- USDT coins have raised a total of $16 billion since Bitcoin’s peak of $74,000

- Whale activity increases as Bitcoin and USD liquidity move in correlation

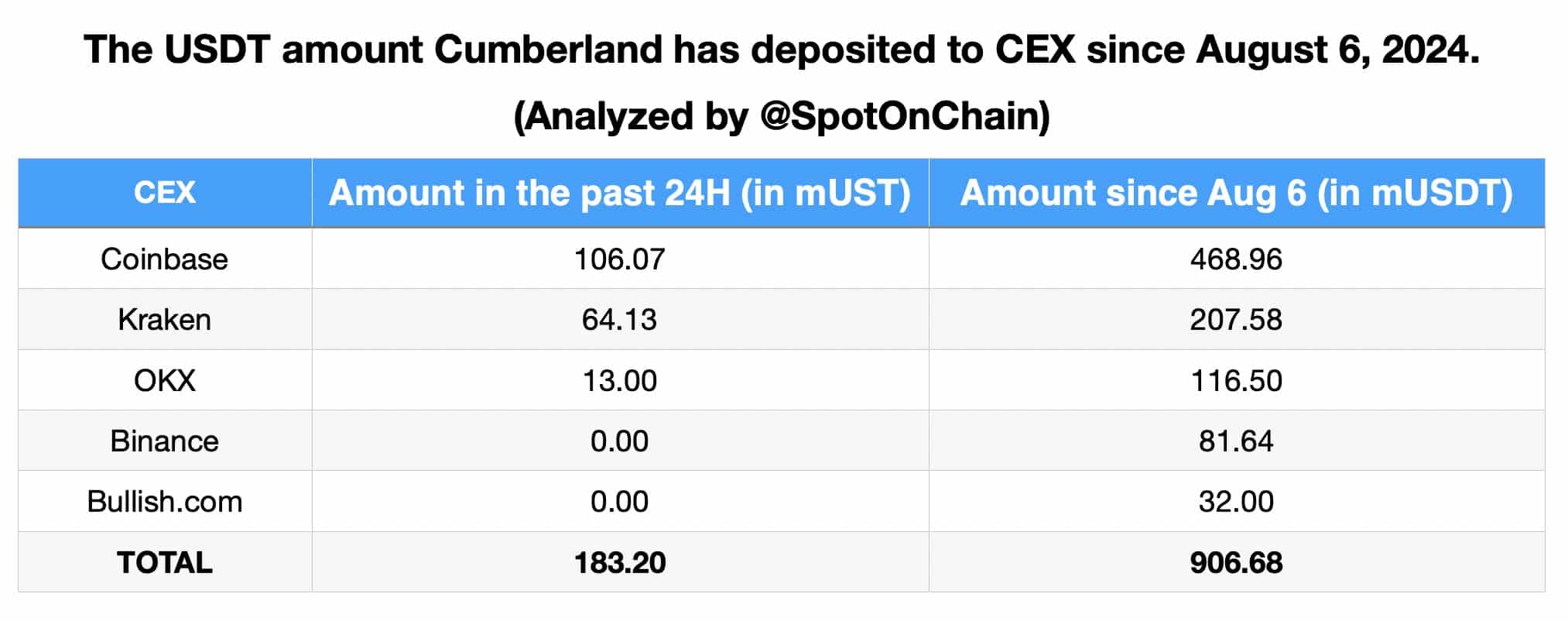

Tether Treasury minted 1 billion USDT on Ethereum and sent 183.2 million USDT to Cumberland for exchange deposits in the last 13 hours. SpotOnChain reports this observation on X.

Since the crypto market crash on August 5, Cumberland has received 953 million USDT from Tether and injected 906.7 million USDT into various exchanges. These include Coinbase, Kraken, OKX, Binance and Bullish.com.

Source: SpotOnChain

Additionally, Tether ($USDt) has been integrated into the TON blockchain, pushing USDT’s market capitalization to an all-time high of $115.6 billion.

Adding up Tether’s $1 billion mints for the day, at the time of writing, they totaled $16 billion since Bitcoin’s peak of $74,000.

As major financial players prepare to enter the market, they can use this liquidity to drive prices higher. This new Tether development is a sign of increased whale activity on centralized exchanges due to seamless transactions.

The continued coinage also coincides with recent market increases, supported by secure and efficient infrastructure such as MPC wallet providers, custodians and RPC solutions. Simply put, this all translates into greater activity on centralized exchanges.

So there is reason to expect that these coins and transfers will boost the momentum of the crypto market.

Source: TradingView

A walk with whale activities

However, after the minting and transferring activities, Whale “0xbe6” withdrew 935.1 WBTC ($55.6 million) from Binance at an average price of $59,451.

