- Solana recorded a massive increase in stablecoin inflows.

- There was a potential 10% gain on the line as SOL consolidated around the 50-day SMA.

Solana [SOL] has recorded a massive influx of stablecoins, leading market observers to suggest, based on historical data, that SOL could soon become a success.

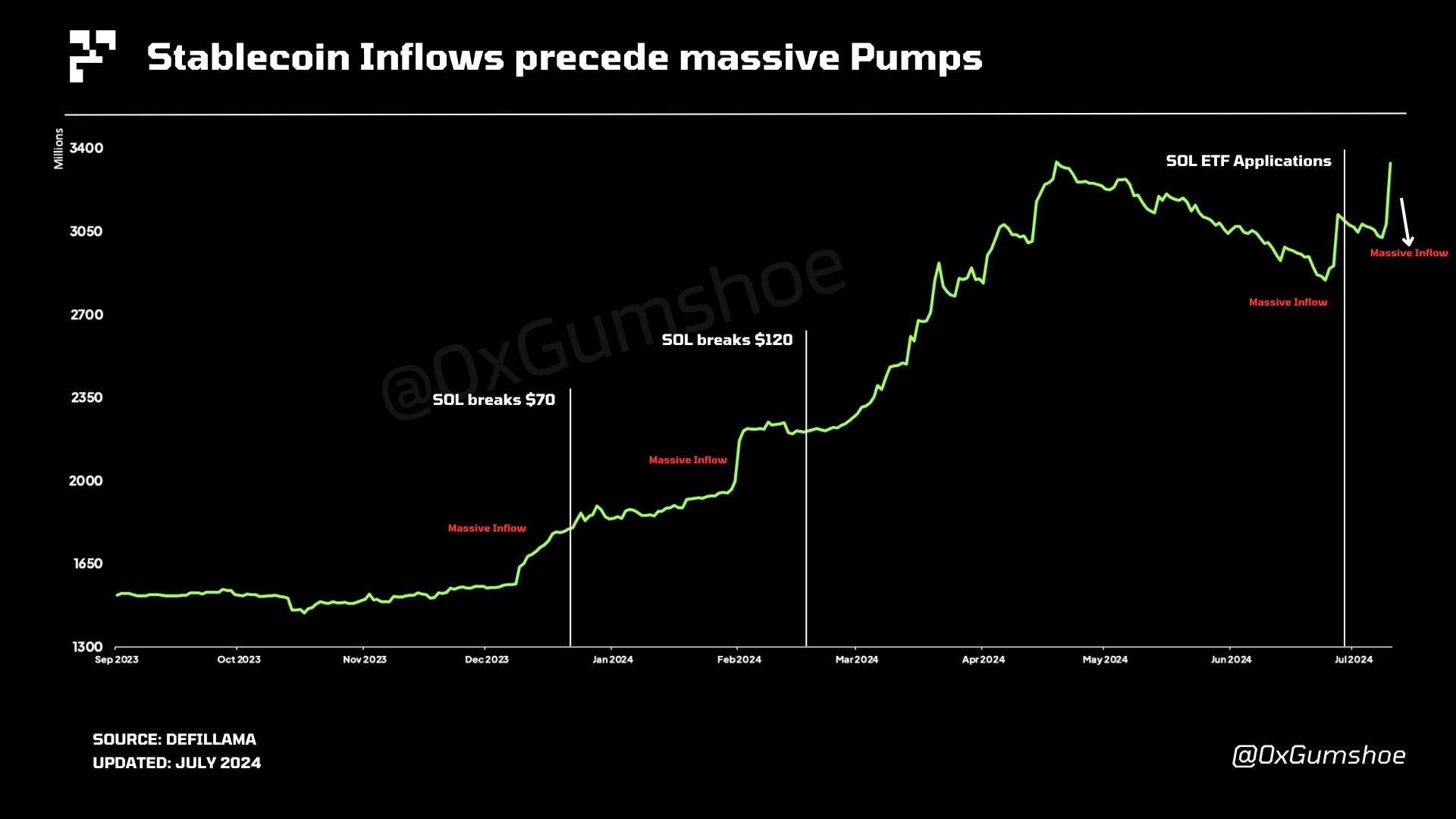

According to a pseudonymous market observer Gumshoethe recent surge in stablecoin inflows was setting the stage for a possible SOL rally.

“SOL pumped hard the last three times we had a SUDDEN increase in the number of stablecoins. The last time this happened, we had a SOL ETF application hours later’

Additionally, the analyst suggested that this could be inside information for an upcoming update that could impact SOL’s price.

Source: X/Gumshoe

According to Gumshoe, SOL’s move above the $70 and $120 levels occurred after massive stablecoin inflows. The last increase occurred on July 9, with a value of more than $260 million, per DeFiLlama facts.

It’s worth noting that the day coincided with CBOE’s (Chicago Board of Options Exchange) confirmation of the VanEck and 21Shares SOL ETF plans on the exchange.

