- Stacks’ strong correlation with Bitcoin suggested a possible rally.

- STX is trading above the 200 EMA but has broken back into four-month resistance.

The correlation between stacks [STX] and Bitcoin [BTC] Prices were strong, with a correlation coefficient of 0.86. Stacks served as a high-beta play on Bitcoin and provided leverage within the BTC ecosystem.

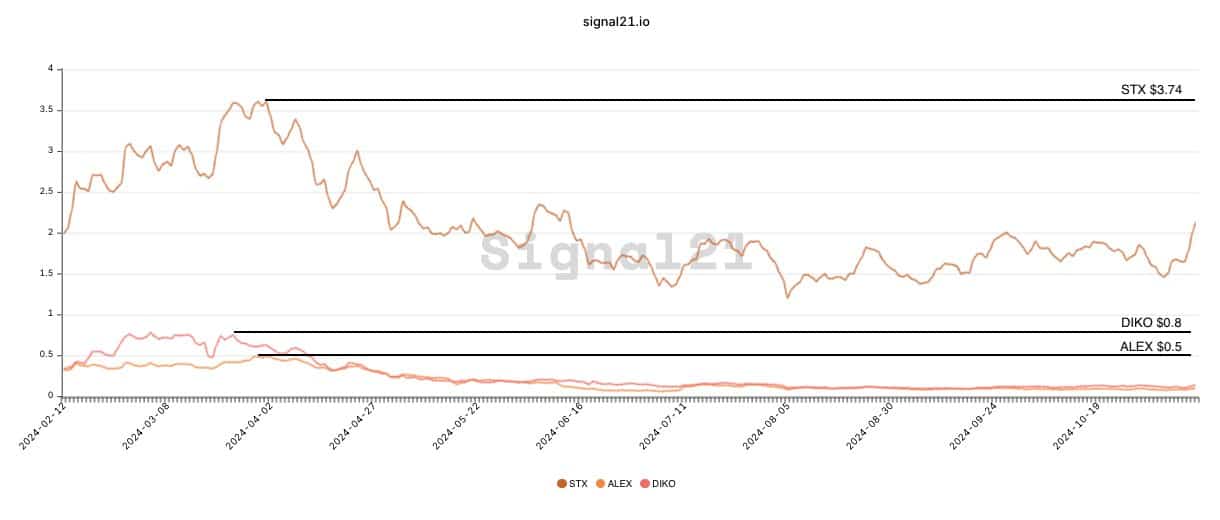

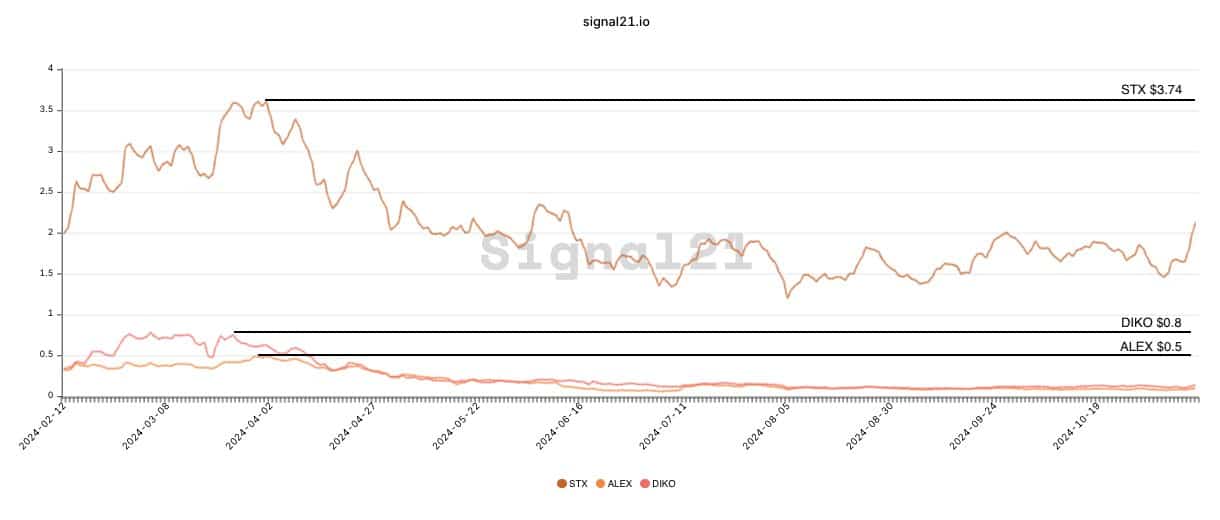

Similarly, ALEXLabBTC (ALEX) and Arkadiko Finance (DIKO), leading DeFi protocols on the Stacks platform, offered higher beta capabilities tied to STX.

This created a multi-layered investment potential within the growing Bitcoin ecosystem. However, STX, ALEX and DIKO remained well below their March highs from earlier this year.

