- Solana’s stock is up 8% after retesting the bullish pennant support

- Positive funding rates and higher volumes could support potential upside

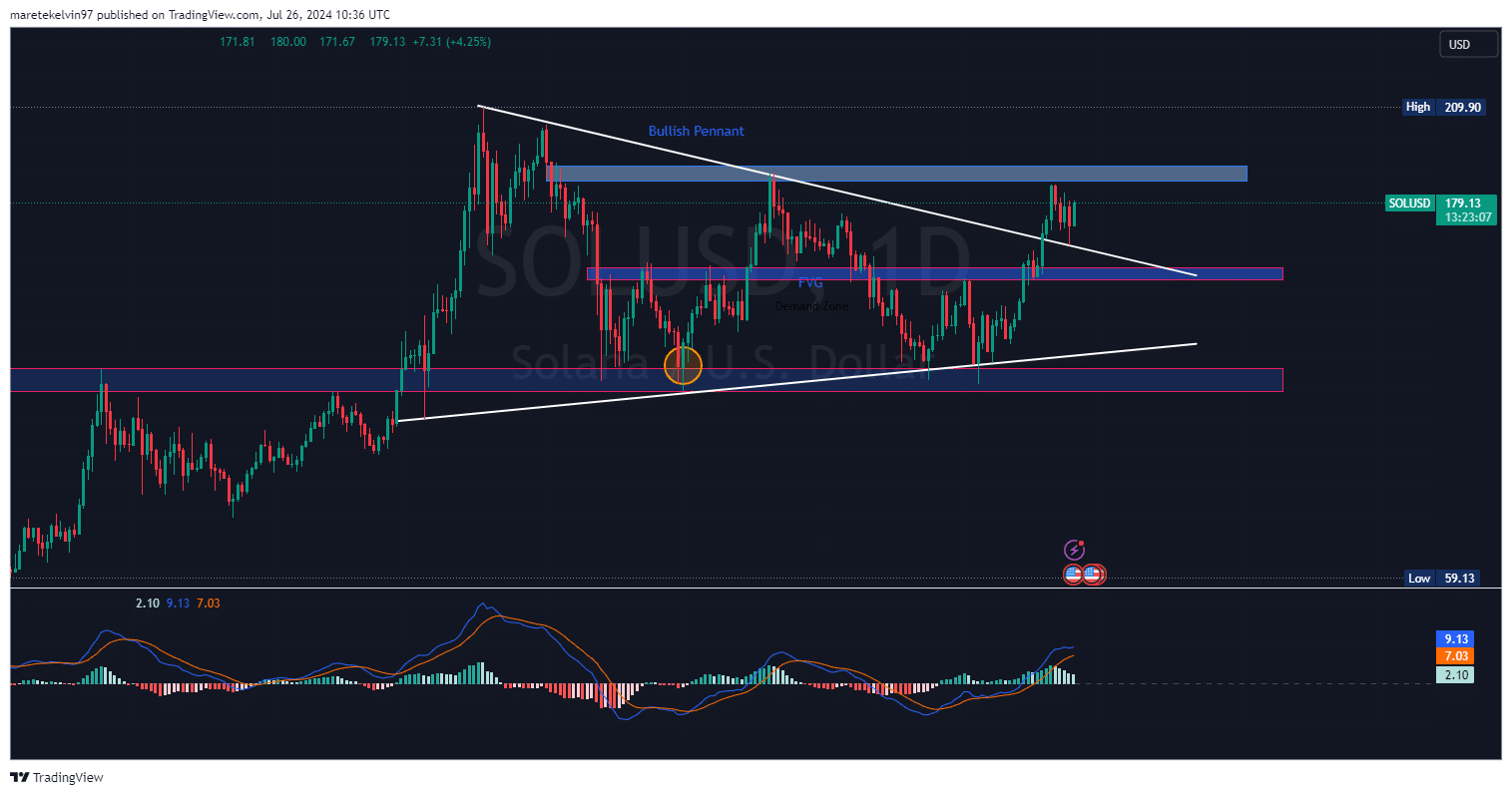

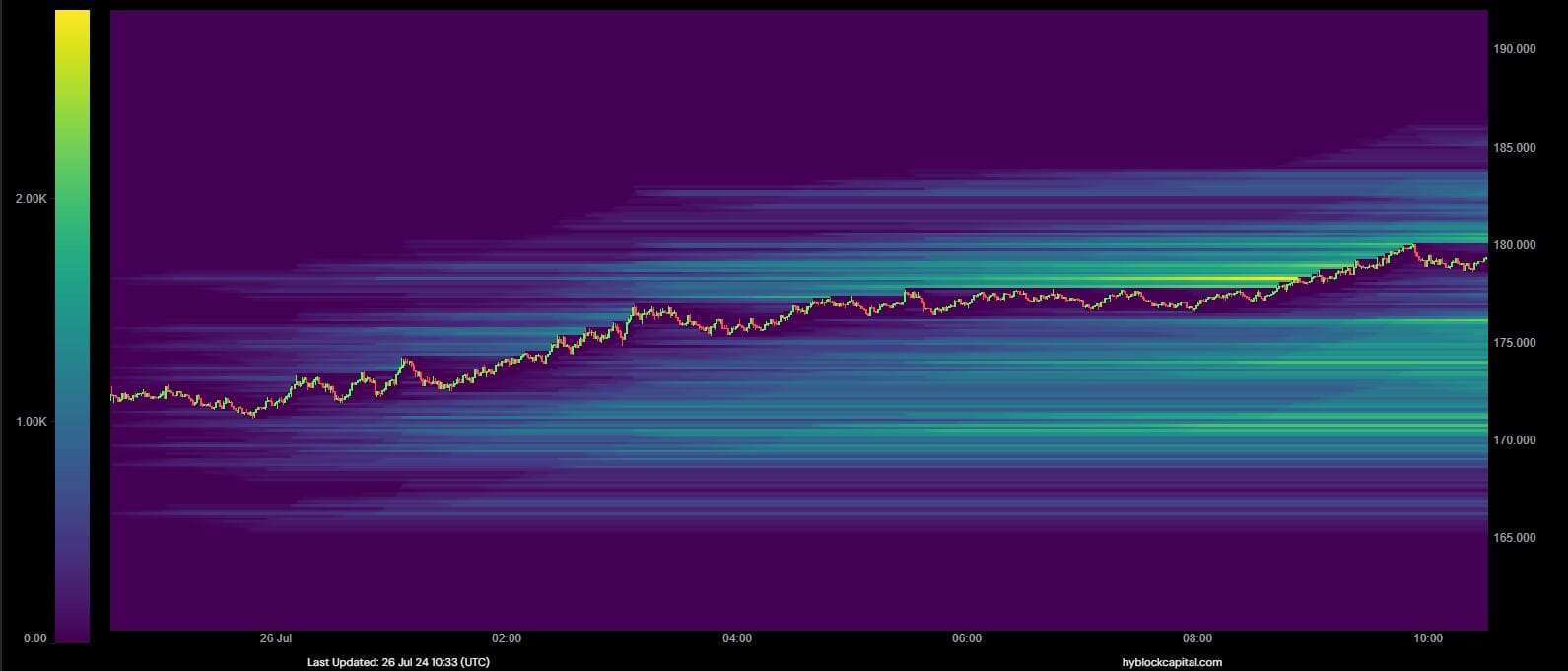

Solana is up 8% since retesting the key support level at $166. The coin consolidated within a bullish pennant pattern before managing to break out past the pattern resistance level on July 19. SOL then retreated to its key level just after breaking out of the bullish pennant resistance zone.

At the time of writing, Solana appeared to be building bullish momentum as it prepared for a rally to the next resistance level at $190. If the bullish pressure is enough, SOL could rise further past these key levels.

Source: TradingView

What do the statistics say?