Apart from the Solana ETF speculations, the network has recently reached a testnet milestone for its third validator client, Firedancer, which is touted as a game changer for the ecosystem.

Thus, the confirmation of the SOL ETF by the CBOE and Firedancer update could be a major catalyst for SOL’s FOMO and could explain the stablecoin’s rise.

However, was there any change in SOL’s market structure on the price chart?

SOL’s price action

Source: SOL/USDT, TradingView

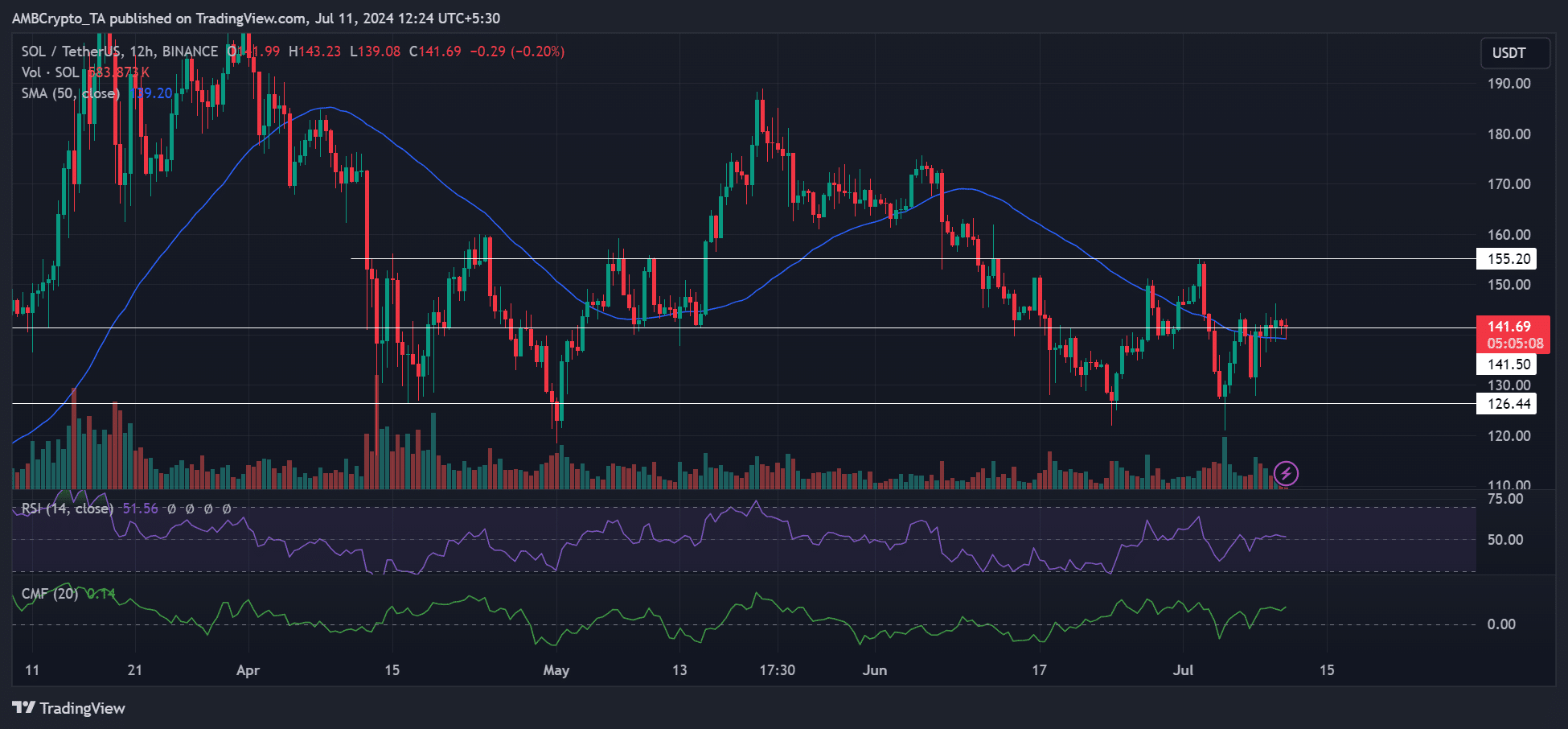

On July 9, SOL made limited gains of around 1% while consolidating around $141, a key resistance level. Interestingly, the 50-day SMA (Simple Moving Average) was also at resistance levels.

A rise in the CMF (Chaikin Money Flow) confirmed the massive inflows, which could be read as investors’ risk-off approach to SOL. This meant that SOL could consolidate around the 50-day SMA and target $155, which would be a potential gain of 10%.

However, the RSI (Relative Strength Index) was flat at the neutral level, meaning there was no strong buying pressure to drive SOL forward.

