Ethena Labs, the team behind the USDe stablecoin, is in the news today integration with Solana’s blockchain on August 7. This strategic move allows USDe to leverage Solana’s fast and cheap infrastructure, significantly expanding the stablecoin’s capabilities.

That’s not all, as Solana’s native token, SOL, will now be used as a backing asset for USDe, pending approval by governance proposals.

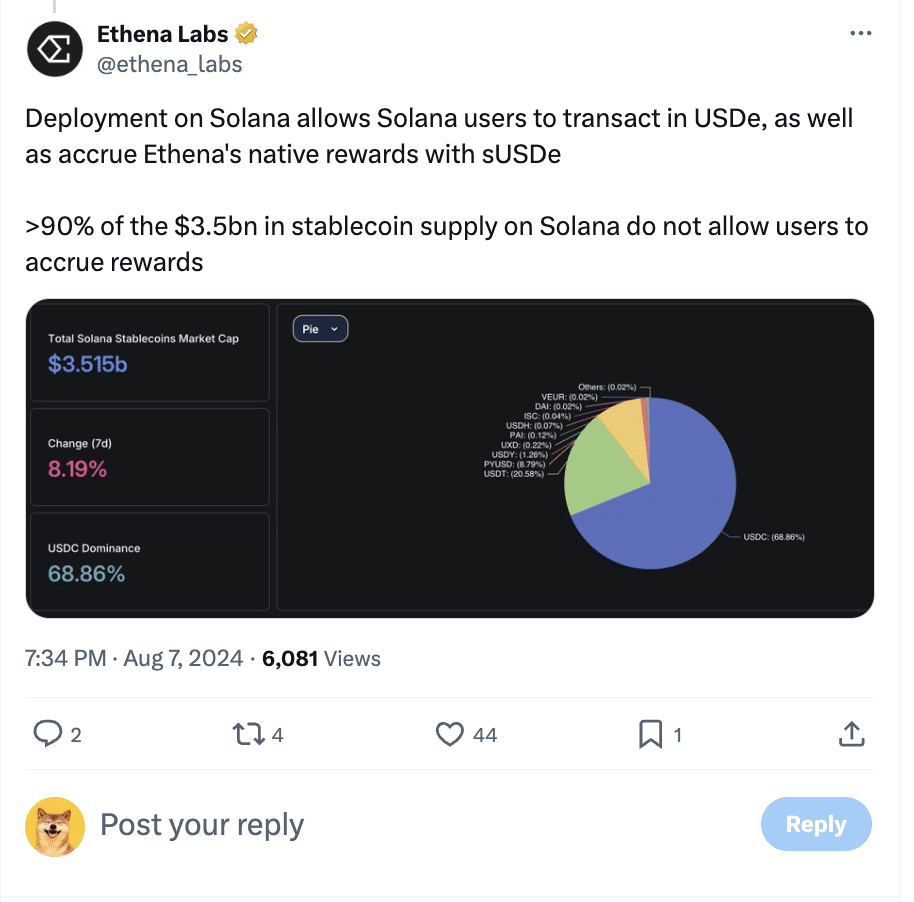

Source: X

According to the DeFi project

“The inclusion of SOL as a backing asset is expected to release an additional $2-$3 billion in open interest.”

This increase in scalability is crucial for the stablecoin market as it provides greater liquidity and stability, making USDe a more robust and reliable option for users.

USDe’s integration with Solana also means that it can now be used on various decentralized finance (DeFi) applications on the Solana network. These include Kamino Finance, Orca, Drift and Jito. Users can provide liquidity to these platforms or use USDe as collateral for margin trades.

By doing this they can earn Ethena Sats, which can be converted into ENA tokens at the end of each campaign. This functionality provides users with more ways to interact with the DeFi ecosystem, increasing their earning potential and participation in the growing DeFi market.

What does this mean for DeFi?

Kamino Finance, for example, is a platform that allows users to automate their DeFi strategies, making it easier for them to optimize their returns. Orca is a decentralized exchange that offers a user-friendly interface and efficient trading options.

On the contrary, Drift offers a decentralized trading platform for derivatives, while Jito focuses on providing advanced trading tools and analytics.

The inclusion of USDe in these platforms will provide users with more robust and diverse options to use their stablecoins in the DeFi space.

The integration of USDe with Solana marks a major milestone for Ethena Labs and the stablecoin market. By leveraging Solana’s capabilities, USDe aims to provide its users with a more scalable, efficient, and versatile stablecoin solution.

The additional liquidity and supporting assets will increase the stability and usefulness of USDe, making it an attractive option for users looking to run DeFi applications on Solana.