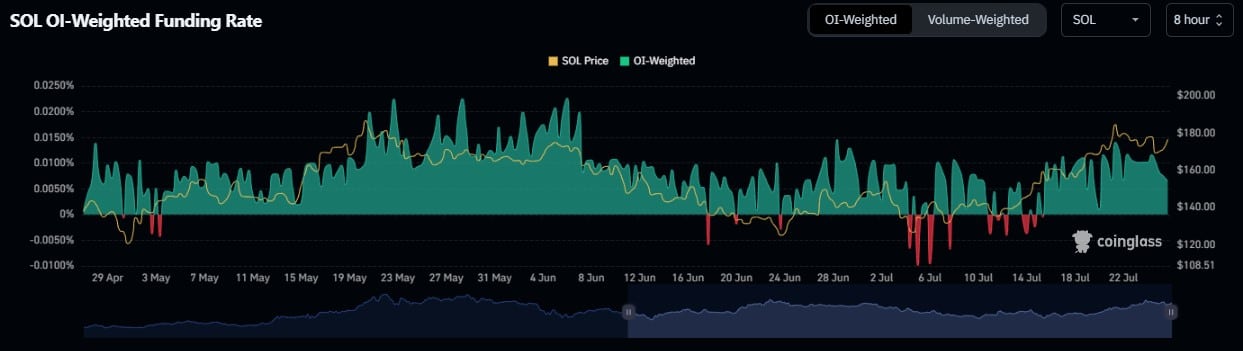

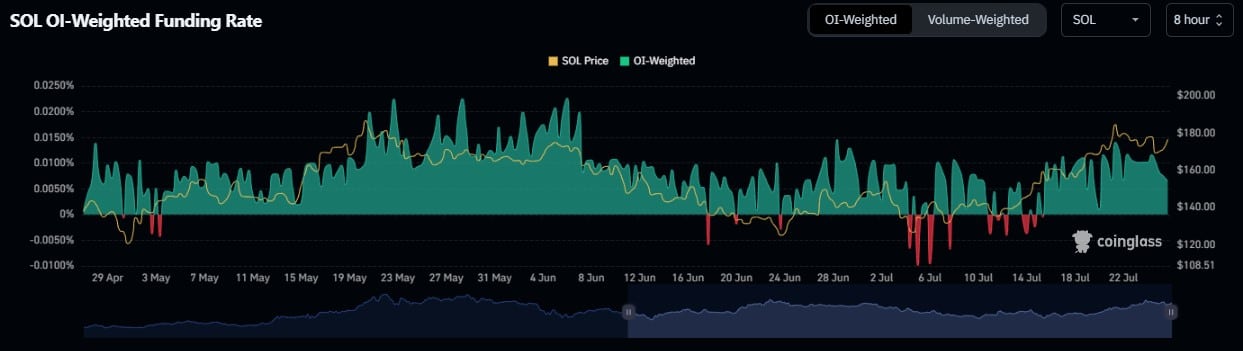

According to Coinglass’ OI-weighted funding rate data, there has been significant volatility in Solana’s funding rate in recent weeks.

Recent data even indicated a slight positive distortion in financing. This can be interpreted as growing bullish sentiment among investors in the market.

