- After a 300% price increase last month, the value of XLM fell last week.

- Buying pressure increased, but there were chances of a bearish crossover.

After a month of huge price increases, Stellar [XLM] bears took back control. Despite this, however, multiple bullish patterns had appeared on the token’s price chart. In the event of a successful breakout, XLM could expect to hit $0.90 next.

Stellar’s new bull patterns

XLM has shown incredible performance over the past 30 days, outperforming most of the top cryptos. To be precise, the price of the token increased by more than 300% during that time.

However, the trend changed in the last seven days when the products taken showed a slight price drop of 3%. At the time of writing, XLM was trading at $0.4879.

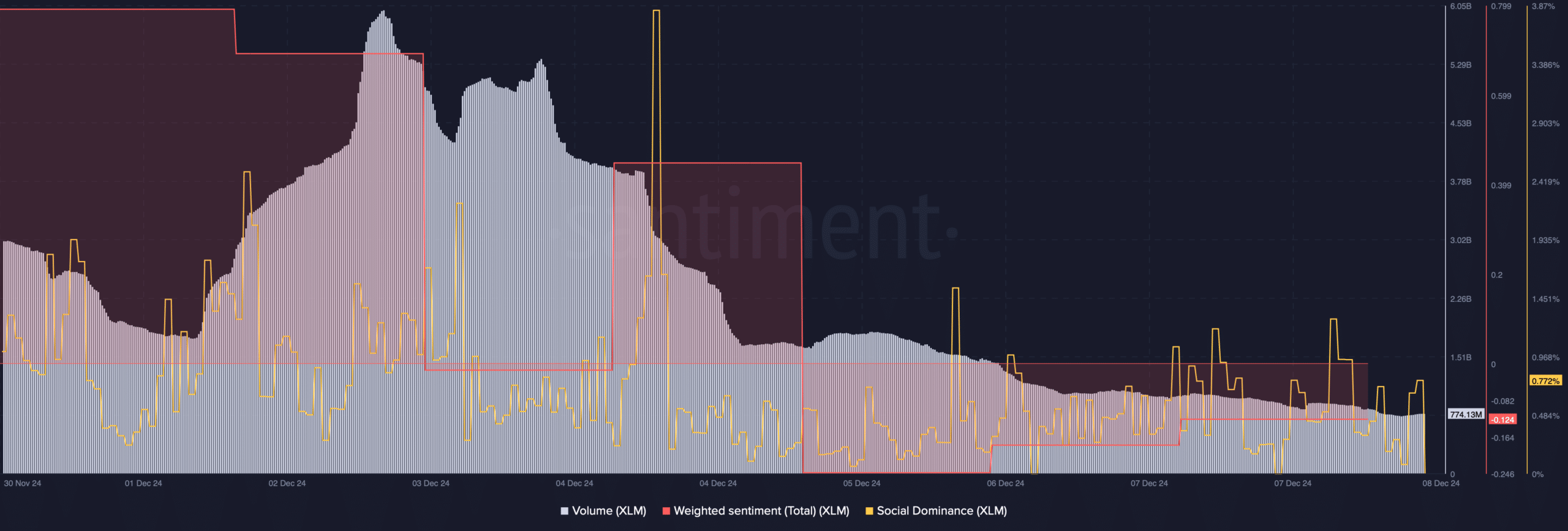

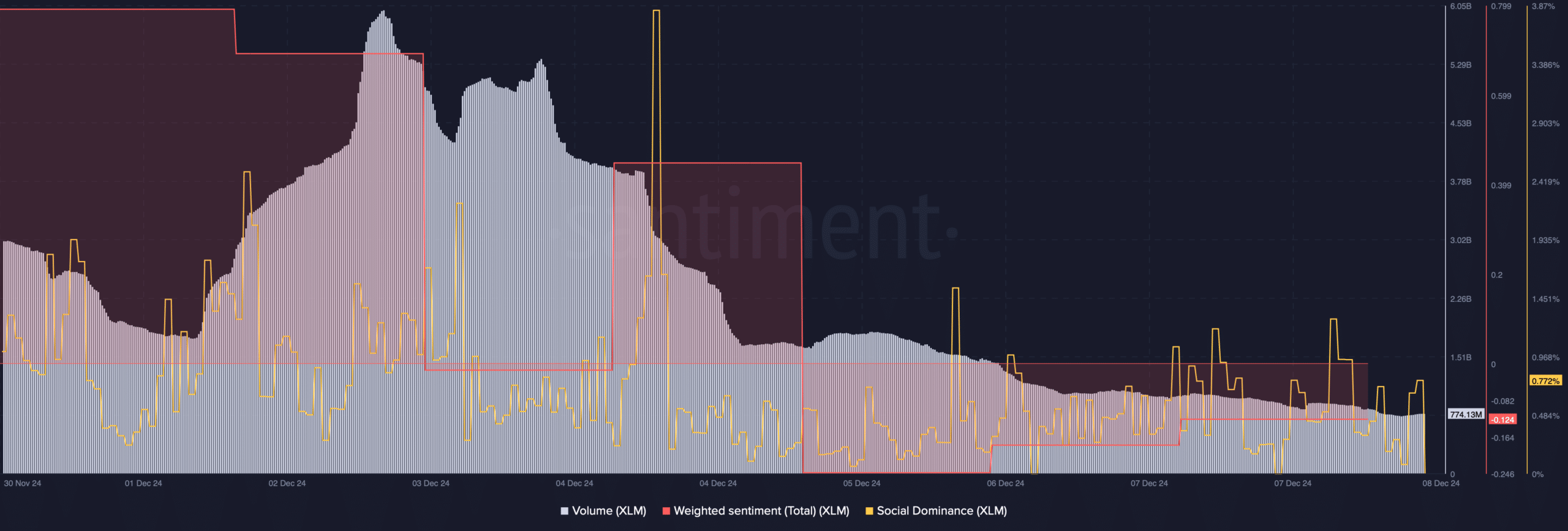

The latest price drop had a negative impact on Stellar’s social metrics. For example, XLM’s social dominance declined, indicating a decline in the token’s popularity.

Weighted sentiment also plummeted – a clear sign of rising bearish sentiment. Nevertheless, Stellar’s trading volume fell sharply along with its price. This meant there were chances of a bullish trend reversal.

