- Solana is showing a solid recovery as the market bottoms out from the last crash.

- The robust activity in the chain is making a comeback and paints a clear picture of market confidence.

Solana’s SOL is perhaps the golden goose of the top cryptocurrencies by market cap. The rapid rise since October last year attracted many investors and traders.

Every dip that has occurred since then has been followed by a rapid recovery.

Can SOL keep the same status after the last crash? The answer to that question can come down to one word. Attention. SOL was one of the few top coins that staged a rally similar to what we saw in previous bull runs.

Much of SOL’s success was due to the Solana blockchain managing to hijack the memecoin narrative. The latter played to the network’s advantage this year, boosting demand for SOL.

The recent market crash threatens to trigger a shift in demand dynamics. The threat of the bullish phase being curtailed could introduce a more cautious approach, hence a shift in focus on memecoins.

Should you sell your SOL?

While the end of the memecoin hype is real, SOL’s price action may indicate something else. The cryptocurrency fell as much as 42% from its July low to the bottom of the recent FUD-filled retracement.

However, it bounced back as strong as it fell.

The dip caused SOL to drop to $110 on August 5. It was exchanging hands at $139.87 at the time of writing, thanks to a 26% recovery.

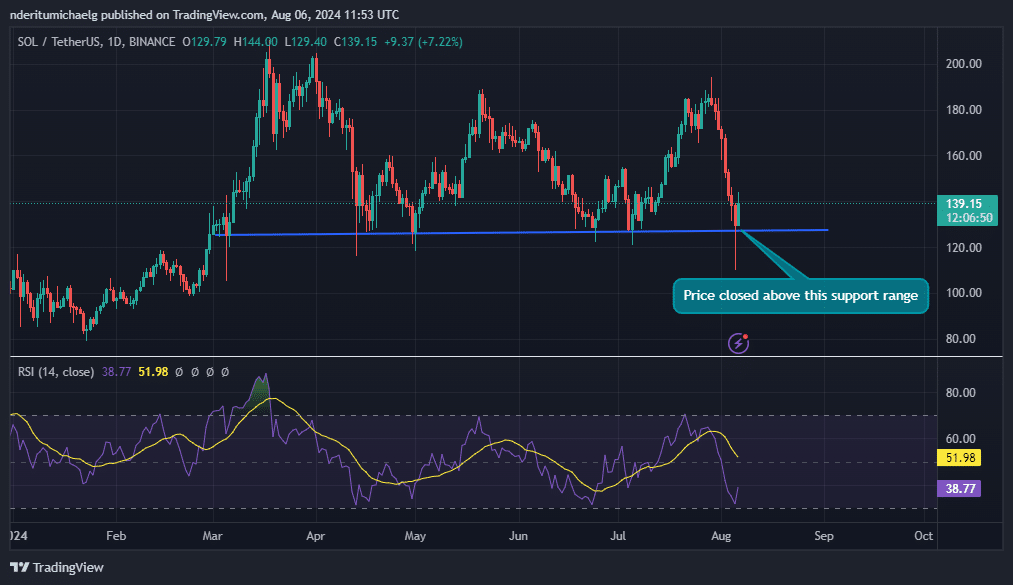

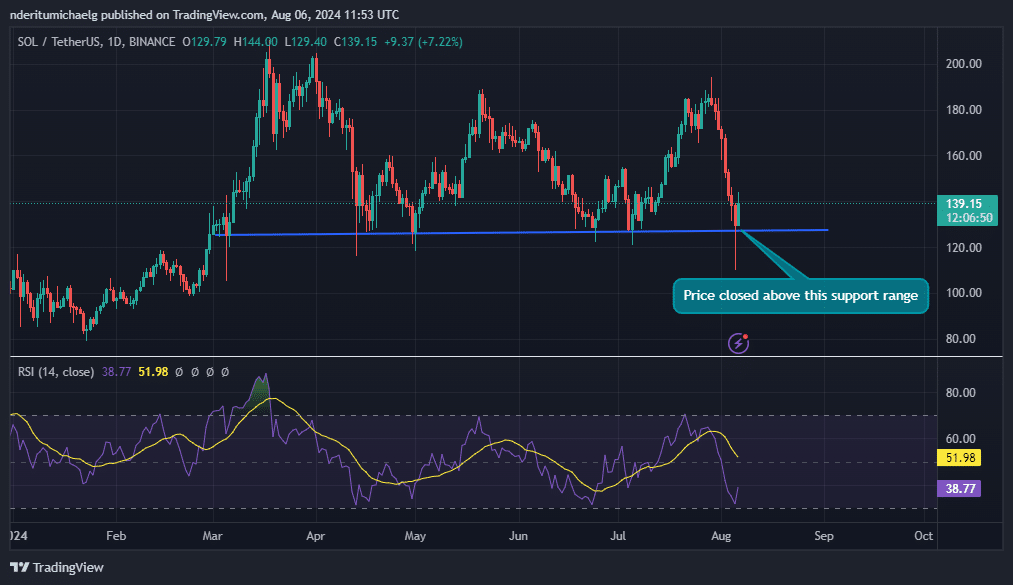

Source: TradingView

It is also worth noting that despite the selling pressure, the price still closed above a key support level in the $126 price range. A bold statement indicating what the market currently considers SOL’s lowest range.