Source: Coinglass

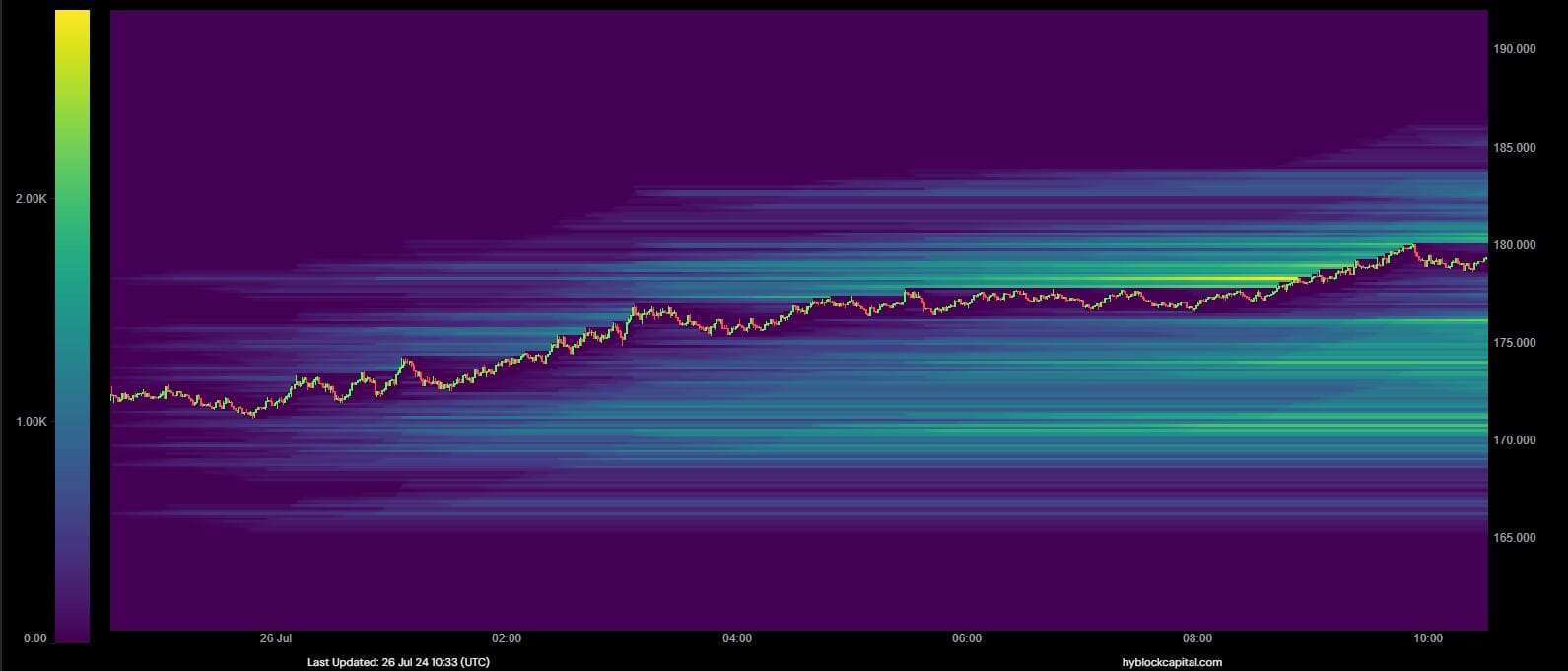

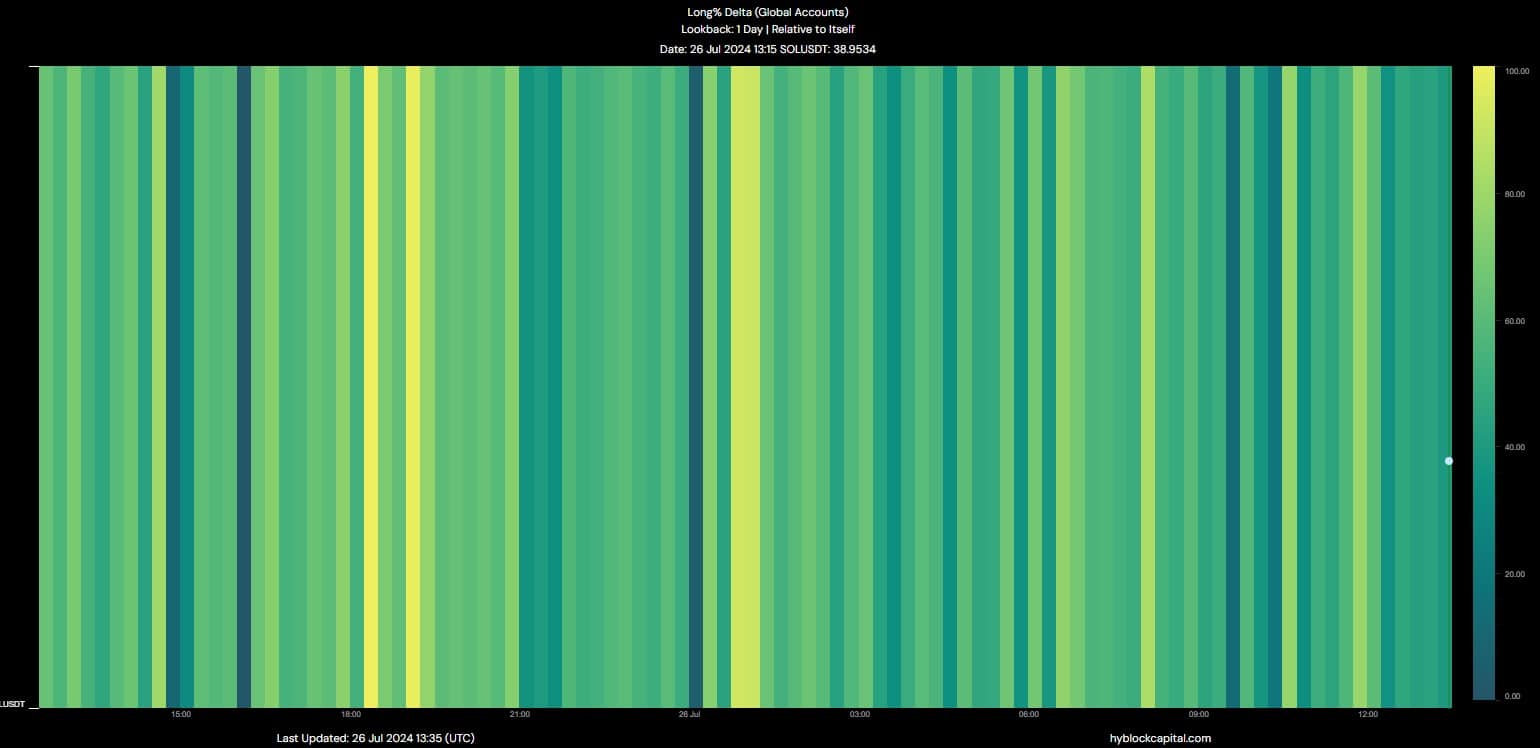

Based on the aforementioned Open Interest, AMBCrypto further analyzed the liquidity data to assess the direction of the market.

