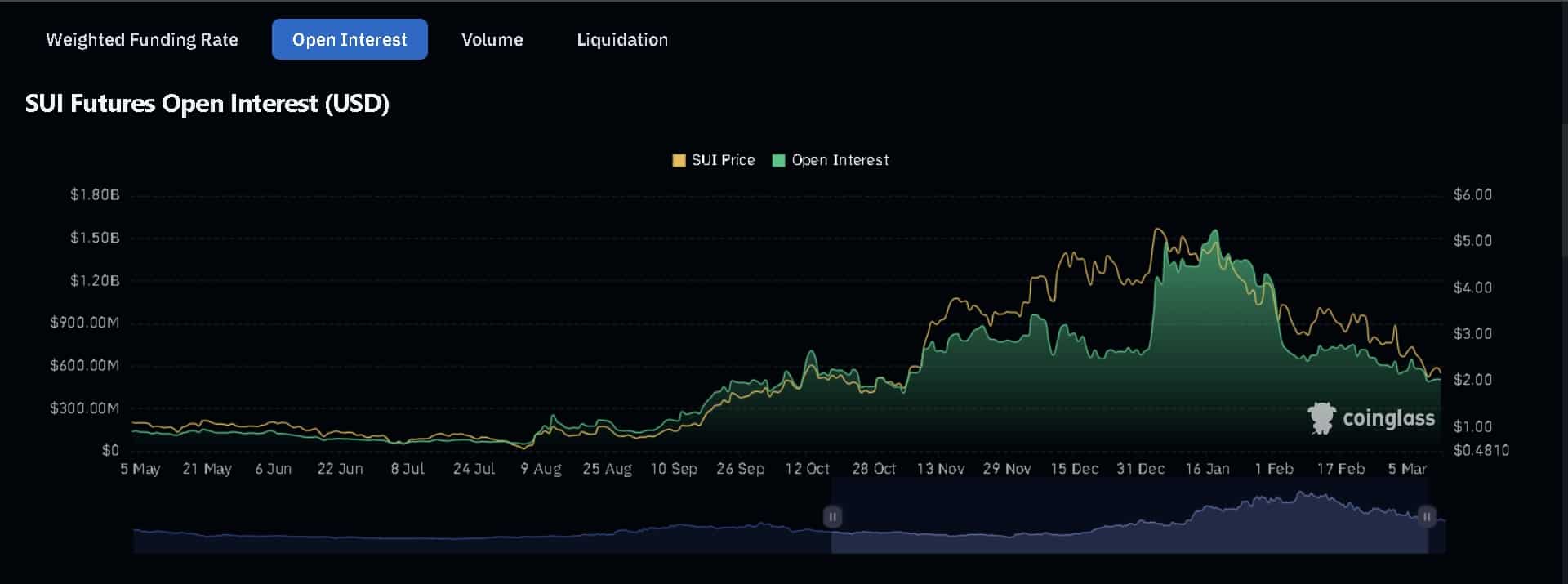

Traders started placing bets in the derivatives market. At the time of writing, the financing rate and the open interest rate low have become positive, which gradually suggests buying.

The financing percentage, which follows which market cohort – buyers or sellers – has control, shows that buyers have the lead because it reads 0.0007.

Low positive suggests in this context that buying activity has just started but remains minimal.

Source: Coinglass

Likewise, open interest has shown a similar movement. It has grown by 2.02%for the past 24 hours and reached up to $ 618.07 million.

If there is a gradual increase, together with a positive financing percentage, this means that there are more long contracts than shorts on the market, and SUI could tilt higher in favor of the buyers.