- SUI’s price break above $4.27 signified bullish momentum, supported by strong technical indicators.

- Social dominance and positive financing rates boosted optimism despite small price corrections.

Sui [SUI]’S The decentralized exchange ecosystem has made remarkable progress, with Total Value Locked (TVL) increasing from $1.51 billion to $1.87 billion since December 2. This significant growth underlines the strong network engagement and increasing adoption of DeFi offerings.

The coin was trading at $4.67 at the time of writing, down 1.65%. SUI’s trajectory begs the question: can it maintain its upward momentum and secure its place among the leading DeFi platforms?

SUI’s price action reflects major bullish signals

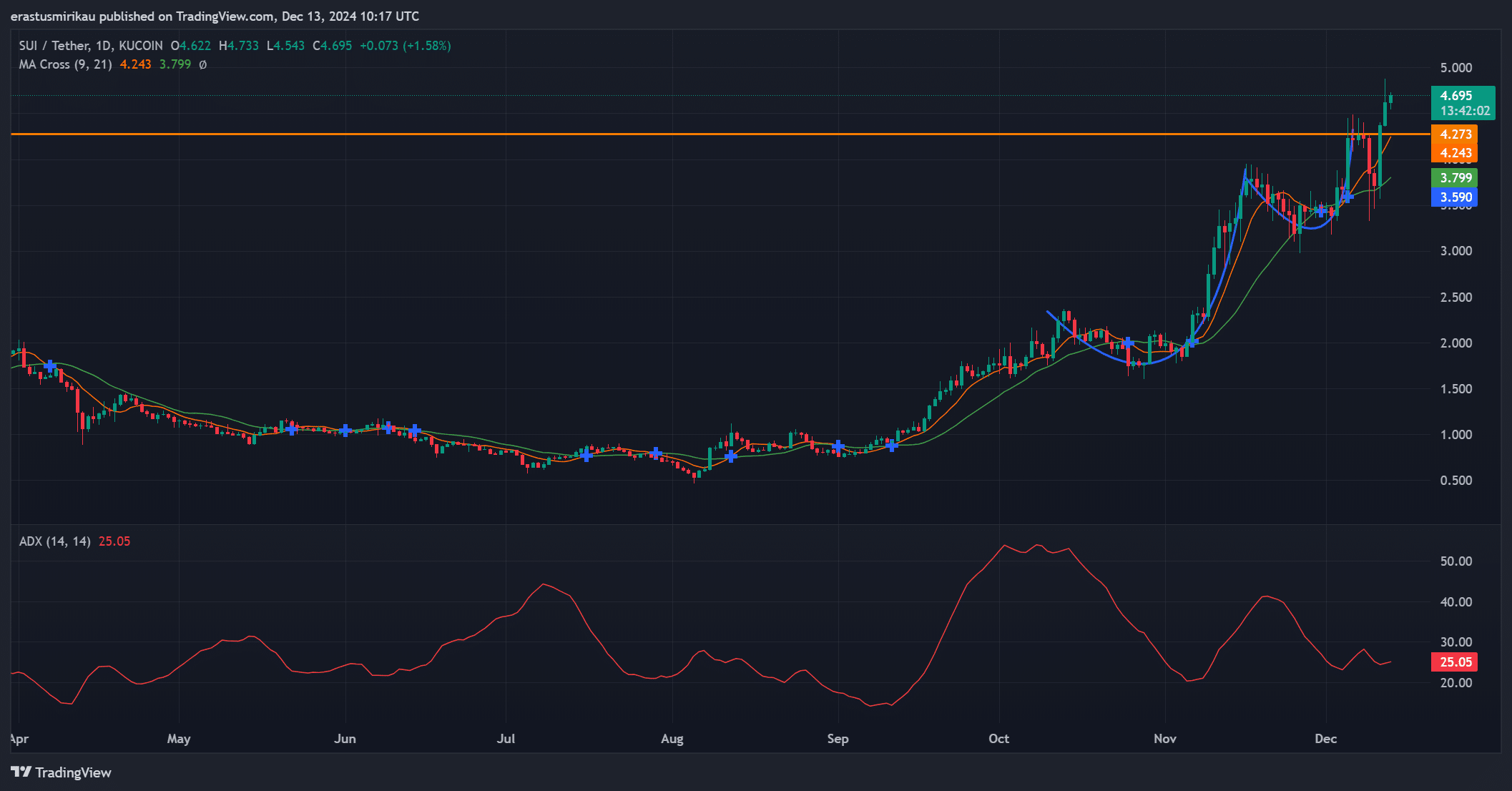

Sui’s price movement indicates a promising trend after recently breaking above the critical resistance level at $4.27. This breakout, coupled with a Moving Average (MA) crossover between the 9-day and 21-day lines, demonstrates strong bullish momentum.

