In the midst of the Bearish Market sentiment, SOL, the native token of the Solana blockchain, receives a lot of attention from crypto enthusiasts because of the recent price decrease. From today, February 2, 2024, the general cryptocurrency market has witnessed a remarkable price decrease. Nevertheless, SOL has reached a crucial level of support with a history of impressive price oversourcements.

$ 100 million worth Sol outflow

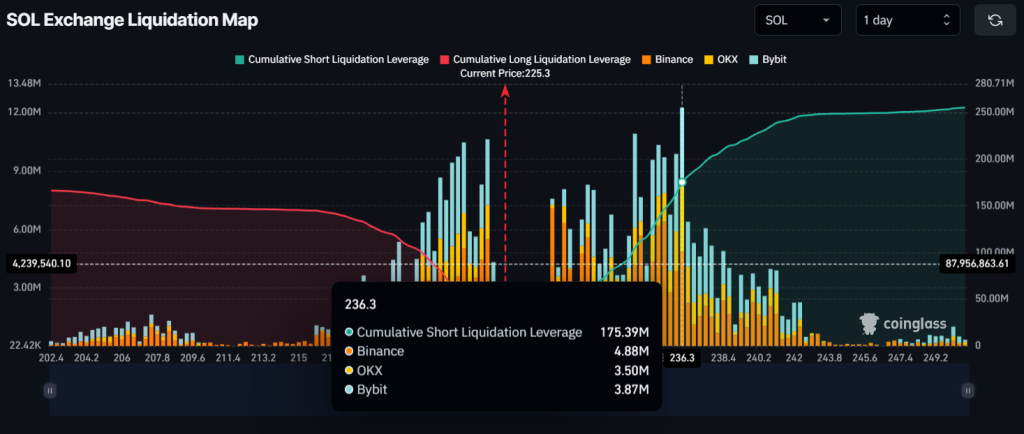

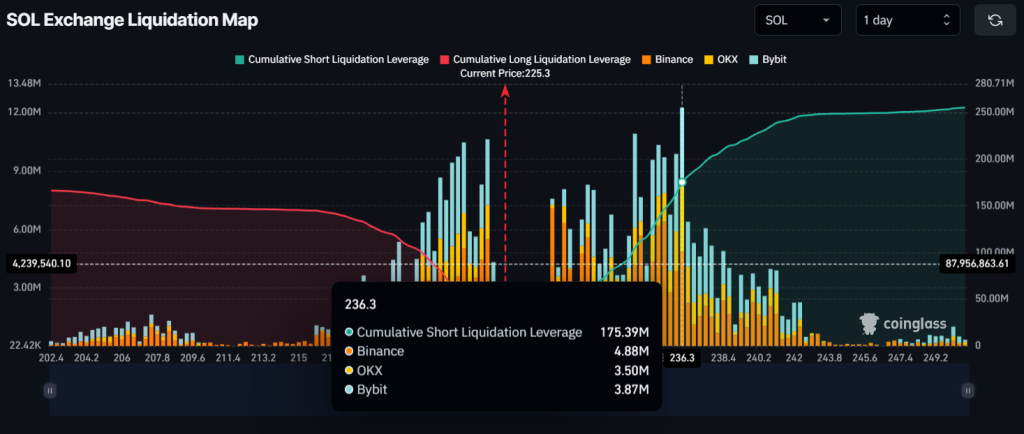

Looking at the historical price momentum, long -term holders and investors have collected the tokens, as reported by the uncleaning analysis company Coinglass. Data from Spot -Inflow and outflow showed that exchanges have seen a considerable inflow of more than $ 100 million in Sol -Tokens in the last 48 hours.

This outflow of the stock markets indicates potential accumulation, and given the current market sentiment it seems to be an ideal buying. It has the potential to create purchasing pressure and to activate a further upward rally.

Intraday traders, however, seem to be moving in the opposite direction of the crypto -whale, because they seem to benefit from the current market sentiment.

Traders Bearish View

Data shows that short sellers are considerably on the short side. According to the data, $ 236.30 is a level where short-sellers are persuaded, with $ 175.50 million in short positions. In the meantime, $ 223 is again an over-delivered level, where bulls for $ 46 million have open long positions.

When combining this data, it seems that investors and holders bet on long -term profits in the long term and consider this an opportunity, which explains the recent potential accumulation. In the meantime, short-sellers seem to benefit from the current market sentiment and bets on short-term profits.

Current price momentum

SOL is currently being traded near $ 224.15 and has experienced a price drop of 3% in the last 24 hours. In the same period, trade volume fell by 20%, indicating lower participation of traders and investors compared to the previous day.

Solana (SOL) Technical analysis and upcoming levels

According to the technical analysis of experts, Sol Bullish appears despite the recent accumulation, because it has formed a bearish and hand pattern on the daily age of time and is ready for a neckline drop.

Based on the recent price promotion, when Sol transfers the neckline and closes a daily candle under $ 220, there is a strong possibility that Sol could see a price fall of more than 14% to reach the next level of support at $ 190.

However, this Bearish statement will only apply if SOL closes a daily candle under the neckline; Otherwise it can fail.