Source: Santiment

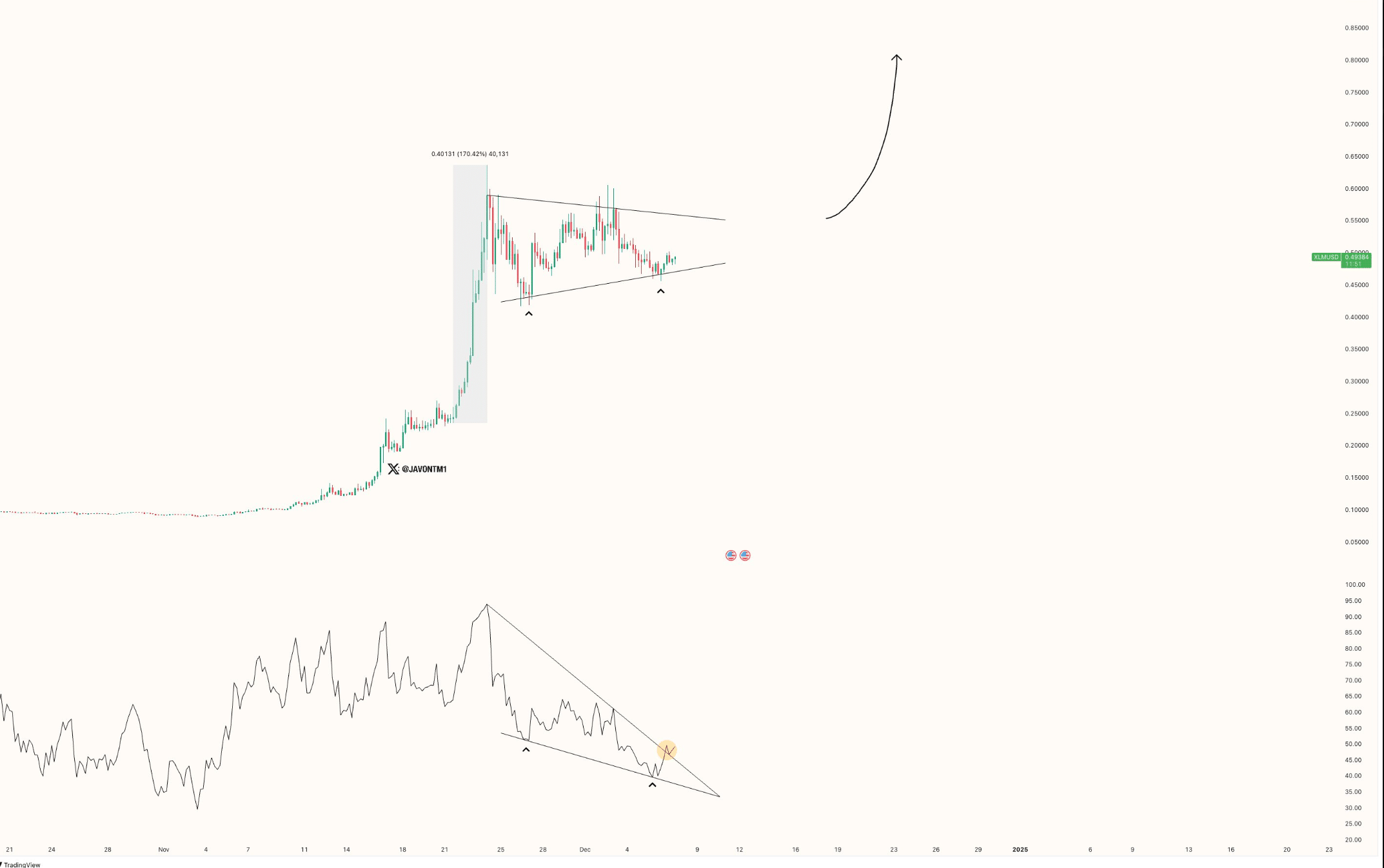

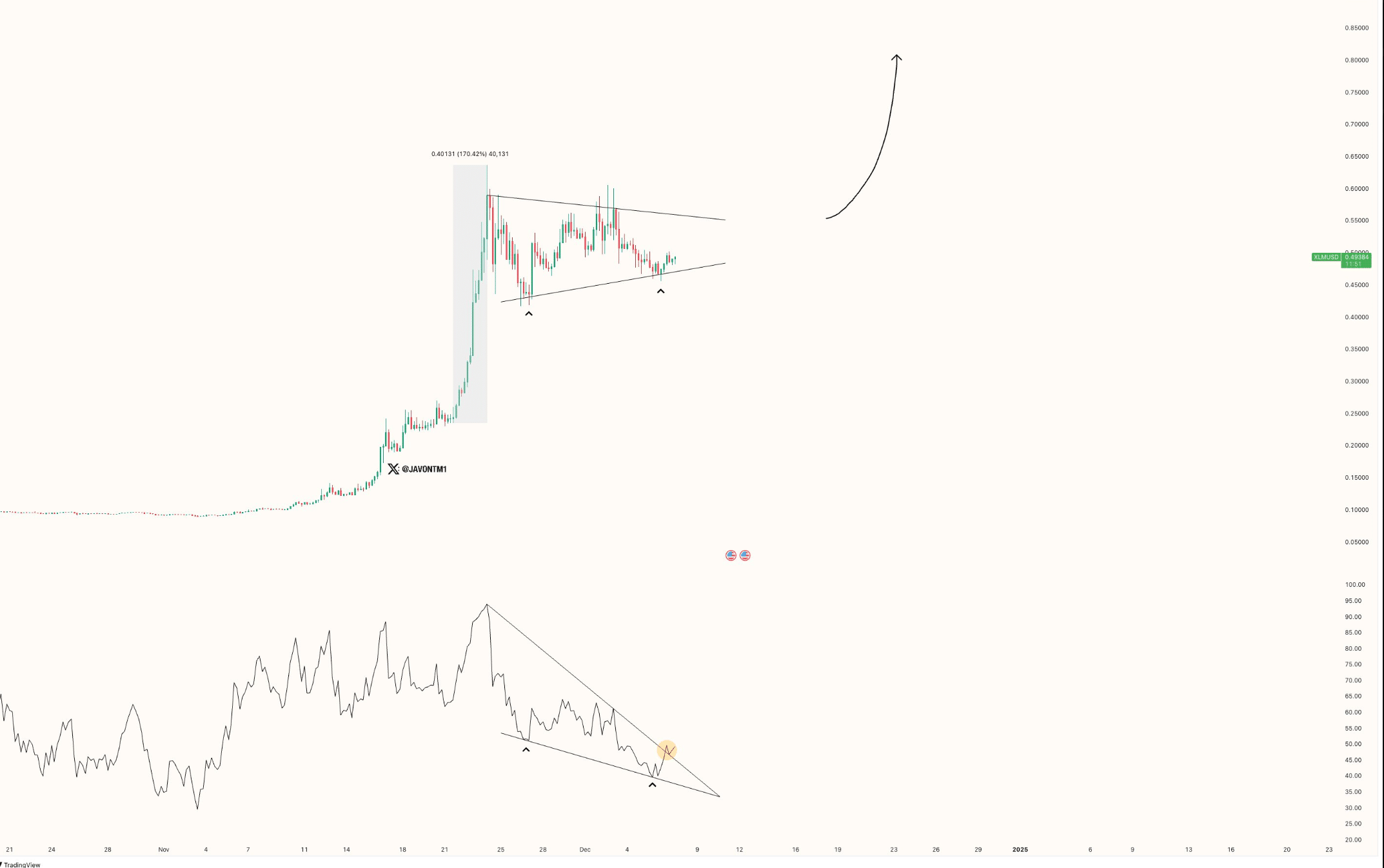

Javon Marks, a popular crypto analyst, recently posted tweet revealing two bullish patterns that appeared on Stellar’s charts. The first was a bullish symmetrical triangle pattern that formed in November.

The price of XLM consolidated within the pattern and was on track to approach the pattern’s resistance at the time of writing.

The second falling wedge pattern formed on the token’s Relative Strength Index (RSI) chart. Fortunately, the RSI broke above the bullish pattern.

If the price of XLM follows a similar trend and manages to stage a breakout, the token could move towards $0.90 in the coming days.

Source:

Will XLM Break Out Soon?

