- Bitcoin’s influx of stablecoins signals growing purchasing power and a potential price breakout

- A 36% increase in “HODL” behavior of short-term holders strengthens Bitcoin’s upside potential

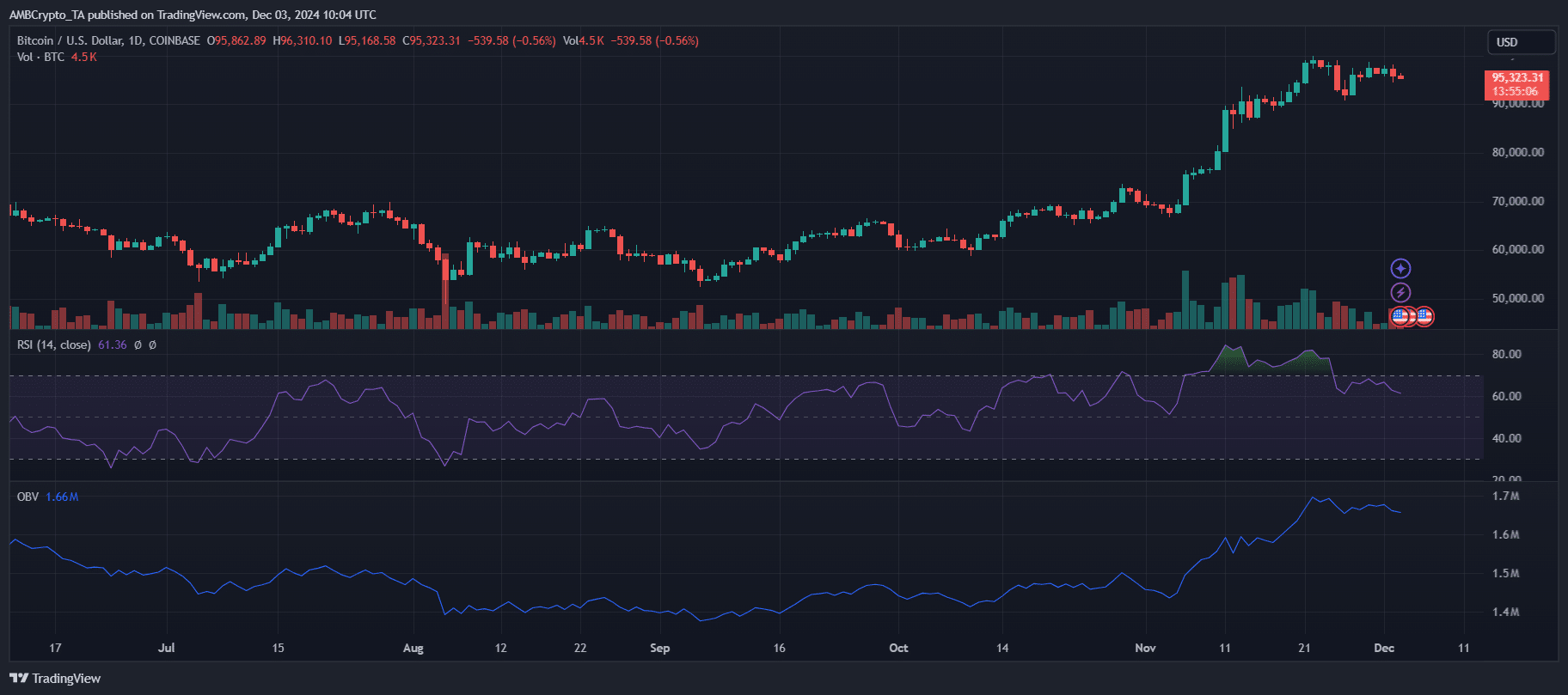

