- STX is up 17.88% over the past seven days, while one analyst was looking at $2.78.

- Stacks’ expected Nakamoto upgrade caused STX’s trading volume to rise 136.23%.

Over the past 24 hours, the Bitcoin crypto market has experienced significant volatility [BTC] falling from under $60,000 to $58,000. Major altcoins were not exceptional either, with increased liquidation in the past day.

However, Stacks [STX] has defied the market trend to continue with sustained gains. It is striking that STX has experienced moderate price increases over the past three weeks.

At the time of writing, STX was trading at $1.74. This represented an increase of 1.15% in the last 1 hour and an increase of 1.62% in the last 24 hours.

Before this, the altcoin experienced a significant price increase. In the last seven days, the price of STX has increased by 17.88%.

Despite these gains, the STX remained below last month’s high of $2.04 and still 55.61% lower than its ATH from five months ago.

Therefore, the current surge raises questions about what is driving STX’s prevailing market conditions.

What’s Driving STX’s Rise?

One of the factors determining STX’s current market conditions is the long-awaited Nakamoto upgrade. According to Stacks official X page (formerly Twitter), the upgrade is expected to happen on August 28.

While Stacks usually takes 10 minutes to confirm transactions and create a BTC block, the Nakamoto upgrade will improve the speed to five seconds.

Likewise, the ecosystem will experience scalability, lower costs and faster confirmation of transactions. The upgrade will therefore make the Stacks ecosystem better, faster and more secure, which is essential for traders.

Market sentiment

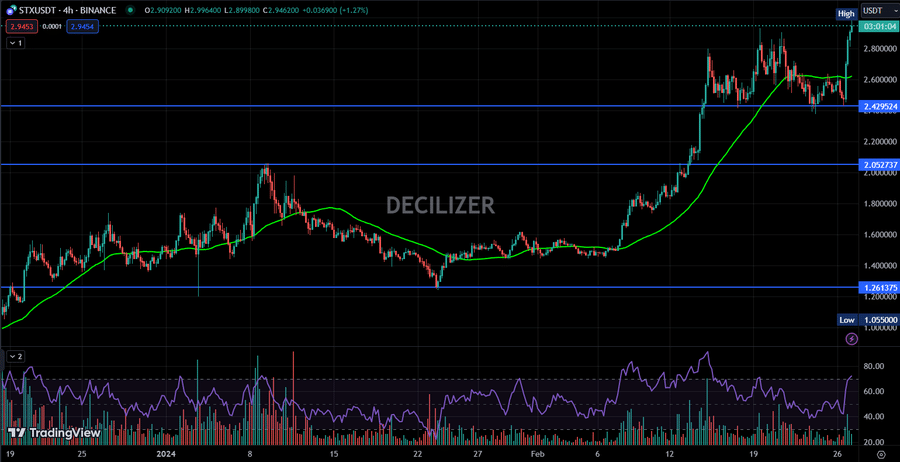

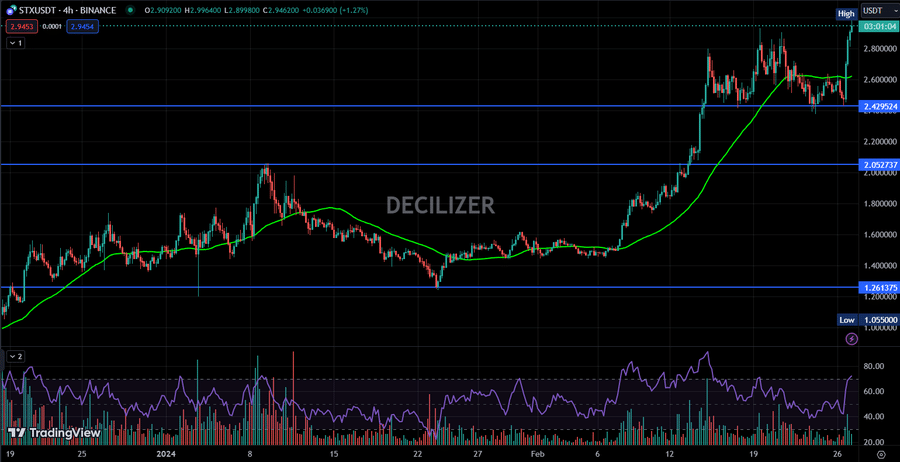

While the Stacks community waits for the Nakamoto upgrade, analysts are betting big on STX’s prospects. To that extent, crypto analyst Decilizer predicted a new ATH if current market conditions persist.

In his analysis, he stated that the altcoin is likely to reach the $2.78 target, noting:

“After establishing support at $1.46, it is all set to cross our next target of $2.78.”

Source:

According to this analysis, STX will experience a growth of 59.77%. He supported this analogy with the previous 570% growth during the previous bull run.

What price charts suggest

While Decilizer’s analysis offered promising future prospects, it is essential to determine what other metrics indicate.