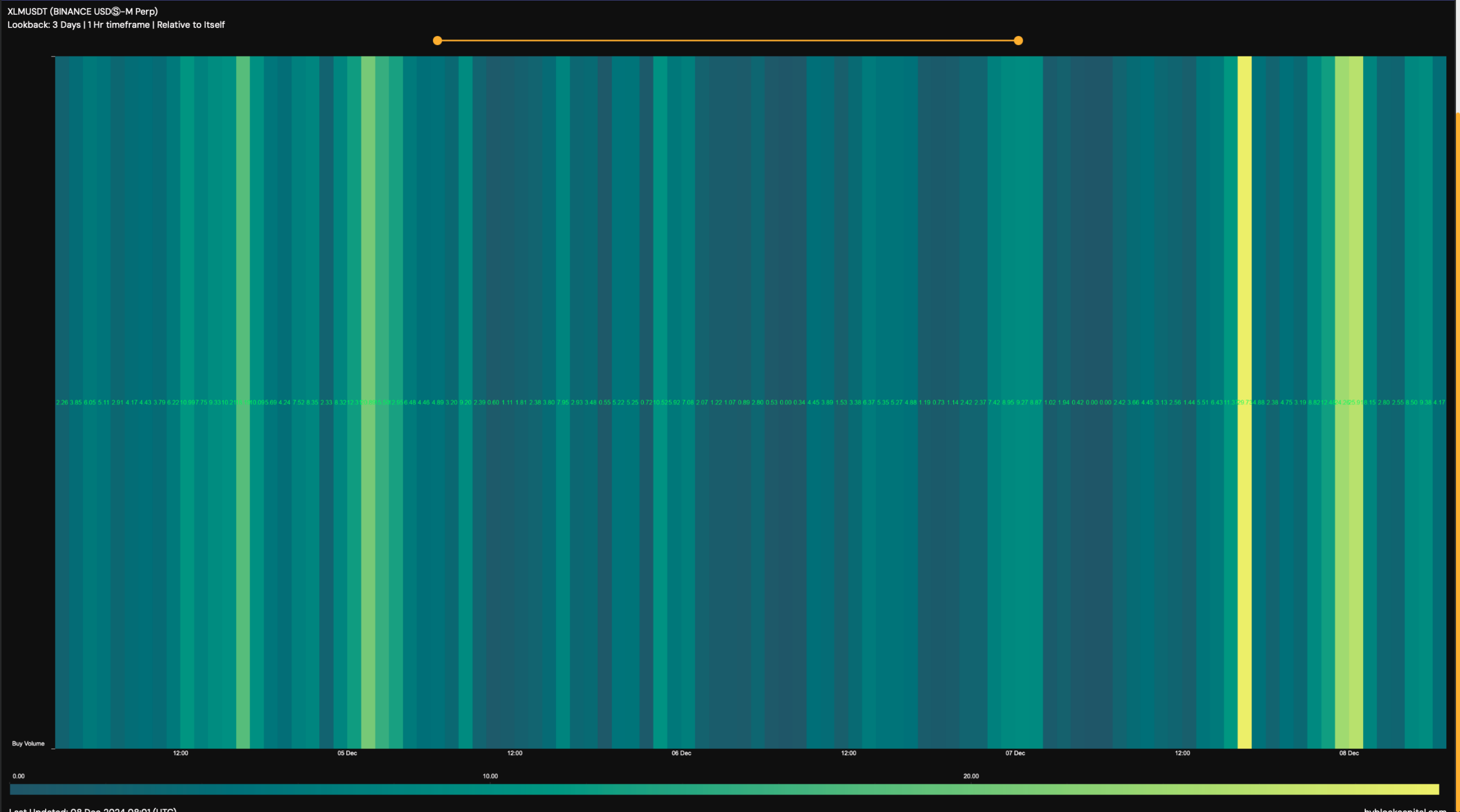

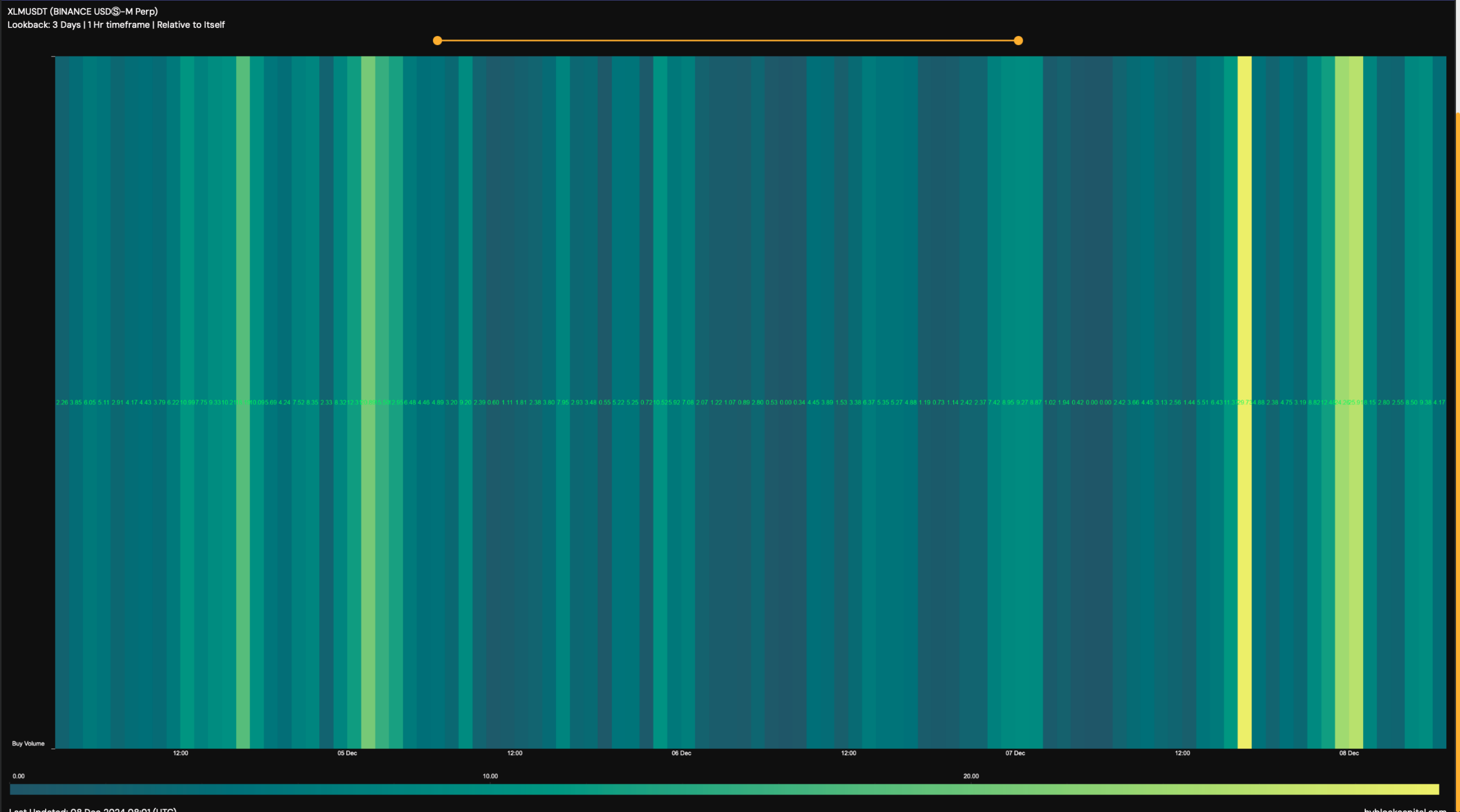

Hyblock Capital’s data showed that even though XLM’s price fell victim to a correction, investors bought the dip. The buying volume of the token has increased several times in recent days.

When the metric increases, it indicates that there is more buying activity taking place in the market for a particular token.

Source: Hyblock Capital

However, not everything was in the token’s favor. For example the ratio long/short experienced a sharp decline.

This meant there were more short positions in the market, which usually indicates less confidence among investors in an asset.

