- STX has defied market trends with a 30-day high of 16.71%.

- Due to the positive market sentiment, analysts are looking at $2.4.

While other altcoins have seen high lows following Bitcoin’s decline in recent months, Stacks [STX] remained in an uptrend for six weeks. During this period, STX has increased its market value and prices have continuously increased.

However, as the crypto market recovers and BTC crosses the $69,000 mark, STX appears to be losing momentum. The current price action has analysts concerned that some are showing optimism while others think a reversal is imminent.

The prevailing market sentiment of STX

Over the past month, STX has experienced a sustained uptrend. Yet the prevailing market sentiment shows positivity and optimism.

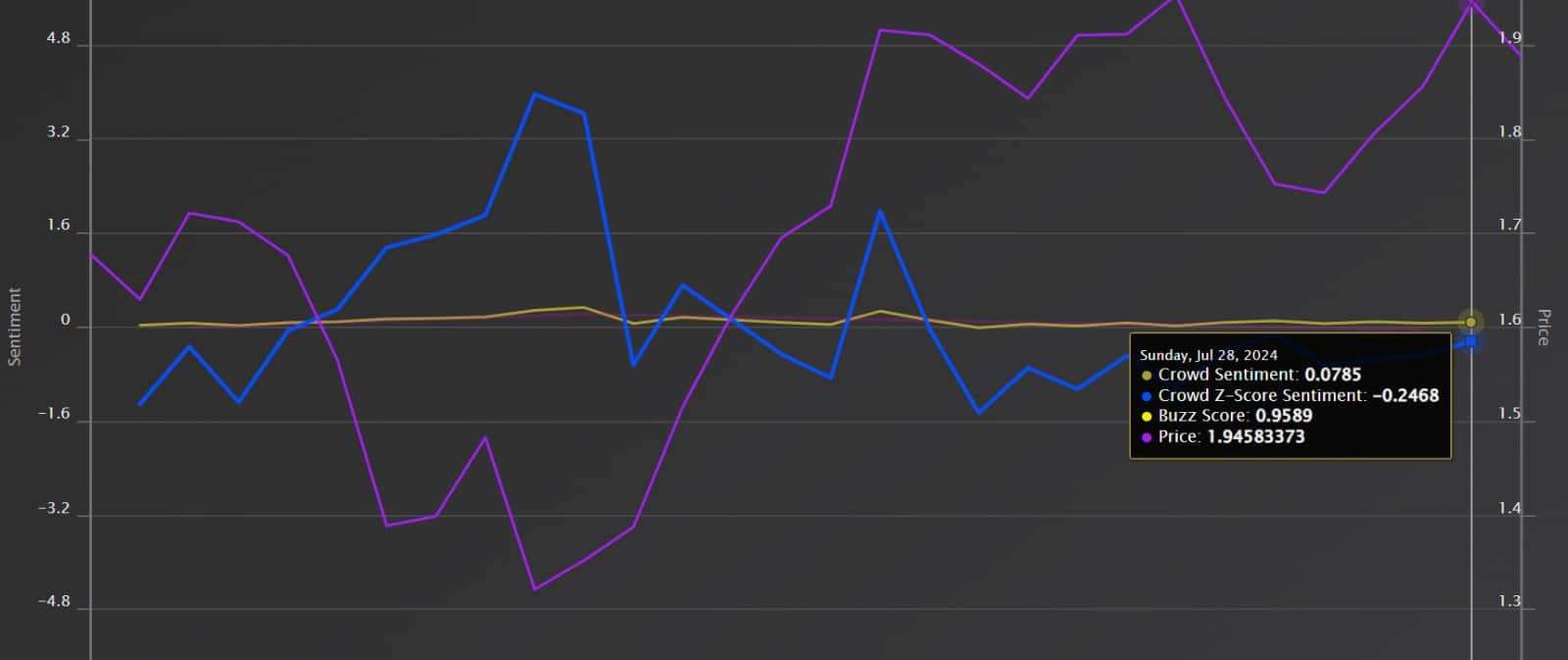

According to Market Prophit, STX is enjoying positive market sentiment with a Crowd Sentiment of 0.0785 and a Crowd Buzz of 0.9589. Analysts are optimistic and see a potential breakout and continued upward momentum.

