- Stablecoin inflows were not fully driven by the crypto market rally on June 21.

- Binance.US asked its users to convert their USD holdings into stablecoins.

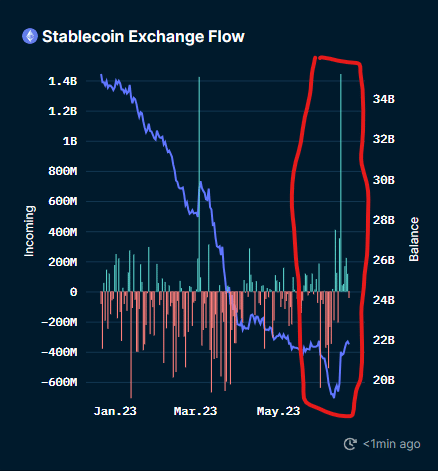

After witnessing a major exodus from centralized exchanges (CEXs) over the past month, stablecoins are making a comeback. According to a tweet from on-chain research firm Unlocks Calendarthe number of stablecoins being transferred to exchanges has increased significantly in recent days.

Source: unlocks calendar

Realistic or not, here is USDT’s market cap in terms of BTC

The demand for stablecoins is skyrocketing

A high inflow of stablecoins usually indicates buying pressure. This is simply because they remain the primary way for traders on non-fiat crypto exchanges to enter and exit trades. Most novice investors prefer to convert their fiat currencies to US dollar pegged stablecoins such as USD Coin [USDC]and Tether [USDT] before opening their positions.

The crypto market got a new life after bellwether Bitcoin [BTC] rose to 30,000, persuading many long-term investors to lock in profits after weeks of HODLing.

However, Glassnode revealed that the June 21 surge wasn’t the only cause of the surge. On the contrary, the offer has slowly expanded over a period of two weeks.

Source: Glassnode

Following legal action against crypto giant Binance by regulators, its US arm, Binance.US, suspended all forms of US dollar trading on the platform as part of its transition to a “crypto-only” platform. As a result, users converted their USD to stablecoins to continue trading on the platform.

And while withdrawals have been in USD enabled again on the platform, Binance.US warned its users that the relief would be temporary and asked them to convert their USD holdings into stablecoins.

USDT, USDC lead inflow

According to Glassnode, top stablecoins such as USDC and USDT saw their exchange supply increase significantly over the past week.

The share of USDT’s foreign exchange supply as a percentage of total circulating supply increased from 13.6% on June 14 to 14.5% at the time of writing. In addition, USDC’s share rose from 5.5% to 6.4%.

Source: Glassnode

The total stablecoin market cap has risen marginally in the past 24 hours to $128 billion at the time of writing, according to CoinMarketCap. USDT was the largest stablecoin with a market cap of over $83 billion.

The market cap of the second-ranked stablecoin, USDC, exceeded $28 billion.