Source:

This backdrop sets the stage for assessing how Stacks could perform, following Bitcoin’s future moves.

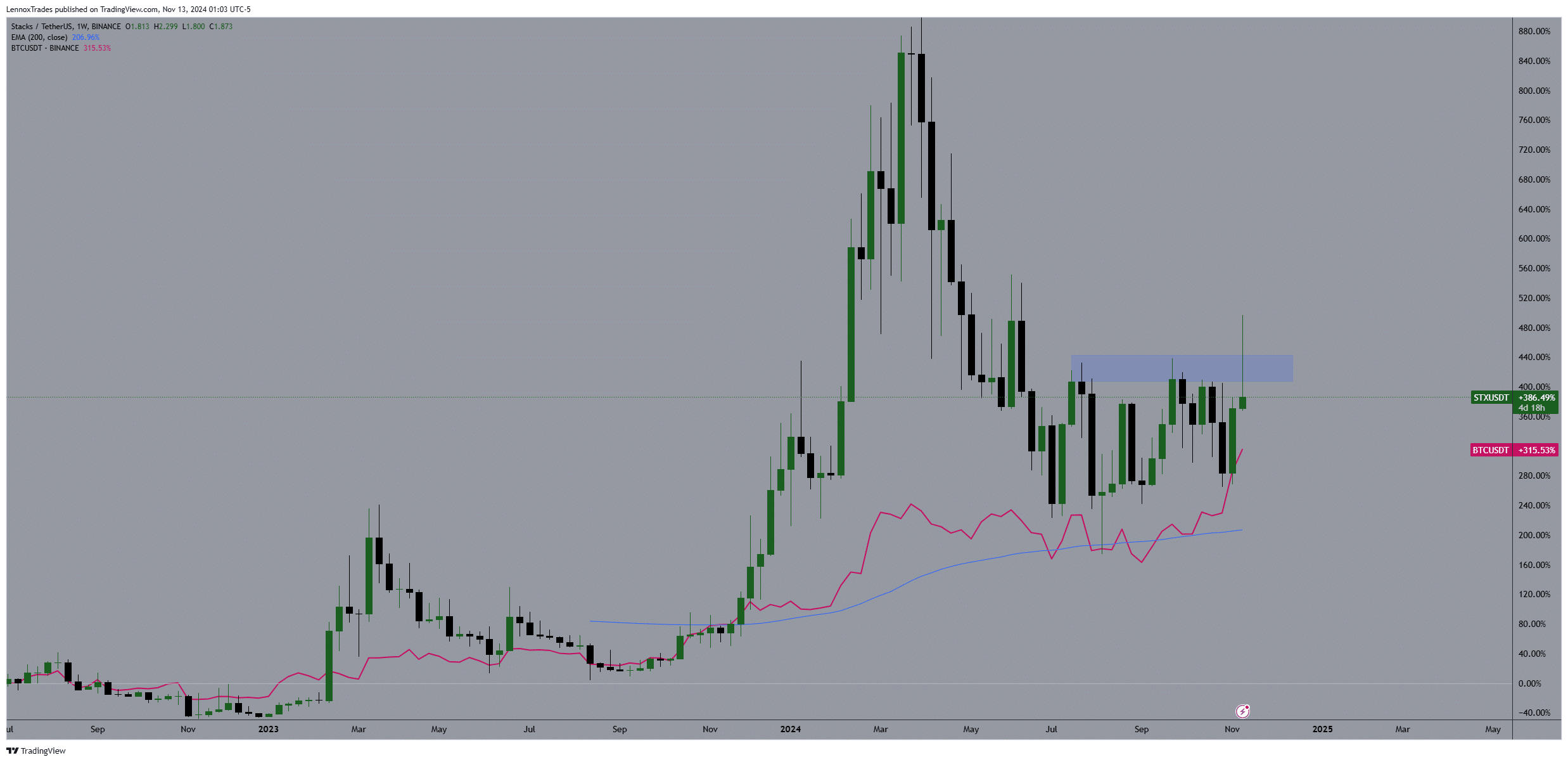

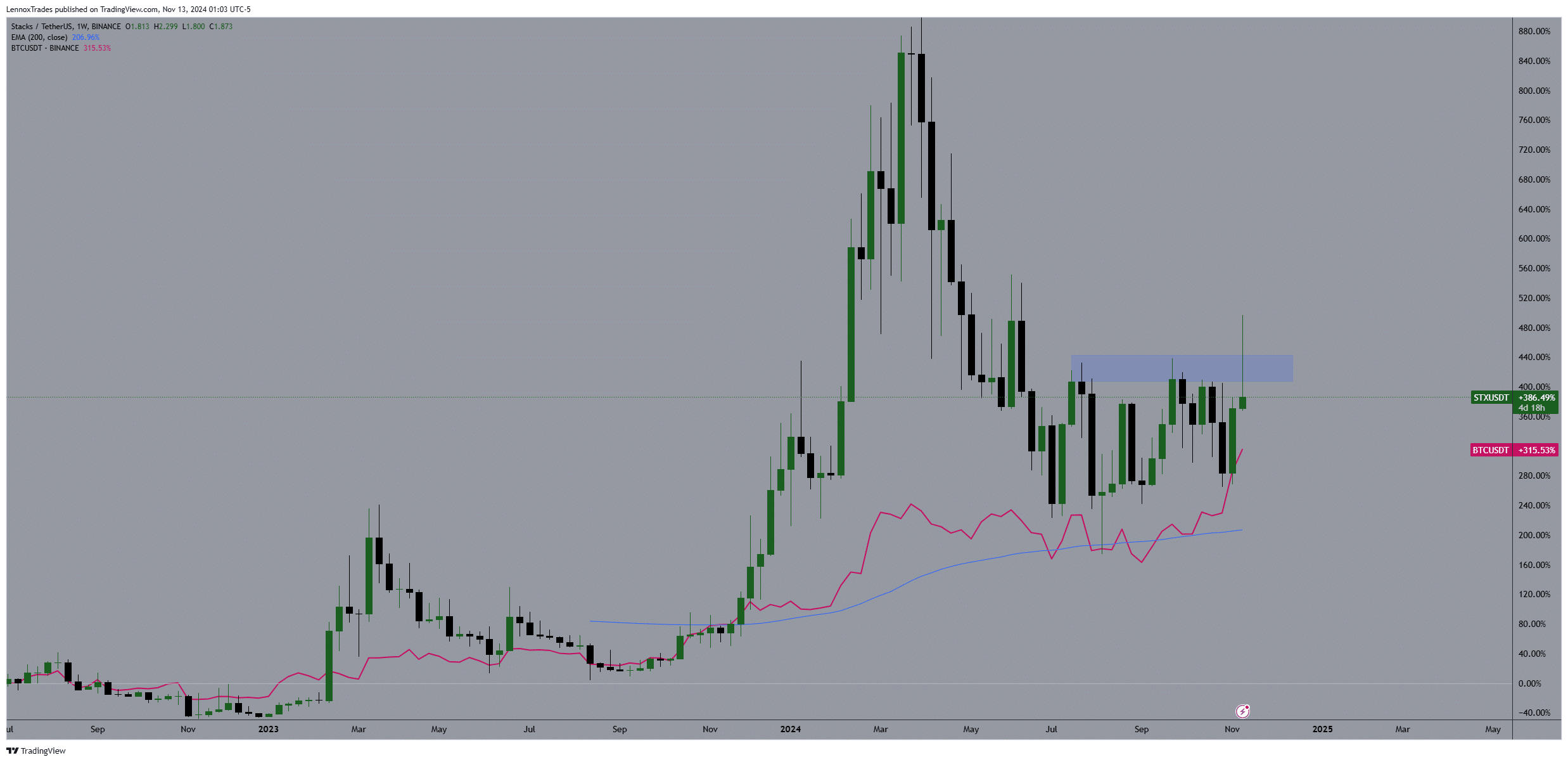

STX is trading above the 200 EMA

Stacks’ price action briefly broke above a four-month resistance level but then fell back within this range, indicating a possible false breakout on the weekly time frame.

Despite this retracement, STX traded above the 200-day EMA, indicating an overall bullish long-term trend. The striking green candlestick breaking through resistance, followed by a red one, illustrates the volatility and uncertainty at the breakout point.

However, maintaining a position above the 200 EMA on the weekly time frame offers a stable outlook, which supports potential future gains.

Source: trading view

Comparing STX’s percentage gains to Bitcoin’s performance shows a correlation in their price actions, with STX mirroring Bitcoin’s overall market movements.

This correlation suggested that if Bitcoin continues its uptrend, STX could indeed pursue the $4 target. Observing Bitcoin’s trajectory will be crucial for predicting STX’s moves, especially since it showed signs of following Bitcoin closely.

Open interest rates and premium index

When Stacks broke out of the consolidation pattern within a certain range, open interest rose sharply, indicating STX would be bought from traders, possibly in anticipation of a rally to $4.

At the same time, the Aggregated Premium also saw a significant spike, indicating that traders were willing to pay a higher premium on futures contracts in anticipation of future price increases.

This aligned with the volume bars showing increased trading activity, further supporting the bullish sentiment surrounding STX.

Source: Velo/Tradingview

Read stacks [STX] Price forecast 2024-25

Given rising Bitcoin prices and increased traditional financial attention, it is likely that the Bitcoin ecosystem like STX will benefit.

The rise in open interest, coupled with rising premiums and volume, could propel the token to new highs as part of the broader bullish momentum in the cryptocurrency markets tied to Bitcoin’s performance.