Source: Markt Profhit

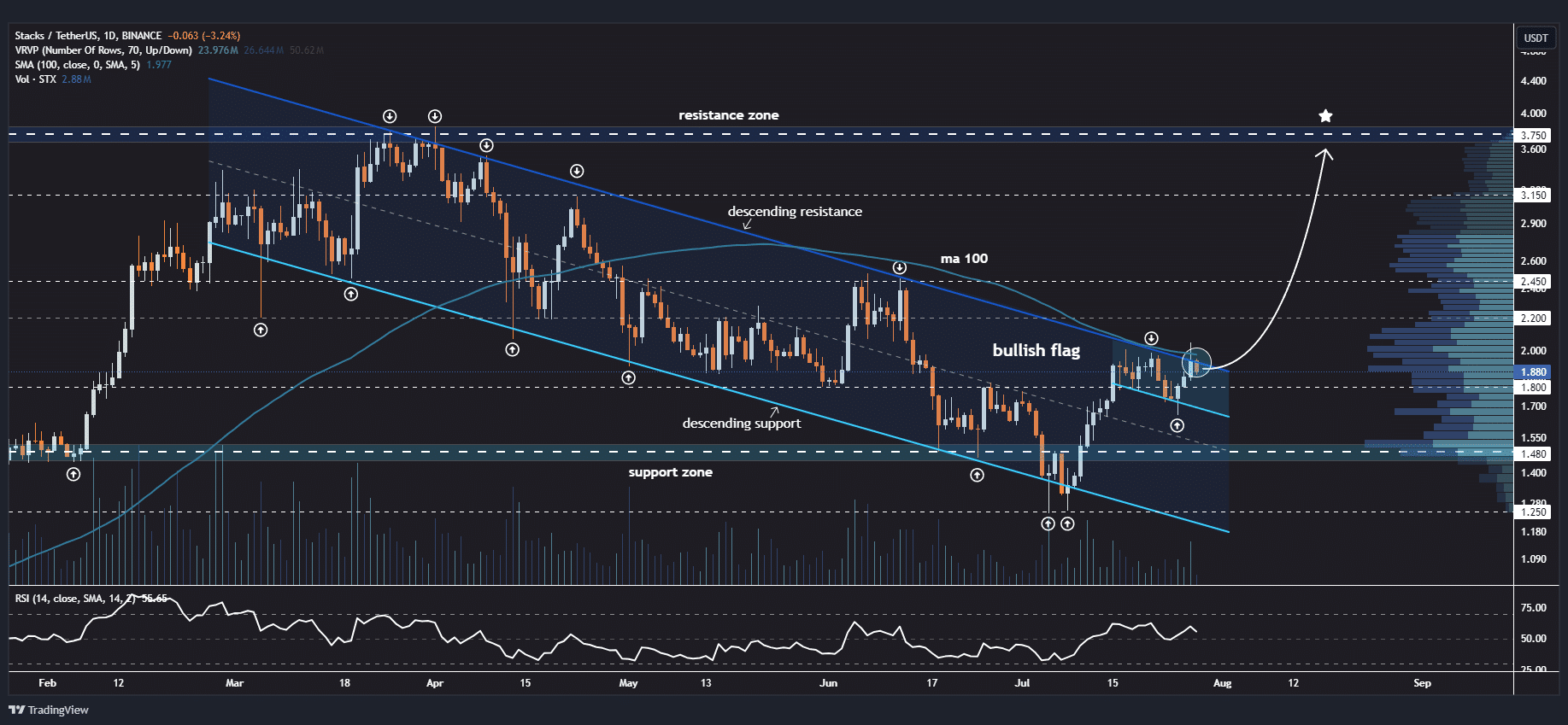

Jonathan Carter shared his prediction on his X-page, suggesting a bull run at $3.75. He noted that,

“#STX Stacks is forming a descending channel on higher timeframes with a bullish flag below the main trendline. An outbreak appears imminent, so watch this space closely. Targets: $2.20, $2.45, $3.15 and $3.75.”

Source:

For a bit, LilaMIa shared her optimism, arguing that STX will experience a bullish run if it breaks out. She noted that,

“I am still trying to clear the descending channel and still expect a huge bullish wave in case of a successful breakout”

Source:

Additionally, Whales Crypto Trading also shared their prediction that a bull run would reach $2.4. They shared that

“Stacks breaks the descending channel within an 8-hour time frame. An upside breakout could trigger a massive bull run towards $2.40.”

