Digital asset manager CoinShares says institutional investors are currently less bullish on crypto due to a strong dollar and ongoing regulatory concerns in the United States.

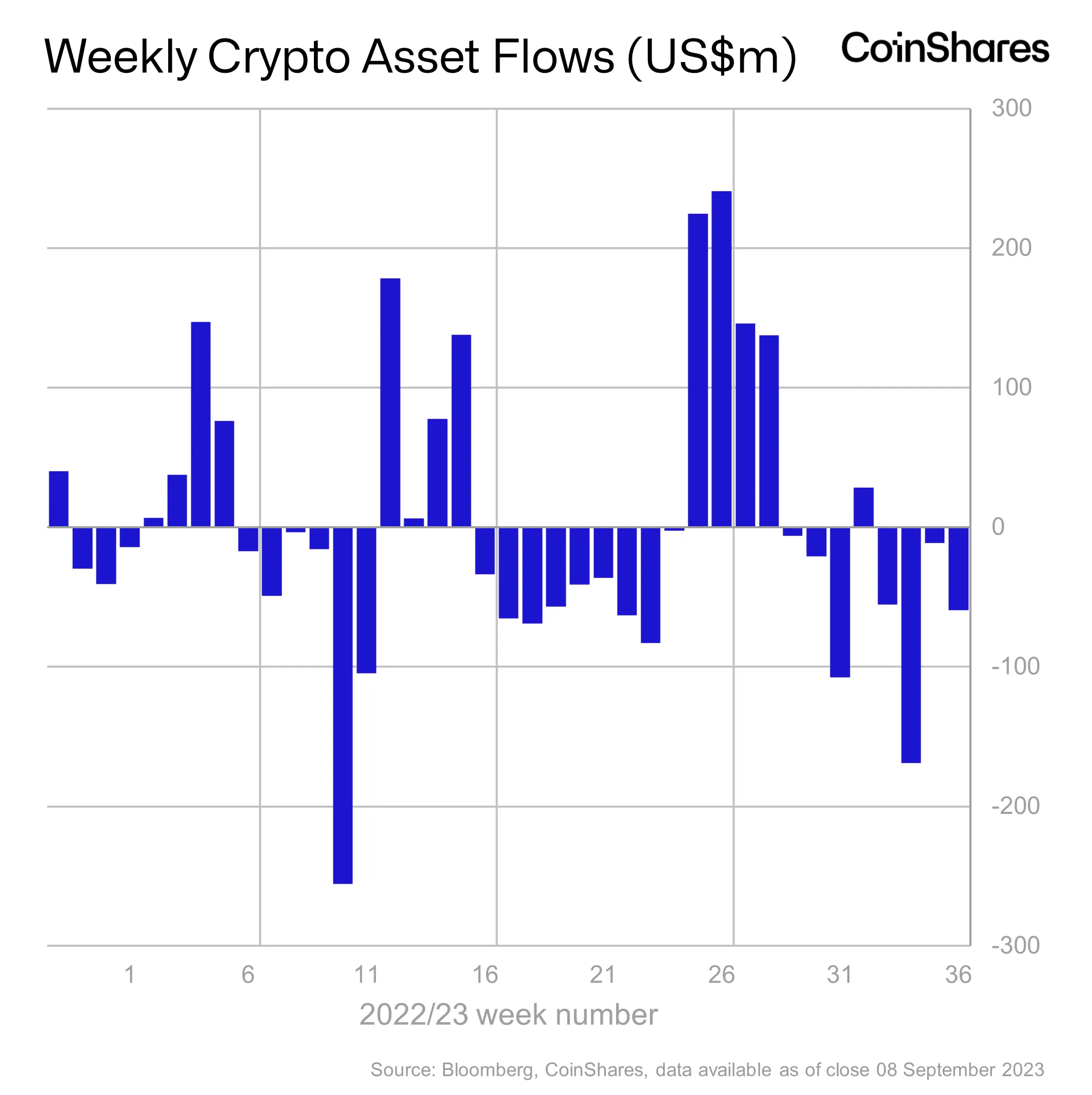

In its latest Digital Asset Fund Flows Weekly Report, CoinShares finds that digital assets saw outflows of nearly $60 million last week, marking the fourth week of outflows in a row.

“Digital asset investment products saw outflows totaling $59 million last week, marking the fourth consecutive week of outflows. These outflows now amount to $294 million and represent 0.9% of total assets under management.”

Says CoinShares,

“There were also inflows into short investment products, indicating that sentiment for this asset class is still poor. We believe that ongoing concerns about the regulation of this asset class and the recent strength of the dollar are the most likely reasons for this. Trading volumes also fell significantly, by 73% compared to the previous week, to just $754 million for the week.”

Bitcoin (BTC), as usual, took the majority of the outflow, with $69 million. CoinShares also noticed a large influx into short BTC products.

“…short bitcoin saw the largest inflows since March 2023, totaling $15 million. In terms of timing, this is interesting because the inflow in March also took place at a time of increased regulatory uncertainty.”

Ethereum (ETH), Solana (SOL) and multi-asset investment vehicles suffered outflows of $4.8 million, $1.1 million and $0.8 million, respectively. XRP products reigned in an inflow of $0.4 million.

Don’t miss a beat – Subscribe to receive email alerts straight to your inbox

Check price action

follow us on Tweet, Facebook And Telegram

Surf to the Daily Hodl mix

Featured image: Shutterstock/Scharfsinn