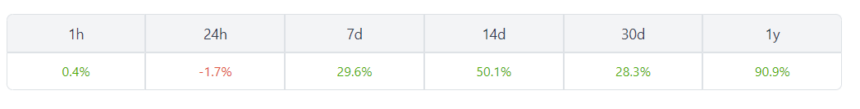

The cryptocurrency Stacks (STX) has recently experienced a remarkable turnaround, with the price bouncing back after hitting a multi-month low of $0.4412. Investors have taken the opportunity to “buy the dip”, leading to a sustained uptrend for STX over the past few days. As a result, STX is now trading at $0.7916, a significant 29% increase from its lowest level this month.

Potential catalysts for STX

Two main reasons are driving Stacks’ price increase. First, Blackrock’s decision to file for a Bitcoin exchange-traded fund (ETF) with the U.S. Securities and Exchange Commission has sparked positive sentiment. However, uncertainties remain about the adoption of the iShares Bitcoin trust, as Coinbase is slated to serve as the custodian of the coins. In addition, the ongoing conflict between Coinbase and the SEC adds to the regulatory uncertainty surrounding the situation.

Related lectures: Bitcoin Just Gained Over 18% in Seven Days: What Happened When This Happened in the Past?

In addition, the SEC’s lawsuit against major exchanges Binance and Coinbase are expected to benefit Bitcoin, as both regulatory bodies recognize Bitcoin as a commodity rather than a security. Consequently, many investors in alternative cryptocurrencies may shift their focus to Bitcoin’s perceived security. Closely tied to the Bitcoin ecosystem and enabling the development of decentralized applications (dApps), Stacks will benefit from this changing investor sentiment.

The growing Stacks ecosystem is another major factor contributing to the rise in the STX price. Bitflow Finance, a decentralized finance (DeFi) protocol, recently introduced an sBTC/sBTC stable swap pool, enabling seamless token swaps. This development improves the usefulness and adoption of Stacks, ultimately reinforcing the positive price performance.

What’s next for stacks?

From a technical analysis point of view, Stacks shows promising signs. The daily chart reveals the formation of a bullish descending wedge pattern, indicating a possible trend reversal. STX has also outperformed the 25-day exponential moving average and is currently testing the 50-day MA.

In addition, the break of the main resistance level at $0.5281, the March low, further reinforces bullish sentiment. As buyers set their sights on the next resistance point at $0.90, a potential 9% increase from current levels, Stacks continues to command attention.

Related lectures: Mask Foundation moves 2.5 million tokens to exchanges, huge dip coming?

The Stacks price is $0.79 at the time of writing, reflecting a -2.10% change in the past 24 hours. The recent price action keeps Stacks’ market cap at $1,101,401,654.52. Stacks, in particular, has posted an impressive 277.22% change since the start of the year, pointing to its strong growth potential.

STX serves as the native token of the Stacks blockchain, which operates as a layer 2 blockchain network that leverages the security of the Bitcoin blockchain for transaction settlement. With its unique positioning and robust ecosystem, Stacks continues to capture the attention of investors and developers alike.

Featured image from iStock.com and charts from Tradingview and Coingecko.com