The data showed an accumulated liquidity pool just above the trading price – a sign that the market had a bullish bias, one that could act as a price magnet for further price increases.

Source: Hyblock Capital

Now Solana was also the talk of the town last week. Currently, it ranks third in terms of potential spot ETF approval. It has also gained more social mentions on various social media platforms. These mentions could precede a possible bull run that may be on the horizon.

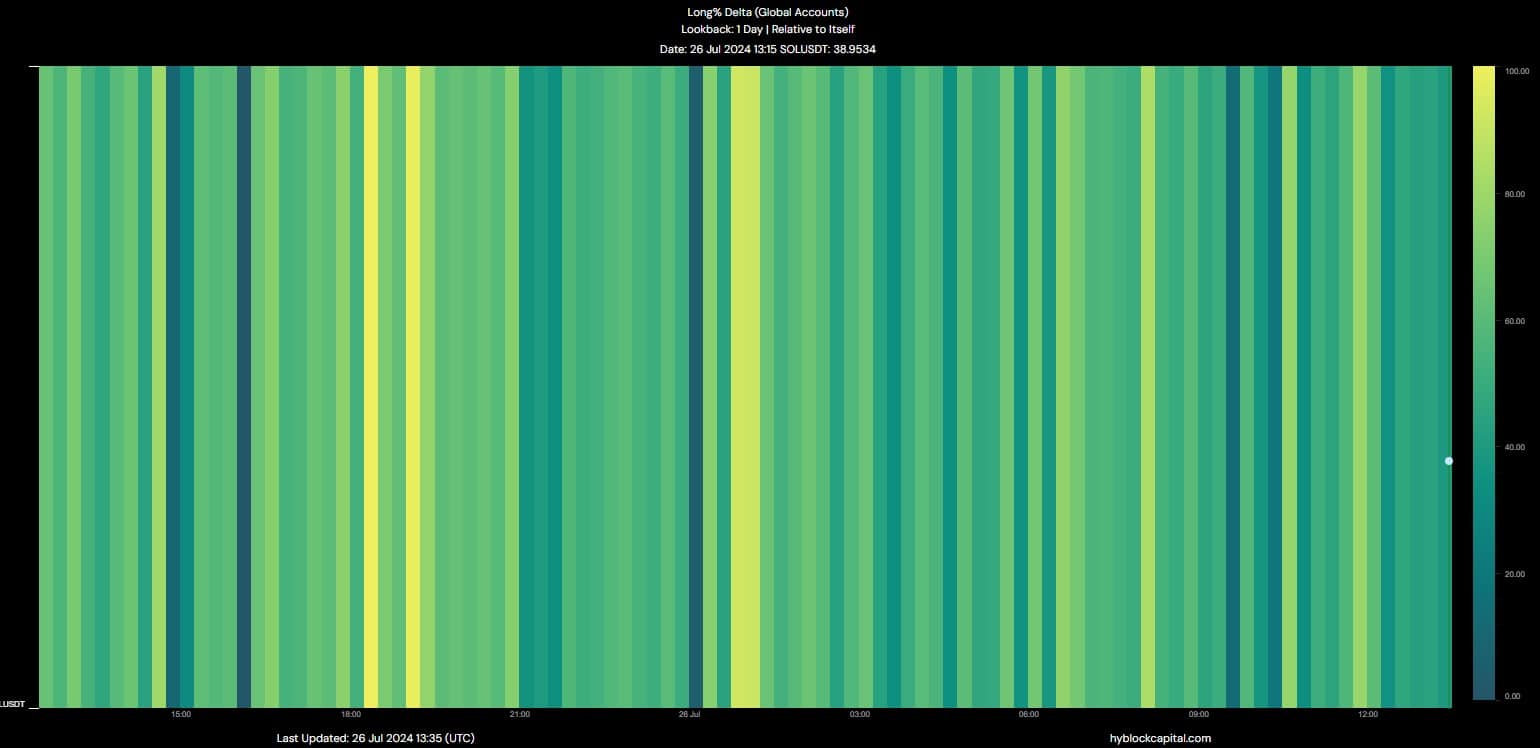

Additionally, delta data for global accounts gave us more information about Solana’s market dynamics.

AMBCrypto’s analysis of Hyblock’s long delta data indicated spiking longs. At the time of writing, the delta stood at 38.95. This accumulation of long positions can therefore lead to a potential price rally on the charts.

Source: Hyblock Capital

What next for Solana?

The altcoin’s price action confirmed the market trajectory, as a breakout from a bullish pattern often presides over a potential bullish continuation.

However, with increased volatility, price corrections that break below this could indicate bearish pressure.