The state of investor confidence in Solana

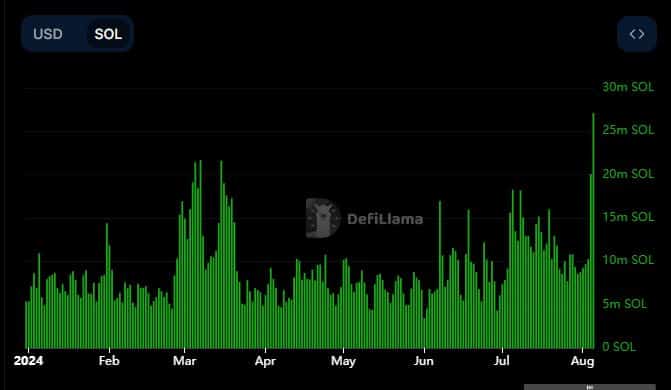

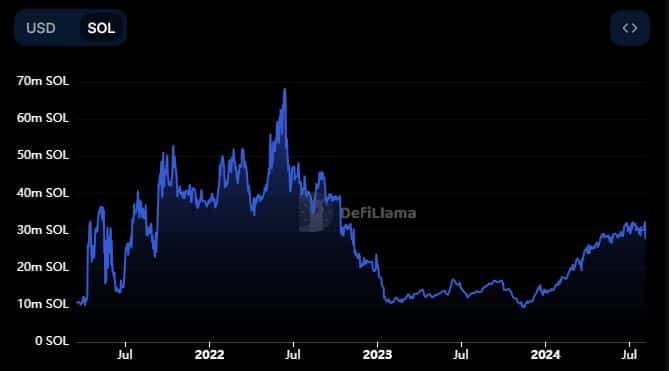

Our last assessment of the Solana ecosystem found that it experienced the highest daily volume spike on the chain on August 5.

The same day it rested on the bottom and bounced back. Volume peaked at $27.11 SOL, the second highest daily volume figure in the past two years.

Source: DeFiLlama

While some of the volume may reflect demand for SOL, it may also have had something to do with network activity related to demand for other assets within the network.

The lower SOL value provided an opportunity to buy other SOL-denominated assets at discounts. This idea is supported by one of the latest announcements from the Solana ecosystem.

This announcement further supports the recovery of demand within the Solana ecosystem. This could reignite the strong ecosystem-driven demand we mentioned earlier that was responsible for SOL’s rapid recovery.

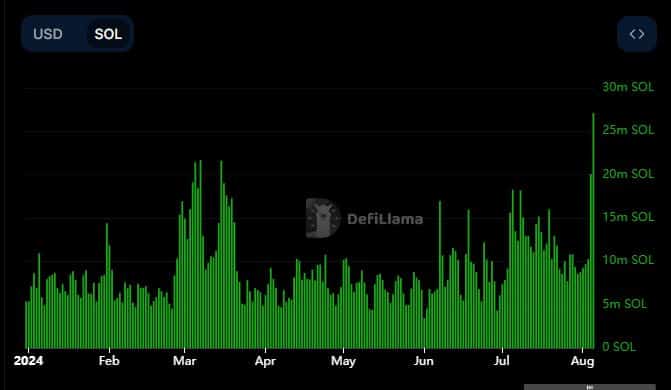

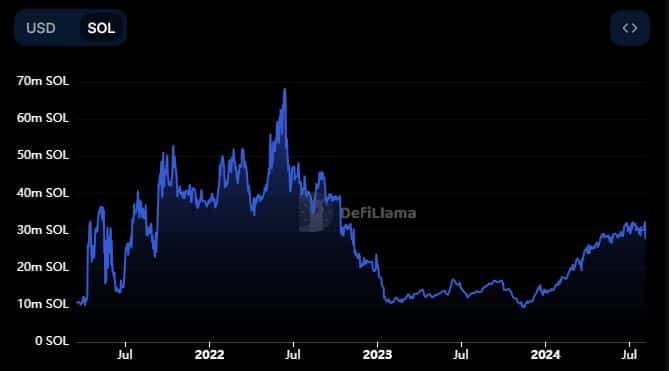

Solana’s TVL also seems to have held up quite well in terms of confidence. The TVL decreased by approximately 4.76 million SOL on August 5.

Equal to approximately $614.7 million. A relatively small dip compared to the billions in TVL outflows we observed in Ethereum.

Source: DeFiLlama

Realistic or not, here is SOL’s market cap in terms of BTC

These combined data points indicated that the Solana ecosystem weathered the storm quite well. User confidence seems intact so far, which may still make SOL more attractive to investors.

Nevertheless, the sector could still be susceptible to a potential support break if more selling pressure arises.