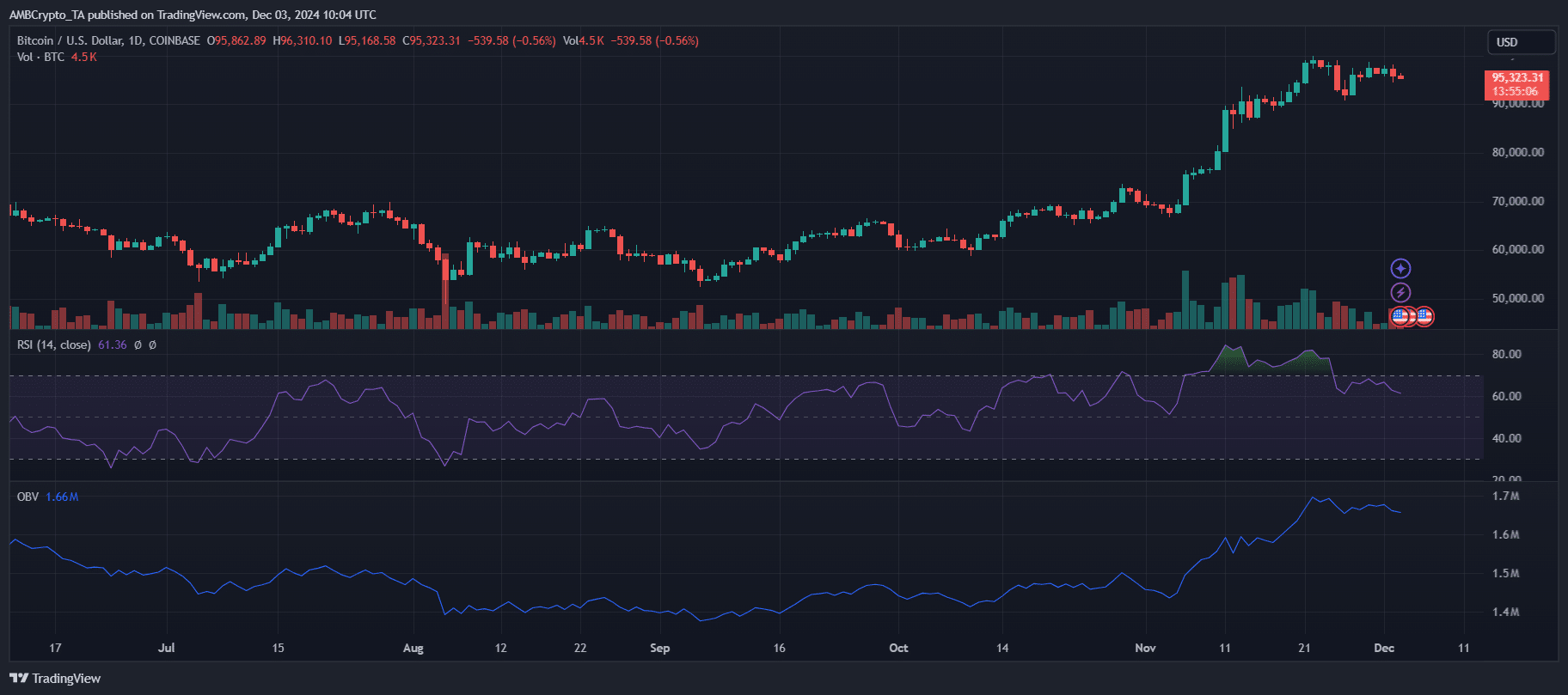

Bitcoin [BTC] recently traded within a narrow range, with resistance at $98,804 and support around $94,603. However, emerging on-chain signals suggest that the leading cryptocurrency could be preparing for a significant upward move.