However, the Average Directional Index (ADX) at 25.05 indicates moderate trend strength, indicating a potential for near-term consolidation.

Therefore, holding the support above $4.27 will be crucial to sustain this rally and build further upside momentum.

Source: TradingView

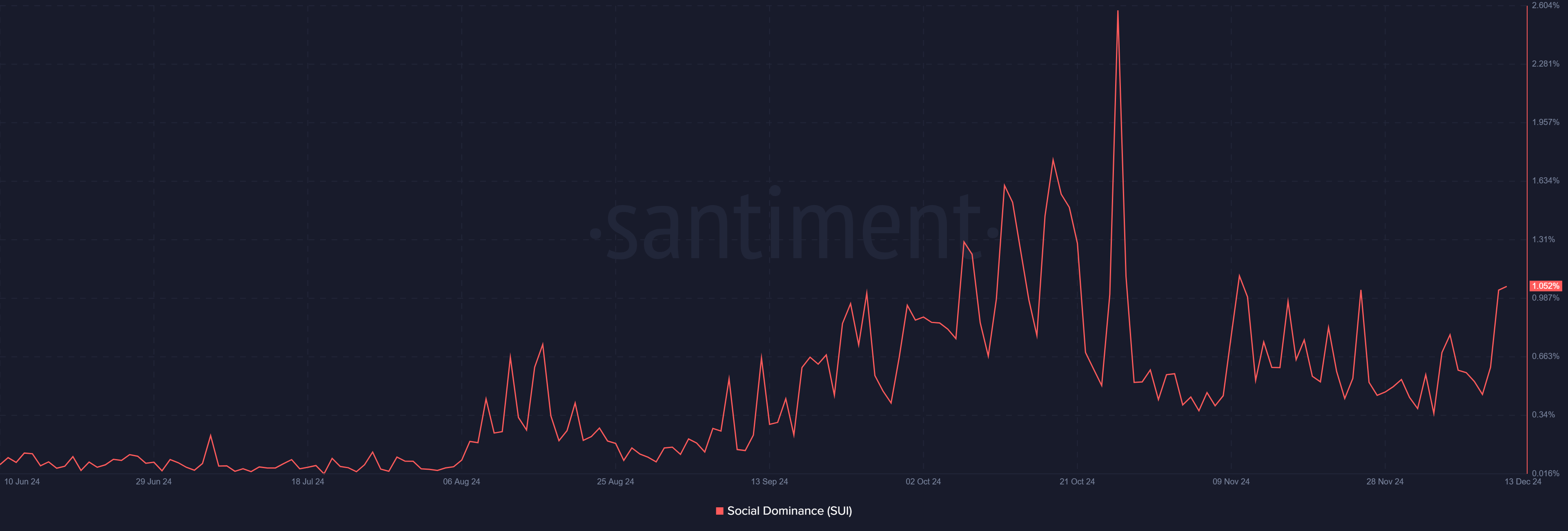

The social dominance underlines the growing interest

Furthermore, increasing social dominance reflects greater community involvement, with figures now above 1%. More mentions and discussions often translate into greater investor confidence, reinforcing positive sentiment in the market.

As such, Sui’s growing presence in social conversations will likely maintain interest and further drive adoption.