Read Stellar’s [XLM] Price prediction 2024–2025

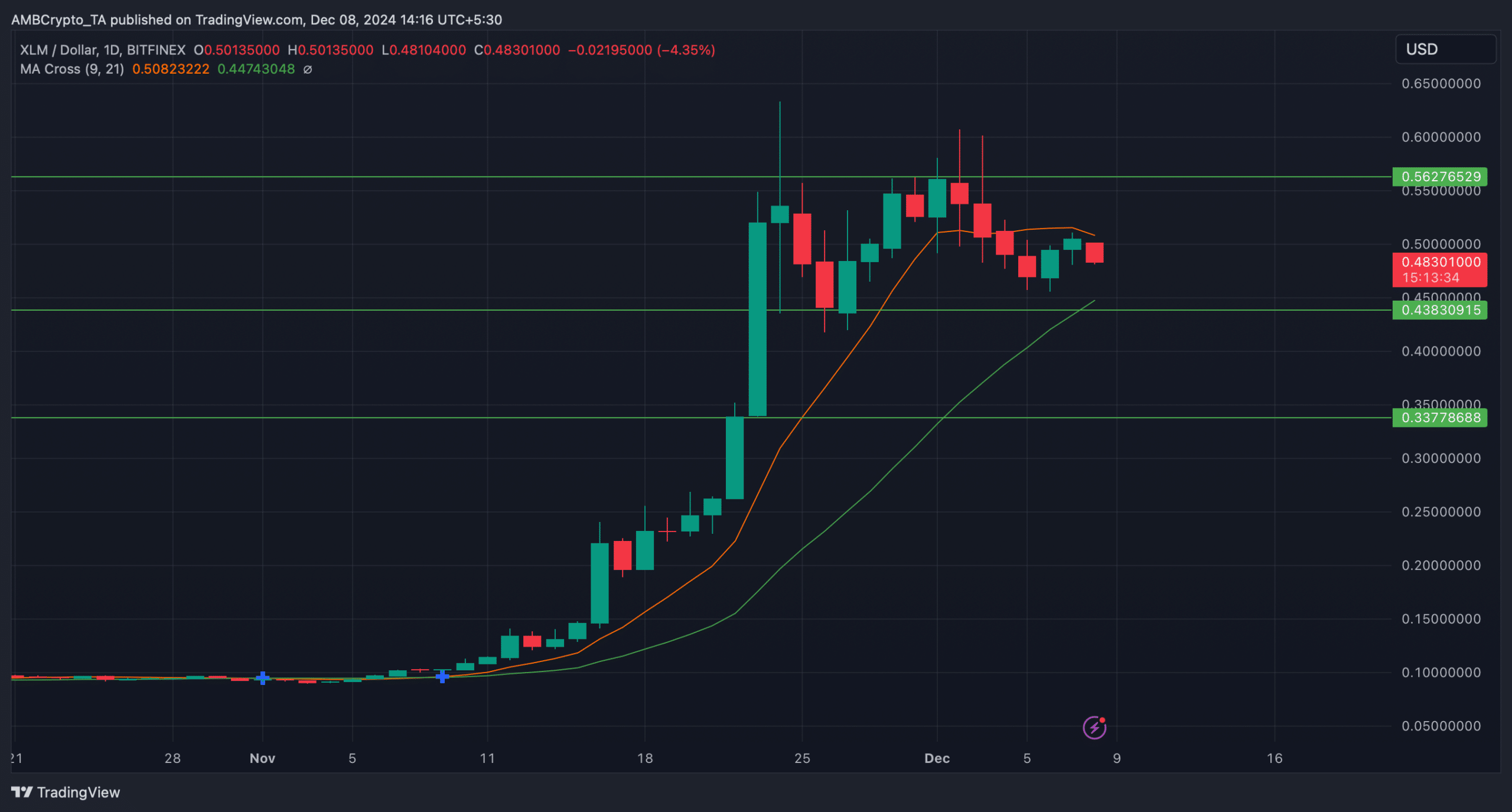

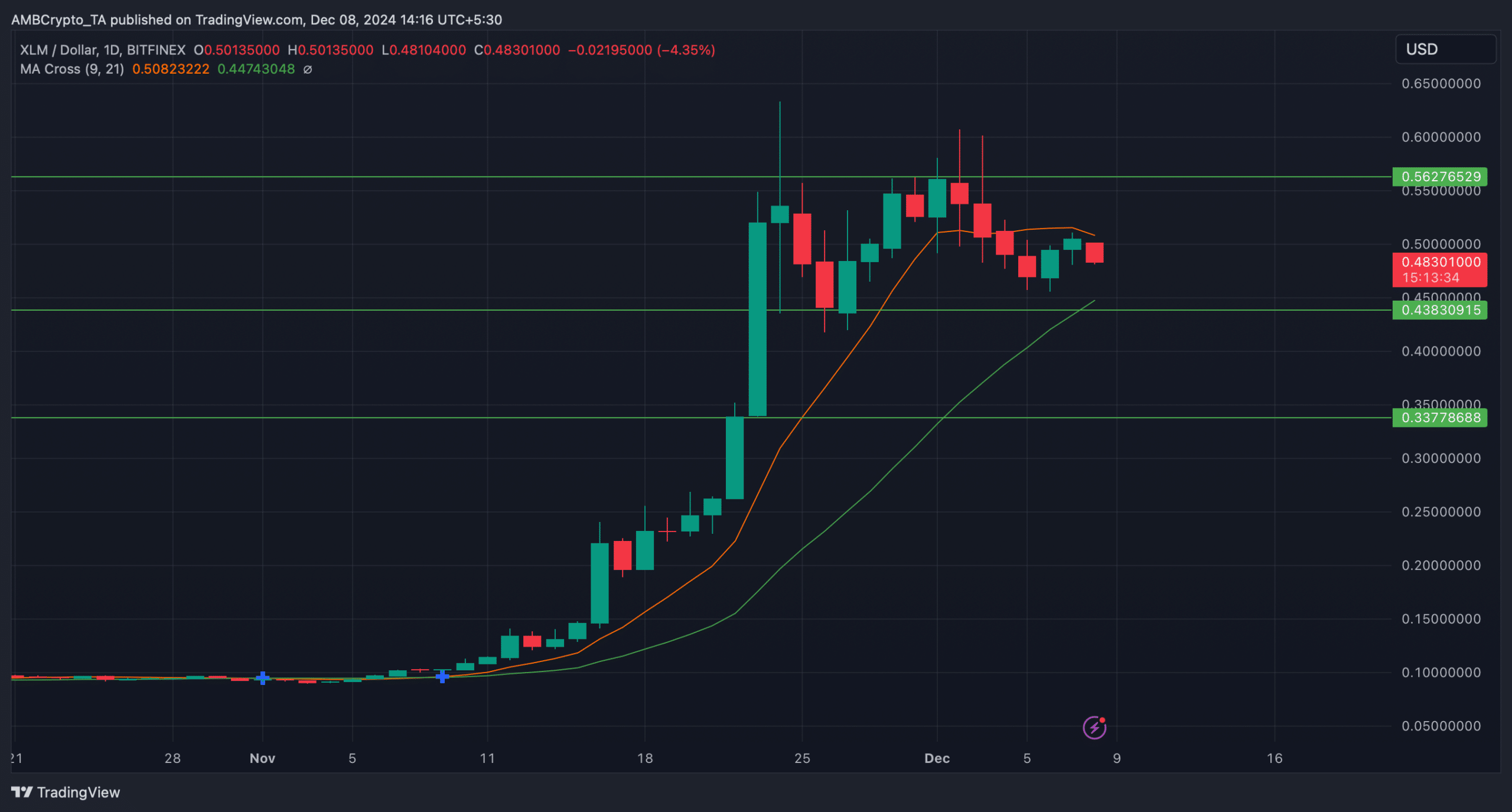

The MA Cross indicators pointed to the possibility of a bearish crossover as the distance between the 21-day MA and the 9-day MA closed.

If XLM continues to decline, the price could find support at $0.43. Nevertheless, in the event of a bullish trend reversal, it will be crucial for Stellar to cross the USD 0.56 resistance to support the rally.

Source: TradingView