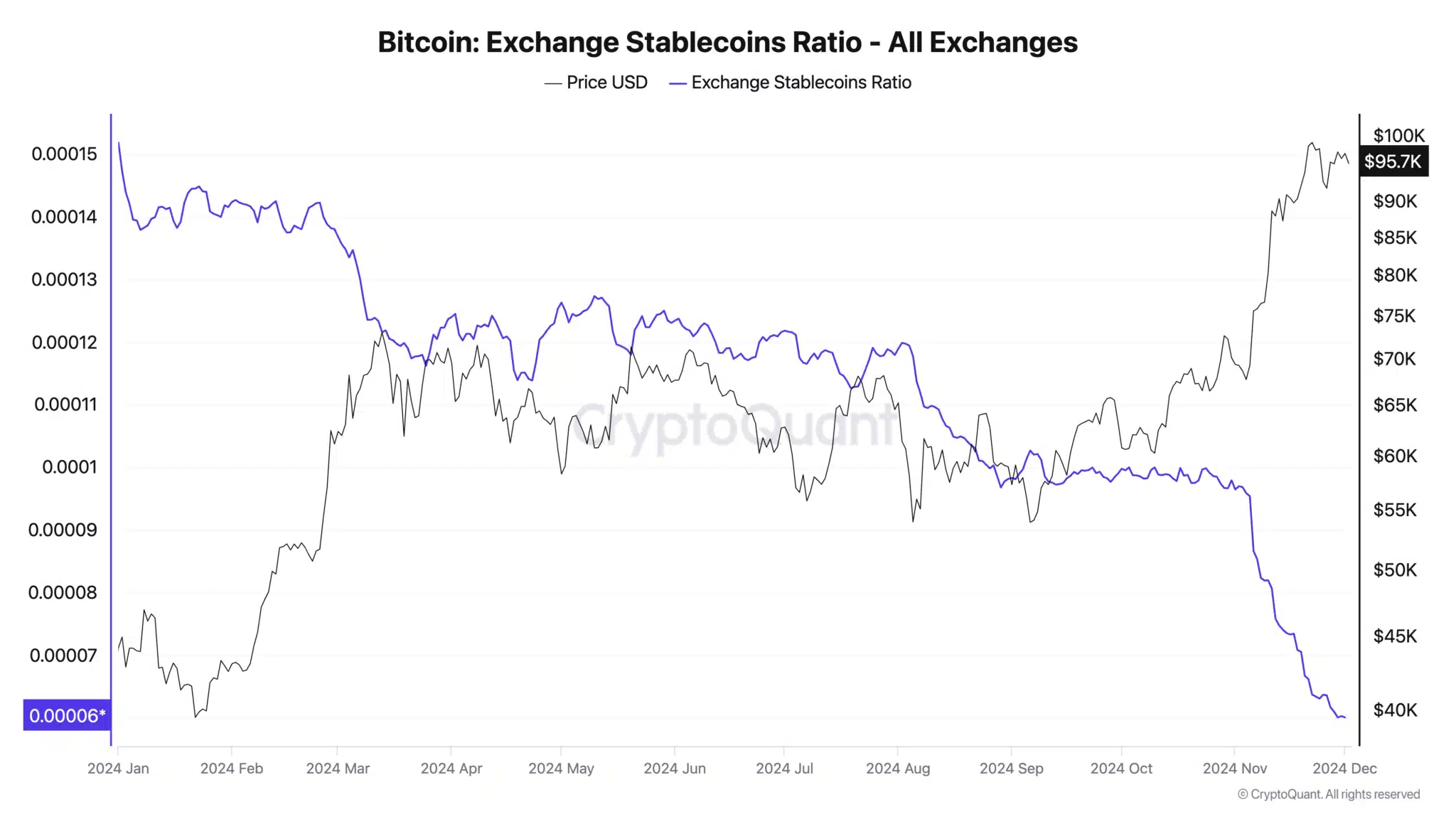

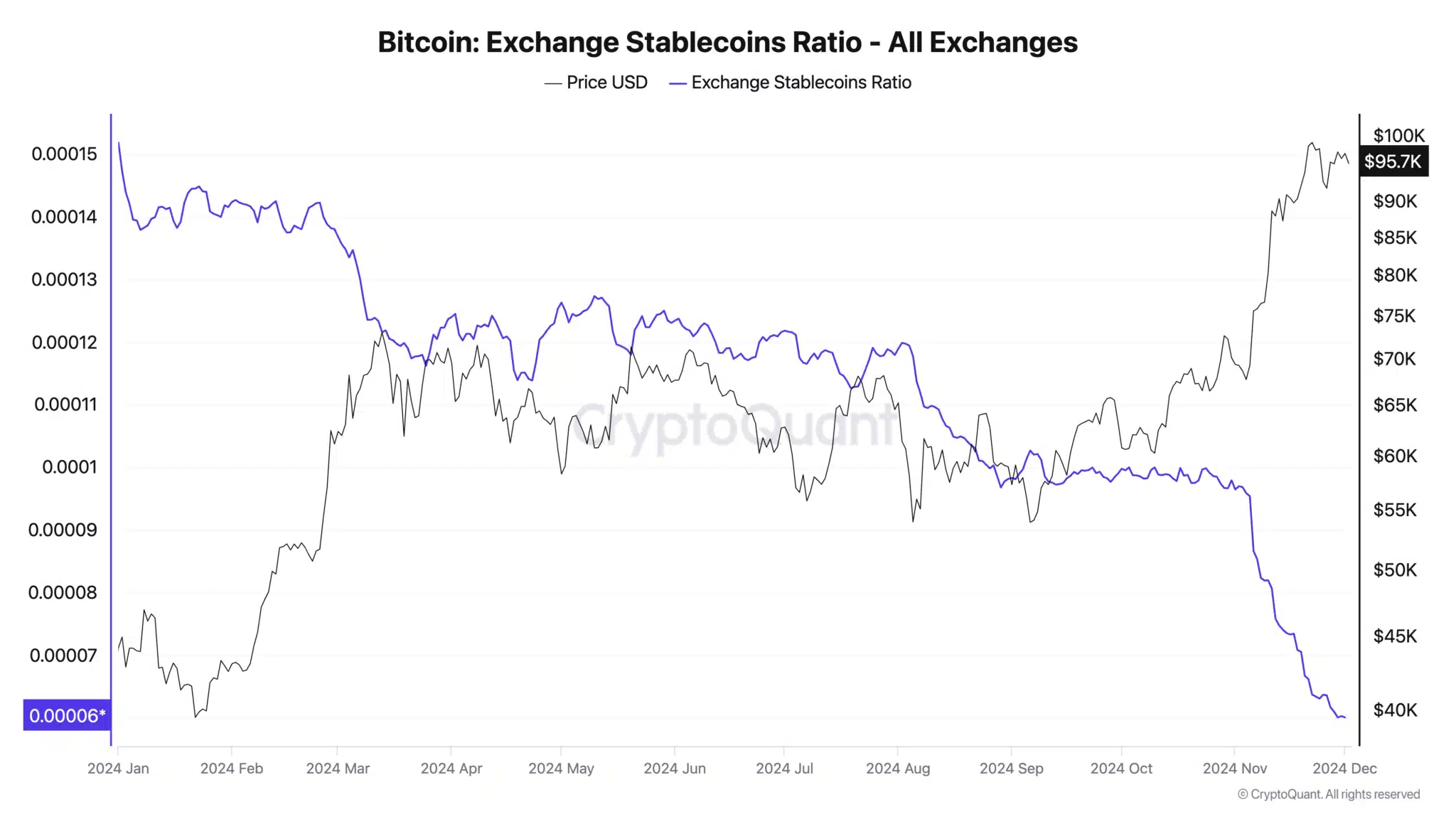

In particular, the Exchange Stablecoins Ratio has seen a sharp decline, indicating an increase in purchasing power on the exchanges. This shift in market dynamics has led to speculation that Bitcoin may be poised for a rally, possibly breaking the current price range and moving to new highs.

As the market braces for potential growth, investor sentiment is becoming increasingly optimistic.

A look at BTC’s performance

Bitcoin’s recent trading range reflects a consolidating market, with the price struggling to break the $98,804 resistance level while support remains above $94,603.

The daily RSI at 61.41 indicates moderate bullish momentum, although a clear breakout signal is missing. Notably, trading volumes have shown a small decline, indicating that the market is cautiously waiting for a decisive move.

Source: TradingView

OBV maintains an upward trajectory, underscoring continued buying pressure despite price stagnation. This difference between price and OBV indicates latent bullish potential.

Moreover, the decline in the Exchange Stablecoins Ratio reinforces this outlook, indicating a build-up of purchasing power on the exchanges.

A break of the resistance at $98,804 could catalyze momentum towards $100,000, but failure to maintain momentum risks a return to lower support levels.

Exchange stablecoins ratio and hodling impact

The Exchange Stablecoins Ratio, which now stands at 0.000060, the lowest level in 2024, underlines the significant purchasing power on the exchanges. This metric reflects the growing supply of stablecoins relative to Bitcoin, indicating that investors are well positioned to acquire BTC.

Historically, such conditions have preceded bullish price action as demand exceeds supply.

Source: CryptoQuant

Moreover, the increase in hodling behavior among Bitcoin holders is a notable factor in the short term. Data from CryptoQuant shows a 36% increase in their average holding period over the past month.

Source: Into The Block

This reduces direct sales pressure, promotes scarcity on the market and strengthens price stability.

Together, these dynamics – the low Exchange Stablecoins Ratio and increased confidence among holders – increase Bitcoin’s potential to break the $98,804 resistance, with $100,000 increasingly within reach.

What can you expect from Bitcoin?

At the time of writing, Bitcoin was trading at $95,323, slightly below the key resistance level of $98,804. The influx of stablecoins on exchanges, reflected in the low Exchange Stablecoins Ratio, indicates significant purchasing power that could drive demand.

If short-term holders maintain their ‘HODL’ strategy and investor sentiment remains bullish, Bitcoin could overcome this resistance and move closer to the psychological $100,000 mark.

Read Bitcoin’s [BTC] Price forecast 2024–2025

However, any increase in selling pressure could see BTC consolidate within its current range or return to the critical support level at $94,603 before attempting another breakout.

The trajectory of the market depends on whether demand maintains its momentum in the coming sessions.