- Stellar has re -tested $ 0.3 as resistance, but has been confronted with rejection for the past ten days

- Retest of the demand zone of $ 0.2 can have a small bullish response, but investors must remain careful

Stellar [XLM] Has had to deal with 14.5% losses in the last 24 hours. This, after Bitcoin [BTC] Did to $ 74.5ka a few hours before the time when the stock markets worldwide fell in the aftermath of the tariff waves. However, Altcoin traders must be careful. Especially since the bearish trend of the past three months became much stronger due to recent events.

Buyers can be patient instead of trying to buy the bottom right away, because there are no indications that has even formed a bottom. BTC trends can also be checked for instructions on the wider market.

Stellar is falling below $ 0.2, because the sales pressure is intensifying again

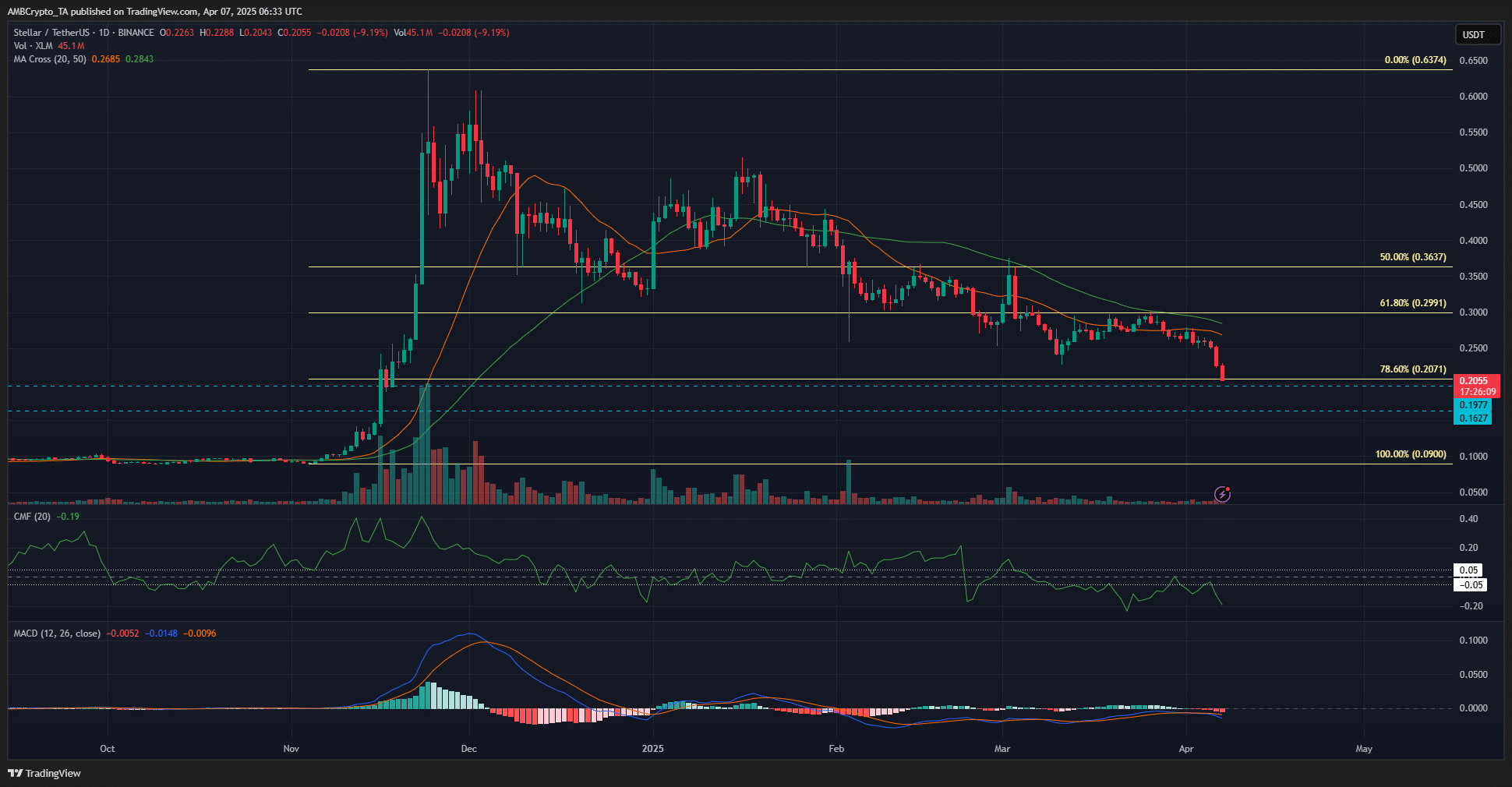

Source: XLM/USDT on TradingView

The 1-day trend remained seriously bearish. The advancing averages of 20 and 50 periods were above the price and showed that Beerarish Momentum was dominant. The MACD went lower again after a movement above the zero line.

