- Solana’s daily transactions fell last month

- The price of SOL has risen by more than 2% in the past 24 hours

Solana [SOL] has generated a lot of buzz in the crypto space with multiple token launches on the blockchain. However, aside from that, the blockchain has also seen a huge increase in its network activity, especially as it reached a new milestone.

Solana’s new ‘all-time high’

SolanaFloor, a popular X-handle that shares updates related to the blockchain ecosystem, recently posted tweet point to an important development. According to the same number, monthly active addresses on Solana exceeded 30 million – a record high.

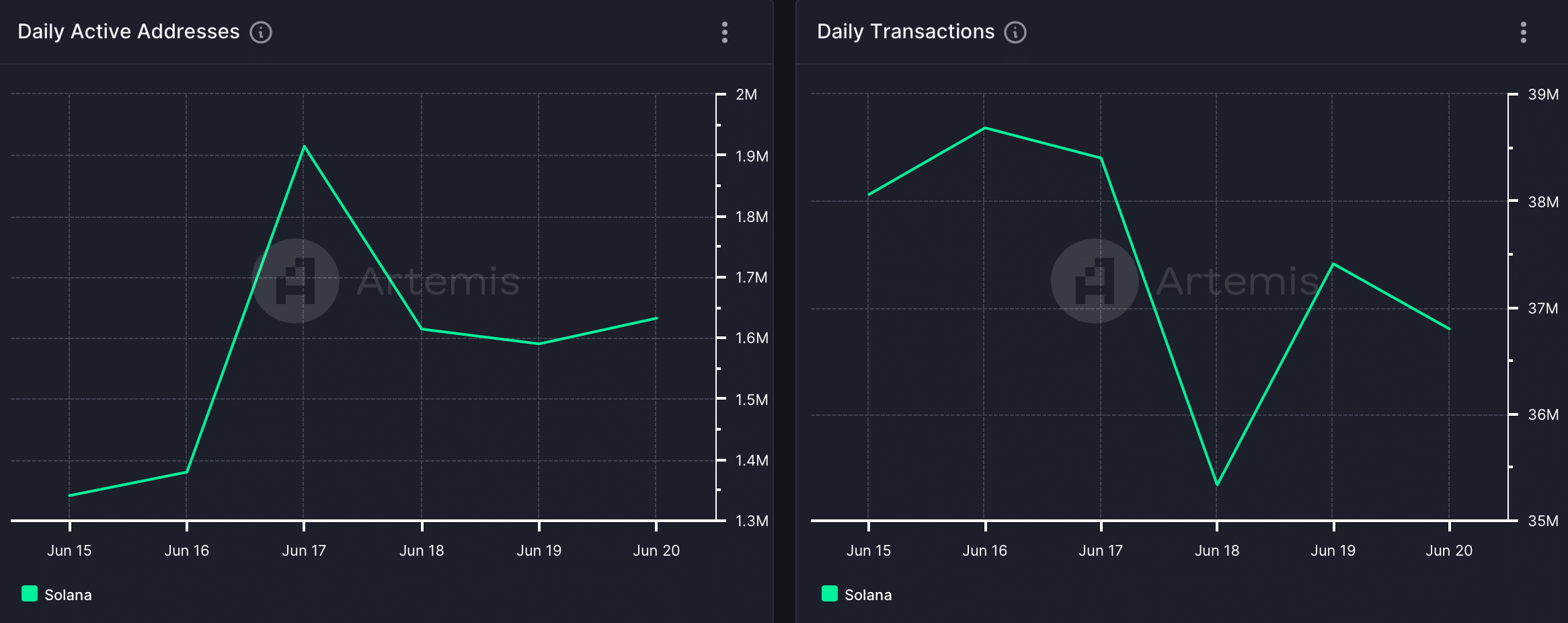

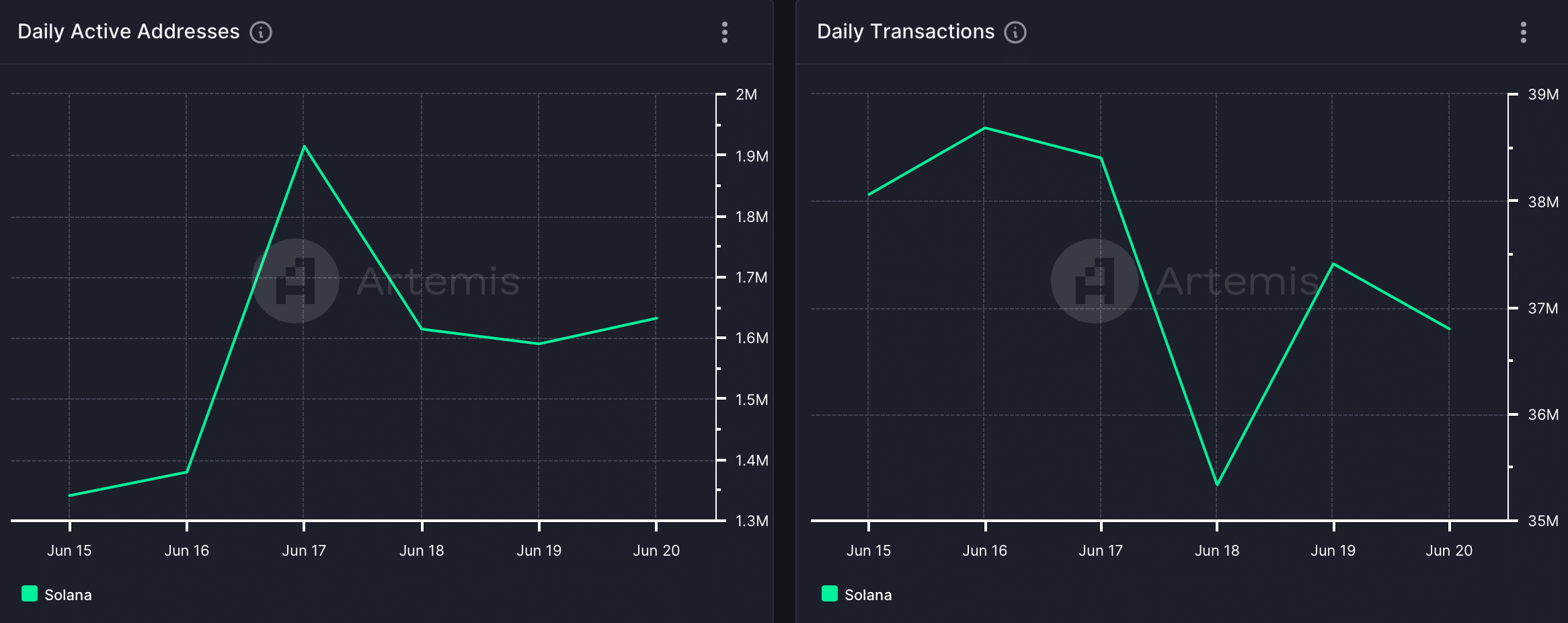

Since this was a commendable development, AMBCrypto took a closer look at how the blockchain’s network activity has been over the past 30 days. Our analysis of Artemis’ facts revealed that SOL’s daily active address count reached 1.9 million on June 17. However, after that the graph started to decline.

In fact, it was surprising to note that despite reaching an ATH in terms of monthly active addresses, the blockchain’s daily transactions declined over the past month.

Source: Artemis

There was also a decline in the recorded value during the month. This appeared to be the case as both Solana’s fees and revenues declined.

A similar trend was also seen on the TVL chart, which reflects a decline in blockchain performance in the DeFi space.

SOL is back on track

While all this was happening, the SOL bulls stepped up their game as the price of the token finally managed to rise. According to CoinMarketCapSOL has fallen by more than 6% over the past seven days. However, the past 24 hours showed signs of recovery from previous losses as the price of SOL rose by more than 2%

At the time of writing, SOL was trading at $134.67 with a market cap of over $62 billion.