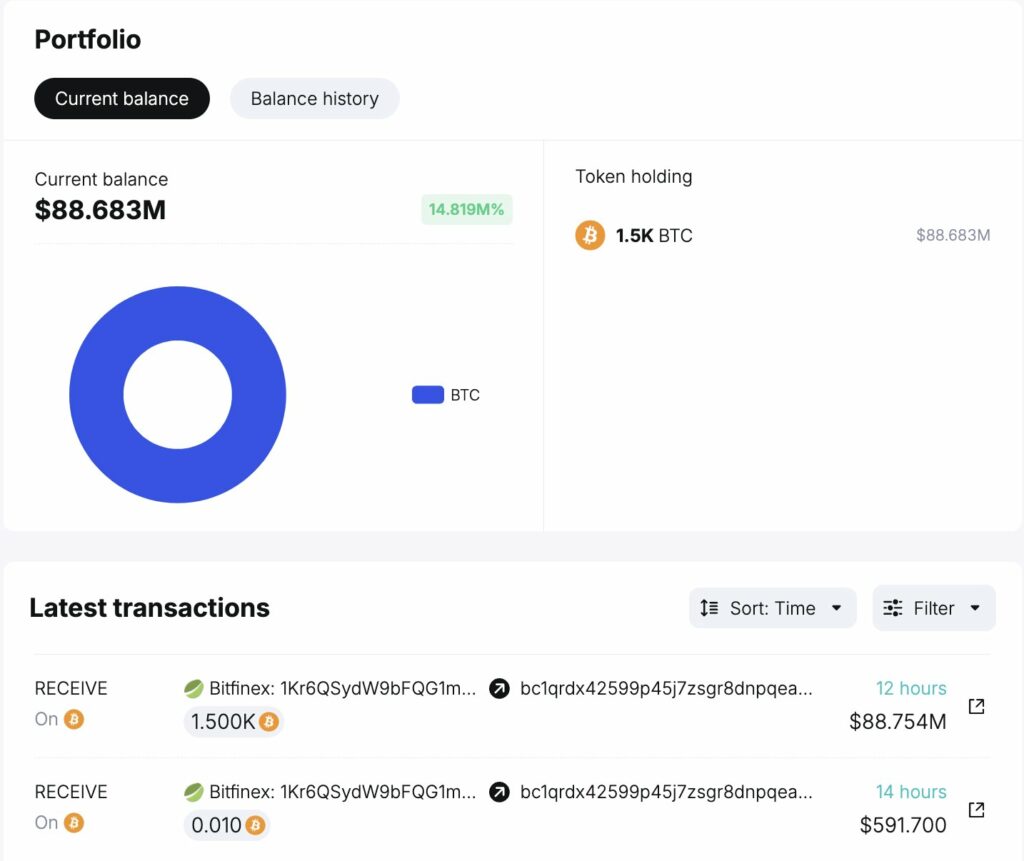

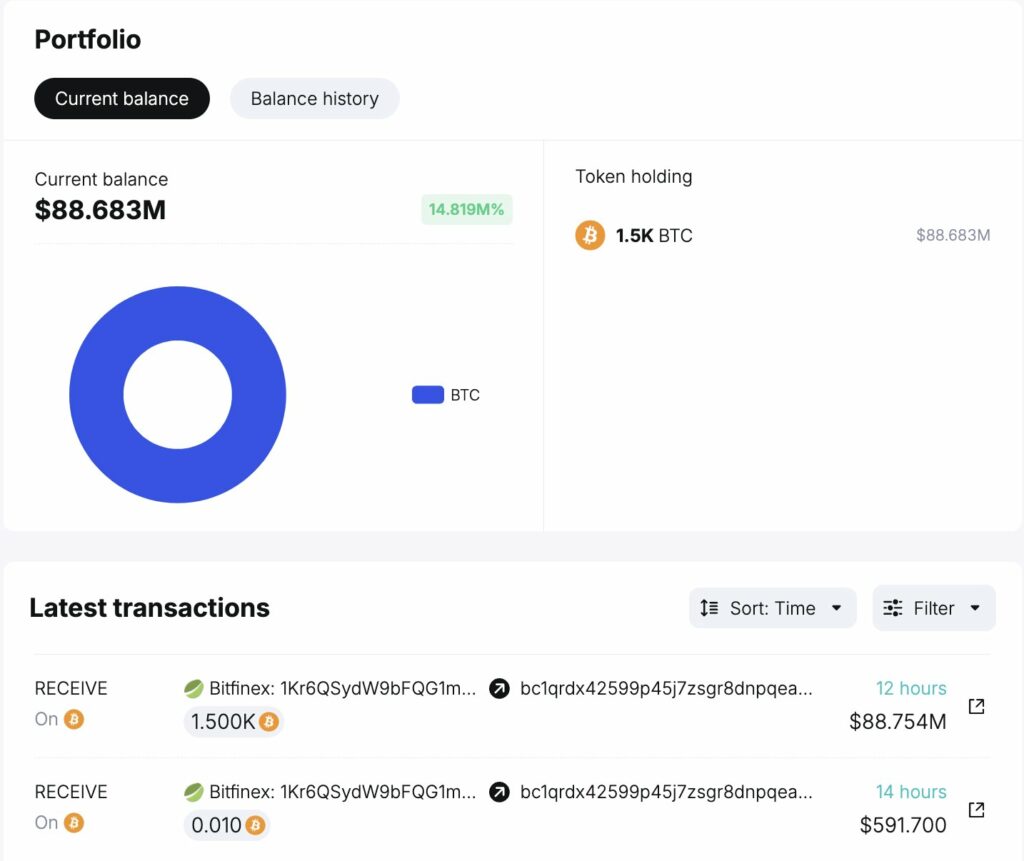

Similarly, a few hours later, another Whale “bc1qr” withdrew 1,500 BTC ($89.1 million) from Bitfinex at a price of $59,393.

These significant transactions from these two prominent whales were identified by data from SpotOnChain.

Source: SpotOnChain

Bitcoin and USD liquidity rhyme

Moreover, it is worth noting that Bitcoin and USD liquidity tend to move together. However, ETF flows pushed BTC higher this year despite low USD liquidity.

On the contrary, now USD liquidity is increasing in the charts. This could boost risky assets as the trend continues due to USDT issuance.

Source: TradingView

This newfound rhythm between BTC and USD liquidity will likely impact USDT. Especially since it has recently been released in larger quantities to centralized exchanges.