This was the result of the consolidation phase around $ 0.25- $ 0.3 in March, which was followed by sharp losses in April. The CMF has been below zero since March and has again been well below -0.05 to indicate heavy capital flows from the Stellar market.

Together the momentum and the sales pressure meant that further losses could probably be for Stellair. The Fibonacci retracement levels based on the November Rally showed that the level of 78.6% at $ 0.207 was.

At the time of the press, the price was just below this test support level. The levels of $ 0.197 and $ 0.162 were also long -term support levels to pay attention.

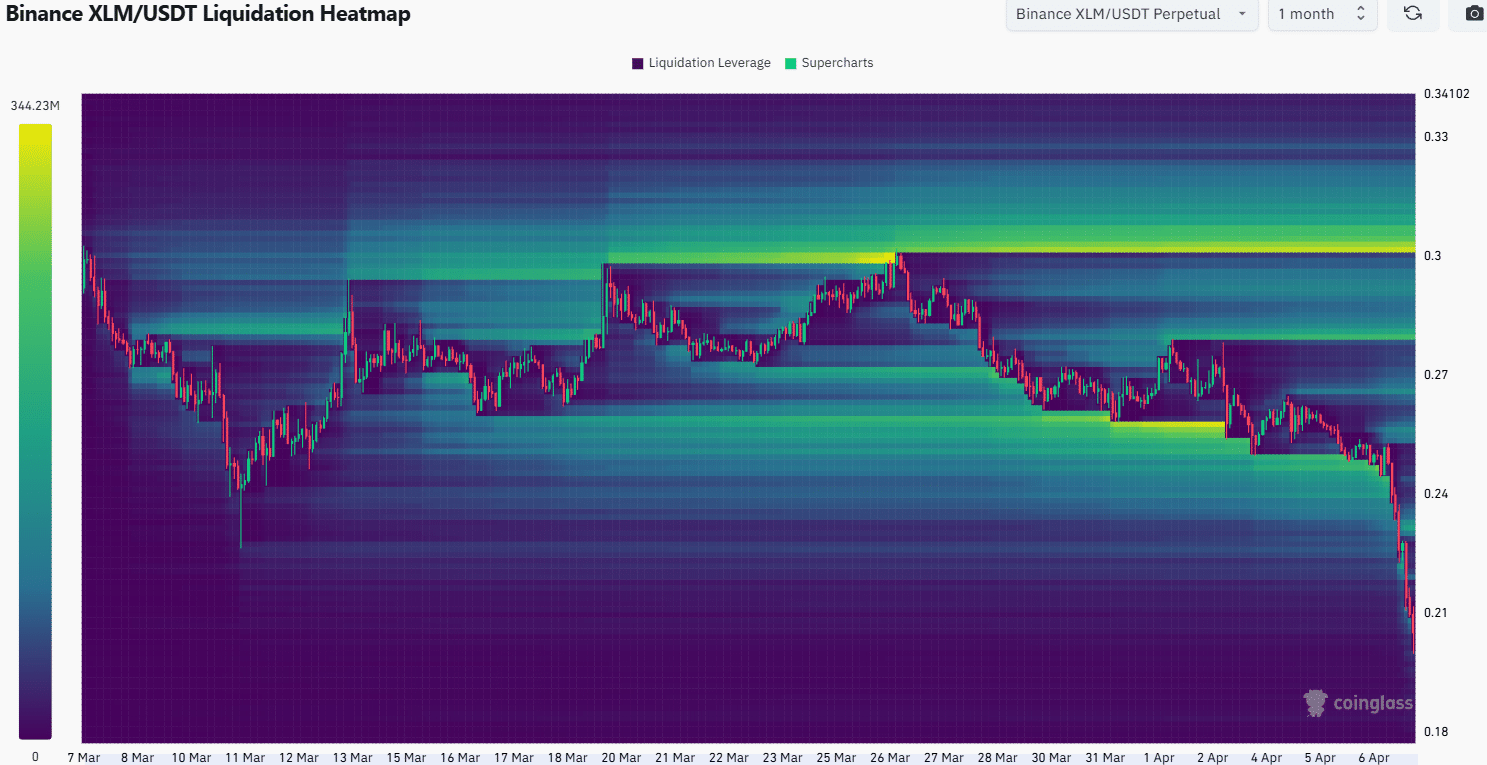

Source: Coinglass

The 1-month liquidation heat revealed that the $ 0.246- $ 0.26 zone was filled with long liquidations.