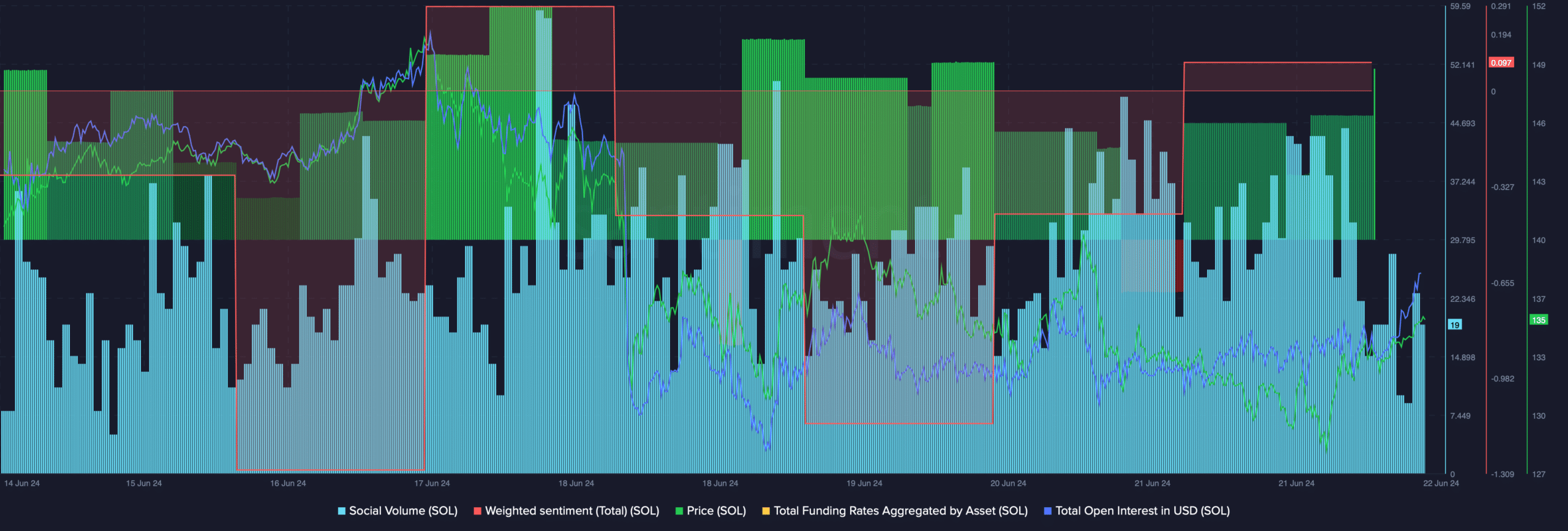

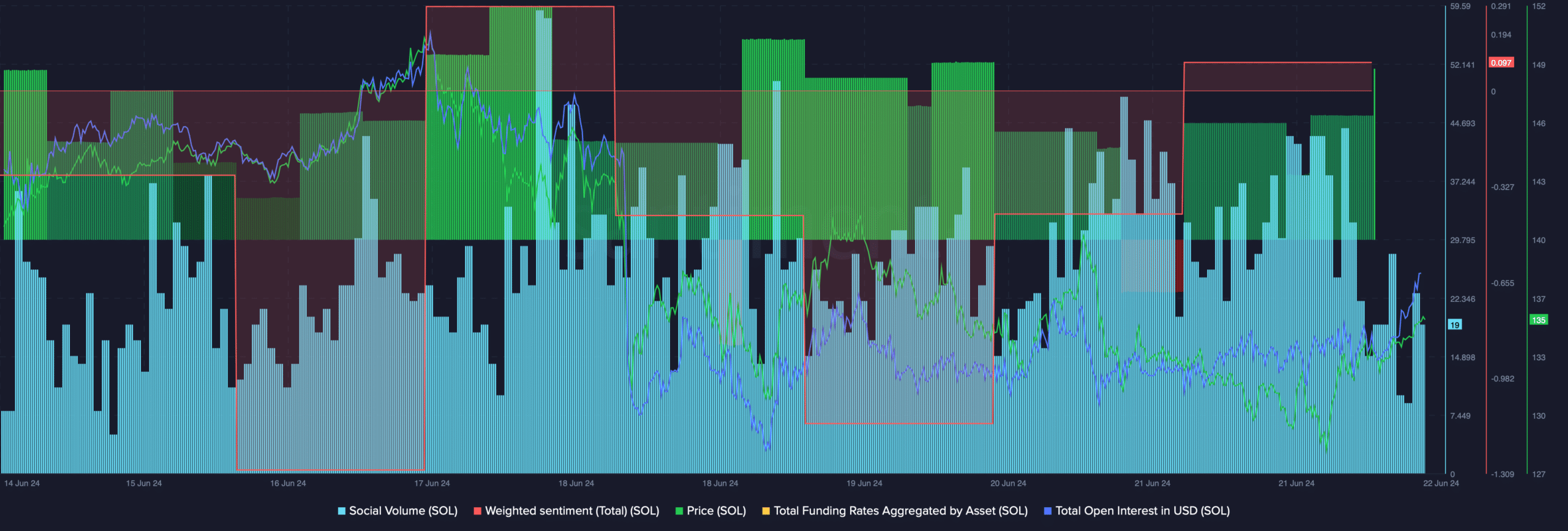

The recent price increase also positively impacted the token’s social metrics. For example, after a dip on June 19, weighted sentiment rose and ended up in the positive zone. This clearly meant that investors continued to have confidence in SOL, and bullish sentiment around the token increased.

Social volume also remained high, reflecting its popularity in the crypto space. Furthermore, SOL’s open interest also rose along with its price. When open interest rises, it means there is a good chance the current price trend will continue.

Is your portfolio green? look at the SOL profit calculator

Nevertheless, SOL’s financing rate also increased. In general, prices tend to move in a different direction than financing rates. This could therefore cause problems for SOL in the short term.

Source: Santiment