Cardano (ADA), the blockchain platform known for its scalability and technological approach, has made significant strides in the crypto market, as highlighted by the recently released Messari report.

The report provides valuable insights into Cardano’s performance in the second quarter of 2023, cementing its position as a prominent player in the industry.

With a strong focus on fostering a robust ecosystem and pushing the boundaries of decentralized finance (DeFi) and non-fungible tokens (NFTs), Cardano is poised to reshape the blockchain technology landscape, Messari said.

Cardano TVL ranking skyrockets, climbing from 34th to 21st

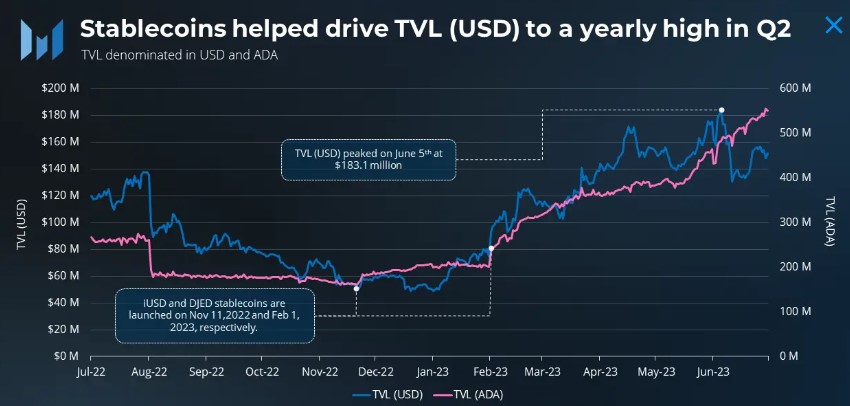

According to the report, Cardano experienced substantial growth in stablecoin value, up 34.9% quarter-on-quarter (QoQ) and significantly up 382.1% year-to-date (YTD).

Indigo Protocol emerged as a frontrunner in stablecoin and synthetic asset issuance, solidifying its dominance in the space. In addition, the Total Value Locked (TVL) witnessed a shift to newer projects as protocols created in the past six months accounted for 47.4% of TVL dominance in Q2.

USD TVL was up 9.7% QoQ and 198.6% YTD. Cardano’s TVL ranking climbed from 34th to 21st across all chains in 2023.

On the other hand, average daily transactions using decentralized applications (dapp) on Cardano increased by 49% quarter on quarter, marking the third consecutive quarterly increase. In addition, Minswap, an automated market maker (AMM), showed the largest absolute growth in transaction volume.

However, several new dapps have also contributed to the overall increase. Minswap’s popularity skyrocketed in the second quarter, surpassing the leading NFT marketplace jpg.store in terms of dapp transactions.

This trend coincided with the industry shift as DeFi activity gained momentum while NFT activity declined. The overall increase in dapp transactions reached a substantial 49.0% quarter on quarter, averaging 57,900 daily transactions.

Q2 NFT stats reflect market correction

According to Messari, the NFT metrics experienced a decline in the second quarter. Average daily NFT trades fell 35.7% quarter on quarter to 2,900, while total quarterly trading volume fell 41.9% quarter on quarter to $46.2 million.

This downward trend was in line with the broader market, as even rock bottom prices for blue-chip collection fell in 2023.

In particular, NFT sales volume remained mainly concentrated in jpg.store, which dominated the market with a market share of 98%. Nevertheless, unique buyers continued to drive NFT activity, with a relatively small number of sellers targeting this larger group of buyers.

Messari further emphasizes that Cardano’s ecosystem expanded across multiple sectors, especially DeFi. Protocols for swaps, stablecoins, synthetic coins and uniquely Cardano-centric services such as staking power lending have emerged alongside incumbents.

Cardano’s second quarter showed substantial growth and diversification across several industries, including DeFi, NFTs, and Layer-2 solutions.

The key metrics revealed an increase in stablecoin value, a shift in TVL dominance to newer projects, and an impressive increase in average daily dapp transactions.

While the NFT metrics declined, the ecosystem showed resilience and competition between protocols.

In contrast, Cardano’s native token, ADA, has been down since April 15 in line with the broader market trend, after hitting its annual high of $0.4620.

ADA is trading at $0.2933, reflecting a 1.4% decline in the past 24 hours. In the past fourteen days, it is down almost 6%.

Featured image from iStock, chart from TradingView.com