Source:

What the STX price chart indicates

Notably, AMBCrypto’s analysis showed that STX was on a strong uptrend with potential for further continuation. STX was trading at $1.94 at the time of writing, after gaining 3.24% on the daily charts. The altcoin has seen an increase of 16.71% in the past 30 days.

Looking at STX’s Directional Movement Index, the altcoins DMI is showing a strong upward trend. The positive index stood at 25.98, while the negative index was below 16.51, indicating that upward momentum is strong.

Moreover, the Aroon Up line at 85.71% is above the Aroon Down line at 71.43%, further proving the strength of the current trend.

Source: TradingView

Moreover, the Relative Vigor Index (RVGI), a technical indicator that measures asset conviction trends, is positive at 0.027. After crossing its signal line from below, RVGI has experienced a bullish crossover.

This shows that closing prices are higher than opening prices, indicating bullish momentum.

Source: Santiment

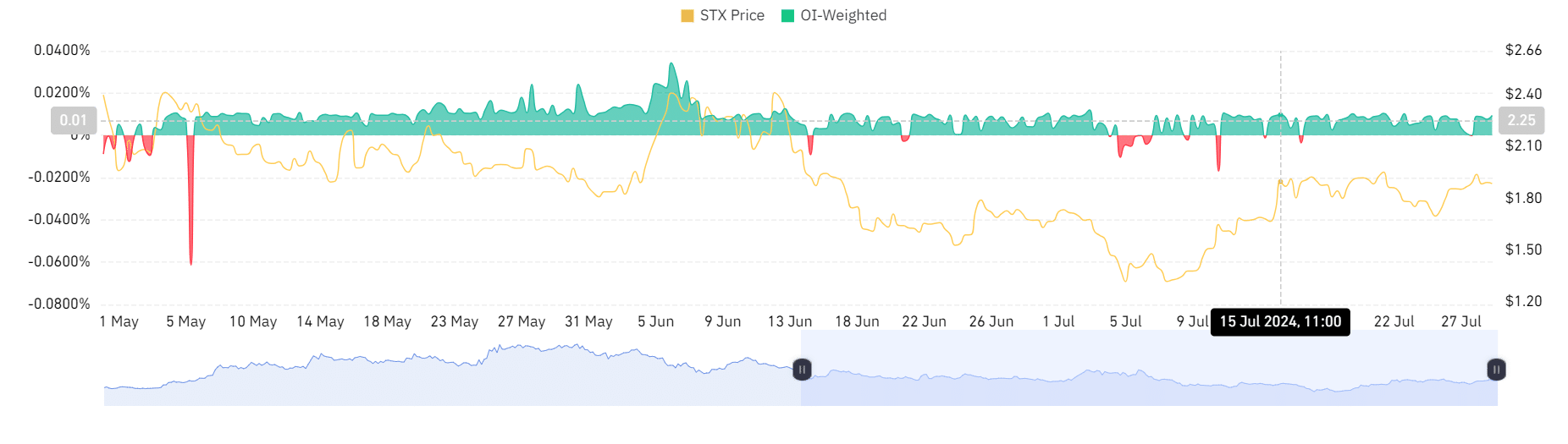

Looking further, AMBCrypto’s analysis of Santiment data also showed that the exchange’s aggregated funding rate is positive at 0.01. This implies that holders of long positions pay for short positions, indicating that traders are willing to pay a premium to hold their positions.

Such a scenario suggests that investors are confident in STX’s price and are anticipating a price increase.

Source: Coinglass

Finally, STX’s OI-weighted funding rates have been positive in recent weeks. A positive WFR indicates that long position holders are willing to pay a premium to maintain their position.

This further confirms our analysis of Santiment data, indicating that the current trend will continue.

STX reversal or breakout?

At the time of writing, STX was posting a 3.68% gain on the weekly charts. Our analysis also shows that the altcoin enjoys positive market sentiment, with buyers in control of the market.

Read stacks [STX] Price forecast 2024-25

Therefore, if current market conditions persist, the altcoin will break out of the critical resistance at $2.04. A breakout from this zone will prime the crypto to challenge the $2.47 resistance level.

However, if the bulls lose momentum, there will be a reversal and drop to the immediate support level of $1.80.