Source: Santiment

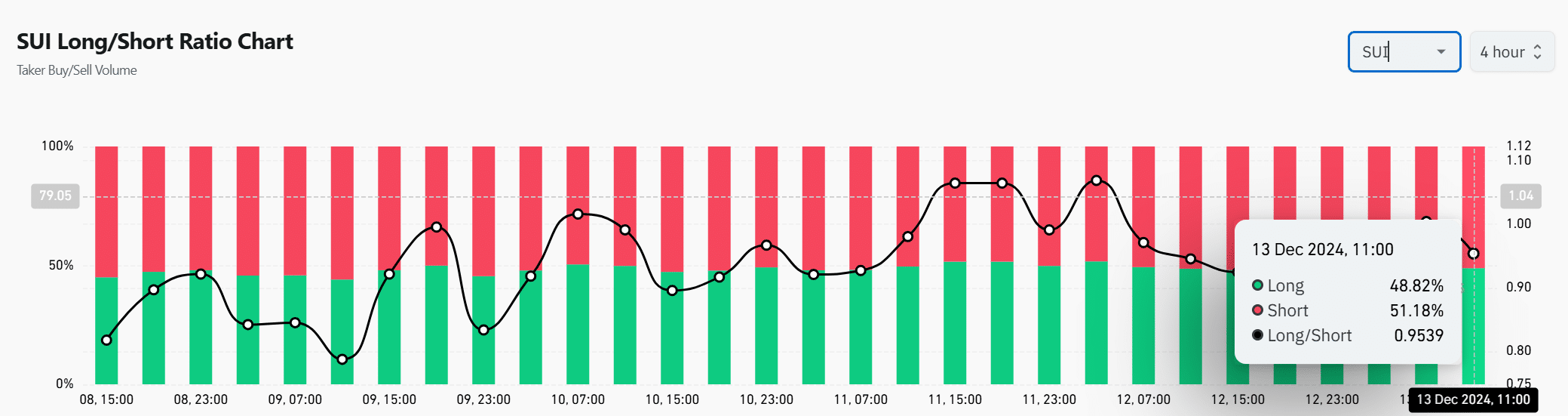

The Long/Short ratio indicates cautious optimism

The Long/Short ratio showed almost balanced sentiment: 51.18% of positions were shorts and 48.82% were longs.

This signals cautious optimism among traders, who are preparing for possible corrections while still recognizing the potential for further upside. Therefore, this equilibrium indicates both short-term opportunity and caution.

Source: Coinglass

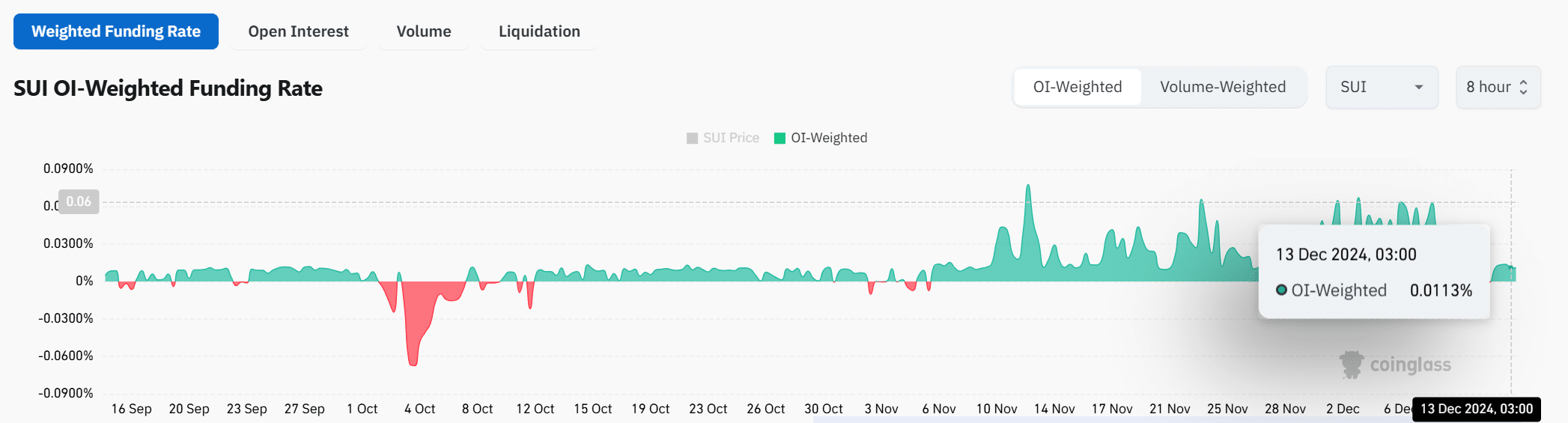

Positive funding rates reflect bullish sentiment

The Open Interest (OI)-weighted funding rate of 0.0113% highlighted market confidence as traders are willing to pay premiums for long positions.

This is in line with Sui’s upward trajectory, indicating that derivatives traders believe in the project’s long-term potential despite the recent small pullback.

Source: Coinglass

Read Sui’s [SUI] Price forecast 2024-25

In short, Sui’s technical strength, increasing social engagement and positive financing rates indicate that Sui is well positioned to support its growth.

By maintaining critical levels of support and leveraging community interests, Sui has the potential to solidify its dominance in the DeFi space and achieve even greater milestones.