- The Solana/Ethereum ratio returned to pre-FTX collapse levels in 2022.

- Despite the sideways market movement, coin accumulation continued to flourish.

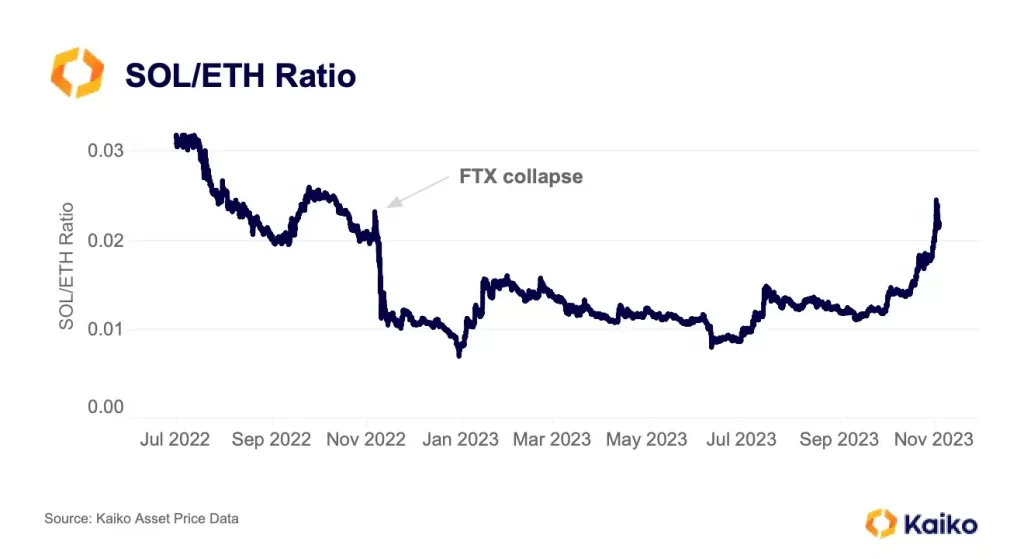

The Solana [SOL] to Ethereum [ETH] The ratio has risen steadily since September and has returned to levels seen before the collapse of crypto exchange FTX in November 2022, Kaiko Research found in a new report.

This ratio is a measure of SOL’s performance against ETH. It is calculated by dividing the price of SOL by the price of ETH.

An increasing SOL/ETH ratio indicates that SOL is outperforming ETH, while a decreasing SOL/ETH ratio indicates that SOL is underperforming ETH.

According to the on-chain data provider:

“Since September, SOL has been the clear outperformer, with the ratio between the two jumping from 0.011 to almost 0.025, breaking the ratio seen just before FTX’s collapse.”

Source: Kaiko Research

SOL and its success story

At the time of writing, SOL was trading at $41.47, according to data from CoinMarketCap. Since September 1, the value of the altcoin has increased by more than 100%. At press time price, the coin was exchanging hands at a price level last recorded in August 2022.

Source: CoinMarketCap

Although SOL has fluctuated within a tight range in recent days, bulls continued to control the spot market at time of publication.

An Average Directional Index (ADX) reading of 68.47 at the time of writing suggested that SOL’s current uptrend was strong. Typically, ADX values above 50 indicate that the market trend is robust and lasting over a period of time.

Because the positive directional index (green) was above the negative directional index (red), buying momentum exceeded SOL’s distribution. This, combined with an ADX value of 68.47, indicated that the bears would find it difficult to displace the bulls in the short term.

Furthermore, key momentum indicators were seen trading above their respective highs at the time of writing. For example, SOL’s Relative Strength Index (MFI) and Money Flow Index (MFI) stood at 73.75 and 57.95 respectively.

Realistic or not, here is the market cap of SOL in ETH terms

This indicated that despite price consolidation in recent days, buying activity among spot market participants continued to outpace selling activity.

Source: SOL/USDT on TradingView

Furthermore, SOL’s Open Interest has been steadily increasing since October 14. Valued at $514 million at the time of writing, it has risen more than 80% since then. The OI was at an end according to the highest level since March Mint glass.

Source: Coinglass