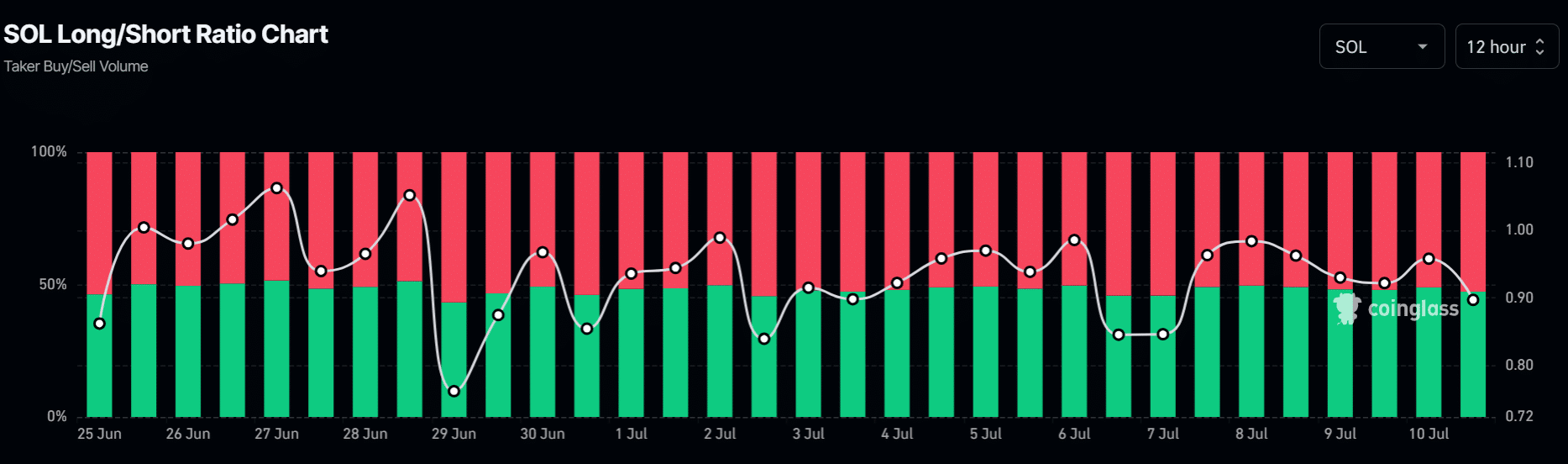

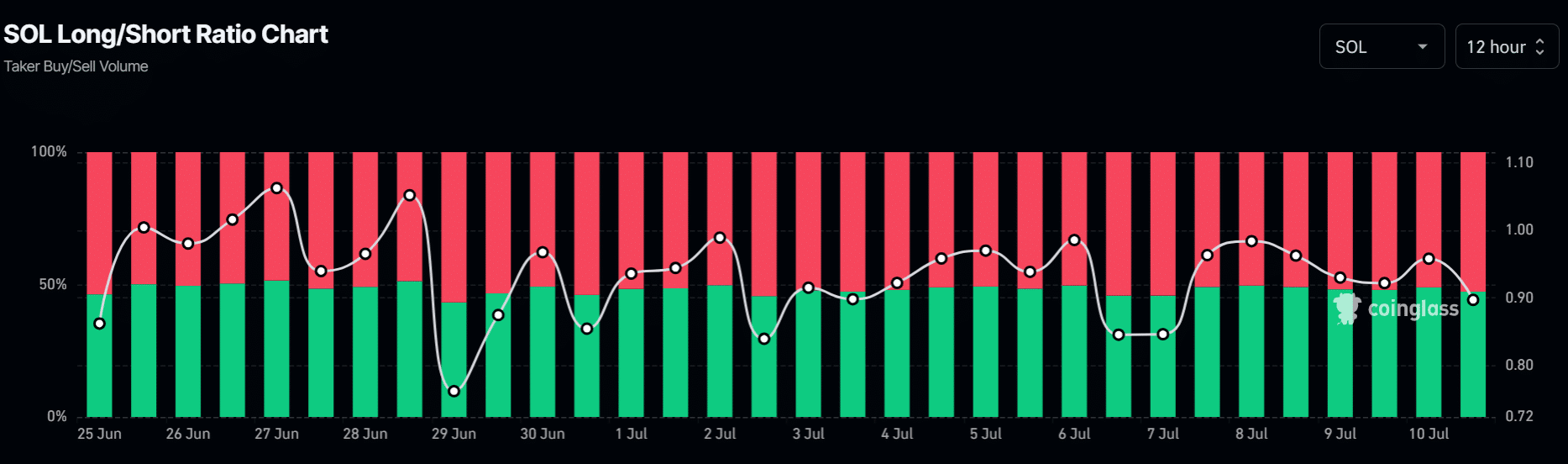

Furthermore, the percentage of traders who are long SOL has fallen since July 8 from 49.6% to 47% at the time of writing. This meant that recovery from SOL could be delayed unless Bitcoin [BTC] recent losses reversed.

Source: Coinglass

However, another market observerbased on historical patterns, projected that SOL could reach $2800 in the long run.