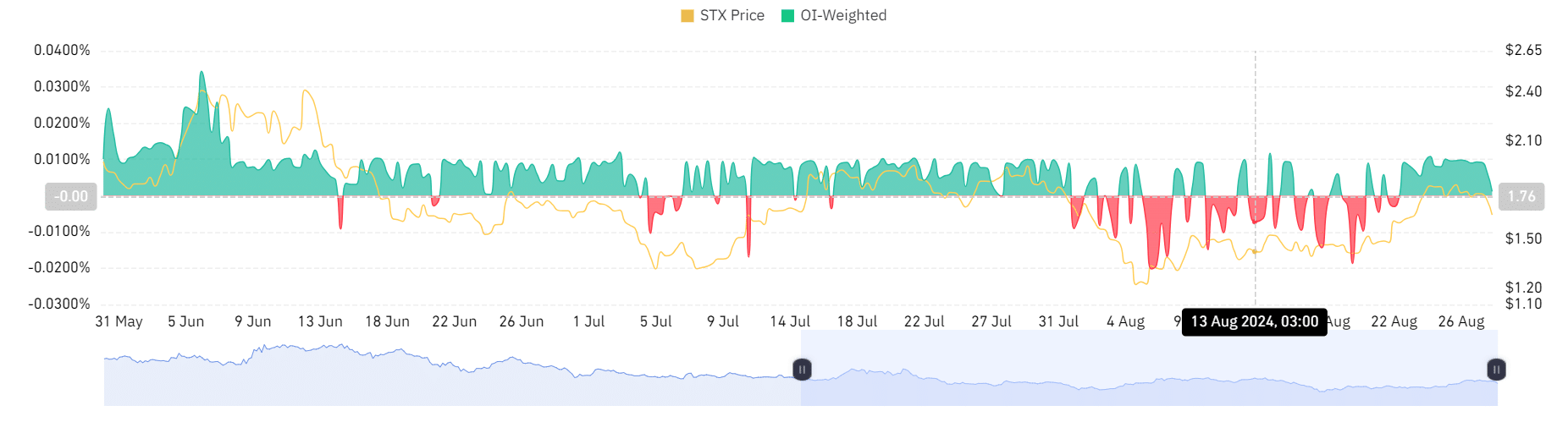

Source: Coinglass

For starters, STX’s OI-weighted funding rate has remained positive over the past week. This showed increased demand for long positions, with many investors betting on the altcoin’s prices to win over those who went short.

This is bullish market sentiment, which strengthens investor confidence.

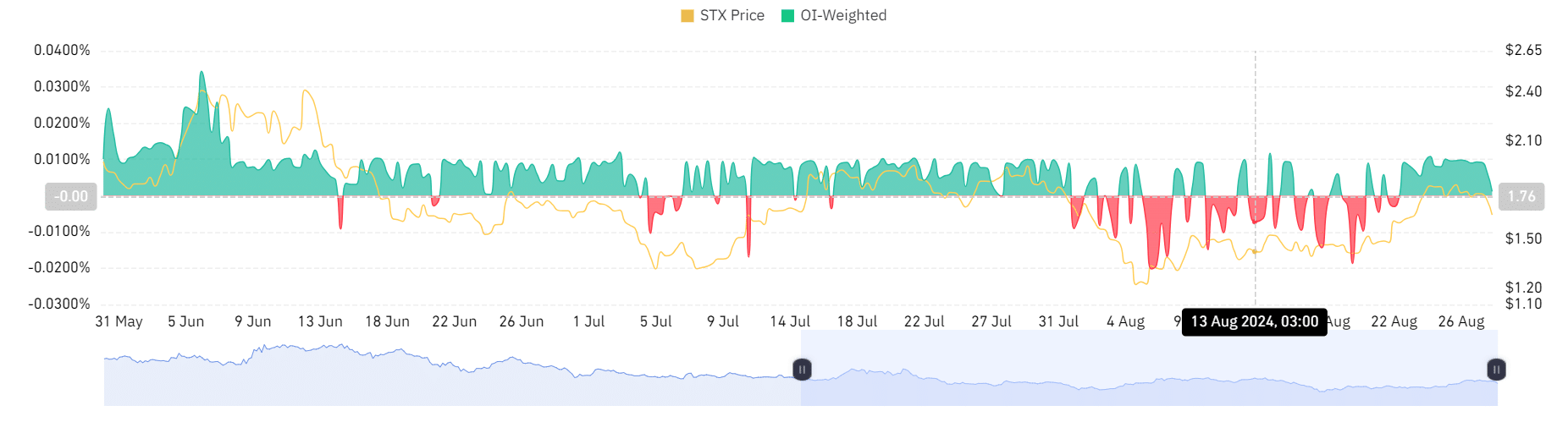

Source: Santiment

AMBCrypto’s analysis of Santiment also showed a positive funding rate aggregated by the exchange over the past seven days.

This further supported demand for long positions, indicating that the majority of participants were optimistic about STX’s future price direction.

Source: TradingView

Read stacks’ [STX] Price forecast 2024–2025

Therefore, with strong upside momentum as indicated by DMI with a positive index above the negative index, STX is well positioned for further gains.

If current market conditions persist, STX will break the $2.0 resistance level, positioning the altcoin to challenge the $2.5 resistance level.