They also coincided with the local support levels from the first half of March. The last price dunge took the price of XLM far under the liquidity cluster of $ 0.24.

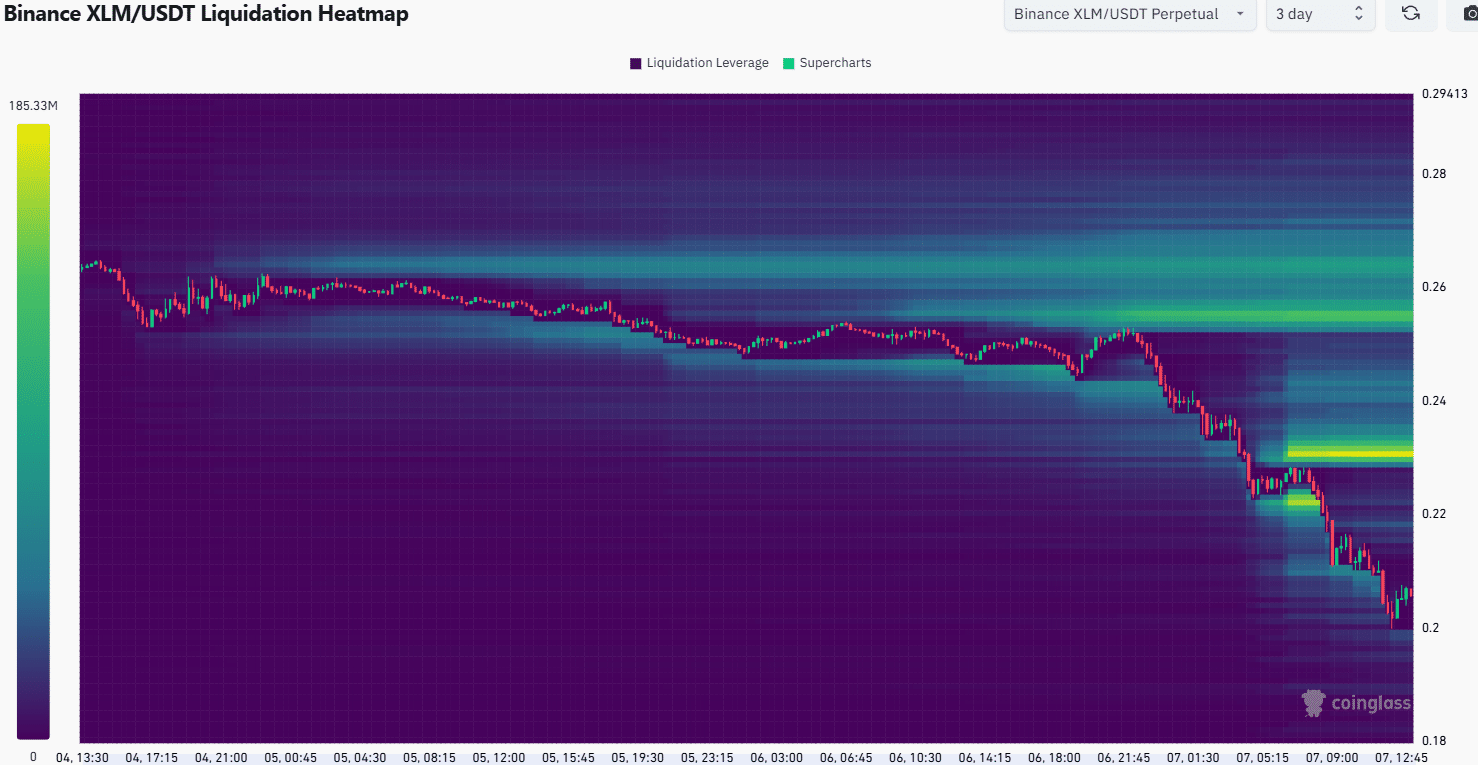

Source: Coinglass

A further consideration of the local liquidation levels gave some indications about the next step of XLM. The structure of liquidity around $ 0.23 presented an attractive target and the possibility of a bearish reversal in the case of a price bounce.

Furthermore, the $ 0.255- $ 0.265 zone is the next magnetic zone to pay attention. Stellar traders must be careful and not immediately try to buy the bottom.

Disclaimer: The presented information does not form financial, investments, trade or other types of advice and is only the opinion of the writer