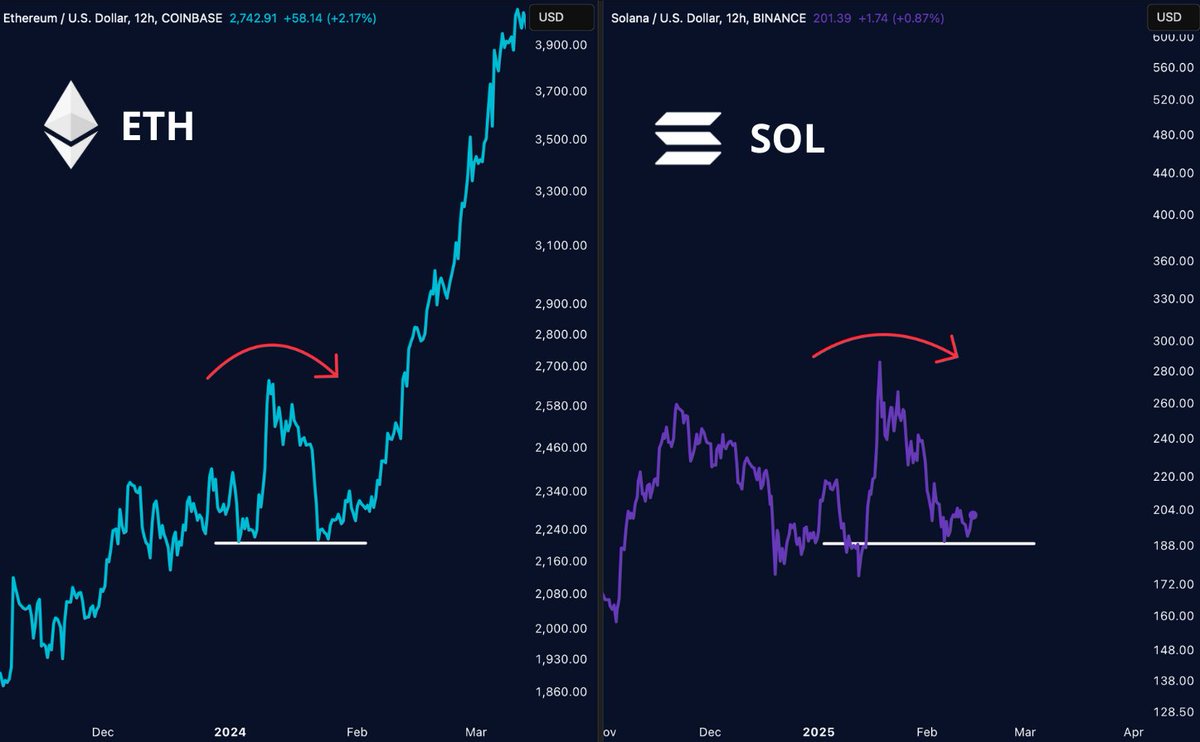

- Solana may mirror Ethereum’s breakout from 2024

- The double bottom pattern of Solana on the daily graph can be a precursor of a potential uptrend

Ambcryptos analysis of the prevailing price structure of Solana (SOL) has demonstrated a mandatory parallel with the increase in Ethereum 2024. At that time, Ethereum went on a robust upward route, a marked by a rally of $ 2,500 in December to $ 3,700 in March.

This movement emphasized a bullish recovery after the formation of a double bottom on the charts between mid -January to the beginning of February. At that time, the most important price levels were set at $ 2,400 and $ 2,800. Similarly, Solana can show a potential soil pattern, with its price stabilizing above the time of $ 190 level.

The graph of SOL indicated that the price action could reflect the earlier breakout pattern of ETH. With expansion, as in the case of Ethereum, the top can also be income for Solana. If it really follows the ETH process and rises by 80% as it did, SOL can go up to $ 340 to $ 340.

Source: Trade reproduction

Here, however, it is important to note that although historical parallels offer a bullish view of Solana, a variety of market dynamics or wider economic factors can temper this process. These can lead to fluctuations or a more moderate or realistic walk.

The correlation shown here underlines the potential for significant movements. Nevertheless, market participants must also take into account the potential for differences due to unique factors that influence each cryptocurrency.

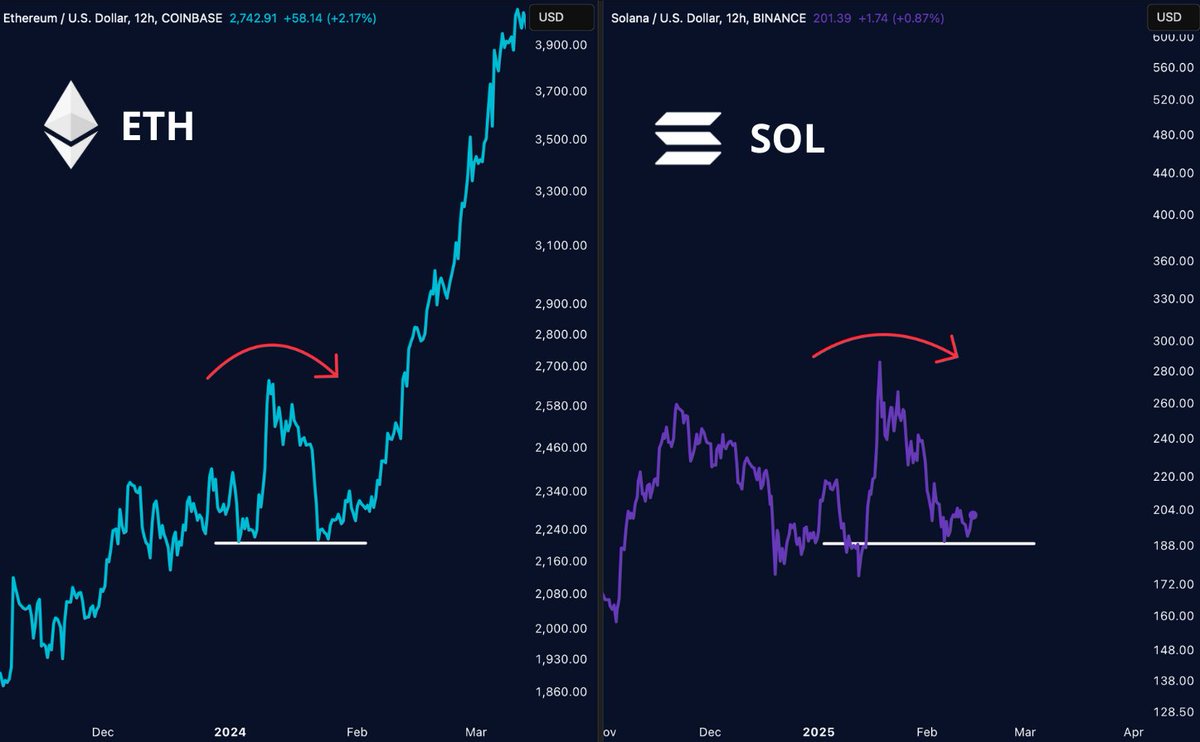

Double soil signals potential reversal

A deeper look in the classic double bottom pattern, identified by two different lows around the $ 190 level, signaled potential reversal points for SOL. This technical education, often interpreted as a bullish indicator, seemed to imply that Sol found strong support for this price range after a period of decline.

The neckline of the pattern, represented by the resistance line around $ 210, is crucial for confirming the trend removal. If SOL successfully spends this neckline, it can initiate a rally and focus on higher resistance levels near the $ 230-mark.

Source: Trade reproduction

Conversely, the not exceeding the neckline can lead to Sol that the support levels redest, with a risk of further decreasing if these levels cannot apply. A walk in volumes can attach the breakout strength.

A persistent movement above $ 210 resistance would confirm this bullish scenario. On the contrary, a drop under the support of $ 190 can indicate Beerarish continuation.

Solana’s regular adoption

At the same time the Crypto Task Forcecollaboration with Jito Labs And Multicoin Capital exploring stake inside Exchange Trade Products (ETPs) Can generate access to yields on Solana Democratis.

This movement can attract Institutional investorsProviding a well -known investment vehicle (ETPs) while using the high yield options for turning off on Solana. This would increase liquidity and stability, which further produces Solana to regular financial systems.